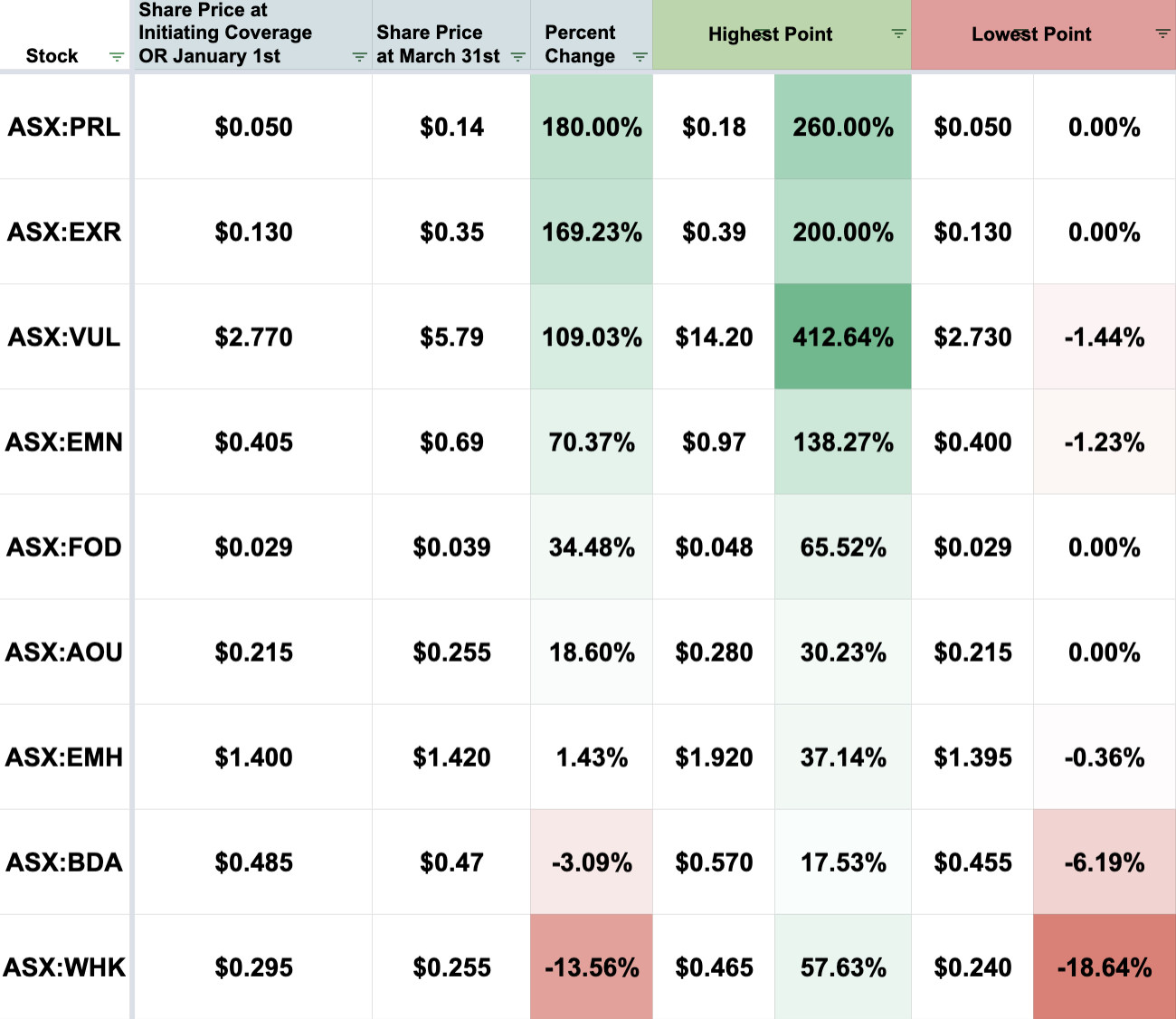

How Our Investments Performed in Q1 of 2021

At Wise Owl we invest in a carefully selected portfolio of ASX listed companies that we hold for the long term – and we share our research.

Today we analyse how each of our investments performed in the first quarter of 2021.

We cover what each company has delivered, how the share price has performed and what we expect to happen next for each of our portfolio companies.

To date we have taken positions in nine carefully researched small cap ASX stocks.

We added five new stocks to our portfolio during January 1st to March 31st 2020 PRL, EMH, FOD, BDA and AOU:

We are always running due diligence on potential new ASX stocks, and expect to add new investments to our portfolio during the next three months.

Wise-owl was acquired by StocksDigital in March 2020 and was converted to a free subscription “investment portfolio model” similar to StocksDigtial’s two other sites nextinvestors.com and catalysthunter.com.

Our model is to share our research and commentary on a small number of carefully selected portfolio companies we are invested in for the long term – around 10 per year.

Wise-owl shares some common portfolio companies with Next Investors and is now adding its own investments. We will continue to provide you with regular updates on the long term positions in our portfolio over the coming years.

For every investment in our portfolio we write research and commentary including:

- When the company releases important news and what it means

- If we think there might be a potential short term price rise

- When we believe a stock is undervalued

- When there is global news that affects the stock.

Here is how the Wise-owl portfolio performed from Jan 1st to March 31st:

Here is a short summary on the performance of each of our portfolio companies from Jan 1st to March 30th 2021, including:

📋 Description of the company

🌏 Macro Investment Theme

✅ Achievements in the last quarter

💬 Our commentary on the last quarter and what to expect next

📈 Share price performance from last quarter or Initiating Coverage

European Metals Holdings (ASX:EMH; AIM:EMH; NASDAQ:ERPNF)

📋 About: Developing the largest hard rock lithium resource in the European Union.

🌏 Macro Theme: The EU shift to Electric Vehicles, and enforced local sourcing of battery metals.

✅ Raised A$7.1M. Received institutional support including A$5M from a Luxembourg green energy fund.

✅ “Measured” resource drilling underway. 12 holes out of 19 complete. Interim results to date are in line with or better than expectations.

✅ New US based board addition. EMH appointed Ambassador Lincoln Palmer Bloomfield Jr to the board. Ambassador Bloomfield has worked in the security apparatus of the US Government under three Presidents and five Administrations, and will deepen EMH’s understanding of resource security concerns.

💬 Our commentary

- EMH has been quiet this quarter, as it progresses toward a Final Investment Decision. A lack of ASX announcements hasn’t stopped the company’s share price to continue its upward momentum.

- One major catalyst that we would like to see is an early offtake agreement for future lithium production. We have seen other lithium stocks such as Piedmont Lithium surge off the back of an offtake with Tesla.

- We like that EMH is listed in the US, meaning greater access for investors to trade on the shares.

📈 Quarterly share price from Initiating Coverage:

- Start (Mar 3rd): $1.40c

- End (Mar 31st): $1.42c

- Highest: $1.92c

- Lowest: $1.03c

The Food Revolution Group (ASX: FOD)

📋 About: Food and beverage manufacturing company. FOD sells a range of high quality juices, fibres, wellness beverages and supplements. The most widely recognised brand FOD owns is the Original Black Label juice brand, available in Coles, Woolworths, and major retailers.

🌏 Macro Theme: The Foods & Beverages market related to wellness products (preventative) is the fastest growing sector within the $4.8BN US market. The global wellness market is worth US$4.5TN and growing.

✅ Juice Lab Wellness Shots rollout. Now in over 1,000 stores, sales exceeding expectations in first weeks of availability.

✅ Sales continue to grow. FOD is growing at 25.9% versus total market growth of 1.1%. Original Juice Co brand growing at 24.4%.

✅ Metcash and Woolworths to stock the range. Australian supermarkets to all be stocked by May.

✅ Raised $3M. Secured an investment of $3M from two strategic global institutions. The placement price was 3.5c.

💬 Our commentary:

- Following the most recent capital raise, FOD now has the balance sheet strength to increase the profile of its Original Juice Co and Juice Lab products, while also delivering new product ranges to the market in coming periods. These will be key catalysts to watch.

- We expect FOD’s turnaround to continue on the back of further brand recognition and product roll outs.

- Complete quarterly numbers are expected to be delivered in the coming weeks. We expect FOD will once again report higher quarter on quarter sales and revenue figures.

📈 Quarterly share price from Initiating Coverage:

- Start (Mar 8th): 2.9c

- End (Mar 31st): 3.9c

- Highest: 3.9c

- Lowest: 2.9c

BOD Australia (ASX: BDA)

📋 About: BDA is a medicinal cannabis healthcare company that delivers premium, proven and trusted products for both the consumer and medicinal markets across the globe. BDA is already generating revenue and counts on the owner of Swisse Vitamins as an exclusive distributor.

🌏 Macro Theme: Cannabis legislation around the world is loosening up as medicinal cannabis products become widely accepted as health care alternatives.

✅ Quarter on quarter sales growth. Achieved record medicinal cannabis sales growth during the March quarter of fiscal 2021, filling 3789 MediCabilisTM prescriptions.

✅ Treating long-COVID? Drug Science UK will assess the efficacy of BDA’s medicinal cannabis, MediCabilis®, in managing symptoms associated with the long term impact of COVID-19 – known as long-COVID.

💬 Our commentary

- After the quarter end, BDA confirmed its first US binding purchase order for US$312,000 – we think that could lead to many more in what is the largest market for medicinal cannabis.

- BDA continues to perform strongly in the UK, and has now launched nine products through the Swisse brand.

- We initiated coverage of BDA in mid March, and are looking forward to seeing how the company’s sales progresses over the coming months.

📈 Quarterly share price from Initiating Coverage:

- Start (Mar 17th): 48.5c

- End (Mar 31st): 47c

- Highest: 57c

- Lowest: 45.5c

Auroch Minerals (ASX: AOU)

📋 About: Exploring for nickel underneath a historically producing nickel mine.

🌏 Macro Theme: Electric vehicle batteries need nickel. A global nickel shortage is expected this decade.

✅ “Spectacular nickel results” Confirmed spectacular nickel drilling results that are superior to other nickel stocks that rose 1,750% and 213% respectively.

✅ BHP effect. We suspect BHP wants to ramp up nickel production in the area of AOU’s mine, with a view to sell to battery makers like Tesla.

💬 Our commentary

- Unlocking a much larger nickel resource below/along strike to an old nickel mine has happened before in WA – Western Areas is the case study here and shareholders were rewarded.

- AOU continues to deliver impressive drill results, confirming thick, high grade nickel at shallow depths at its historical nickel mine.

- AOU has a number of options that exercise at 10c that have been converting into shares over recent months. This is good in that it brings funds into the company without having to tap the broader market, but it can also dampen the momentum in the share price.

- We think a surge in nickel prices is going to occur in the coming years, off the back of its use in Electric Vehicle batteries.

📈 Quarterly share price from Initiating Coverage:

- Start (Mar 24th): 21.5c

- End (Mar 31st): 25.5c

- Highest: 28c

- Lowest: 21.5c

Province Resources (ASX: PRL)

📋 About: Aiming to be Australia’s first truly Zero Carbon, Green Hydrogen producer.

🌏 Macro Theme: Green Hydrogen is arguable the fastest growing and most talked about emerging area of the global economy as the world turns to green, carbon free energy and transportation.

✅ Increased landholding. Applied for a further 864 square kilometres in the Gascoyne coastal region in Western Australia that could double the potential of its HyEnergy Zero Carbon HydrogenTM Project.

✅ Fortescue pegging ground nearby. Fortescue put applications on the land right next to PRL.

✅ SODAR Monitoring Station. The monitoring station is critical in collecting preliminary wind and solar data every 10 minutes within the project area to assess the wind and solar resource potential.

💬 Our commentary

- Our investment in PRL and its Zero Carbon Green Hydrogen project has been one of the highlights of the quarter.

- When PRL launched its Zero Carbon Hydrogen project we couldn’t help noticing a lot of similarities to Vulcan Energy and our position hasn’t changed.

- We first covered PRL at 2.6c, it is currently 14.5c and with a three stage plan leading into export and full scale production to Asian markets, there is plenty of upside potential.

📈 Quarterly Share price:

- Start (Feb 17th): 5c

- End (Mar 31st): 14c

- Highest: 18c

- Lowest: 5c

Vulcan Energy Resources (ASX:VUL, FRA:6KO)

📋 About: Developing Zero Carbon Lithium to supply Europe’s rapid shift to battery metals.

🌏 Macro Themes: EU shift to Electric Vehicles and enforced ethical, low carbon, local sourcing of battery metals in Europe and North America.

✅ PFS. In January VUL released its PFS which shows an after tax Net Present Value of €2.25 Billion (AU$3.55BN) – much bigger than expectations.

✅ Gina Rinehart Invested. Vulcan raised $120 million, with Australia’s richest persona and famous mining magnate Gina Rinehart corner-stoning the raise.

✅ Three major Board appointments. Vulcan added a senior German chemicals industry executive, a Senior Director with the European Union Transport and Environment (T&E) who was instrumental in shaping policies around EU vehicle CO2 standards and sustainable batteries and a former Tesla executive to provide consulting services to Vulcan in relation to the lithium market, battery supply chain and offtake.

💬 Our commentary

- Massive quarter with VUL share price surging to $14.2 before consolidating back around the placement price of $6.50 for a few weeks. Now hopefully looking for the next leg up soon.

- Volkswagen’s ‘Power Day’ shows how serious and real the EV transition is.

- We feel VUL has now been significantly de-risked, with a market valuation underpinned by the $120M funding round.

📈 Quarterly share price:

- Start (Jan 1st): $2.77

- End (Mar 31st): $5.79

- Highest: $14.20

- Lowest: $2.73

Euro Manganese (ASX: EMN, TSX.V: EMN)

📋 About: Developing a Green and European source of ultra high purity manganese for Electric Vehicle batteries developed from the recycling of a tailings deposit located in the Czech Republic.

🌏 Macro Themes: EU shift to Electric Vehicles and enforced ethical, low carbon, local sourcing of battery metals in Europe and North America.

✅ European Union backing. EU government backed entity EIT InnoEnergy will invest €250,000 and help secure financing of the project and find offtakers.

✅ $30M raised. Used to install, commission and operate the Demonstration Plant and to finalise its Definitive Feasibility Study and Final Environmental Impact Assessment.

✅ US-based OTCQX listing commenced. Will allow US-based investors interested to easily purchase Euro Manganese shares on the actively traded OTCQX market.

💬 Our commentary

- We are very happy with the EIT Inno Energy investment into EMN, which will help with securing project financing and introductions to offtake customers.

- A new $30M capital raised lets the company get on with things.

- As with VUL, we are holding a long term position as we really believe in the EV battery metals theme, especially in Europe over the next 10 years.

- Volkswagen power days show how serious and real this movement is.

📈 Quarterly share price:

- Start (Jan 1st): 40.5c

- End (Mar 31st): 69c

- Highest: 97c

- Lowest: 41c

Elixir Energy (ASX: EXR)

📋 About: Exploring for natural gas on the Mongolian-China border to replace burning of coal for energy in China.

🌏 Macro Theme: China’s new 5 year plan demands reduction of burning dirty coal for energy and aims to reduce reliance on foreign powers for energy supply.

✅ Commenced 2021 field program. Well spudded on 6 March 2021.

✅ Targeting 13 new wells. Elixir aims to complete exploration of 13 wells; it will also be performing some important production test work on the Nomgon sub-basin coal seams.

💬 Our commentary

- EXR has had a great quarter share price wise and have now commenced their 2021 work program.

- We are expecting a similar rate of news flow on drills, results and analysis over the coming months.

📈 Quarterly share price:

- Start (Jan 1st): 13c

- End (Mar 31st): 35c

- Highest: 39c

- Lowest: 13c

WhiteHawk (ASX:WHK)

📋 About: USA based cybersecurity company, providing cyber risk products, services and solutions.

🌏 Macro Theme: Whole nations are now under the threat of cybersecurity attacks. The global cybersecurity market size is forecasted to grow to US$248.26BN by 2023.

✅ ESG Reporting. Adopted Environmental Social Governance reporting standard

✅ Revenue Figures to Digest. Preliminary Final Report for 2020 released which gave investors positive revenue figure from the previous year.

💬 Our commentary

- It has been slow on the WHK front, but we maintain our position.

- Given the lack of material news, its share price is down on the quarter, but it is coiled like a spring and could run on big news.

- Historically WHK has taken time to deliver news, but when it does it is usually in the form of large revenue generating contracts.

- We expect the news to flow from WHK in the second half of the year.

📈 Quarterly Share price:

- Start (Jan 1st): 29.5c

- End (Mar 31st): 25.5c

- Highest: 46.5c

- Lowest: 25c