Introducing Our Latest Investment

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 3,000,000 CAY shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by CAY to share our commentary on the progress of our investment in CAY over time.

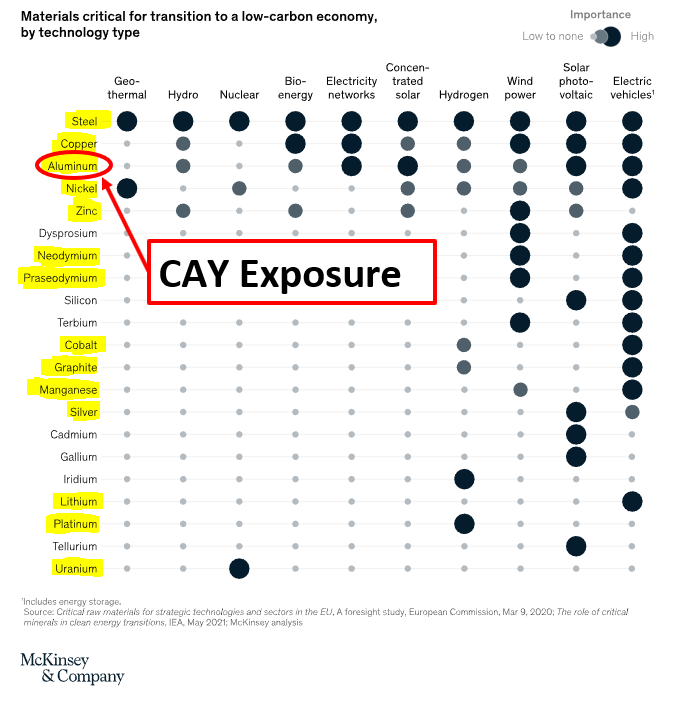

Our most successful investments over the last two years have been in companies developing the raw materials to build the world’s move to a green energy future.

Raw materials to build electric vehicle batteries, wind turbines, solar panels and power grids – we believe demand for these will surge over the next decade.

Our current investments in new energy materials include:

- Vulcan Energy Resources (up 4,750%),

- Euro Manganese (up 677%),

- Evolution Energy Minerals (up 123%)

- European Metals Holdings (up 25%)

While our past performance is no guarantee of future performance, today we add a new investment into our Wise-Owl portfolio that we believe will benefit from the surge in demand for “new energy materials”.

This is an ASX stock we ALMOST invested in back in 2020 but decided to wait for the company to deliver a few more progress milestones first before the time was right for us.

We think that time is now. The last few months have seen this company deliver material progress, however we think the market has not fully caught on to this yet.

We have invested now as we think this company has momentum and is ready for a big 2022, with a number of value generating catalysts in the pipeline.

Today’s new portfolio addition is developing one of the world’s largest, high grade direct shipping bauxite deposits globally.

Bauxite is the key ingredient in aluminium – considered a critical material in the primary technologies that will be the foundation of a low-carbon future including wind power, solar and energy storage (batteries).

We also like that this company is in the development stage (with many years of work and investment put into it) and finally appears closer than ever to getting into production.

Introducing the latest addition to our portfolio:

Canyon Resources (ASX:CAY)

Canyon Resources (ASX: CAY) is developing one of the largest, high grade, direct shipping bauxite deposits globally in Cameroon, Africa.

CAY owns its bauxite project 100% – and is one of the only globally significant projects left that is NOT held by existing major industry players.

Companies like Rio Tinto (capped at US$130 billion) and Alcoa (capped at US$13 billion) make up the top 2 producers of bauxite globally.

CAY is currently capped at ~ $62M – which is currently what some junior explorers trade at. However CAY is well advanced in development, after spending years getting this project to where it is now.

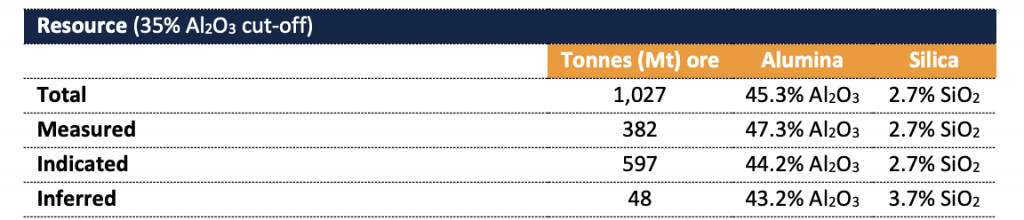

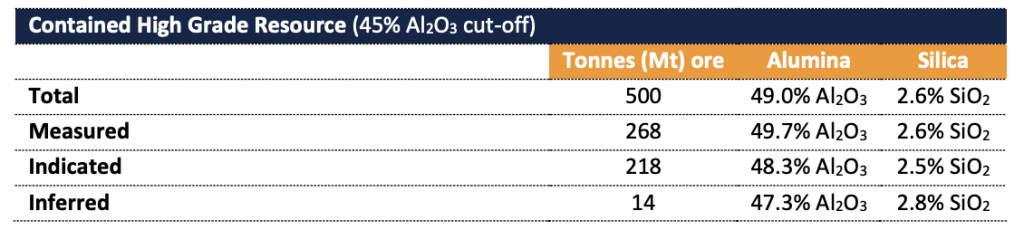

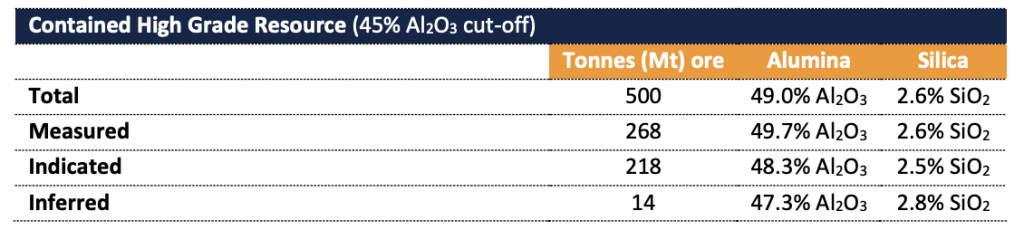

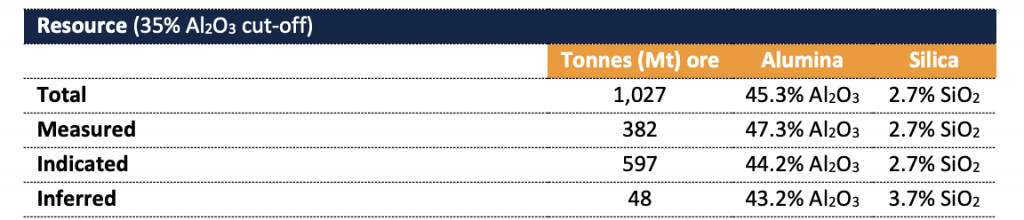

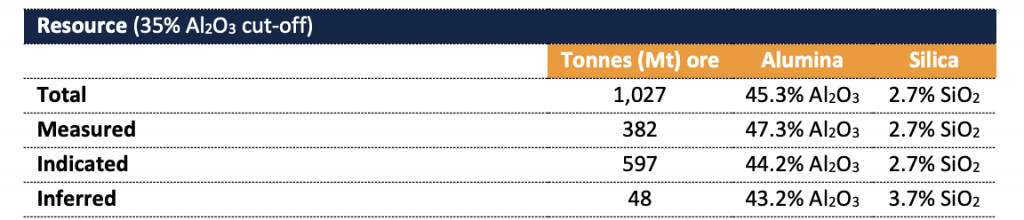

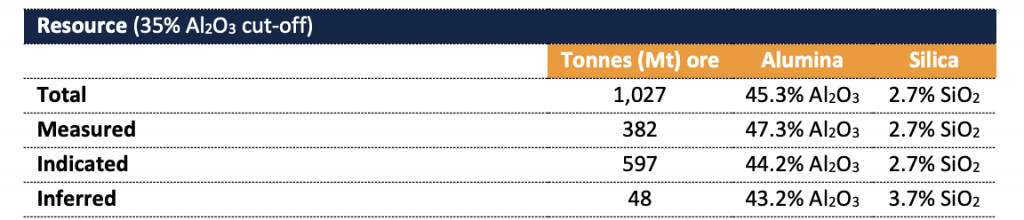

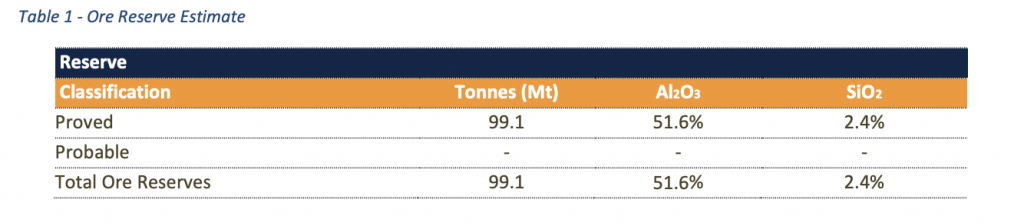

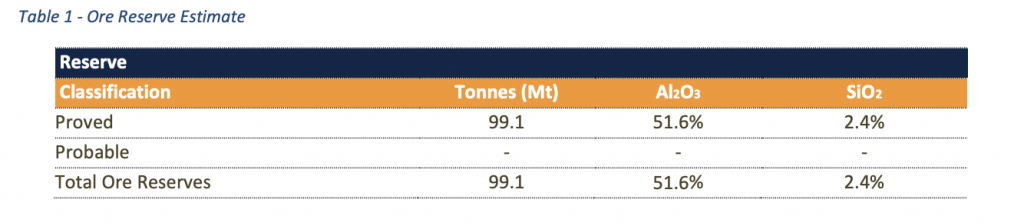

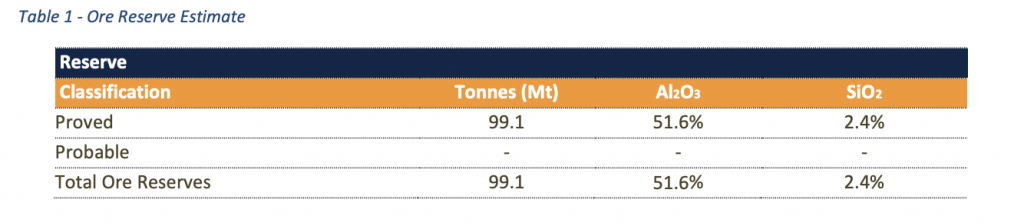

CAY’s project has a JORC resource of 1 billion tonnes @ 45.3% Alumina with a low silica content of 2.7%.

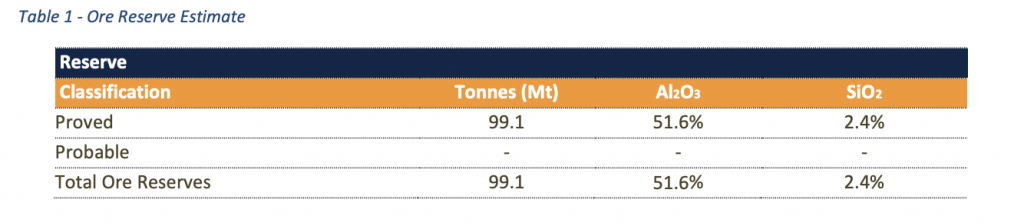

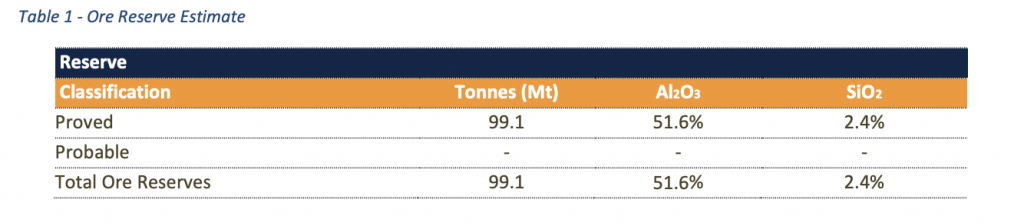

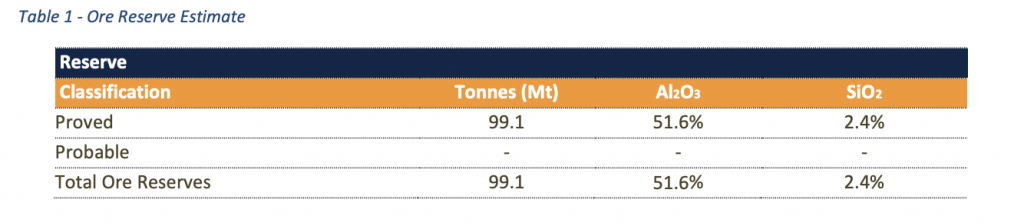

CAY also has a defined reserves figure of 99.1 million tonnes at 51.6% Total Alumina and 2.4% silica content, which underpins a minimum 20 years mine life.

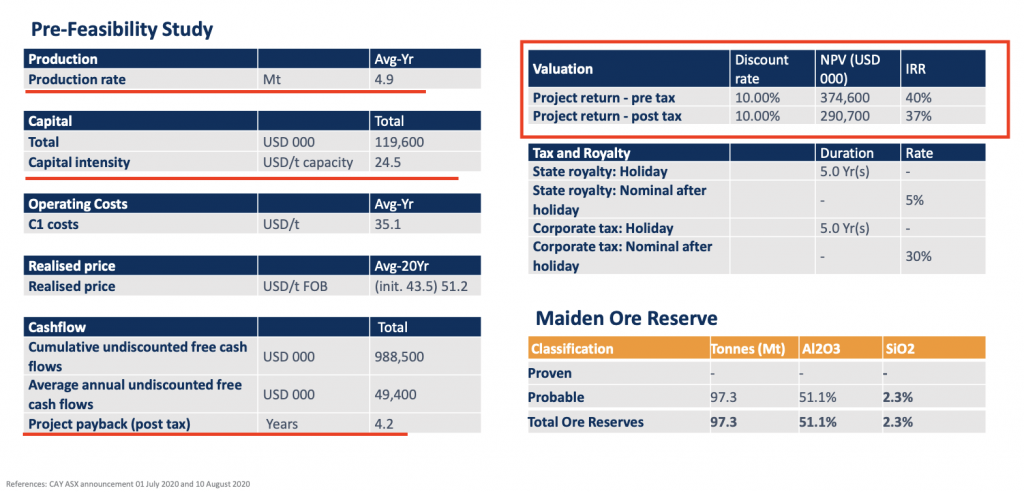

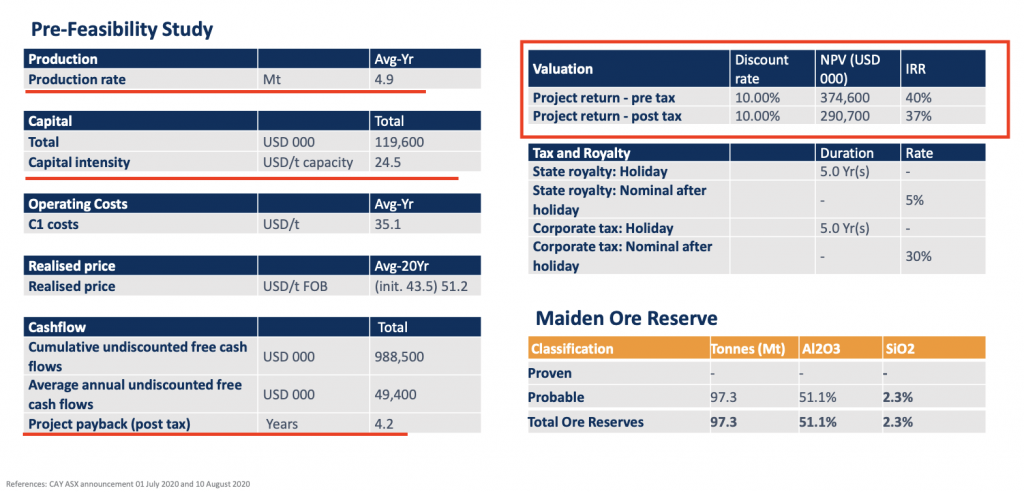

With a PFS completed in 2020, CAY’s project has a post-tax NPV of US$291M with a payback period of 4.2 years, with a US$120M upfront capital cost.

We took our position in CAY at 10c, which we think presents a great entry for our investment given the size of its project and how close to development it is.

We think the upside here is that the project might be taken out by a bigger bauxite player in a couple of years’ time, at multiples of its current value.

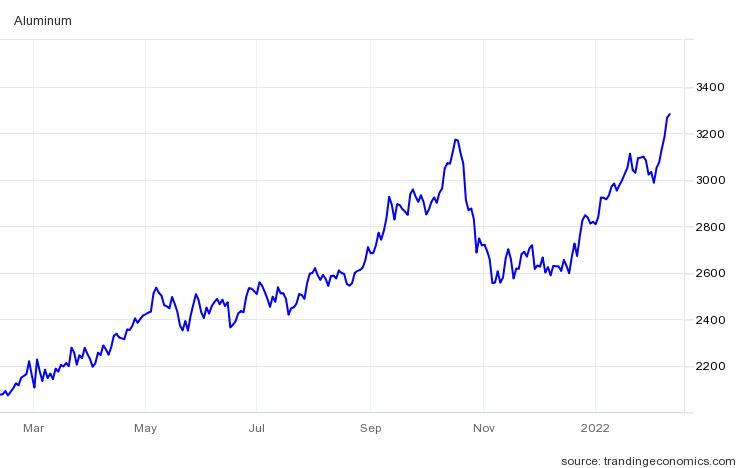

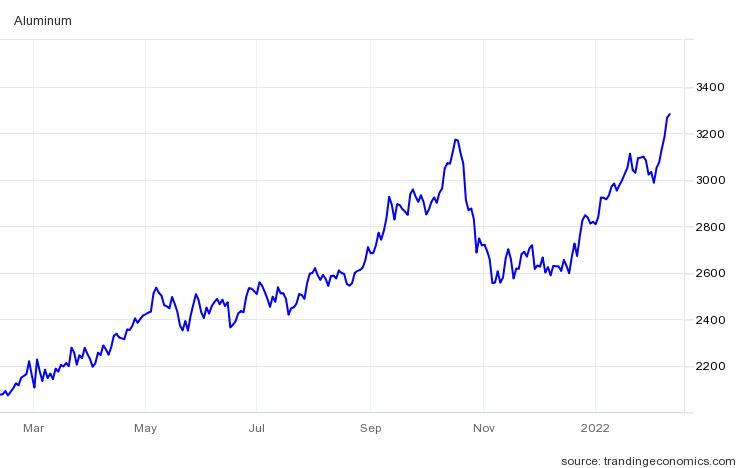

Currently there is a disconnect between aluminium prices and bauxite prices – but we think that aluminium price pressures and bauxite market dynamics will soon feed into this company’s project economics.

We’re of the view that hidden beneath the surface, is a looming bauxite beast.

How does CAY fit into our portfolio?

Those who follow the Wise-Owl portfolio would know that some of our most successful picks have been investments in companies that are positioned to succeed from the green energy revolution and the raw materials that are critical to this structural shift to the global economy.

A recent McKinsey report titled “Materials critical for transition to a low-carbon economy” lists the raw materials needed for a transition to a low-carbon economy (with the exposure we’re adding today highlighted):

Our investment in CAY is part of our strategy to get exposure to all the raw materials on the “energy transition” list from McKinsey below (our current exposures are all highlighted yellow).

Aluminium can often get lost in the commodities supercycle narrative, but the industrial metal still ranks second in terms of total production behind iron ore.

Which is why today’s investment in CAY is designed to give us exposure to aluminium – so that we can better capture the spectrum of raw materials critical to the global energy transition.

Aluminium production doesn’t happen however, without an unheralded mineral – bauxite.

Why now?

As mentioned earlier, we have been following the CAY story for over 18 months now.

We had been waiting for key milestones to be met and for some momentum to build before we made our initial investment in CAY.

Over the course of 2020 and 2021, CAY has slowly but surely started ticking these off, and has driven us to make an investment now.

With all of the below happening concurrently we think 2022 is going to be a landmark year for CAY:

- Mining convention agreement 🔄 – The Mining Convention is the key agreement with the State of Cameroon that sets out fiscal and legal right on the project. Key terms were recently finalised. Once formally signed, this agreement will allow CAY to begin negotiating offtake agreements and development financing partnerships.

- Bankable Feasibility Study (BFS) delivered in H1-2022 🔄 – This paves the way towards a Final Investment Decision, and will aid construction financing discussions.

- Infrastructure development in Cameroon ✅ – The key to unlocking the value in CAY’s deposit. The Cameroon Government recently completed important infrastructure upgrades.

- Appointment of Nfon Ekoko Mukete to board of subsidiary ✅ – The Nfon is a highly distinguished person, one of the few Traditional Chiefs in Cameroon, and is the 1st Vice President of the Cameroon Chamber of Commerce, Industry, Mines & Crafts and a board member of the Cameroon Investment and Promotion Agency. He has joined the board of CAY’s wholly owned subsidiary, strengthening CAY’s in country relationships and access to top tiers of government.

- New CEO appointed ✅ – Jean-Sebastien Boutet appointed as CEO effective Jan 1st 2022. He has over 16 years experience in the bauxite industry and has previously worked as Commercial and Market Development Director for bauxite leader Alcoa. He brings deep industry experience to the CAY team.

CAY now has some serious tailwinds behind it, and we think it is moving swiftly towards commencing production at its bauxite project.

The next big parts of the CAY story will be the Mining Convention being signed and the BFS being delivered.

CAY can then begin discussions with offtake partners and financiers, and move forwards towards making a Final Investment Decision.

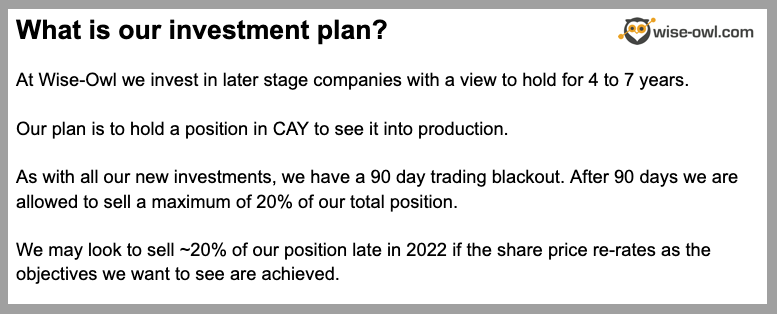

At Wise-Owl, we invest in carefully selected, later stage companies and hold a position for 4 to 7 years. We share our commentary on how each of our investments executes its plan over time.

We have put together a 2022 investment memo for CAY which is a short, high level summary of why we made our investment in CAY and what we expect the company to deliver in 2022.

We will be using the investment memo to track the progress of CAY and to benchmark it with our expectations at the time of making our initial investment.

Click the big button below to read our investment memo:

Our investment thesis: Here are the 7 reasons we invested in CAY

Here’s the summary of the seven key reasons why we invested in CAY and we’ll provide a deep dive into each reason further down in the article.

- One of the largest high grade bauxite projects in the world: CAY is developing one of the largest undeveloped, high grade direct shipping bauxite deposits globally. CAY’s project is one of the only globally significant projects left that is not held by existing major industry players. The project has a JORC resource of 1 billion tonnes at 45.2% Alumina with a low silica content (~2%) making it ideal for production.

- Compelling project economics: CAY has a 2020 PFS completed showing an NPV of US$291M with an IRR of 37% and a 4.2 year payback period. The 2020 PFS also shows that the project has a relatively low upfront capex cost of only US$120M. CAY is looking to get the project into development via a high grade 5 mtpa DSO operation. With an optimised BFS due soon we expect to see an improvement in the project economics which takes into account all of the recent infrastructure improvements in Cameroon.

- Near term catalysts paving the way for a final investment decision: CAY is currently towards the end of reaching an agreement with the state of Cameroon via a process called the “Mining Convention”. Once agreed CAY can move forward with its application for a mining permit as well as commence discussions with financiers/offtake partners. The delivery of a BFS is also a part of this process and will form the backbone for a mining permit application.

- Simple mining process and near term production: Bauxite is a unique commodity in that it is sold as a raw material with very little processing work done on it. Mining methods are generally very simple, with the bauxite being dug up, stockpiled and shipped directly to purchasers without any processing. This means bauxite mining is comparable to direct shipping ore (DSO) operations. With a BFS currently being completed, CAY can make a final investment decision and reach production fairly quickly without the need to build massive processing plants.

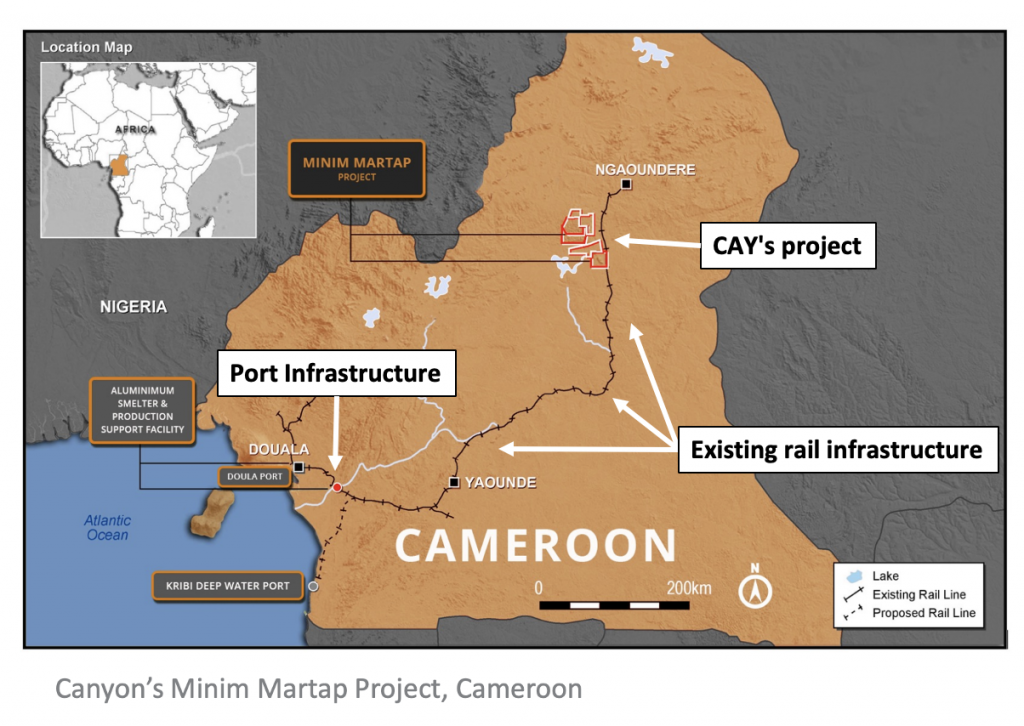

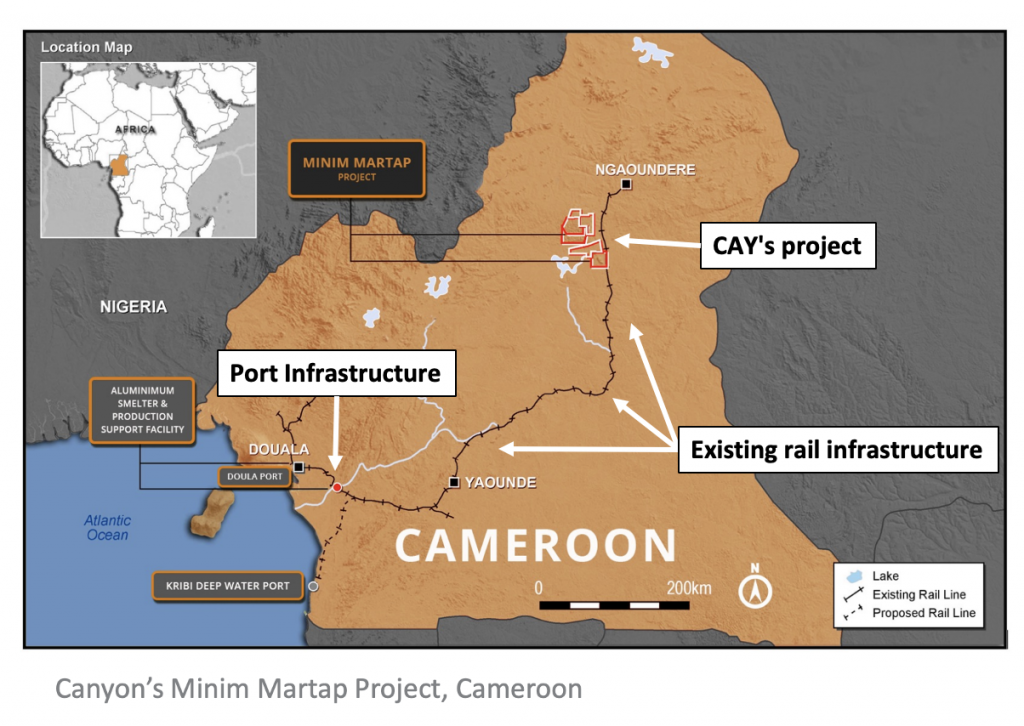

- Infrastructure development in the region: The key to bauxite mining is always its proximity to either port infrastructure from where it can be shipped to export markets or its proximity to smelting facilities where it can be refined into aluminium. Cameroon recently received a EUR$120M commitment from the European Investment Bank to upgrade 1/3rd of the railway line that CAY plans to use. Infrastructure improvements in the area are the final piece of the puzzle for CAY’s project. As long as the infrastructure is available, CAY can always increase its throughput thereby improving its project economics through economies of scale.

- Major impending changes to the bauxite market – Indonesia is planning to ban export of bauxite at the end of 2022, meaning new sources of supply should become more attractive. Additionally, Guinea – the primary bauxite supplier in West Africa and the 2nd biggest producer globally is currently experiencing political instability which could mean there are medium term supply shocks in the industry.

- Political momentum in Cameroon – the government of Cameroon has made mining a major priority. CAY’s project could become Cameroon’s first major mine and in turn this could be a breakthrough for the Cameroon government’s economic agenda. CAY recently appointed Nfon Ekoko Mukete to the board of its wholly owned local subsidiary. The Nfon is a prominent business identity in the country and should help usher CAY’s project through to final investment decision.

Further down, we unpack in more detail each of these seven reasons for investing in CAY. But next we want to run through what we are looking out for CAY to do this year.

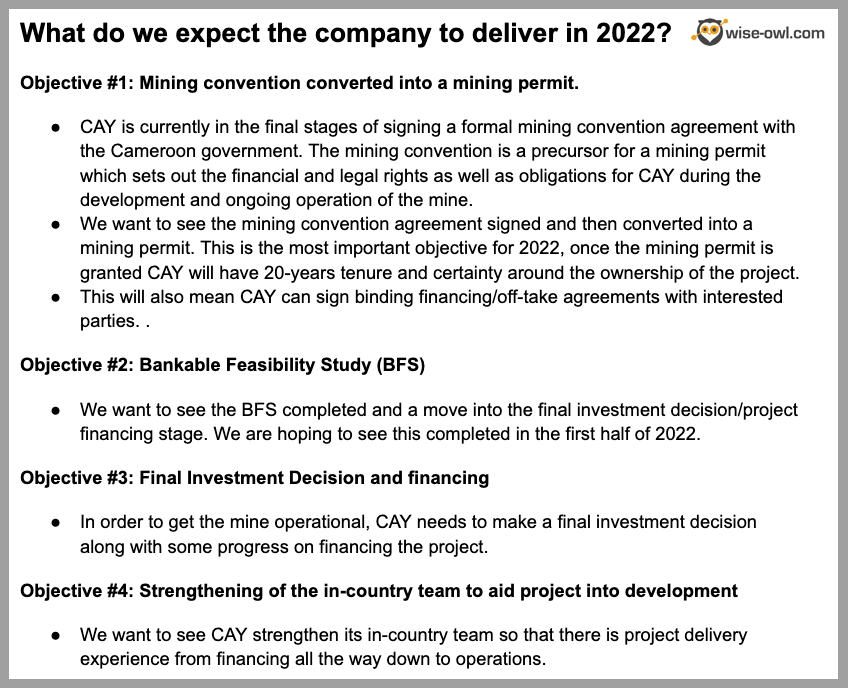

Here is what we want to see CAY achieve in 2022:

The below objectives are an outline of the key things we want to see the company achieve in 2022, we will be using these as benchmarks to measure the progress of CAY at the end of 2022.

The more of these objectives CAY can deliver, the more conviction we are likely to build in our investment in the company – and hopefully the higher the share price can go – although that is also dependent on market forces outside CAY’s direct control.

Our CAY Investment Plan

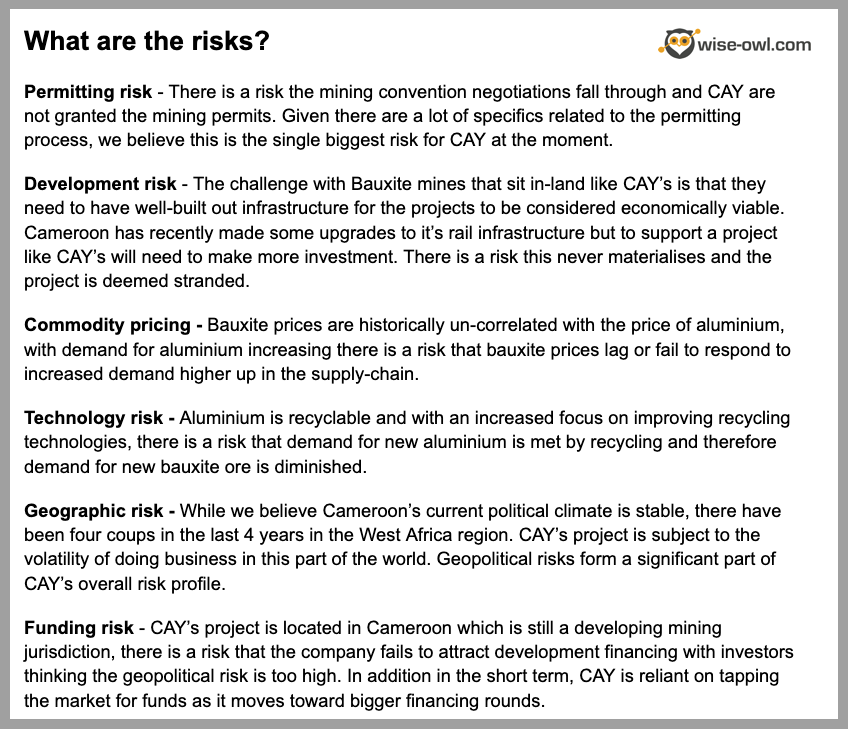

What are the key risks?

Investing in Africa always brings about specific social, political and economical risks.

Cameroon is not immune to any of these challenges.

We categorised these main risks into 4 distinct identifiable risks that we think will be the main challenge to our investment thesis and CAY’s ability to execute its business goals.

These risks are as follows:

For the comprehensive list of the risks involved in this investment, check out the company’s latest annual report and corporate governance statement.

Deep Dive: Further details on the 7 reasons why we invested in CAY.

1. One of the largest high grade bauxite projects in the world:

The first key reason and the base for our investment in CAY is that the company is developing one of the largest undeveloped, high grade bauxite deposits globally.

In fact it is the only globally significant project that isn’t in the hands of the majors – think Rio Tinto (capped at US$130 billion) and Alcoa (capped at US$13 billion) who are the top 2 producers of bauxite globally.

CAY’s project has a JORC Resource of 1 Billion tonnes at 45.2% Alumina with a low silica content (~2%) which makes it ideal for production (more on this later).

Notably though, within this 1 billion tonne resource there is also a higher grade portion of the resource for ~500mt at 49% alumina with silica content of 2.6%.

To get an idea of just how globally significant CAY’s project is, it’s important to consider that the 1 billion tonne JORC resource is made up of only 17 bauxite bearing prospects over CAY’s project area.

This 17 is out of a total of ~62 different prospective zones, meaning CAY has managed to put this resource together on ~28% of the area of the project.

Not that CAY needs it but if the project ever needed additional resources to be discovered to extend its mine life then there are prospects there ready to test.

Given the 1 billion tonne JORC resource, this isn’t likely to be a problem CAY will face in our lifetime or in at least the next generation’s lifetime.

Last but not least with the resource, CAY has also managed to define an “ore reserve” over the project.

An ore reserve is the highest classification a resource can be put into.

CAY’s ore reserve interestingly has an even higher grade and an even lower silica content than its resource (a resource being a lower classification than a reserve).

This means when the project is put into production and the reserves get mined, the highest grade, lowest impurity part of the resource will be mined first.

CAY’s proven ore reserve is 99.1 Mt at 51.6% alumina with a silica content of 2.4%.

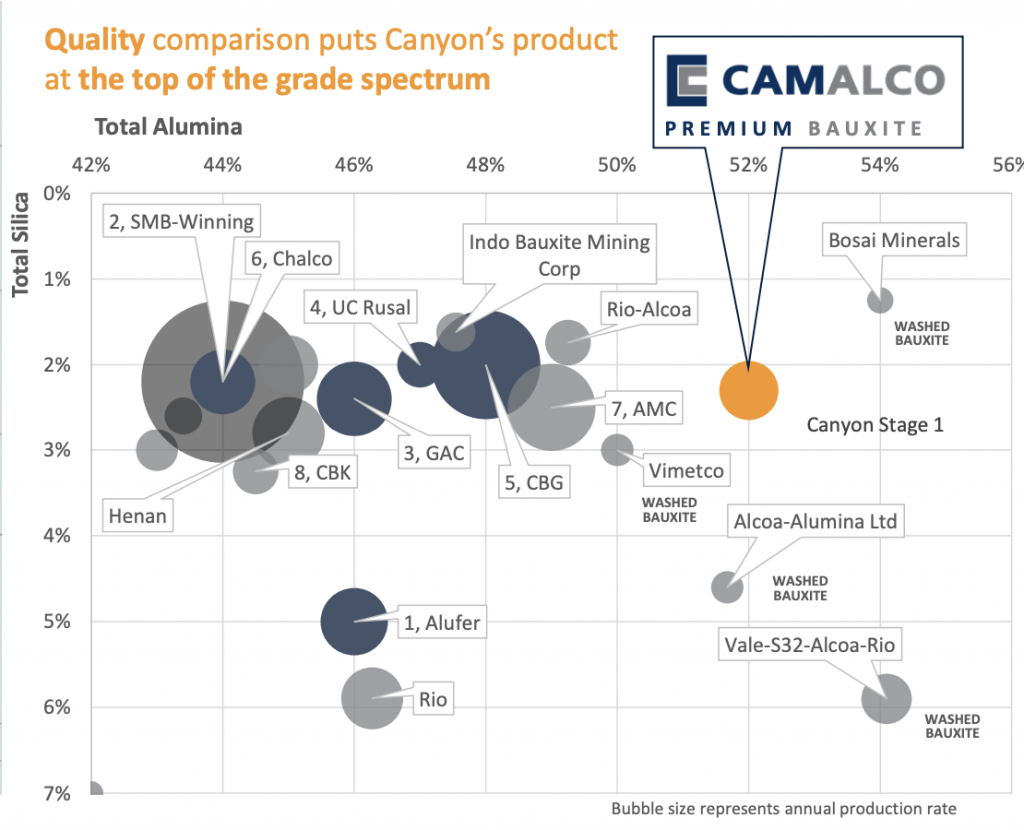

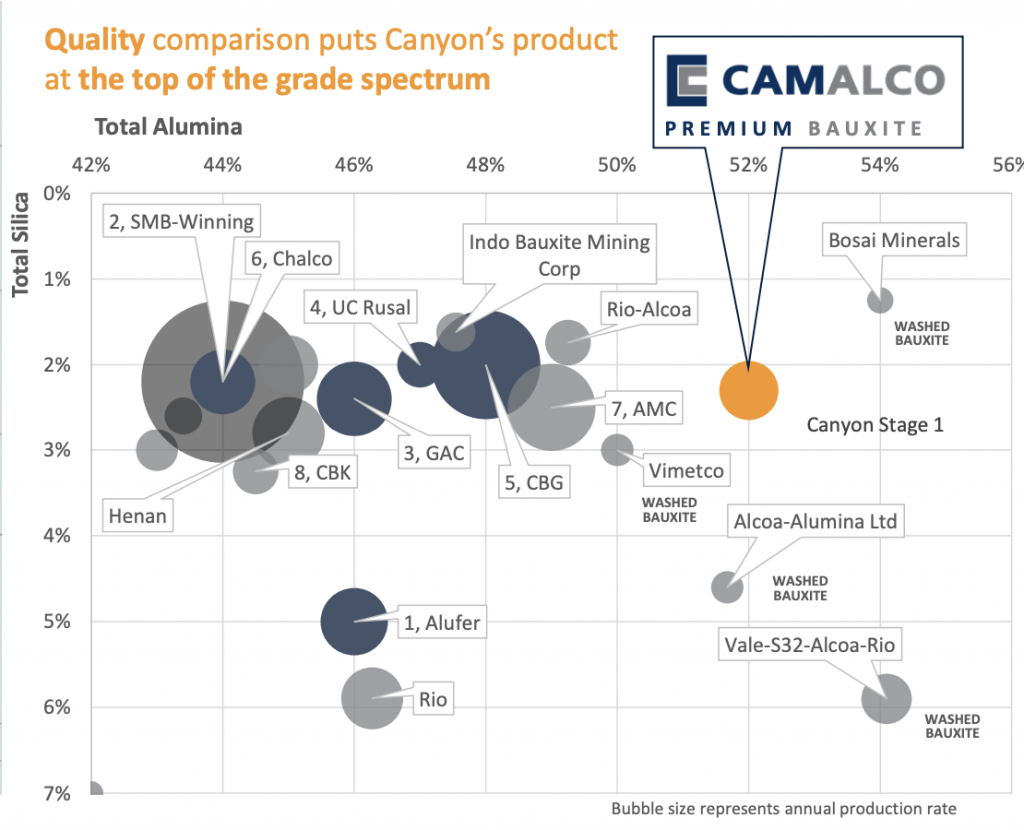

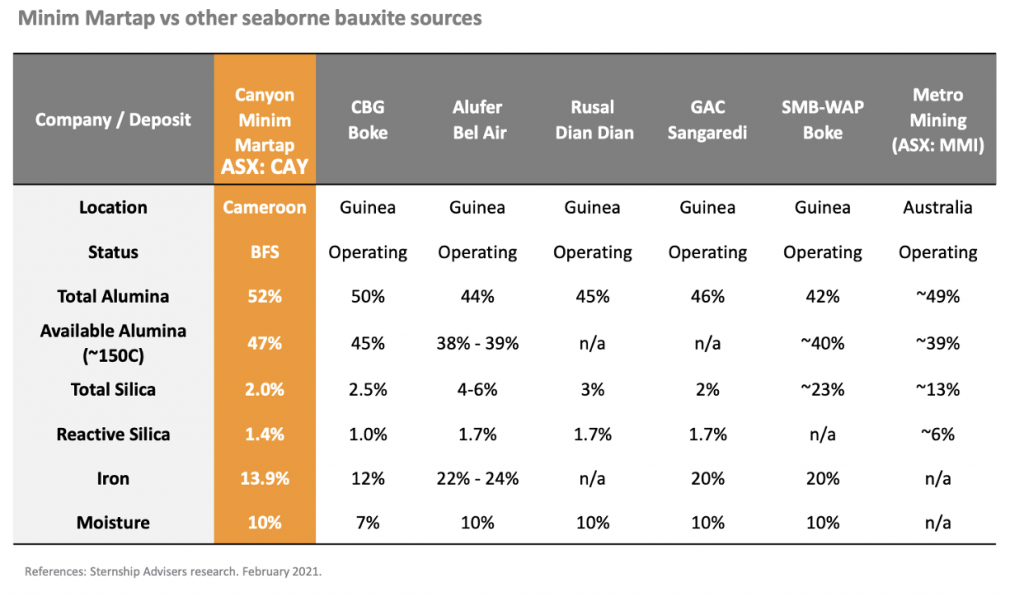

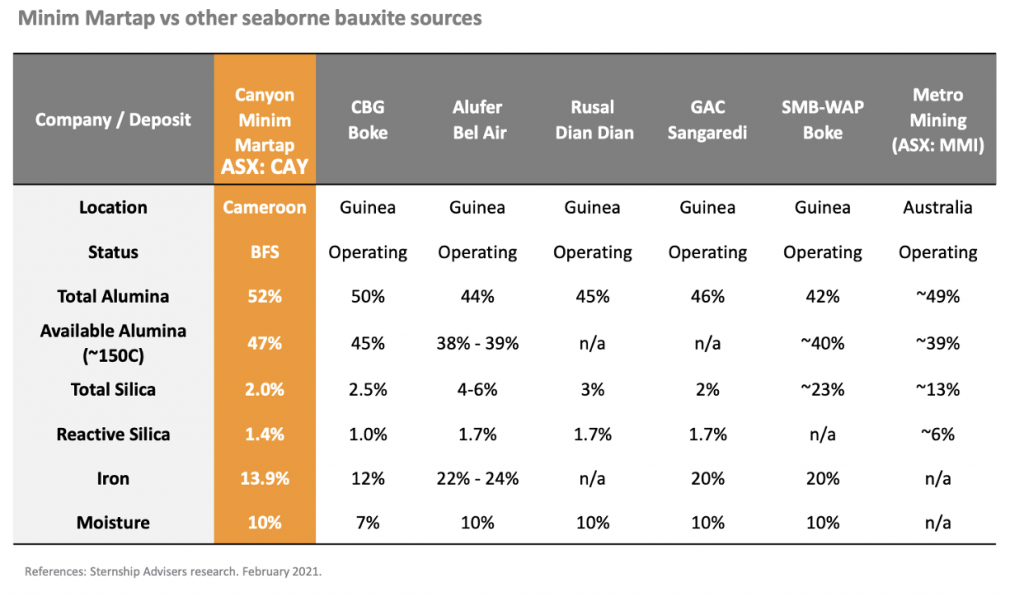

This naturally brings us to the topic of “high grade” and what it actually means.

To try and understand this, we need to visualise how aluminium is made. The typical rule of thumb is that between two and three tonnes of bauxite must be refined to produce one tonne of alumina.

Bauxite is just rocks made up of dirt/soil and aluminium hydroxide elements. The higher the alumina (aluminium hydroxide elements) grades in the bauxite, the less tonnage of bauxite is required to produce alumina.

From a purchaser’s point of view, they want to see high grades of alumina so they can reduce their input costs when making.

The second part of the high grade story is the silica content.

As resources investors we are typically used to thinking higher % ‘s or g/t is always a good thing – however with with bauxite, things are different when it comes to silica content.

Silica is considered an “impurity” for producers because during the refining process, silica can cause reactions that can result in alumina contents being lost as waste material.

So a high silica content in bauxite ore can oftentimes be a deal breaker when buyers are shopping around.

This is where CAY’s resource stands apart from other projects, with its ore reserve having a low 2.4% silica content and its larger 1 billion tonne JORC resource having 2.7% silica content.

Below are two images that help put into context how high quality CAY’s resource is versus its bauxite peers:

With a globally significant resource and high grade bauxite that has low impurities (silica content) it is surprising this deposit hasn’t been gobbled up by one of the major players yet.

2. Compelling project economics:

CAY’s project being one of the largest undeveloped bauxite projects in the world isn’t enough for us to make an investment though.

Whenever we invest in development ready assets, we want to see that the numbers stack up just as well as the quality of the projects.

CAY’s project definitely met our investment criteria with respect to the numbers.

In 2020 CAY completed a Pre Feasibility Study (PFS) modelled around its proposed Stage 1 development plan which is based around a 5 million tonnes per annum (Mtpa) DSO operation.

The ore is shipped via the already operating and underutilised rail line that runs from the project area to the existing port infrastructure at the Douala port in Cameroon.

Below is the summary of the 2020 PFS, the key take-aways for us are as follows:

- Upfront CAPEX of US$120M.

- Operating costs of US$35.1/t over the mine life.

- Project payback period of 4.2 years.

- Post tax NPV of US$291M.

- Internal rate of return (IRR) of 37%.

Importantly CAY also gets a full 5 year tax holiday which explains the fast payback period.

This will mean more cash in the door to CAY at a time where CAY will most likely have just borrowed to fund the project.

The 2020 PFS sets a good baseline for the project economics from which CAY can improve.

CAY is currently completing a Bankable Feasibility Study (BFS) which is loosely based on all of the information that was used for the PFS.

But there have been some changes that we think will mean vastly improved project economics when the BFS is finally released.

Change #1: Rail infrastructure getting a boost by the government

The first of these changes has been the Cameroon government’s rail authority “CamRail” upgrading the rail infrastructure across the country with ~338km in new rail line constructed and over 68 railway bridges constructed.

This is part of the government’s efforts to build out infrastructure in the country to promote investment from companies like CAY.

The benefit to CAY’s project will be that rail capacity can be increased and any bottlenecks that exist over the rail infrastructure should be eliminated.

After all, faster and more efficient rail lines could mean CAY can increase throughput at the project.

It’s also worth noting that the rail authority confirmed the rail lines were suitable for CAY’s aimed production of 5 mtpa, so CAY don’t have to make any allowances for this in their CAPEX figures.

A side note on this is that the Cameroon government is actually planning a rail extension which could open up CAY’s project to the newly built, deep water port of Kribi – this is the key to unlocking the stage 2 expansion plan for CAY’s project. In any case we will be watching for new developments closely.

At the moment the focus is more on what we know though.

Change #2 – resource and reserve upgrades

The second major change is the resource and reserve upgrades CAY have done since the 2020 PFS.

CAY has managed to increase the project’s resource from ~900 million tonnes to a total JORC resource of ~1 billion tonnes. But more importantly CAY managed to move ~382mt of the project’s resource into the “measured” category through infill resource drilling.

Whilst doing all of this drilling, CAY also managed to take the ore reserve from “Probable” into the “Proved” whilst also increasing the resource grades.

We expect the increased grades and classifications of the resource will increase the confidence in the inputs of the BFS and hope this translates into improved project economics.

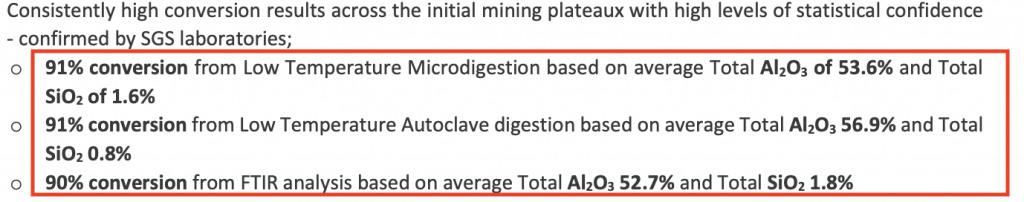

Change #3 – Advanced metallurgical testwork now completed.

The third key change over the last 2 years has been the advanced metallurgical testwork is now complete.

Metallurgical testwork confirmed samples from the project could be converted with a 90%+ recovery rate into alumina with grades of ~52% and importantly a sub 2% silica content.

With clear improvements made and heaps of developments in terms of logistics in the region we expect costs to be slightly lower and the BFS to point at improved project economics.

An improved BFS is likely to put CAY in a stronger position when dealing with off-takers and financiers. Providing a level of assurance the project can be mined economically.

3. Near-term catalysts paving the way for a final investment decision:

We mentioned earlier in our note that we have been following CAY for over 18 months and that we had set key milestones for the company that we wanted to see achieved before CAY would be considered investable for us.

These key milestones were mostly centred around the Year 3 Commitments CAY had under its exploration permit, as seen in the image below:

- A final feasibility study – Delivered as a PFS in 2020. ✅

- The commencement of the mining convention – Now well advanced and in the final stages of negotiations. ✅

CAY is now moving towards the 2nd stage of the permitting pathway above and has 3 key catalysts coming over the next 12 months which will be the final pieces of work completed before a mining permit can be issued.

The first of these is the signing of the “mining convention agreement”.

This part of the permitting process involves months and months of negotiations with the Cameroon government to set out all of CAY’s fiscal and legal rights as well as obligations during the development and ongoing operation of the mine.

The mining convention is essentially the last step before CAY can apply for and be granted its mining permit.

CAY started the mining convention discussions on the 5th of November 2021 and negotiations continued all the way through to the 6th of December 2021. In CAY’s recent December quarterly, the company commented on this saying that negotiations were done and the final agreements were expected to be signed during Q1 2022.

With only 6 weeks left in the quarter, this news should be a major catalyst for the stock in the short term.

The longer term significance of this is more interesting to us though, as the signing of the Mining Convention will confirm the key financial parameters for the project, and gives CAY the greenlight to enter discussions with financing, offtake and logistics partners.

The second of these near term catalysts is the completion of the Bankable Feasibility Study (BFS).

The BFS started on the 23rd of December in 2020 when CAY announced that an agreement had been signed with leading Chinese engineering, procurement and construction (EPC) firm Changtian International Engineering Corporation (a wholly owned subsidiary of state owned China Minmetals Corporation who have US$86 billion in revenues and over 200,000 employees).

Under the agreement the EPC contractor would be in charge of delivering the BFS in-line with the stage-1 development program that was used in the PFS in 2020, a 5 Mtpa operation shipped out of the Douala port.

With improvements to the metallurgical testwork and increases to the resource for the project we expect the BFS to show increased project economics but we are more interested in what the BFS means for CAY in terms of time to production.

As seen in the image below, CAY needs to have its DFS/BFS and ESIA completed before it can apply for a mining permit.

As soon as the BFS is completed CAY will move a step closer towards being able to apply for the mining permit which is the last stage of permitting before the mine can commence production.

Importantly the BFS will also provide financiers the most detailed type of feasibility study from which financing decisions can be made with a lot more certainty.

Financiers always like to see a project de-risked as much as possible before they are happy to provide debt financing and the BFS is the gold standard for de-risking a project.

Another positive is that a delivered BFS will provide potential offtake partners assurance that CAY can operate the mine economically and that whatever offtake agreement is signed will likely be delivered into.

Overall the BFS gives CAY’s management team the confidence to go and sign binding agreements with these financiers/offtake partners whilst also progressing the project towards meeting the prerequisites for a mining permit in Cameroon.

On the 8th of December 2021, CAY announced that it had identified optimisation opportunities and that these would be worked into the BFS before it is completed. At the time it was guided for a release before the end of Q1 2022.

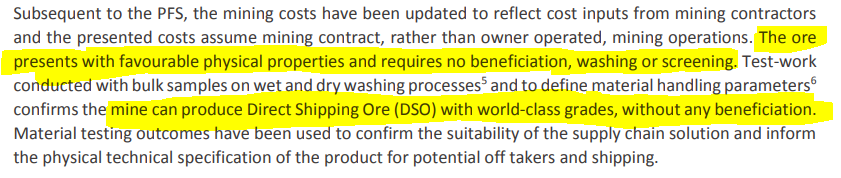

4. Simple mining process and near term production:

When a phrase like “one of the largest projects in the world” is thrown around, investors could be forgiven for thinking that they were about to build a mine the size of Canberra and spend billions of dollars getting there.

For CAY this just isn’t the case.

The first part is true, CAY is developing one of the largest undeveloped bauxite projects in the world. As for the latter, CAY is not spending billions of dollars to get there.

As we mentioned briefly earlier, bauxite is a really unique commodity in that it is just rocks made up of aluminium hydroxide elements. The best way to think about it is that its ore with a heap of soil and dirt surrounding it.

Getting the ore out isn’t as simple as washing the soil and dirt off but for the miners like CAY this doesn’t even matter, you simply load the bauxite ore onto ships and send them off to the smelters who do the rest of the work.

This differs to other commodities where typically the miners will need to crush, process and refine the ore into almost concentrates, taking for example a lump of rock with some gold in it and translating it to a bar of 100% gold before they can sell it.

This makes CAY’s project a direct shipping ore (DSO) development project. This means the mining methods are relatively simple and there is no need to spend heaps of capital building out processing facilities or any processing related infrastructure.

As Australians, the easiest way to try and understand just how much of an impact this has, is to think about all of those iron ore explorers that are tripping over each other’s heels to discover a DSO iron ore project.

CAY’s project is as DSO as they come.

CAY simply has to dig up the bauxite, stockpile it, get it onto the nominated logistic routes and ship them directly to the purchasers. No processing and no on site sorting of the ore.

This has two key advantages for CAY:

- It means CAY can ramp up production really quickly – All CAY has to do is sort out the logistical issues around the project, being mining fleet capacity or freight capacity and then production can be ramped up to whatever the logistical infrastructure can handle.

- It means CAY can focus its attention on one thing – All CAY has to do is make its logistical infrastructure more and more efficient and as the project ramps up, economies of scale can take care of bringing down costs.

All of this is reflected in the PFS that CAY did in 2020 which showed a start up capital requirement of only US$120M. This isn’t a number that investors are used to hearing when they hear “one of the largest undeveloped projects” in the world.

The high grade near surface nature of CAY’s bauxite deposit means mining for CAY is just that little bit easier versus its bauxite peers. Namely it means CAY has a much lower strip ratio (reference to how much worthless dirt needs to be dug out to get to the mineralised areas).

CAY plans to use conventional mechanised equipment including surface miners, bulldozers, front end loaders, haul trucks and other typical ancillary mining equipment.

Below is an image from 2021 of what CAY had envisaged the mining fleet would look like (2 surface miners, 10 trucks and a 350 man camp site). This epitomises how simple the mining process is for CAY’s project.

Of course with the upcoming BFS due, we expect some refinement to this and are eagerly waiting to see what CAY has changed in an attempt to improve project economics.

Speaking of the BFS, all of the above means that once the BFS is done, mining permits issued, financing and offtake agreements sorted, CAY can quickly progress into a final investment decision and get the project into production rather quickly.

5. Infrastructure development in the region:

Following on from all of what we have discussed so far, it’s pretty clear that CAY’s project is heavily dependent on well developed infrastructure.

This was one another part of the CAY story we have been following closely for the last 18 months.

Things changed in late 2020 when the Cameroon government received EUR$120M in financing from European Investment Bank to upgrade a 330km section of track that sits on the exact same railway line that CAY is planning to use to get its product to the Douala port.

The financing news really took our interest because up until then there was an underutilised railway line that just wasn’t suitable for CAY’s freight requirements.

After the Cameroon government completed these upgrades CAY received confirmation from the Cameroon rail authority “CamRail” that the railway line was now deemed capable enough of shipping the desired 5 Mtpa of bauxite and potentially more than this.

Those who invested years ago expecting the mine to be put into production quickly can be forgiven for not reacting to an upgrade of rail infrastructure in the area.

The CAY share price off the back of this announcement was unchanged.

But we can understand exhausted long term holders may have been thinking “Why should I care about this”.

The reality is that this is the key to unlocking the potential of CAY’s project, developed rail infrastructure solves one of the biggest issues CAY has faced. The issue of getting the bauxite from the mine to the port.

All of this comes together and derisks stage 1 of CAY’s development plans.

Once a final investment decision is made and the asset is in production, the next big development in terms of freight infrastructure will be to see the Cameroon government develop railway infrastructure to the newly constructed deep water port of Kibri (seen below).

That is something to discuss later but if we can see a similar commitment to develop infrastructure leading to that port, then this could mean CAY’s project becomes significantly bigger.

6. Bauxite market changes and market dynamics

Bauxite market changes and aluminium market dynamics are a key part of our investment thesis for CAY, and we did a deep dive on the rather opaque bauxite market.

In the short term, the bauxite story starts with a neighbouring country – Indonesia.

Indonesia is planning to ban export of bauxite at the end of 2022, meaning new sources of supply should become more attractive.

Additionally, Guinea – the primary bauxite supplier in West Africa and the second biggest producer globally, is currently experiencing political instability which could mean there are medium term supply shocks in the industry.

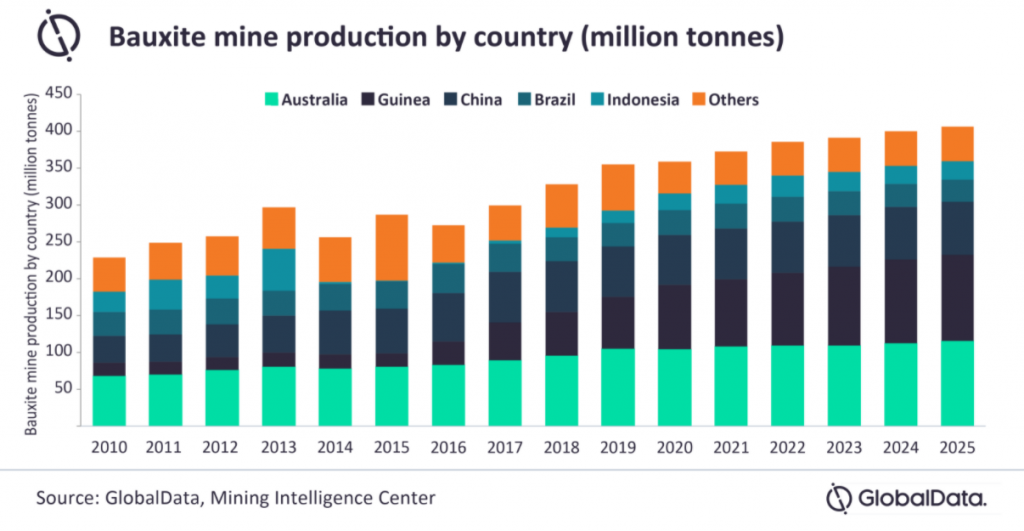

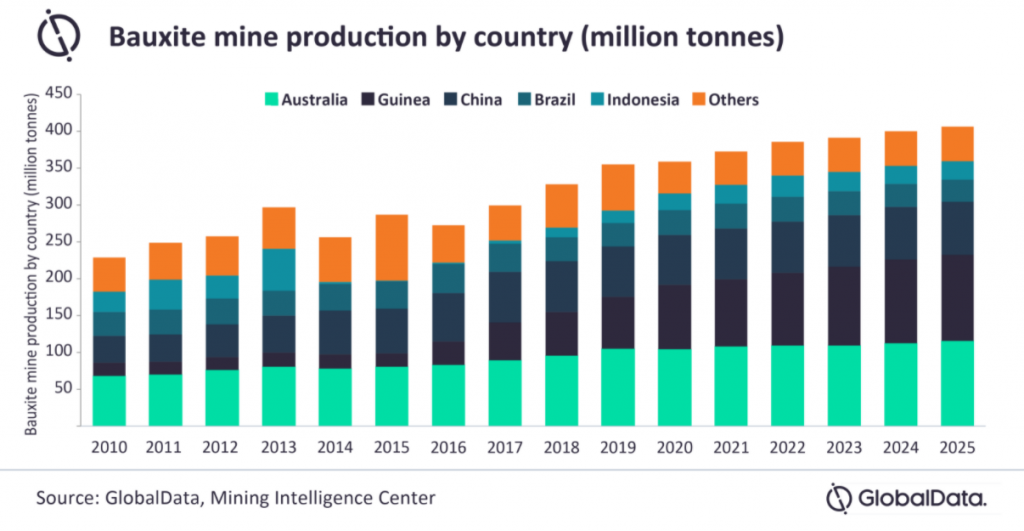

You can see a breakdown of the major bauxite producers below with projections through to 2025:

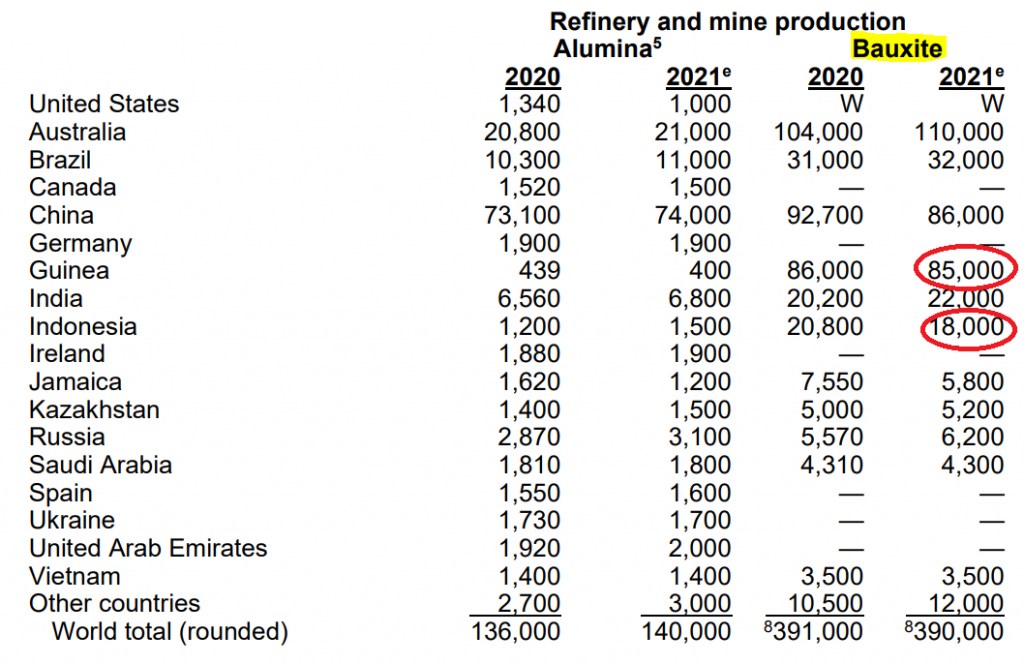

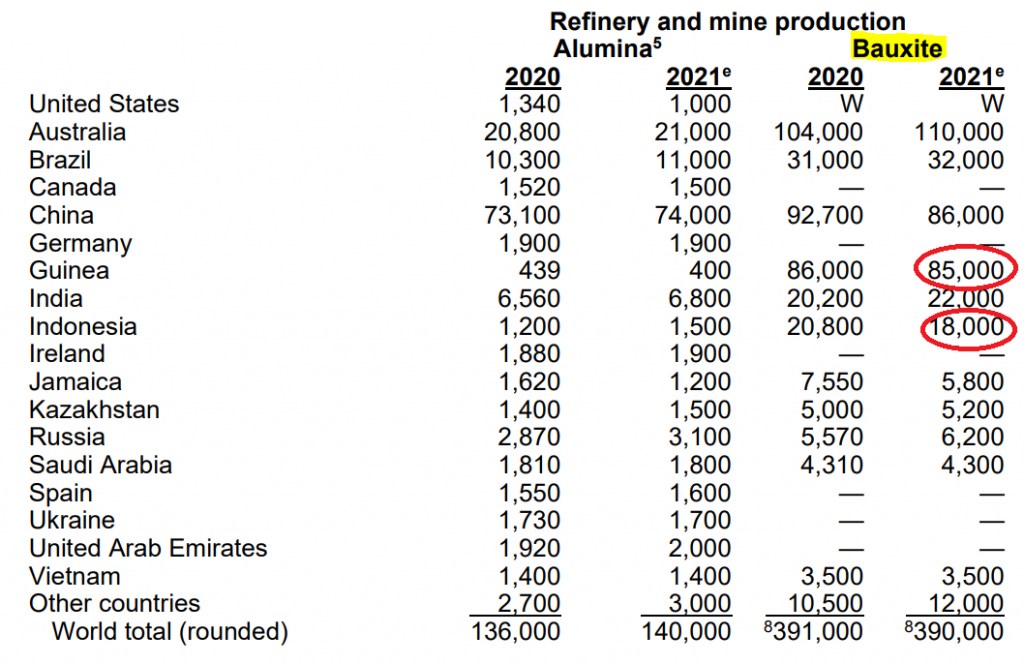

And a summary of 2021 bauxite production figures below (Guinea and Indonesia circled in far right column):

What if Guinea suffered a drop in production/went offline and Indonesia banned bauxite exports?

If both happened at the same time, we think that could wipe out around a quarter of bauxite supply quite quickly – furthering the appeal of CAY’s high grade bauxite with low silica content (a key contaminant in bauxite which drives up the cost of aluminium production).

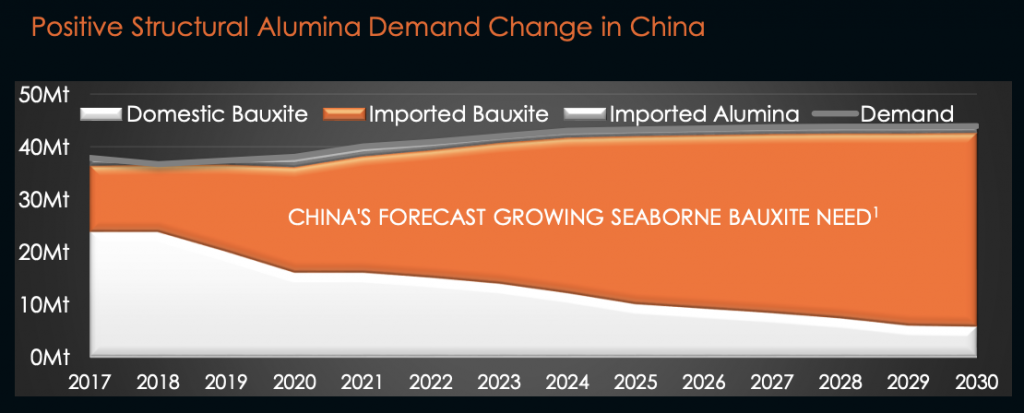

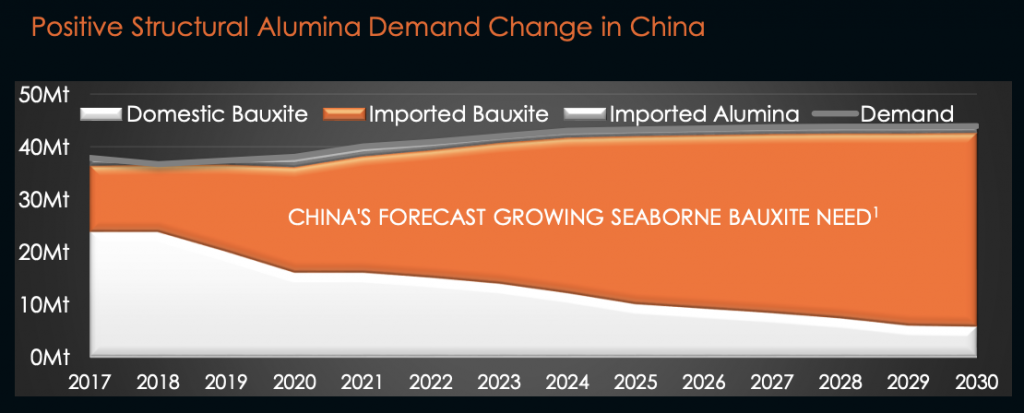

You can also see in the left hand column that China has about 3x greater production in 2021 than the next largest alumina producer (Australia).

Throw in a projected 20% increase in Chinese demand for imported bauxite – and you get a sense for what we think is unfolding right now.

This demand trend in China is set to play out for the next 8 years:

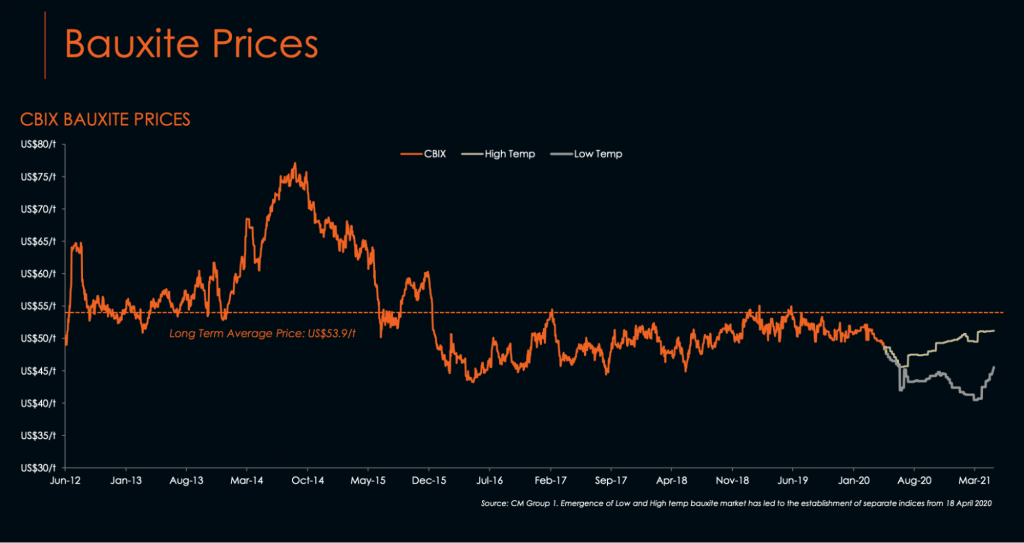

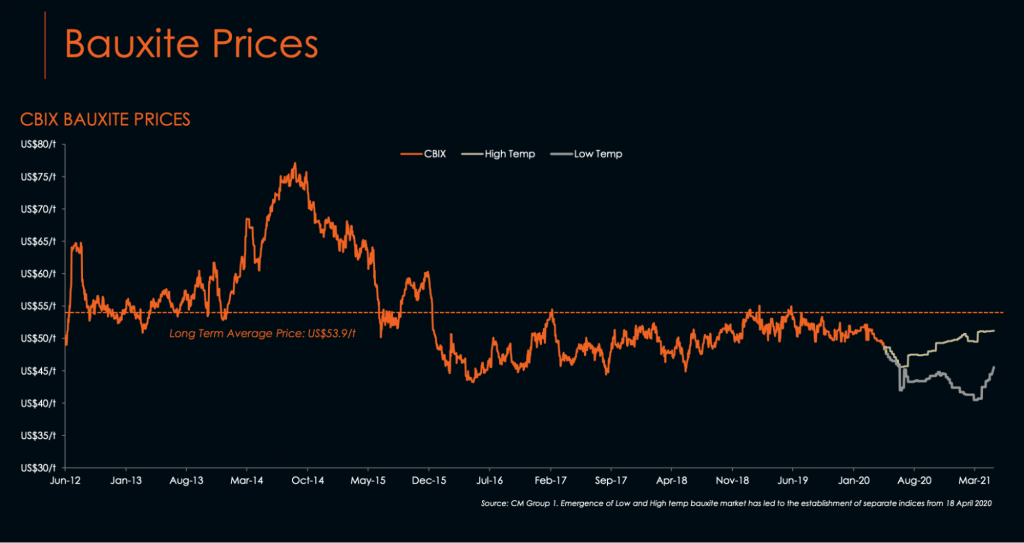

Now, it is worth noting that there is a disconnect between bauxite prices and aluminium prices.

You can see the price chart below:

Remembering that not all bauxite is the same, and that CAY has the highest grade undeveloped bauxite project in the world.

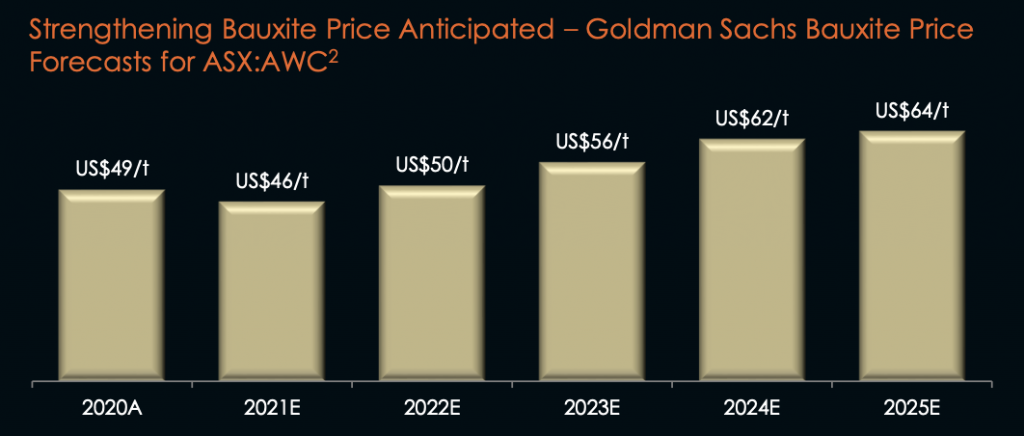

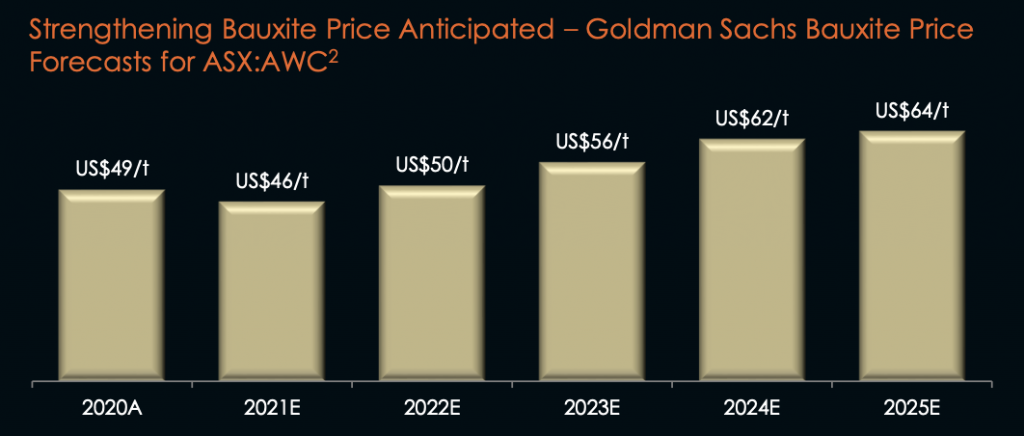

Goldman Sachs is projecting the following increase in bauxite prices through to 2025:

Each incremental increase directly feeds into the economics of CAY’s mine. And given CAY’s quality product we expect their bauxite to fetch a premium to these prices.

This is about more than just economics though.

CAY needs the backing of the Cameroon government, and fortunately for CAY, they have a strong supporter.

7. Political momentum in Cameroon

CAY’s relationship with the government of Cameroon is critical to their success.

The key person backing CAY in Cameroon is Nfon Ekoko Mukete.

The Nfon or “chief” has an impressive CV and is an influential businessman in Cameroon.

The Nfon is a prominent social/business identity in the country and could help usher CAY’s project through to final investment decision.

And as a board member of the Board Member of the Cameroon Investment and Promotion Agency, and a Vice President of the Cameroon Chamber of Commerce, Industry, Mines &

Crafts, we think he brings with him the right contacts and political clout to CAY’s project

We also think his business acumen and social position were key reasons why CAY appointed the Nfon to the board of CAY’s subsidiary company, Camalco Cameroon S.A.

Combine the Nfon’s backing with a broader commitment by the Cameroon government to make mining a major priority, and we believe there is sufficient political momentum to make CAY’s project Cameroon’s first major mine.

Which in turn, could be a breakthrough for the Cameroon government’s economic agenda.

If you want to follow the CAY story and our investment journey or any other investment in our portfolio, subscribe to Wise-Owl for updates.

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 3,000,000 CAY shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by CAY to share our commentary on the progress of our investment in CAY over time.