FYI signs JV with Alcoa – Now free carried into production

Our battery metals investment FYI Resources (ASX:FYI) has today signed the long awaited binding term sheet with Alcoa that essentially free carries FYI into producing high purity alumina.

Free carry? What this means is that FYI is keeping 35% of the project, while Alcoa is earning 65% of the project in return for paying for EVERYTHING up to US$194M (~A$268M) in a three phase plant development AND providing its expertise and global distribution networks to make the project a success.

That means FYI is now free carried into production. Our investment horizon is 5+ years so we are very happy with this result, but this morning’s share price action has seen a few short term holders and speculators leave in a rush.

While there has been some selling on today’s expected news, as long-term investors, we still expect several more re-rating events — such as offtake agreements, demonstration plant progress, Front End Engineering Design…etc — as FYI progresses through to commercialisation and delivery of its first product in 2023. Not to mention further commercialisation of FYI’s intellectual property on potential new projects (more on that another day).

Now that the current project has been significantly de-risked, with a clear pathway to production and earnings, we expect the next phase for FYI is that institutional funds will start to build positions. FYI’s strong Environmental, Social, and Governance (ESG) focus will help attract the attention of ESG funds looking to invest in projects that support the global energy transition.

Because (free carried) FYI doesn’t need any more cash to fund the project (they still have $9M in the bank), we believe the only way for these large funds to build a position is to buy stock on market. Even though there has been some selling today, for every seller there is a buyer…

When we invest we like to see a project move from a retail story to a long term institutional story over time. But behind today’s market action looks to be a couple of holders who invested solely for the JV announcement who couldn’t wait to pass the baton in an orderly fashion — we expect the institutions to arrive later.

Battery metals investing has been good to us (VUL, EMN and EMH) and we look forward to seeing what FYI and Alcoa deliver next as the global battery metal thematic continues to heat up.

Today’s news marks a giant leap towards FYI becoming a significant, long-life, high-grade producer of high purity alumina (HPA) following months of negotiations with $9.5BN NYSE-listed Alcoa Corp’s Australian subsidiary.

And for (long term) FYI investors, the certainty this JV brings was well worth the wait.

Immediately standing out to us is that the deal means FYI is now essentially free-carried through to production — substantially derisking the HPA project’s development.

The cost to FYI comes as a reduction from full ownership to a 35% holding, while Alcoa gains a controlling 65% stake — at a cost of funding some US$194M of development.

For perspective, development of the full scale HPA facility is estimated to cost US$200M, subject to further engineering studies. And now, with the Term Sheet locked in, we know that Alcoa will stump up almost all of this.

That greatly reduces the risk to FYI, and while its ownership has been reduced to 35%, this still translates to a project value (NPV) close to A$500M to FYI, of a total NPV of ~A$1.41BN.

Alcoa will also take over management of the project. In our view, this is great news — Alcoa is the world’s leading aluminium producer and has a lot more tools and resources at its disposal than does FYI.

FYI entered into a 90-day exclusive joint venture (JV) negotiation with Alcoa’s Australian subsidiary in May to accelerate development of its HPA project. Since then, the JV discussions were extended twice, by ~30 days on each occasion.

FYI has now finally announced it has agreed to a binding JV term sheet with Alcoa for the development of the HPA project.

This sets out the pathway to a JV that would lead to the world’s first significant kaolin-based HPA production by as early as 2023, subject to final investment decisions for both parties.

The term sheet provides a clear development pathway with the parties developing in parallel:

– A demonstration plant, with capacity of ~1,000tpa HPA, in a location yet to be confirmed, and

– The primary production facility, with ~8,000tpa HPA capacity, in WA.

The demonstration and primary production facilities will be based on FYI’s proven HPA process flow sheet design.

FYI say that development and construction of the demonstration plant and primary facility will commence “as soon as practical” once final engineering is completed.

We’ve scanned through the release, and our 5 key takeaways are:

- The JV ultimately results in Alcoa owning 65% and managing the project, and FYI retaining 35%

- FYI is essentially fully carried for the project capital – meaning minimal dilution for existing shareholders through to commercialisation

- Clear synergies are in place, with project development benefiting from Alcoa’s structure, technologies and alumina production capabilities. On the marketing side, FYI benefits from access to Alcoa’s global Tier 1 customers and existing relationships – we expect to see offtake agreements announced over the next year.

- The high ESG and sustainability of FYI’s HPA process is attractive to customers also – important considerations especially for automotive companies and lithium battery manufacturers

- FYI and Alcoa will pursue downstream and broader HPA opportunities

We are investors in several battery metals companies, and are doing very well with our sector investments to date. Vulcan Energy is up over 6,000%, Euro Manganese is up more than 600%, while European Metal Holdings is up over 25% since we initiated coverage.

We are investors in several battery metals companies, and are doing very well with our sector investments to date. Vulcan Energy is up over 6,000%, Euro Manganese is up more than 600%, while European Metal Holdings is up over 25% since we initiated coverage.

As our pick within the high purity alumina sector, we were attracted to FYI given its relationship with Alcoa, management’s significant skin in the game (the Managing Director holds 5.25%, Board and management ~10%) and that the company was utilising conventional processing methodology in a low risk jurisdiction.

We added FYI to our Wise-Owl portfolio just before it began exclusive JV talks with Alcoa in May, when the stock was trading at under 50 cents. Today’s news gives us confidence in the project’ future and significantly de-risks our investment.

Our FYI investment remains a bet that with Alcoa onboard the project’s future is significantly enhanced, as the HPA market continues to grow strongly over the next decade.

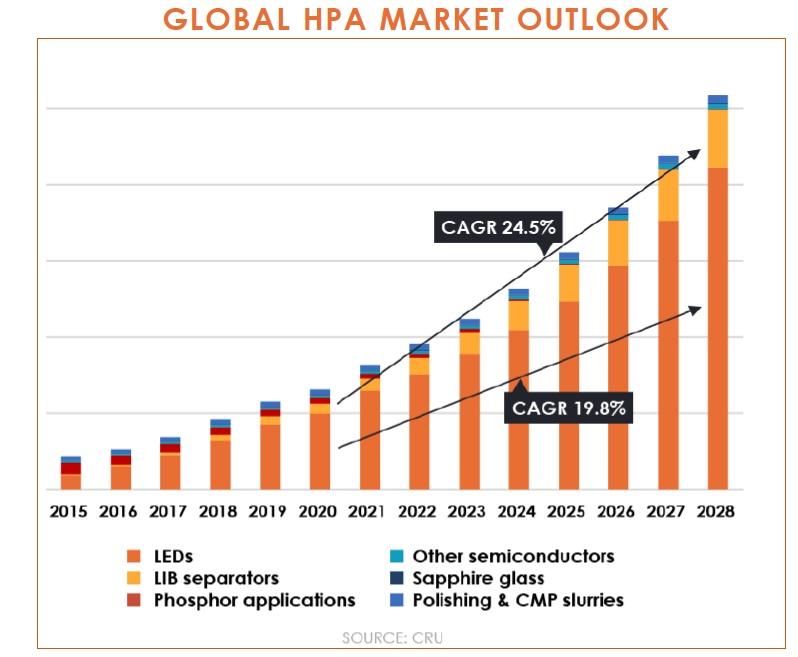

We like its chances, as HPA is increasingly being used for battery separators in Electric Vehicle (EV) batteries and energy storage, as well as in established industries including LED lighting and semiconductors.

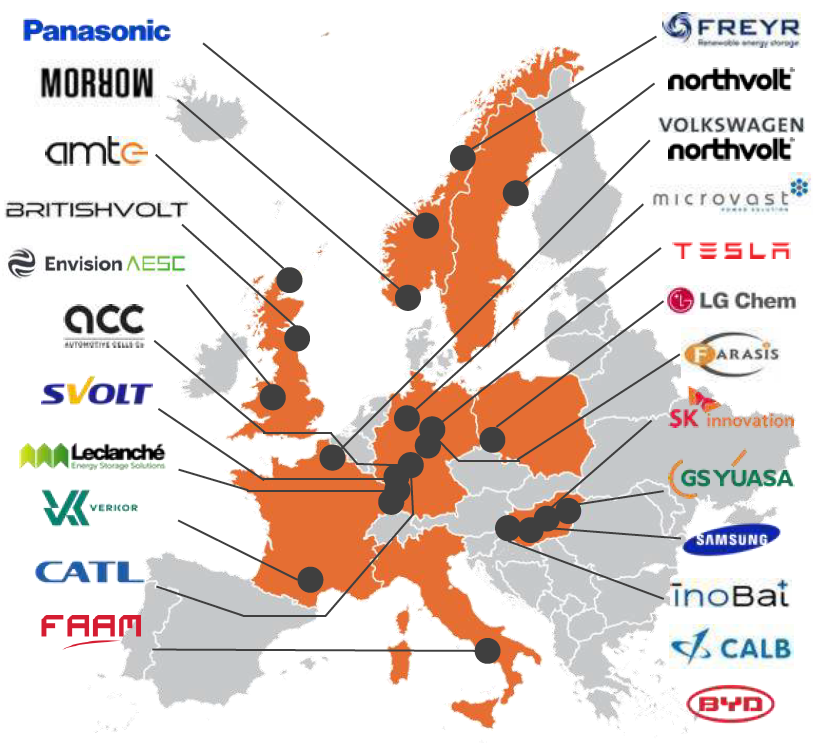

One macroeconomic shift that’s very much in our favour is auto-makers across the globe switching to EV production as more and more consumers make the switch from petrol guzzling cars to EVs – a trend that will continue to grow rapidly.

The following graphic shows the unprecedented investment flowing into new European battery capacity as a result of these trends. A similar scenario is unfolding in North America.

Source: Roland Zenn, FYI HPA presentation Benchmark Minerals EV Battery Fest 2 June 2021

Source: Roland Zenn, FYI HPA presentation Benchmark Minerals EV Battery Fest 2 June 2021

We consider there to be plenty of upside left for FYI. The HPA project is at an advanced stage of development, and now with Alcoa’s backing, the path to commercialisation appears straight forward.

The project has strong economics, as confirmed by its updated Definitive Feasibility Study earlier this year that demonstrated a Net Present Value of over US$1BN (A$1.4BN) on the back of expected high margins and a high quality product mix, though this was assuming higher production rates.

For reference, FYI is currently capped at $190M.

As long-term investors, we expect several more re-rating events such as offtake agreements, demonstration plant progress, Front End Engineering Design…etc as FYI progresses through to commercialisation and delivery of its first product in 2023.

The details of the deal

FYI plans to produce high purity alumina at Kwinana, “Battery Alley”, an industrial area in Western Australia. The plant will source feedstock from its fully-owned Cadoux kaolinite deposit, located 256km down the road.

Today’s announcement provided details of how exactly the project will progress over three-stages, each preceding a decision to advance.

Phase 1: cost US$7M, production trials and demonstration plant design in 2021-22 prior

Phase 2: cost US$50M, construction of 1,000tpa demonstration plant in 2022 in a location to be determined; design of full-scale HPA plant

Phase 3: cost US$200M, construction of 8,000tpa full-scale HPA plant in Kwinana in 2022-23, first production in 2023

All up, this accounts for 9,000tpa production. This is less than the 10,000tpa assumed in the DFS that provides for a NPV of US$1.015BN (~A$1.41BN), and so impacts our valuation of FYI.

Of note, US$194M in project development costs will come out of Alcoa’s wallet. That means that there should be minimal or no dilution for FYI shareholders, at least on the project financing side.

FYI bringing high purity alumina into the ESG era

What stands out to us is FYI’s innovative high purity alumina (HPA) process sheet. In a nutshell, FYI’s process aims to replace the outdated, expensive, energy intensive and polluting traditional method that evolved little since the 1880’s.

This traditional process derives aluminum via bauxite, with production costs around the US$15,000/t mark. But FYI derives its HPA from kaolin clay, rather than bauxite, which has a much lower environmental impact.

The process is simple, resulting in cheaper capital and operating costs. And it generates low toxic waste, with extensive recycling at the inputs and outputs.

FYI has calculated a reduction in greenhouse gas emissions of approximately 50%, and a 40% reduction in processing energy consumption per ton of HPA.

With Alcoa’s backing, we believe that FYI’s HPA project will become the world’s first such kaolin-based significant HPA producer supplying the EV market.

Utilising FYI’s proprietary technology, the plant will produce both 4N (99.99% purity) and 5N (99.999% purity) HPA, at costs estimated at US$6,661/t. — significantly lower than the standard process delivering today’s supply.

Stars aligning for disruption

Timing wise, FYI will be supplying into a strongly growing market, one that we expect will continue to do so over the next decade.

The current global 4N HPA market demand is ~30ktpa, but is expected to more than treble over the next 7 years to more than 104ktpa by 2028, growing by 18.7% annually (CAGR) — according to market intelligence firm CRU Group. CRU expects the 4N market to be in a supply deficit from 2024, as current production levels fail to keep pace with demand growth.

So the stars appear to be aligning very well for FYI:

- 2023 – First product delivery utilising new cleaner technology with costs less than half traditional methods

- 2024 – Ramp up to full production

- 2024 – Supply side deficit hits HPA market

If FYI is successful, then it would be first to market with an innovative process that could force current production methods towards extinction, at a time when the HPA market is predicted to be in deficit.

What we expect to see next

The year ahead should be very active for FYI as it progresses towards commercialisation. A demonstration plant will now become the focus prior to full-scale construction of the final HPA plant.

- Further JV downstream opportunities revealed

- Multiple offtake agreements

- Demonstration plant progress

- Final Engineering & Investment Decision (FID)

FYI Corporate Milestones

✅ $6M Capital Raise @20c

✅ Catalyst Hunter Portfolio Launch

✅ International Fund GEM Global makes strategic investment

✅ Wise-Owl Portfolio Launch (and Catalyst Hunter Graduation)

✅ Project of “National Significance” in Australia

🔲 Demand for HPA increases

🔲 Institutional Fund Takes Position 1

🔲 Institutional Fund Takes Position 2

🔲 Unexpected Announcement 1

🔲 Unexpected Announcement 2

🔲 Unexpected Announcement 3

FYI High Purity Alumina Project

✅ HPA Product submitted for Metallurgical Recovery Results

🟩 Metallurgical recovery results from pilot plant

✅ Updated DFS NPV to over $1BN (CH Update)

✅ Joint Venture Negotiations with Alcoa Commenced

✅ JV With Alcoa: Update 1, Update 2

✅ Binding JV term sheet Signed with Alcoa

🔲 JV formalised following FID (final investment decision)

🔲 Offtake 1

🔲 Offtake 2

🔲 Offtake 3

🔲 Demonstration Plant Progress

🔲 Project Funding

Investment Milestones

✅ **Initial Investment (Catalyst Hunter): $0.20

✅ Initial Investment (Wise-Owl): $0.50

🔲 Increased Investment

✅ Price increases 250% from initial entry

🔲 Price increases 500% from initial entry

🔲 Price increase 1000% from initial entry

🔲 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Profit

🔲 Hold remaining Position for next 2+ years