FYI strengthens Environmental, Social and Governance (ESG) as Alcoa Joint Venture approaches…

Our investment FYI Resources (ASX: FYI) is in the advanced stages of bringing its High Purity Alumina plant into production in WA. This week it strengthened its Environmental, Social and Governance credentials with the appointment of Dr Sandy Chong to the FYI Board.

Trillions of dollars per year are now flowing into companies with Environmental, Social and Governance focus – also known as ESG.

Auto-makers around the world are now demanding best-in-class ESG battery materials supply as they switch to producing electric vehicles to supply a global population of consumers also demanding ESG.

As a key component to lithium-ion batteries, High Purity Alumina demand is experiencing tremendous growth as electric vehicles become increasingly ubiquitous.

We think the appointment of a board member with extensive ESG experience is a significant step for our investment in FYI to ultimately sell their product or be acquired.

We’ve been investing in the battery metal space for a while and have a very strong track record… Vulcan Energy for lithium (up 3,800%) and Euro Manganese (up 200%) … ultimately we’d like to have every key material input to create a battery within our portfolio – so we have FYI Resources for High Purity Alumina (HPA).

And it’s only a couple of weeks to go until we hear news about FYI’s joint venture deal with $7B global player Alcoa…

Having considered multiple HPA players, FYI stood out given how advanced its project is, attractive project economic metrics, and its strategic relationship with the world’s leading aluminium company ($7B Alcoa) seeking to also enter the battery space.

In January we made our first investment in FYI, topping up further in May following even more attractive metrics out of its updated Definitive Feasibility Study.

To date, we’ve been pleased with the progress that FYI continues to make, both on the project and corporate front.

Which is why we welcomed last week’s appointment of Dr Sandy Chong to strengthen FYI’s board and ESG credentials.

Dr Chong’s appointment further bolsters the ESG credentials of FYI, given her experience. She was awarded Australia Community Citizen of the Year in 2020 and was named Asia’s Top Sustainability Women of the Year award in 2019 for her contributions both in Australia and abroad. Her CV is certainly impressive – a Harvard Alumni, winner of the 2020 Executive of the Year for the US Stevie® International Business Awards, and 2016 Singapore Management Consultant of the Year.

With ESG credentials becoming increasingly important, especially amongst institutional and global funds, we view Dr Chong’s appointment as quite positive, as FYI advances its HPA project towards project financing/ strategic partnership and offtake negotiations in the year ahead.

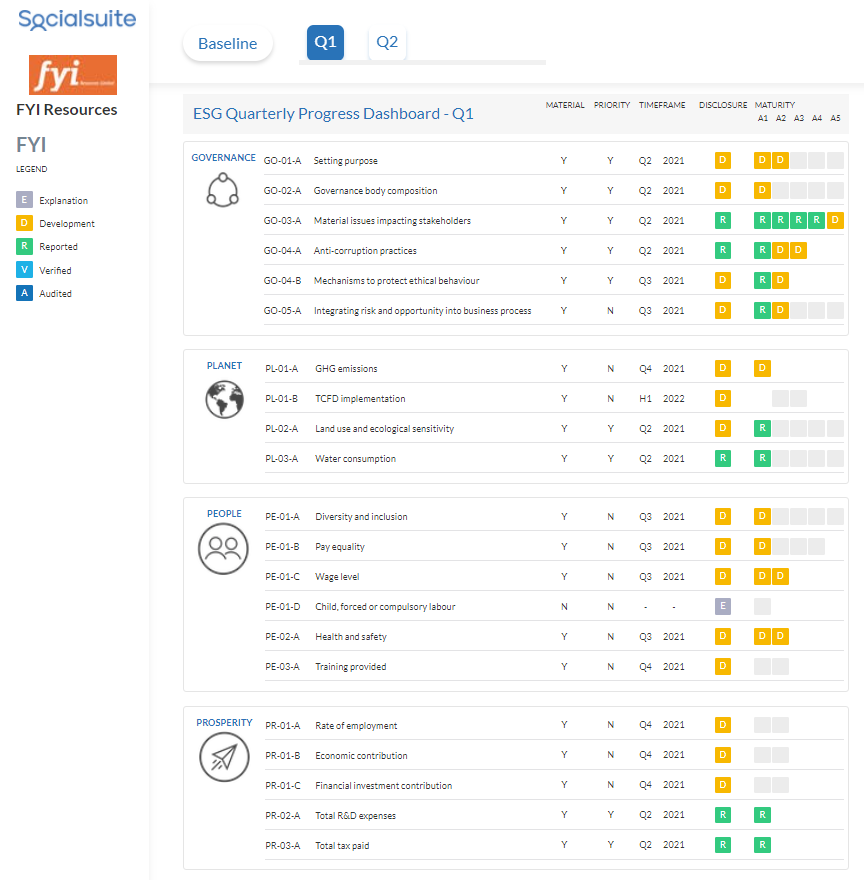

FYI joins many other ASX companies reporting their quarterly ESG disclosure progress using the World Economic forums 21 ESG metrics applied for small to medium ASX companies

Click to view their quarterly ESG disclosures dashboard:

FYI is capped circa $270M – and recently updated a Definitive Feasibility Study which demonstrated a Net Present Value of over A$1.3BN for its HPA project.

On the horizon, the company is less than 2 weeks away from announcing details of its JV discussions with the $7.55BN Alcoa, which would leverage the companies’ combined strengths to capture opportunities in the high-growth HPA market.

Latest research points to continued strong HPA demand

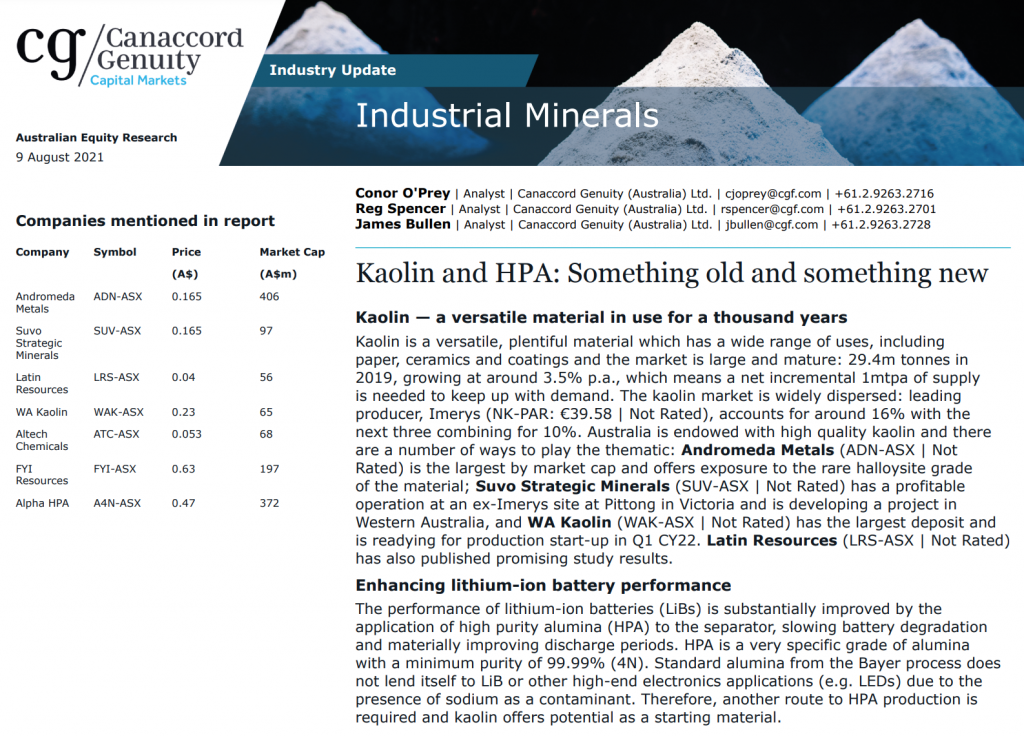

Last week, Canaccord Genuity released a detailed research report on the kaolin and HPA sector — ‘Kaolin and HPA: Something old and something new’.

Canaccord notes strong HPA growth continuing through the decade ahead:

Canaccord notes strong HPA growth continuing through the decade ahead:

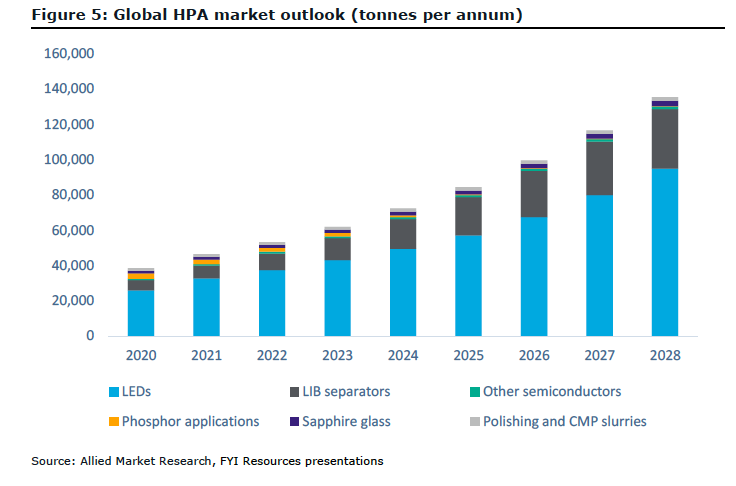

“Indeed, demand for HPA from the LED market is set to grow at a very healthy 19.8% p.a. between 2020 and 2028.

“According to Allied Market Research, demand for HPA-coated LIB separators, which

are set to become the second-most common use for HPA, is expected to grow at 24.5% p.a. over the same time period, and the LED and LIB separator applications alone are projected to see the HPA market reach 104k tonnes p.a. in 2028, from c.30k tonnes in 2021, for a CAGR of around 17% p.a.

Given the strong demand for lithium batteries going forward, the flow on impact will require new HPA supply to meet increased demand. FYI’s HPA project is among the most advanced new entrants seeking to fill this gap.

Why we invested in FYI

Here are the four main reasons why we invested in FYI.

- FYI is leveraged to the “Battery Metals” thematic. We have done well in this space before.

- FYI’s development project is at an advanced stage. FYI’s Definitive Feasibility Study demonstrated an NPV of over A$1.3BN.

- Potential Alcoa (NYSE:AA) JV. Exclusive talks with Alcoa on a potential JV are set to be concluded in the coming weeks.

- FYI has a cheaper and less energy intensive process for HPA production. FYI’s HPA production is cheaper and has less carbon emissions than its peers

- FYI has strong ESG credentials which attracts more investment, better talent and more consumers of the product.

What we’re watching for next

FYI took a major step towards commercially producing a superior HPA to meet market demand earlier this year, when it entered into exclusive JV negotiations with Alcoa — a Fortune 500 company and the world’s largest alumina producer. It was this development that gave us the confidence in the company’s prospects to add it to our long term investment portfolio.

Without a doubt, the next important FYI step is the conclusion to the Alcoa JV discussions.

Having extended its exclusivity agreement with Alcoa for another 30 days, as we reported earlier this month, we now expect a decision of a definitive agreement in the first week of September.

Subject to a JV structure being agreed upon, that would direct how commercialisation would proceed.

We also expect offtake negotiations to advance, as too the Final Engineering and Investment Decision (FID).