FOD on Cusp of Turnaround with Strong Quarterly and New Products

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 7,857,143 FOD shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by FOD to share our commentary on the progress of our investment in FOD over time.

Our investment in The Food Revolution Group (ASX:FOD) is tracking better after revealing two cash flow positive months in its latest quarterly and announcing the launch of a new product, Plant-Based Protein Smoothies.

Now we are just waiting for the FOD share price to catch up to the operational and financial progress.

FOD is a beverage manufacturing company that sells premium fruit juices and probiotic wellness shots in major supermarkets Coles and Woolworths – you might recognise FOD’s signature orange juice range with the distinct black label.

We initially invested in FOD because we believed that it was on the cusp of a business turnaround, and although it has taken much longer than expected, and there has been an unexpected leadership change, we have stuck with the company as it executes on its Fix → Reset → Growth strategy.

Signs of this turnaround emerged last year when FOD announced in its annual report a $7.3M increase in 2021 operating earnings (EBITDA) and today we are seeing the continued improvement with two consecutive months of operating positive cash flows.

FOD also announced last week the release of its new “Plant-Based Protein Smoothies” to expand its Juice Labs product range in Coles. We haven’t managed to get our hands on these new drinks yet, but we will provide our full and unbiased review once we have tasted them.

We haven’t managed to get our hands on these new drinks yet, but we will provide our full and unbiased review once we have tasted them.

These products are on-trend as the plant-based food and beverage movement gathers momentum amongst young and health-conscious consumers.

From a share price perspective, 2021 was not the year for FOD, with the stock dropping from 3.5¢ when we first invested in Feb 2021 to all time lows at around 1.8¢ last week. We have still not sold a single share in FOD and maintain our initial investment.

We understand some share price weakness after the management change, but we think that the company has been oversold given the strong earnings performance and recent slate of new products launched.

Ultimately though, the market will judge FOD by the strength of its brands and their ability to generate cash and revenues to accelerate the growth of its business.

This is critical to the success of the business and we will mark FOD’s performance accordingly against some key objectives.

The three key objectives that we want to see FOD achieve in 2022 are:

- A sustained strong financial performance

- Consolidate the growth of newly launched products

- New products and innovations

We go deeper into these objectives in our 2022 investment memo which you can read here, and we will be tracking FOD’s progress against these objectives over the next year.

With that in mind, let’s take a closer look at yesterday’s news…

Operating Cash Flows and its importance to FOD

Every quarter, ASX listed companies release a quarterly report, an “Appendix 4C Announcement” that highlights all of the business’ cash flows and operating activities for the quarter.

This is an important tool for investors to evaluate the performance of a company – especially for revenue generating companies like FOD.

The cash flow statement is separated into three different sections, with the first section highlighting Operating Cash Flows.

Operating cash flows are cash inflows and outflows of the business that relate to direct business operations – like receipts from customers, and payments for marketing, staff, inventory cost and corporate expenses.

If operating cash flows are positive it gives the business flexibility to re-invest that cash to accelerate business operations and pay-off any outstanding debts without needing to raise capital from the market.

For revenue generating businesses like FOD, raising capital from the market can be a good thing for a major undertaking – like a strategic acquisition – but is generally not ideal if a capital raise is done to fund operations.

Particularly operations which are not generating revenue growth.

If a capital raise is done to fund operations it is a sign that the company’s performance is unsustainable.

This is why it is so important for revenue generating companies to reach ‘operating cash flow positive’ – a key marker for success for our investment in FOD.

Once investors are confident that a company has crossed into cash flow territory, usually following several quarters of positive cash flow, then there is less fear of a dilutionary capital raise which would dilute their shareholding.

In our last note we wrote that we hoped FOD to be operating cash-flow positive in this quarter because the majority of FOD’s fruit inventory is purchased during the winter months, and sales grow as the weather warms up.

This quarter, FOD reduced its operating cash out-flow from $2.4M to $588K, and while the company did not reach ‘operating cash flow positive’, November and December were cash flow positive months – which is still a good sign.

FOD’s gross revenue was also up 5% on the previous comparable quarter – another leading indicator that the company’s financial performance is reaching a sustainable level.

We expect FOD to be operating cash flow positive in the next two quarters which would be a big milestone for the company.

Conversely, we would be disappointed if FOD needs to issue new shares to raise capital again to fund its operations.

A FOD Peer Comparison

With a business like FOD’s it pays to put its operations into some context.

Looking at the valuation is one thing but then being able to try and put it up against participants in similar markets is the best way to try and gauge whether or not something is “expensive” or “cheap”.

The issue with this approach is that it’s almost impossible to find a like for like, as all businesses have key competitive advantages and different moats that add to or subtract from their valuations.

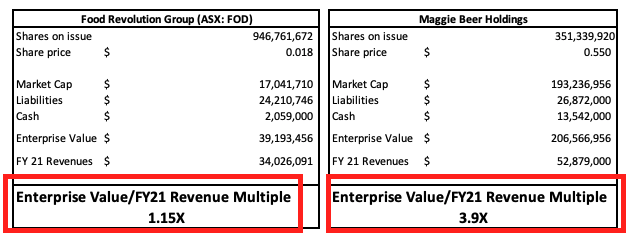

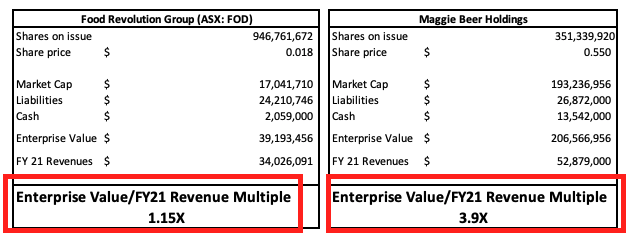

We wanted to compare FOD with one of the biggest turnaround stories in the FMCG space of the last two years Maggie Beer Holdings (Now capped at $193M), which operates a business selling several different product lines ranging from dairy products like milk, cream and yoghurt all the way down to gift hampers.

They are not like-for-like companies, they have different product lines, different marketing budgets and the face of the company, Maggie Beer, is a celebrity and adds brand power and promotional value.

That said, Maggie Beer operates on a similar business model to FOD with a core brand that seeks growth through new product lines. So we thought it would be an interesting exercise matching up the key financial metrics of these businesses for a better picture of where FOD could be in the long-run.

The numbers below for each of these businesses is our calculation of the enterprise value for both of these business (We have included lease liabilities as this is a big cost of doing business for both companies):

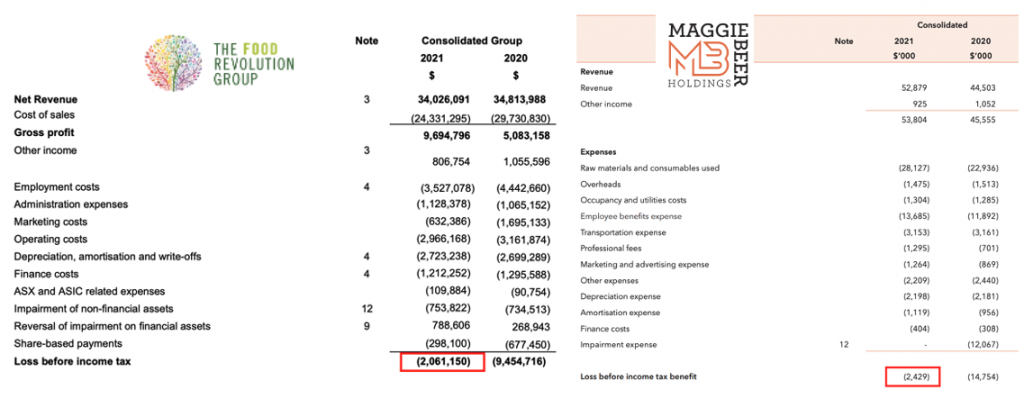

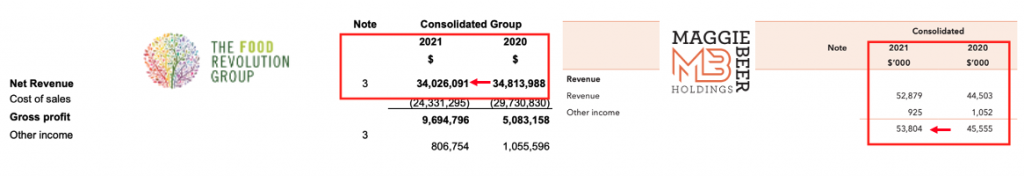

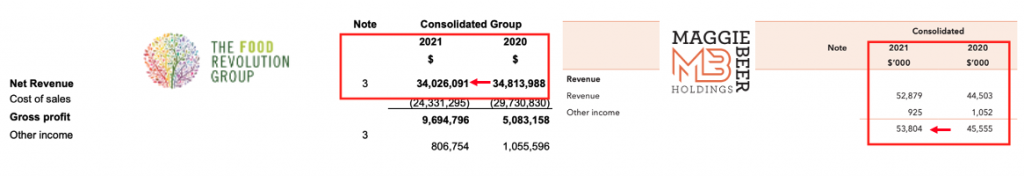

The first metric that jumps out to us is that Maggie Beer trades on an almost 4x enterprise value/FY21-revenue multiple whereas FOD is trading at just under 1.2x enterprise value/FY21-revenue multiple.

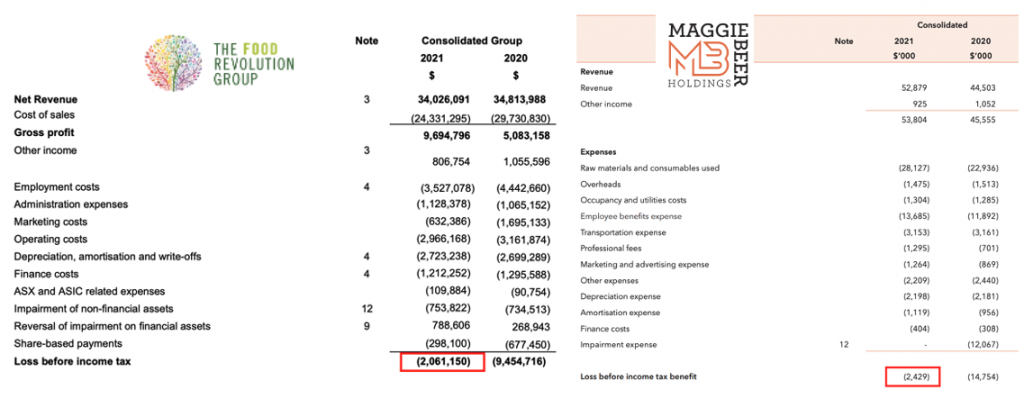

Looking at revenues isn’t always enough, so we also took a look at net profits.

For FY21, FOD had a net loss of $2.2M and over the same period Maggie Beer a net loss of $2.4M.

One explanation of the 3x difference in multiples, is that the market is more focussed on growth projections.

In FY21 Maggie Beer increased its revenues from $44M to $53M, growth of almost ~20% year-on-year. Over the same period, FOD revenues were actually down by ~2.2%, not a massive change but down nonetheless.

This is where we think the difference is… FOD is being valued as a mature/late-stage orange juice manufacturer and the valuation shows it.

We think this may change with FOD’s developments at its product suite level.

If FOD can replicate what Maggie Beer did and build out different streams of products, show some growth and have its enterprise value/revenue multiple trade at around the 4x value then its implied share price is significantly higher than where it is today – somewhere around ~12¢.

That being said, there are some risks that investors should be aware of that would prevent FOD from reaching this goal – namely the debt risk that is associated with the company right now.

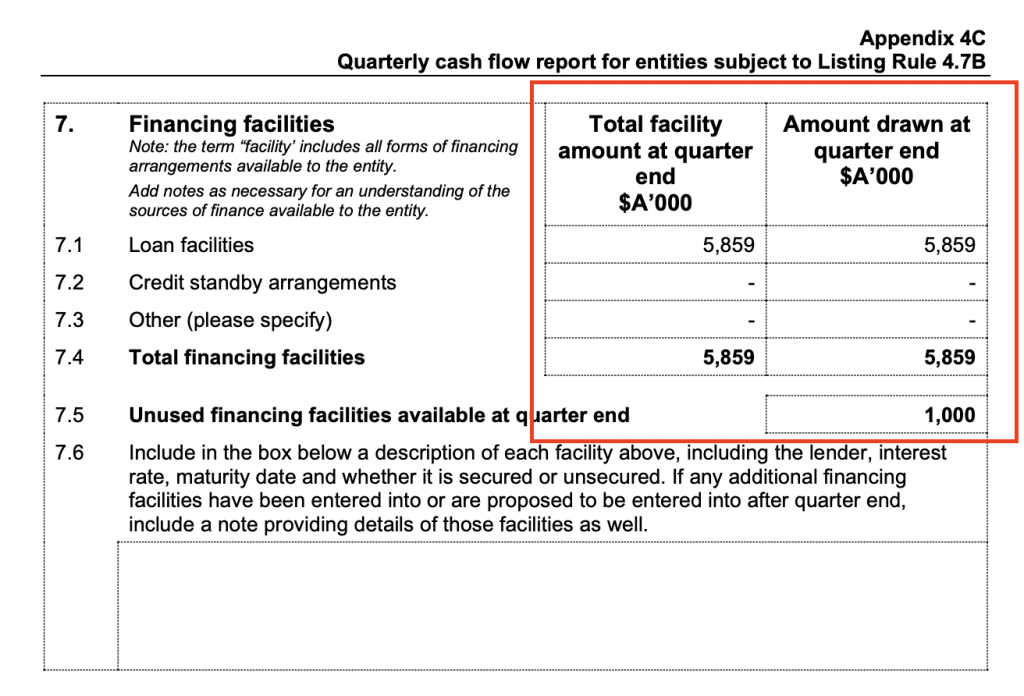

FOD in July 2021 refinanced its legacy debt facilities into one single facility with NAB.

In the 4C released yesterday we can also see that this facility is fully drawn for the $5.9M that is available from it, the company only has $1M in financing facilities available, all of which can only be used for “invoice financing”.

This means that it isn’t available to spend on pursuing growth opportunities.

FOD therefore needs to maintain its cash flows to fund this debt AND finance its growth opportunities (R&D, marketing, new product launches etc…) which can be a difficult balance to strike when working within a competitive industry.

We go into the full risks for FOD in our investment memo which you can read here.

FOD’s turnaround needs strong brands – here’s what they’re doing

Last week FOD announced the launch of a new product range “Plant Based Protein Smoothies” which will be stocked by Coles and Woolworths from mid-Feb.

According to industry analytics service IBIS World, health consciousness is the biggest driver for demand in the Juice and Smoothie industry.

We think that FOD’s new product, with its sleek branding and a decent whack of protein at 16g will appeal to a younger, health-conscious demographic.

We will be keeping an eye on initial market data from Coles to see if the product is gaining traction with consumers and whether increased distribution eventuates in June this year.

This new product launch directly impacts our third Key Objective for FOD “New Products and Innovations” and we see it as a critical development in FOD’s turnaround story.

New products = new opportunities for revenue and growth.

FOD is also looking to consolidate the growth of its existing products through an increase in marketing activities for Wellness Shots and Carbonated Wellness Drinks (cans) launched last year.

We’ve started to see ads for these products across instagram and YouTube.

We note that the Juice Lab Wellness Shots currently have 55% market share and although this is a drop from the 70% market share reported in September after new brands entered the market, it still indicates that FOD is maintaining a market leading position in the space.

2022 will be an interesting year for FOD as it continues to consolidate its three new products launched under the Juice Labs brand.

We think that the biggest opportunity for FOD will be to target different distribution channels and we will be looking out for new products in convenience stores and service stations.

Tracking our FOD investment

At Wise-Owl you may have seen that we have published investment memos on a number of stocks in our portfolio.

As investors, we see this as an important part of the investment process and a good way for us to track our investment against expectations.

You can read all about our FOD investment here in our investment memo.

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 7,857,143 FOD shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by FOD to share our commentary on the progress of our investment in FOD over time.