Graphite to boom in 2022? EV1 targeting greenest graphite into European markets

Our graphite investment, Evolution Energy Minerals (ASX:EV1), is now pursuing production of the world’s greenest graphite battery materials.

EV1 was our Wise Owl “Pick of the Year” for 2021 and we make no secret of the fact that our best investments are in the battery metals space.

To date, we’re currently sitting on a 4,440% return from our initial entry for Vulcan Energy Resources and a 669% return from Euro Manganese.

Here’s the quickest version of why we made EV1 our “Pick of the Year”:

EV1 is pursuing near-term production of high quality graphite (Definitive Feasibility Study complete) for the electric vehicle market, utilising best in-class ESG principles, which in turn could unlock significant funding opportunities from large pools of ESG capital that need to find a home in future-facing and sustainable resources.

Our past successes Vulcan and Euro Manganese are both located in Europe, we’ve learnt today that EV1 is now also targeting the European EV market and has become a member of the European Battery Alliance.

The European Battery Alliance is an organisation which brings together over 600 stakeholders, including government organisations like the European Commission, the European Investment Bank and corporate giants like Tesla, Umicore and LG Chem.

Its purpose is to fast track offtakes, financing and partnerships to drive the European electric vehicle sector.

Vulcan became a member of the European Battery Alliance when it was trading at just 26 cents. Today Vulcan is trading at ~$8.80.

We know that’s not the reason Vulcan climbed to where it did of course, but it’s a positive signal for us that EV1 is trying to tread a similar path – and is why EV1 is one of our biggest investments.

By joining the European Battery Alliance, EV1 is signalling its intent to become a supplier of battery materials to Europe… with strong sustainability and ESG credentials.

We look at and analyse a large volume of companies and EV1 strikes us as a company that is deeply serious about its ESG commitments – something we think will materially improve its access to finance and ultimately its cost of capital for its proposed graphite mine in Tanzania.

EV1’s Board is incentivized to deliver on its ESG commitments and performance bonuses will be withheld if their commitments are not followed through on – they could even lose their position in the event of a serious incident.

In other words, EV1 has ESG ingrained in the fibre of its business – more so than nearly any company we’ve seen.

We also believe that 2022 is going to be the year for graphite, a material that makes up 95% of a battery anode and we’ve sighted a growing number of mainstream media articles pointing to a looming graphite boom. We’ll summarise the key points from those today.

We’re enthused to see Phil Hoskins assume the Managing Director role at EV1 – Phil is someone who has been working on this Tanzanian graphite project since the first drill hole was made in 2014.

What’s more, EV1 has also started a downstream value add program meaning they are seeking to produce higher margin products. As a general rule, investors are very keen to see this because these higher margins have historically led to higher market caps for EV1’s peers.

Adding value to the raw graphite product downstream by refining and processing BEFORE selling it can be highly profitable and is viewed favourably by the market, especially in the graphite space – as we have seen with EV1 peers EcoGraf Limited (~$250M capped) and Magnis Energy Technologies (~$410M capped).

EV1 is currently capped at ~$70M.

We took a bigger than usual position when we first invested in EV1 and it’s probably our favourite investment at the moment (which is why we called it our pick of the year).

Here’s how we’ll break things down today:

- What the European Battery Alliance means for EV1

- ESG, Europe and how EV1’s project becomes reality

- Why we think graphite could “do a lithium” in 2022

- Graphite media review

- Introduce Phil Hoskins, the new EV1 Managing Director

- Why we think EV1s downstream tech holds key to margin and re-rate

If there’s one key takeaway from what we cover today, it’s that EV1 is making significant progress across a number of important aspects of their business.

EV1 has also reiterated that they are on track for a construction decision as early as H2 2022.

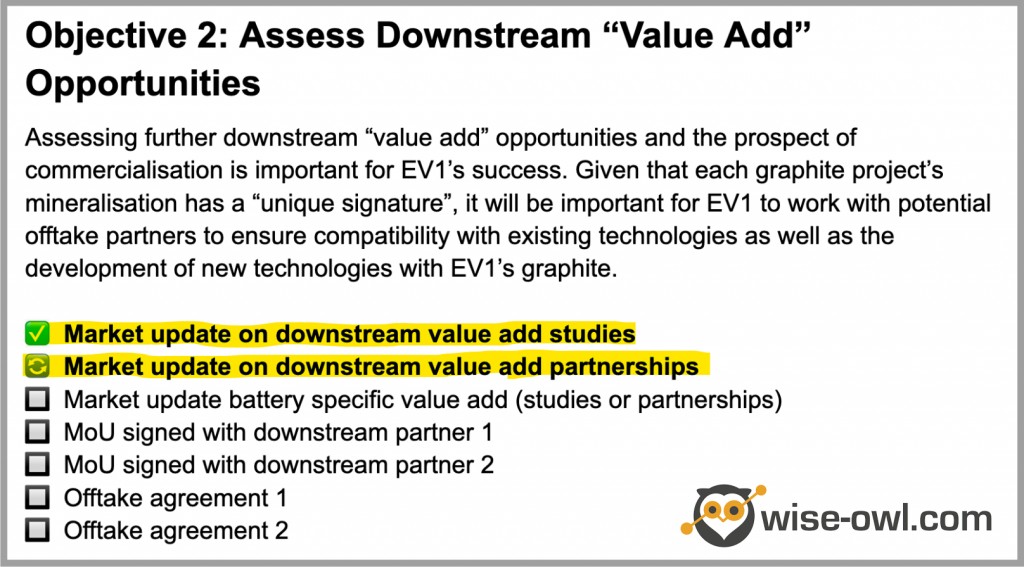

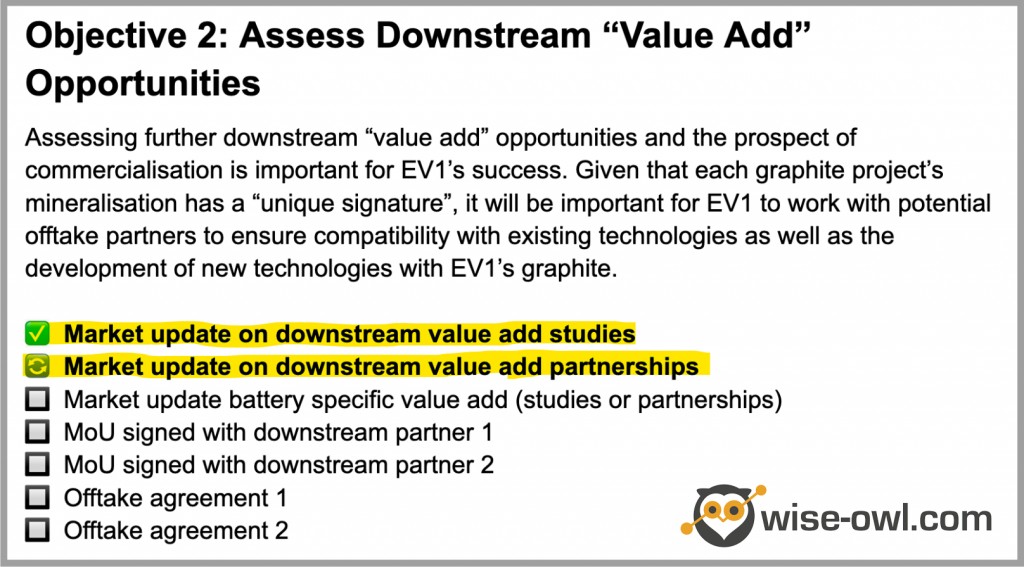

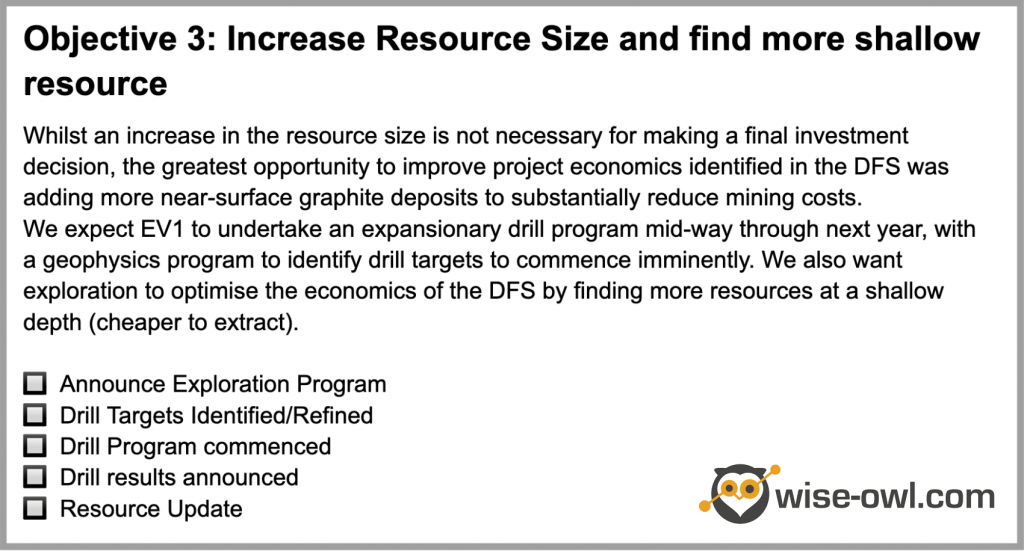

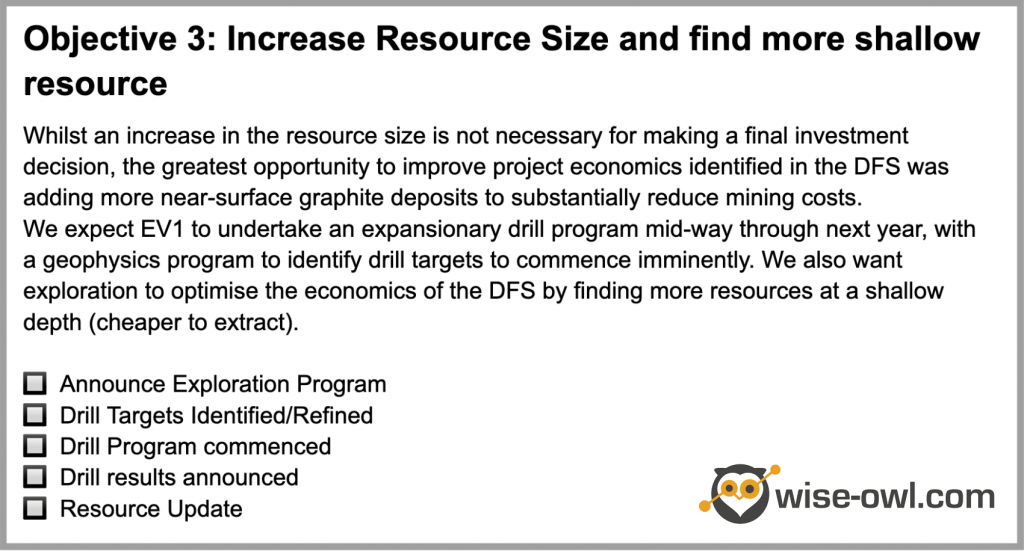

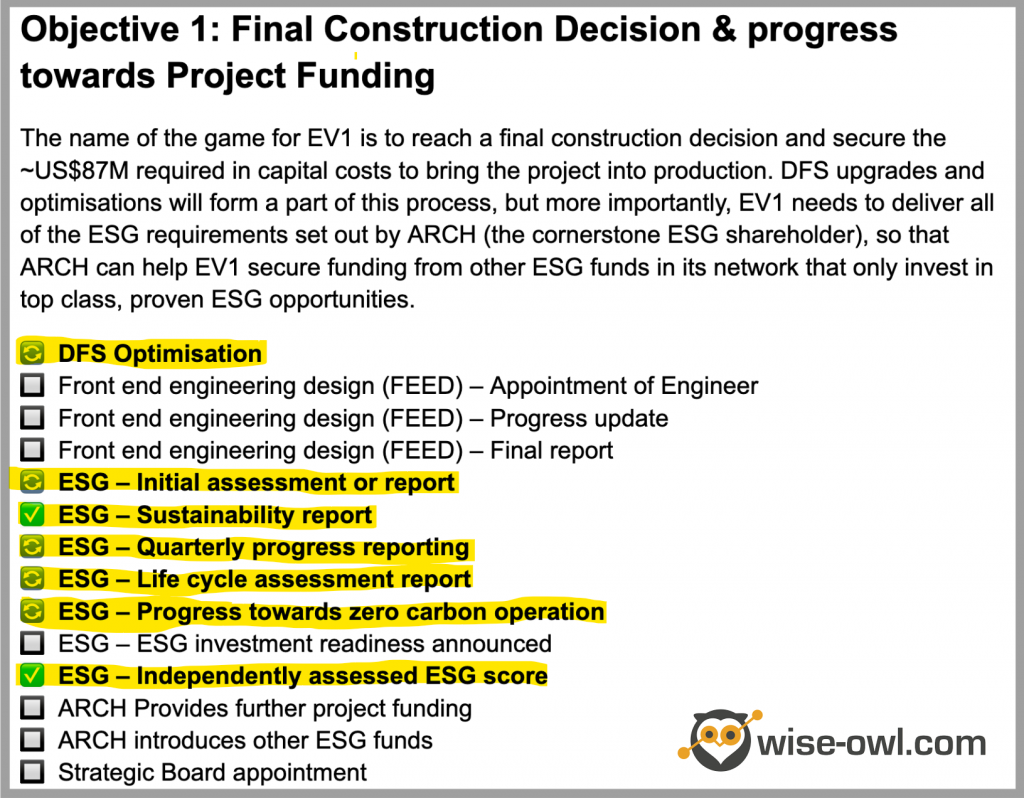

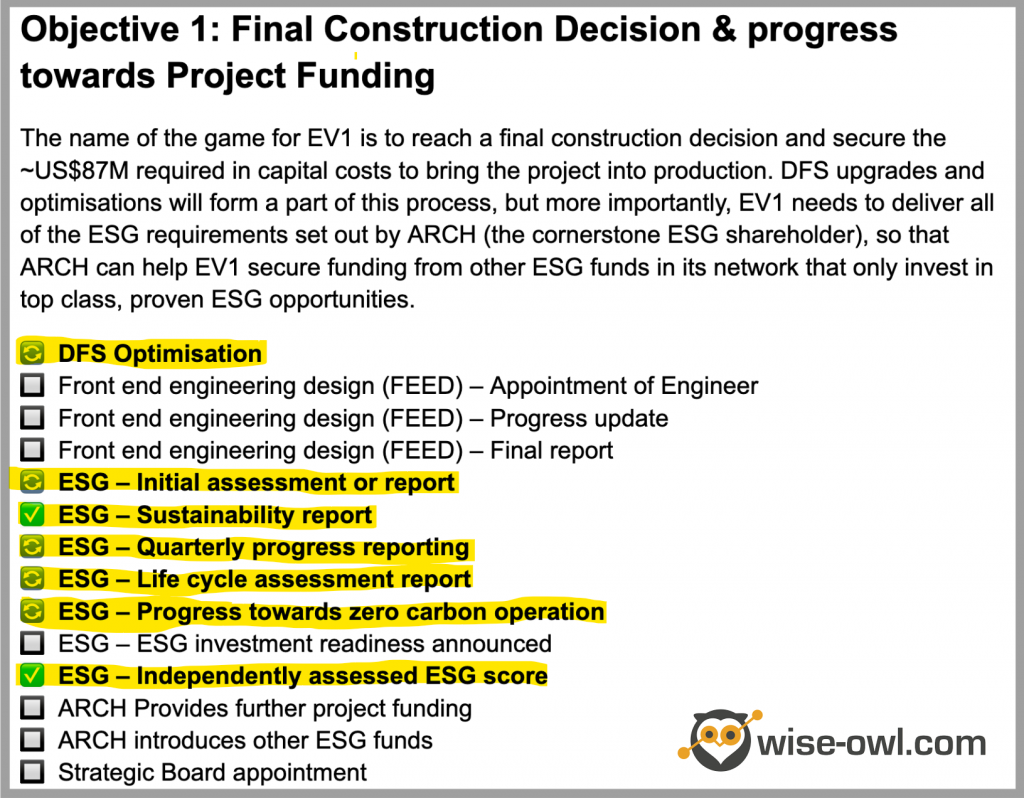

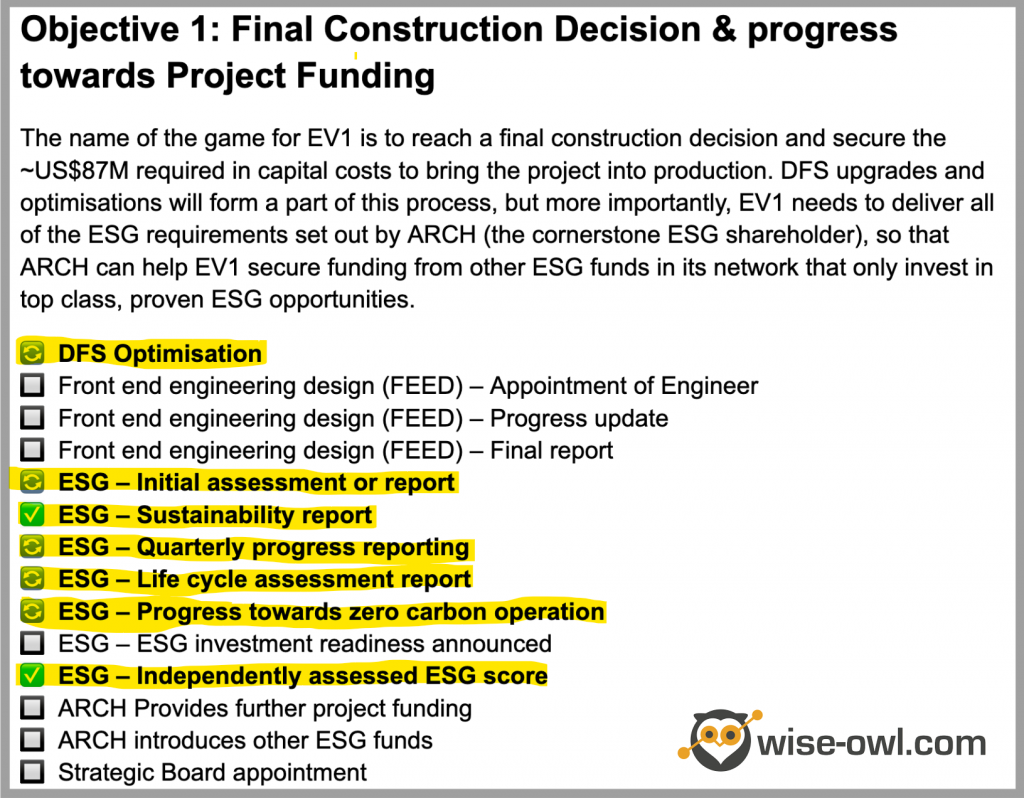

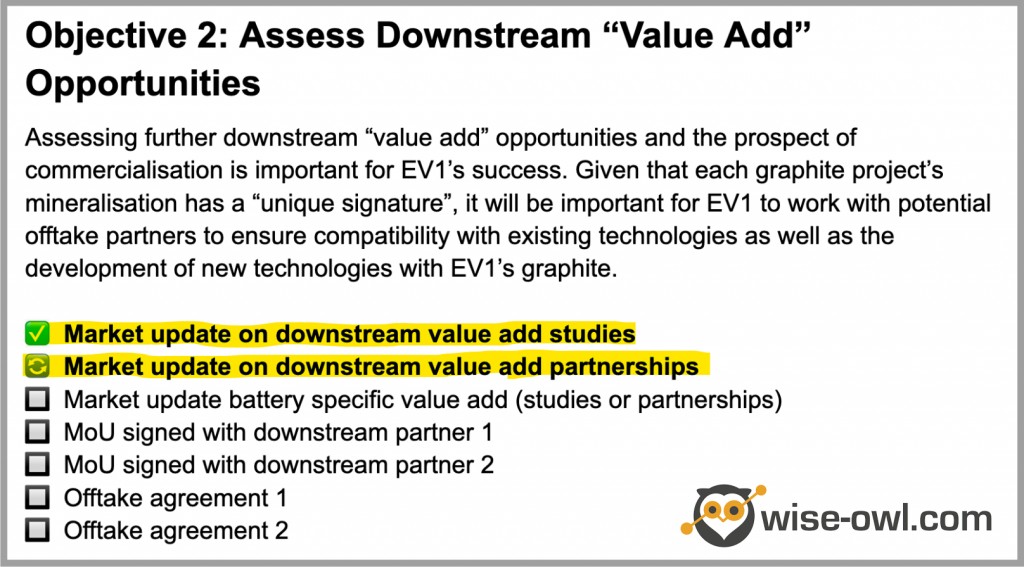

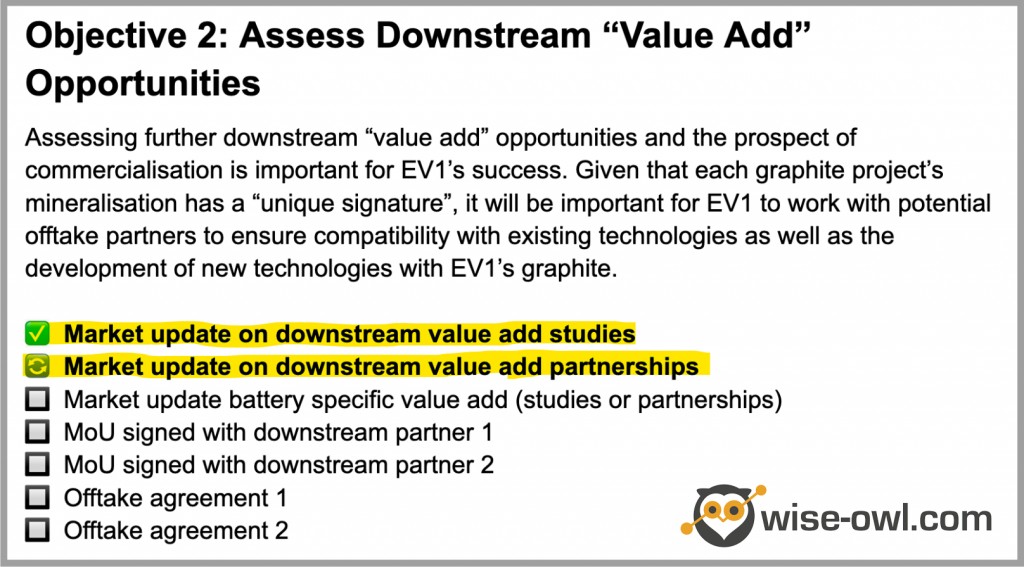

These are the three Key Objectives that we’ve laid out for EV1 in our Investment Memo.

We use this memo to track how EV1 is progressing over time against its key objectives, and we have included milestones we want to see that feed into each objective.

Here is the progress EV1 has made against its key objectives since our last communication:

EV1’s Key Objectives, Updated Milestones (NEW highlighted):

In what we’re going to cover today, the progress for EV1 so far is across Key Objectives, #1 and #2, though we expect exploration progress in the coming months as per Key Objective #3.

Evolution Minerals

Today, EV1 announced that it had been accepted as a member of the European Battery Alliance, which includes over 600 members across the battery supply chain.

The European Battery Alliance (EBA) was launched in October 2017 to create a competitive and sustainable battery cell manufacturing value chain in Europe.

EV1 is now the third company in our portfolio to enter the European Battery Alliance, along with Vulcan Energy Resources and European Metals Holdings.

The platform includes heavyweight companies such as Tesla, Umicore and LG Chem and involves government organisations such as the European Commission and the European Investment Bank.

Given that members of the European Battery Alliance such as BMW, Mercedes and Volkswagen have all publicly committed to building a more sustainable battery supply chain – we think it bodes well for EV1’s ESG focussed, European battery market ambitions to be a member of the European Battery Alliance.

That’s because there’s a close link between sustainable graphite, end users (EV companies) and EV1’s ability to secure financing and make its Tanzanian graphite project a reality.

ESG, Europe and How EV1’s Project Becomes Reality

With today’s announcement, it appears clear to us that EV1’s primary target market is now the lucrative European EV market.

This market is different from the Chinese EV market, as we think European carmakers are more committed to sustainably sourcing their EV raw materials in accordance with ESG principles.

In our opinion, EV1 is to date making strong progress on satisfying the needs of both carmakers and ESG funds which is directly aligned with Key Objective #1 in our EV1 Investment Memo:

London-based ARCH Emerging Markets Partners runs several investment funds, and EV1 is the inaugural investment within its ARCH Sustainable Resources Fund which holds 25% of EV1.

As EV1’s cornerstone investor ARCH requires ESG principles to be embedded in its investments and, we note that EV1 recently received its maiden independent ESG rating.

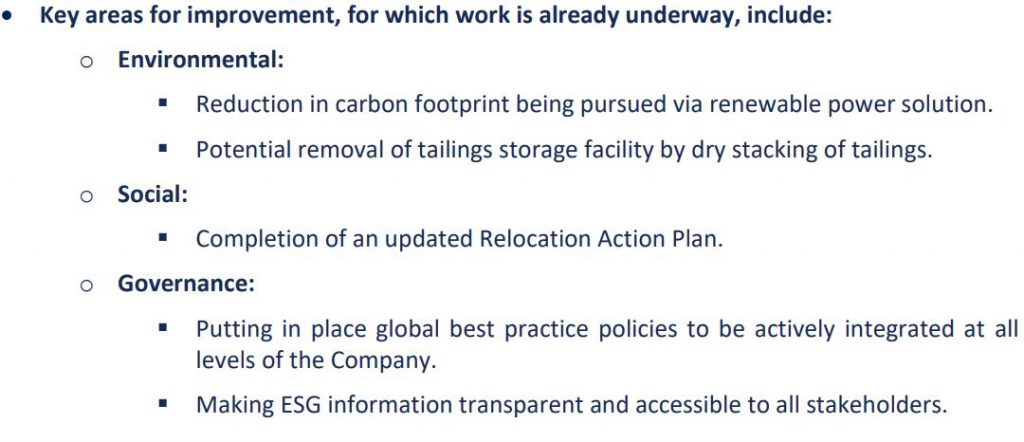

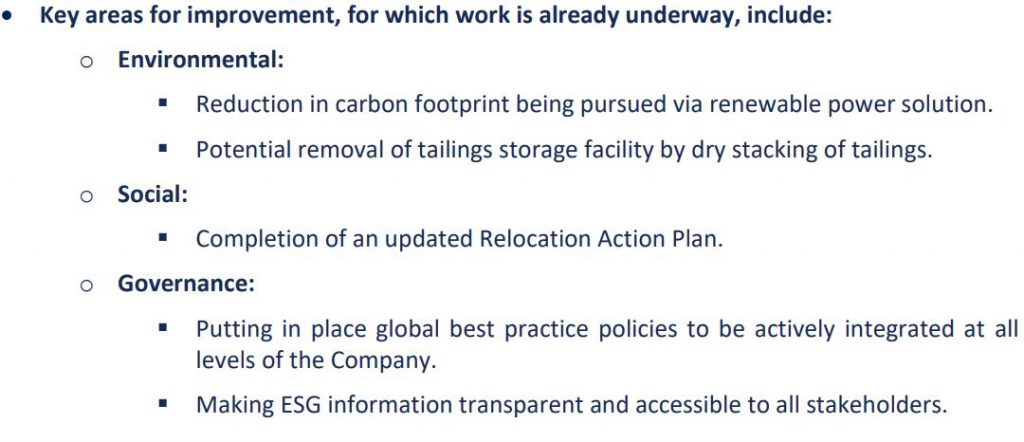

EV1 recently announced a baseline ESG “B” rating – which we think all things considered is a good start for the company.

And the fact they are measuring ESG means they can start improving ESG to improve that score in the lead up to securing financing for its project from ESG funds.

Importantly, EV1 has achievable things it can do to improve this rating:

An “A” would be great and to our knowledge, EV1 is the only ASX-listed graphite company that has engaged an independent ESG assessment organisation.

While many companies are starting to disclose their ESG, EV1 is taking it further by actively investing to significantly improve their ESG credentials and have them independently verified and scored.

We think this should provide a key point of difference between EV1 and its peers as EV companies and ESG funds seek to inject capital into the most sustainable parts of the battery metal supply chain.

With cornerstone investor ARCH on the register, and ARCH’s ability to kick in more funds should EV1 meet its ESG commitments, we think EV1 is well placed to capture a significant share of the green graphite supply chain.

And along the way, we’re looking to see what ARCH can achieve in terms of introducing other ESG funds to EV1’s graphite project – ideally leading to EV1 securing the funds necessary to get its graphite into production.

Internally, we’ve been convinced that graphite will be the next battery material to experience a major price boom, something which could follow a similar trajectory to the most popular battery material out there at the moment – lithium.

Why we think graphite could “do a lithium” in 2022

Our thesis today is that the graphite market is starting to experience the beginnings of a lithium-like boom.

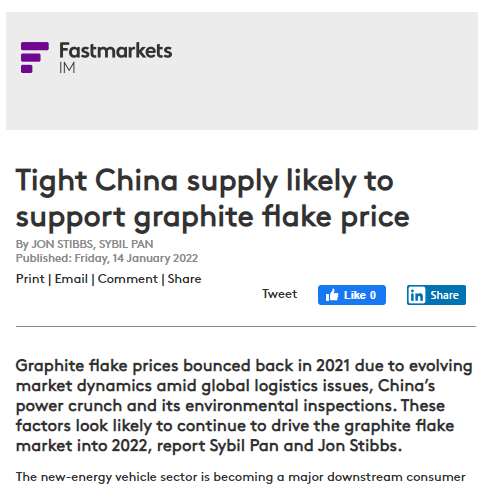

Indeed, this coverage from late last month points to that being the case:

So while lithium gets much of the attention right now when it comes to battery metals investment, we think that attention will soon turn towards graphite.

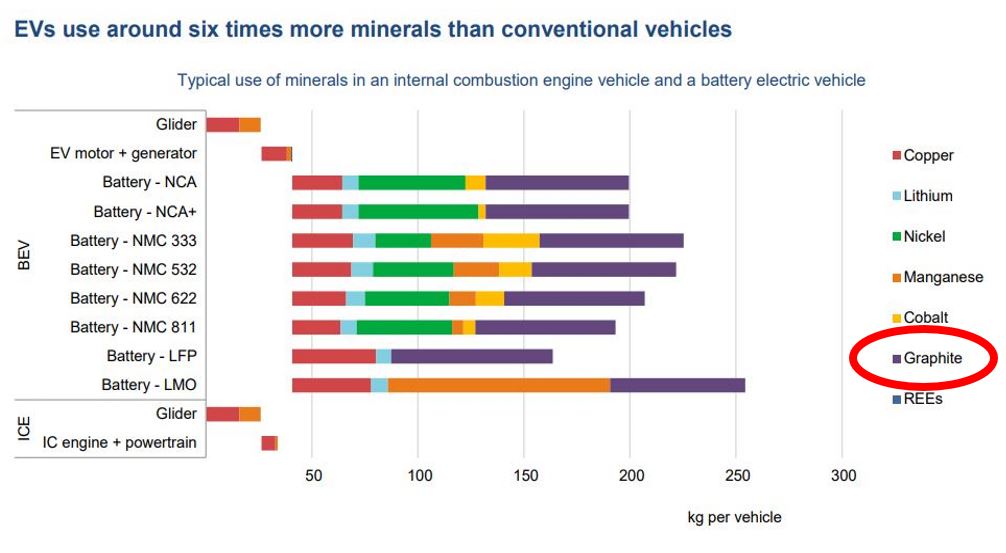

Driving this shift in investor sentiment could be the simple fact that by weight, graphite is the most used raw material in an EV:

That purple bar is graphite, which is the dominant material across a range of battery chemistries.

Graphite composes 95% of the EV battery anode material meaning the average EV has some 70kgs of graphite in it.

For historical context, lithium prices and ASX-listed lithium companies had an almighty run up on the charts in 2017/2018 only to come crashing back down when the lithium price slumped.

It was a similar story for a barometer for the graphite market, Syrah Resources, whose graphite mine is located in Mozambique.

As recently as 2018, it was trading for roughly $4.50 only to fall all the way down to the 20 cent range over the course of the next two years.

Since then, Syrah has started to move upwards once more, something that was accelerated by the announcement of an offtake deal with Tesla.

We think this was an important signal, one that we believe means graphite demand from carmakers is set to boom in the coming years.

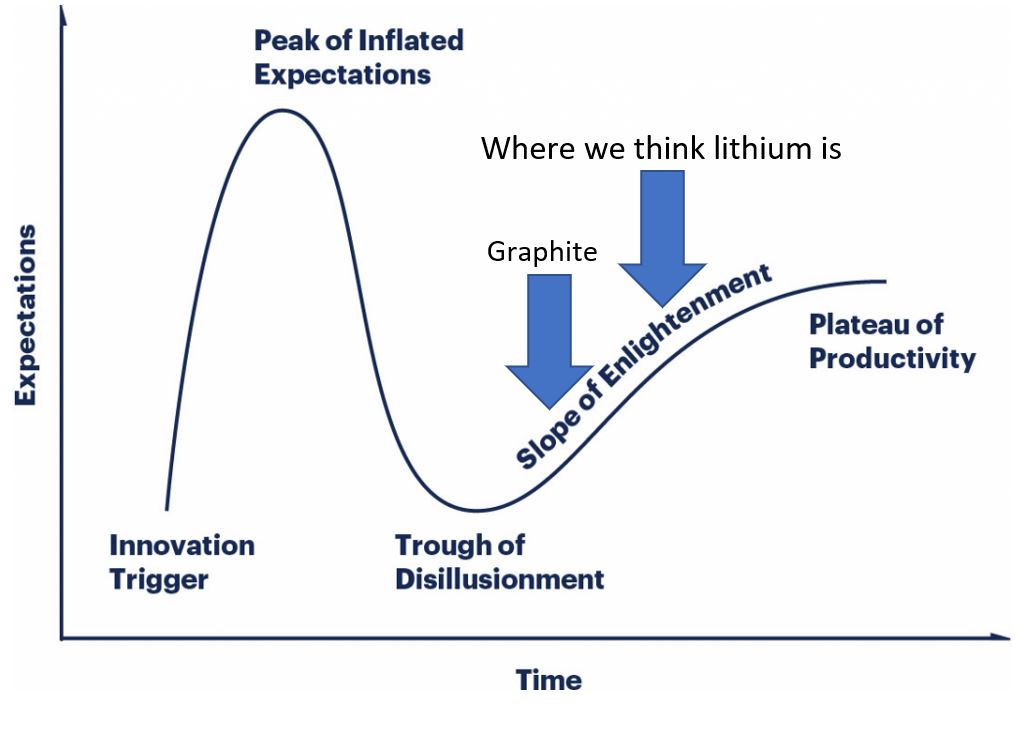

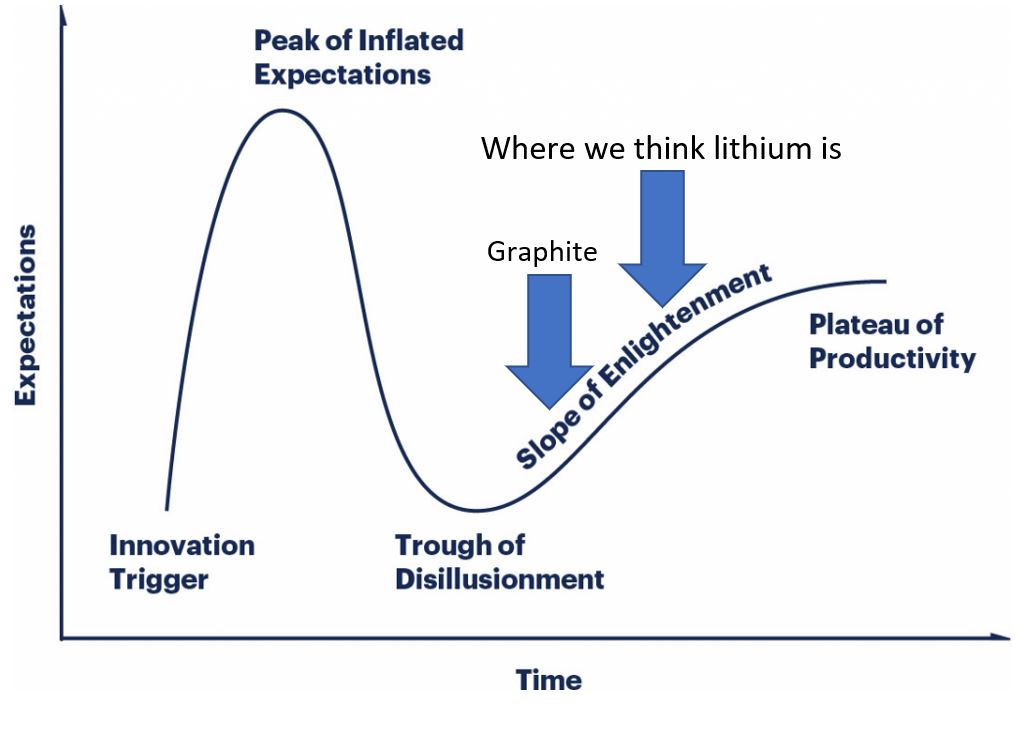

The Gartner “Hype Cycle” is a useful explanation for what happened to lithium prices and companies and what we think could play out for graphite prices and companies soon too:

In other words, lithium had a peak of inflated expectations in 2017/2018 and subsequent “trough of disillusionment” just like graphite BUT graphite is now exiting that trough as well.

Meaning for us, graphite could surprise to the upside more than lithium in 2022.

For early evidence of this you can see one particular European graphite price starting to move sharply higher over the course of 2021:

We think Europe will be the epicentre of the EV revolution – and that revolution will need a large amount of graphite in order to happen.

Put another way, we’re convinced that this time the battery materials boom is real, and that although it is out of the limelight, graphite will be a major part of this unfolding story.

Media Review: Graphite Going Mainstream?

We are yet to see graphite being talked about in mainstream news, but we bet it’s only a matter of time before Alan Kohler riffs about it on ABC.

To grasp what is happening with EVs at the moment a good starting point is the following podcast:

Key takeaways:

- Raw materials shortage underway, 3-4 years in the making

- Downstream processing is important, OEMs seeking supply chain investment.

- LFP battery chemistry being pushed in China

Key takeaways:

- Good in-depth comparison of the state of play for both materials

- Geopolitical tensions (US+Europe vs China) in the graphite market.

- China dominates graphite market but that could soon change

- Logistics costs, uncertain supply playing into prices.

- European graphite price moving higher

- Large graphite flake is generally the go-to product

Key takeaways:

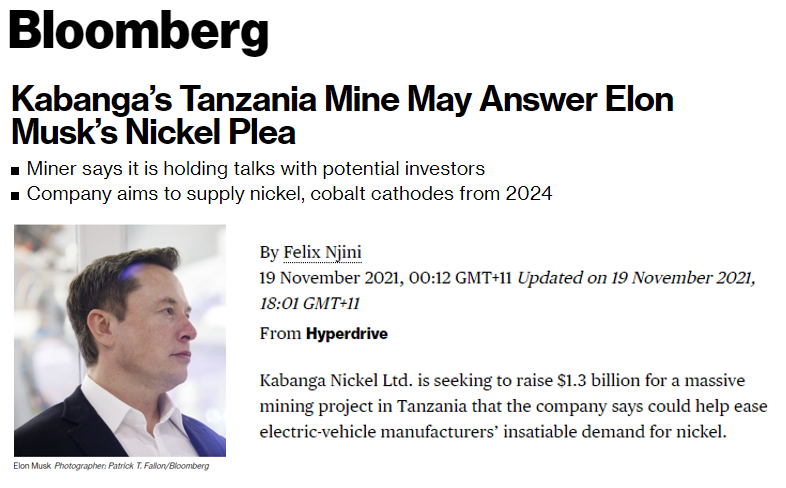

- Tanzania is an emerging mining jurisdiction

- BHP going after battery metals

- Processing tech implemented

Key takeaways:

- Tesla needs battery metals from Tanzania

- US$1.3B project (potentially)

- Raw materials for batteries crucial to US+Europe plans

Meet Phil Hoskins the new EV1 Managing Director

We’re happy to see Phil Hoskins become EV1 Managing Director as he has a deep connection to the company.

Phil’s been involved with the Tanzanian graphite project since the first drill hole in 2014 and brings deep in-country experience and a host of connections in the graphite market.

You can watch a video interview with Mr Hoskins below:

We like to see founders and people who have spent a significant amount of time on a project attached in senior and executive roles at a company for a couple simple reasons – for one, they know the project’s dynamics intimately, and for a second reason – they are usually deeply personally invested in the project’s success.

EV1s Downstream Tech Holds Key to Margin

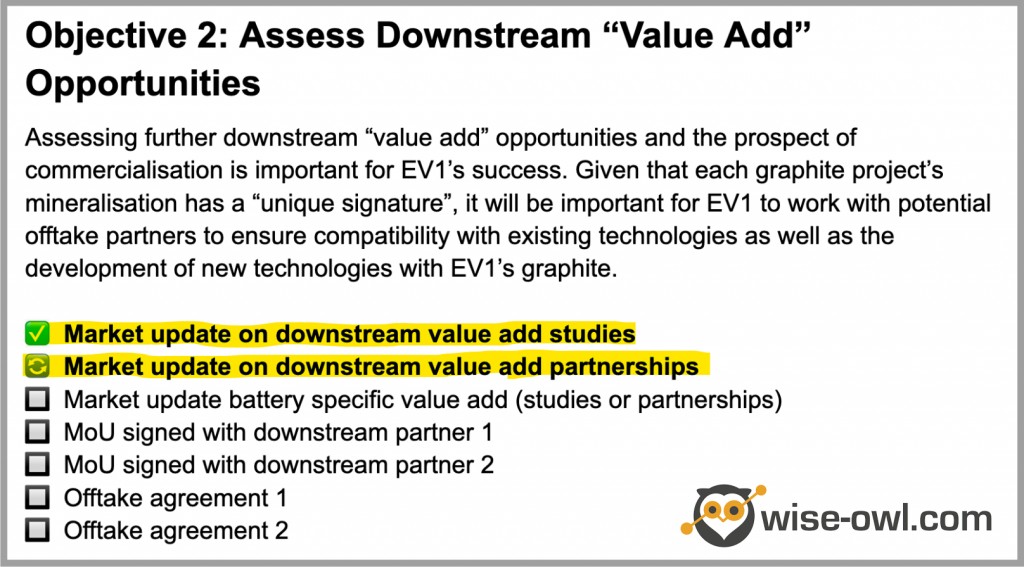

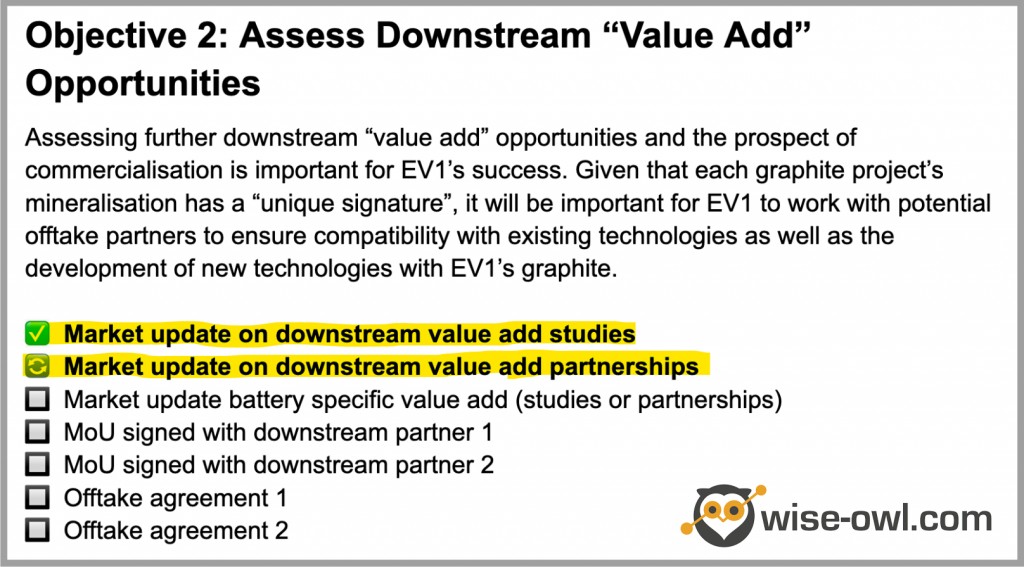

You cans see Key Objective #2 for EV1 from our Investment Memo below:

EV1 is pursuing downstream “value add” opportunities which directly advances Key Objective #2, and what’s more, a recent announcement notes how product qualification with potential Tier 1 offtake partners is advancing right now.

It’s our view that downstream value added products are where you get margin and the potential for EV1 to re-rate.

Digging a material out of the ground and selling it “raw” is the traditional route that most resource companies take.

Adding value to the product downstream by refining and processing BEFORE selling it can be highly profitable and is viewed favourably by the market, especially in the graphite space. – as we have seen with EV1 peers EcoGraf Limited (~$250M capped) and Magnis Energy Technologies (~$410M capped).

~$70M capped EV1 already has DFS-level downstream strategies for expandable and micronised graphite, but we believe the company can re-rate if they introduce downstream battery anode capability as they flagged in the IPO prospectus.

In the prospectus $2.5M has been allocated to pursue/study downstream capabilities. So it’s pleasing to see EV1 take the first steps to pursuing downstream opportunities.

Finally, today’s European Battery Alliance announcement is also complemented by another recent positive step for EV1 – the fact that it has begun a commercial verification program on a more sustainable way of producing coated battery anode materials.

The processing tech that EV1 is pursuing uses heat as opposed to hydrofluoric acid – a rather nasty chemical which is highly corrosive.

EV1 says the graphite it is pursuing will be “the world’s most sustainable battery anode materials.”

The assessment of downstream value add opportunities will happen in parallel with a construction decision which EV1 is targeting for H2 2022.

One of the key reasons we invested in EV1, was its proximity to mining – as it already has a DFS in place.

That DFS is currently being optimised with EV1 seeking improved economics.

If that proves to be true, and EV1 gets the necessary funding for its Tanzanian project, it means that EV1 could be selling its graphite at the early stages of a graphite renaissance.

Our 2022 EV1 Investment Memo

Below is a link to our 2022 investment memo for EV1 where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company’s performance against our expectations 12 months from now.

In our EV1 Investment Memo you’ll find:

- Key objectives for EV1 in 2022

- Why we invested in EV1

- What the key risks to our investment thesis are.

- Our investment plan