EV1 Signs Binding Graphite Offtake, Eyes Downstream Joint Venture for EU Market

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and Associated Entities, own 3,125,000 EV1 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by EV1 to share our commentary and opinion on the progress of our Investment in EV1 over time.

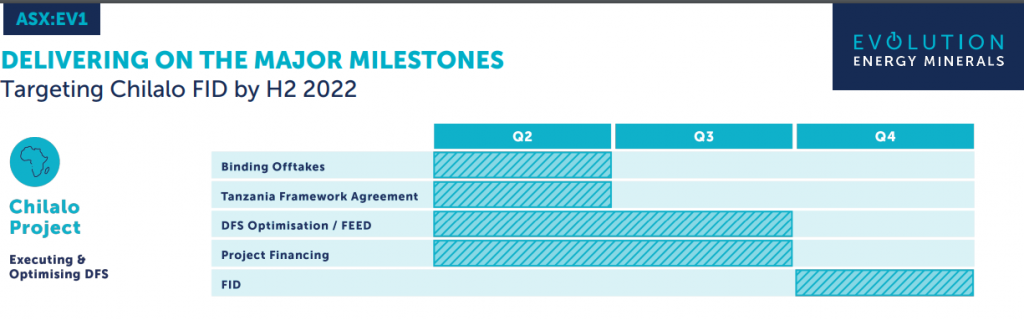

Yesterday our Wise Owl 2021 Pick of the Year Evolution Energy Minerals (ASX:EV1) ticked off a major milestone on the road to obtaining project financing for its development ready graphite project in Tanzania.

EV1 has signed a BINDING offtake agreement with Yichang Xincheng Graphite (YXGC).

YXGC is a global leader in the manufacture of high value graphite products that has been supplying customers in Europe, North America, and Asia for over 20 years.

We were also pleasantly surprised to notice in the conditions of the deal: “EV1 to fully finance and commence construction of its project before 31 December 2022”.

This comes just a week after EV1 signed an MOU with YXGC to assess potential downstream value add opportunities together.

This is a fast turnaround from MOU to binding agreement, highlighting the importance to YXGC — as a downstream graphite product specialist — in securing rare, high quality graphite supplies.

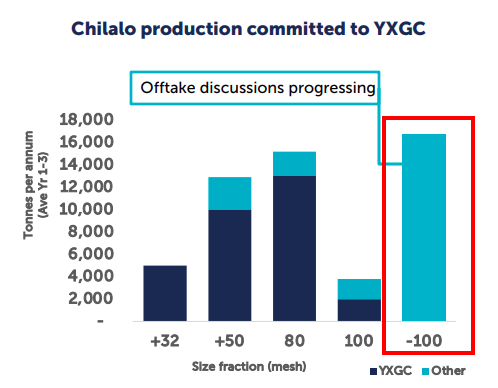

The offtake agreement is focused on the “coarse flake” portion of EV1’s resource which comprises graphite with +100, +80, +50 and +32 mesh sizes.

The pricing for this coarse flake portion of EV1’s resource can range US$970/tonne all the way up to US$3,000/tonne.

So whilst only 50% of EV1’s initial three year production is coarse flake graphite, the higher prices mean that the offtake agreement represents around 70% of its forecast revenue over the first three years.

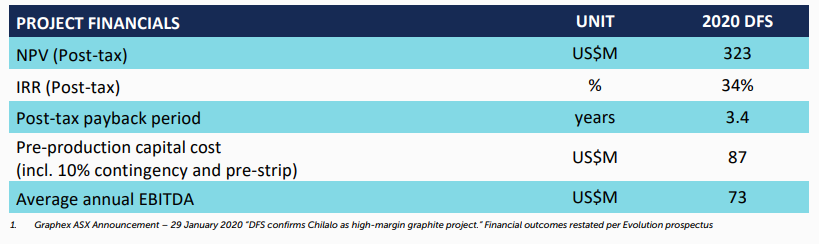

EV1’s 2020 Definitive Feasibility Study (DFS) determined a 3.4 year post-tax payback period, but we think that EV1 will have a lot more leverage when discussing project financing given that ~70% of its revenues in this crucial three year period is now under a BINDING offtake agreement.

Below is a list of our key takeaways from yesterday’s offtake agreement:

- Sale of 30,000 tpa of coarse flake graphite over a minimum period of three years.

- The offtake agreement covers ~50% of production from the first three years and represents ~70% of revenues over that same period.

- Market pricing will be based on spot prices 30 days before the beginning of each quarter.

The offtake agreement is binding, but as is customary for deals like this, there are also some conditions that need to be met, as follows:

- Execution of a binding agreement with respect to the downstream JV in Europe.

- Execution of a binding toll treatment agreement.

- EV1 to fully finance and commence construction of its project before 31 December 2022.

- EV1 to commence production and prepare first deliveries of graphite to YXGC before 31 March 2024.

The significance of this is that the binding offtake agreement brings EV1 much closer to the project financing required to get its project into production.

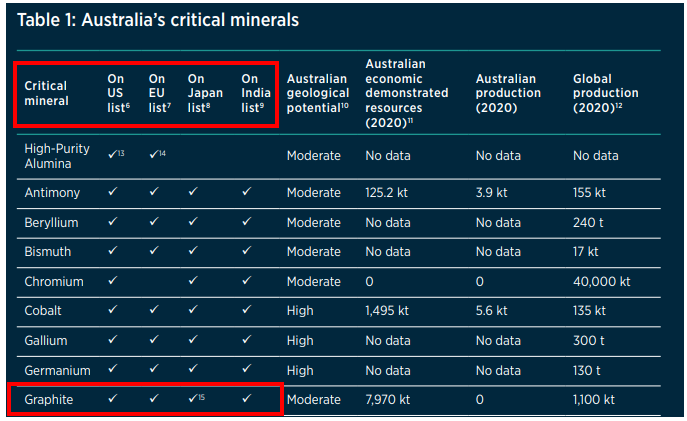

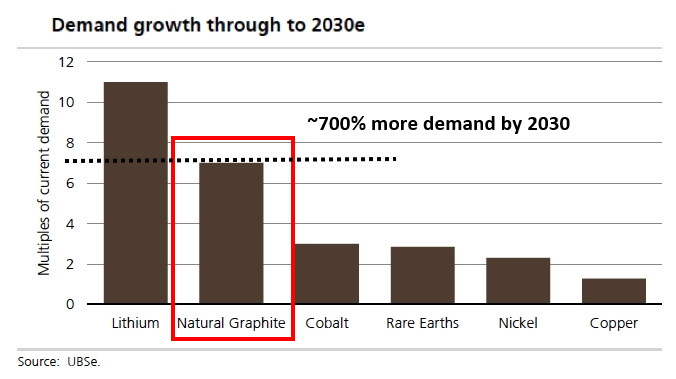

Graphite now features on the critical minerals list of all major developed economies, including the US, EU, Japan, India and Australia. We think that the world is entering a period of heightened demand for graphite, particularly supply from shovel ready projects like EV1’s.  Graphite seems to be the forgotten battery material, yet it is a key component in lithium-ion batteries, making up ~50% of the raw materials in every battery (and over 95% of every battery anode).

Graphite seems to be the forgotten battery material, yet it is a key component in lithium-ion batteries, making up ~50% of the raw materials in every battery (and over 95% of every battery anode).

Hence its inclusion in the critical minerals lists/strategies of countries all over the world.

Evolution Minerals

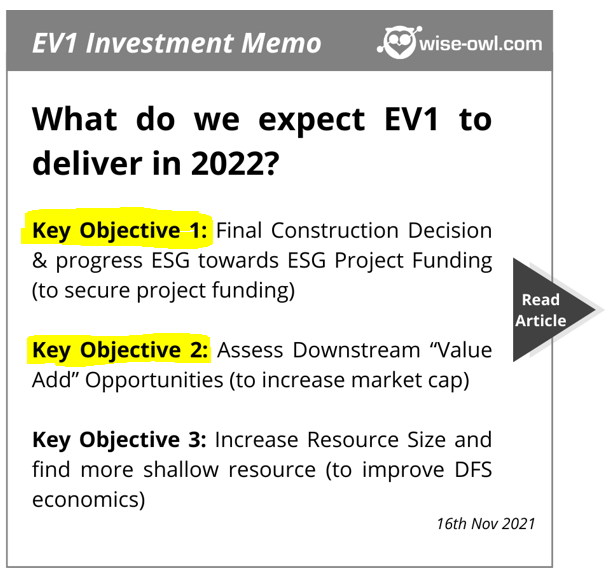

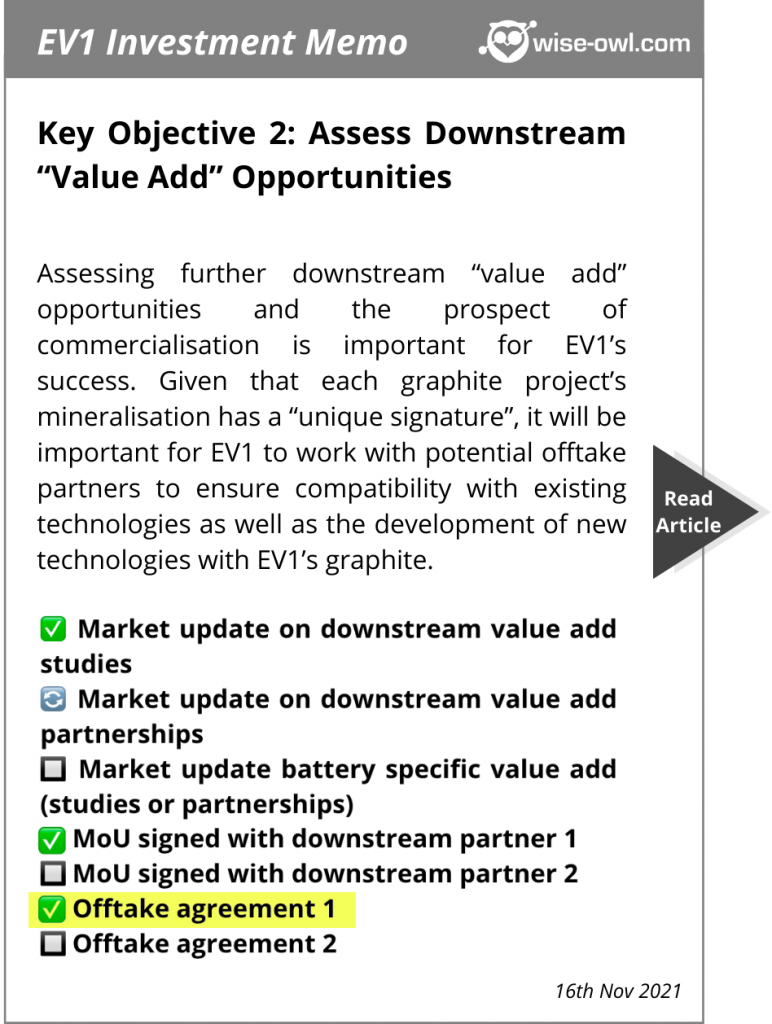

We think that yesterday’s announcement is particularly significant because it demonstrates EV1 making progress across both Key Objectives #1 and #2 of our 2022 EV1 Investment Memo.

We set “progress on project funding” as Key Objective #1 of our Memo. As is often the case with resources projects, financiers tend to look for locked-in offtake agreements that signal that the project is de-risked from a revenue perspective before it goes into production.

We think that with an offtake agreement locked away for ~50% of the project’s production in the important ramp up stage of EV1’s project, the company now has a lot more leverage when discussing project financing with interested parties.

The offtake agreement also fits in with our Key Objective #2 — downstream value-add opportunities and a potential offtake agreement.

The binding offtake agreement is the natural extension to the MOU with YXGC which covers the scoping out of a potential downstream manufacturing facility based in Europe.

Below is a list of the key objectives we wanted to see EV1 achieve in 2022. To view these in detail click on the image below to check out our 2022 EV1 Investment Memo.

With the binding offtake agreement signed with YXGC, we have updated the progress status of the milestones accordingly:

More on the binding offtake agreement

The significance of yesterday’s binding offtake announcement is the impact it has on furthering the financing of EV1’s project.

With the first offtake agreement secured, EV1 can now shop around its project to potential financiers who will see the project as de-risked from a revenue point of view if put into production.

Financing resources projects in the critical minerals space (in EV1’s case this is graphite) can be difficult given that a lot of the demand for a commodity like graphite is based on expected near-exponential future growth over the coming decade.

This is particularly the case with graphite. As we mentioned above, it makes up ~50% of the raw materials in every lithium-ion battery and over 95% of every battery anode. Graphite demand is expected to increase by over 700% by the year 2030.  With downstream investments currently being made at scale, there is often a lag between demand for a commodity and the response of supply. This means that as demand from end users grows, there are no new projects being put into production.

With downstream investments currently being made at scale, there is often a lag between demand for a commodity and the response of supply. This means that as demand from end users grows, there are no new projects being put into production.

This happens because financiers are less willing to finance projects where demand is volatile.

That’s understandable given these financiers take on the project risk of a frontier commodity in exchange for a set interest rate. Instead, they often look to finance projects where demand is less volatile and prices are unlikely to fluctuate as much.

For example, a bank is willing to lend to a copper or iron ore mine because demand is less volatile and the metal’s primary consumption market is well understood. Whereas with graphite, the lender is asked to think about anticipated future demand which can be seen as riskier.

This is where yesterday’s offtake agreement comes in for EV1.

The offtake agreement with YXGC means that ~70% of the first three years forecast revenues have been put into a BINDING offtake agreement.

Generally financiers will be most worried about the certainty around demand in the initial start up of a mine where the company has maxed out its debt facilities building its project.

With the 2020 DFS showing a post tax pay back period of 3.4 years, those first three to four years of EV1’s project will be the most sensitive from a financiers point of view.

EV1 will be fully drawn on all financing facilities and during this period financiers will be expecting the project’s cash flows to start paying back all of the capital spent putting the project into development.

With yesterday’s deal, EV1 has effectively managed to secure ~70% of the revenues over almost 80% of the estimated 3.4 year payback period.

This we think will give EV1 serious leverage when discussing project financing with interested parties and make the whole construction funding process a lot easier.

After going through the terms of the offtake agreement the key takeaways for us are:

- EV1 will supply ~30,000 tpa of coarse flake graphite over a minimum three year period.

- The offtake agreement covers ~50% of production from the first three years and represents ~70% of revenues over that same three year period.

- Market pricing will be based on spot rates ~30 days before the start of each quarter.

As is the case with offtake agreements, there are specific conditions related to the timing of this production and some of the terms agreed in the MOU announced just last week. Below are those conditions and our take on how this impacts EV1:

Condition 1) Execution of a binding agreement with respect to the downstream JV in Europe as contemplated in the existing memorandum of understanding (MOU)

We think that the offtake partner specifically inserting this as a condition means they are serious about pursuing a JV for the downstream manufacturing facility in Europe.

With that, EV1 is likely to place a lot more emphasis on further defining its downstream strategy over the course of this year.

Given this is Key Objective #2 of our 2022 EV1 Investment Memo, we like that the offtake agreement has created some urgency around the assessment of its downstream value add opportunities .

Condition 2) Execution of a binding toll treatment agreement as contemplated by the MOU.

We think that this is more of a formality than anything else. A toll treatment agreement is simply a deal which will set out the payment terms between EV1 and YXGC for processing its graphite ore.

Condition 3) EV1 to notify YXGC that it has obtained the necessary finance and commenced construction of its graphite project before 31 December 2022.

In our 2022 EV1 Investment Memo, we set Key Objective #1 for what we wanted to see EV1 achieve in 2022 with respect to the company making progress with project funding and moving towards making a final construction decision.

We wanted to see EV1 work to bring the project to a place where it had funding secured and the decision made to start developing its project, but were less so focused on seeing actual construction works commence.

With the offtake agreement now conditional on this, we think the likelihood of our objective being completed has increased. We may even see EV1 go a step further and actually start preliminary construction works at its project.

One of the primary reasons we first invested in EV1 was because its project was effectively “shovel ready” — meaning that once financing was organised the project could quickly be put into development.

We particularly like that there is now a firm public deadline for the project to be put into development – and it’s only a little over six months away.

Condition 4 and 5) Commencement of production from EV1’s project before 31 March 2024; and notifying YXGC that first delivery of graphite will occur on or before 31 March 2024.

This is perhaps the riskiest of the conditions in the offtake agreement, especially given the supply chain disruptions that are present all around the world.

If EV1 can get the project financing locked in before the end of the year, make a final investment decision, and commence construction before 31 December 2022 (Condition 3), the company would have around one year and three months to get the project into production.

This is definitely achievable. Even so, we suspect that the offtake partner would not walk away from this deal if there were delays because of supply chain issues during the construction process.

The mining industry and the end users of the raw materials that are produced are well aware of these delays, so we don’t think this will be a major roadblock after construction commences.

We think the end users will be more concerned about actually receiving the supply, rather than the specific timing of it. However, it makes sense for them to add conditions like this into the agreement to apply pressure to EV1 and ensure they deliver.

What’s next for EV1?

Offtake agreement for fine flake graphite (pending) 🔄

Yesterday’s announcement relates to most of the coarse flake graphite that EV1 will produce with mesh sizes comprising +100, +80, +50 and +32 mesh sizes. (The highest value mesh sizes can fetch sales prices ranging from US$970/tonne all the way up to US$3,000/tonne).

The announcement also mentioned that EV1 is still in discussions with other interested parties with respect to offtake agreements on the fine flake graphite production. This represents ~35% of the life of mine production from EV1’s project.

With the fine flake product mostly used in the manufacturing of battery anodes, we suspect that EV1 won’t have any issues getting an offtake agreement over the line on this front.

The image below helps visualise what is currently under offtake agreements and what isn’t.  Framework agreement with the Tanzanian Government 🔄

Framework agreement with the Tanzanian Government 🔄

EV1 is currently in discussions with the Tanzanian government over a “framework agreement”.

Once signed, this agreement would provide fiscal and regulatory certainty to EV1 and to potential financiers.

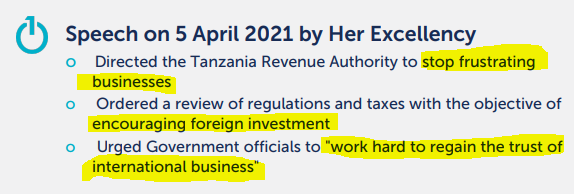

Long time followers of the ASX small cap mining space may be familiar with the regulatory volatility in Tanzania over the last decade. However, things have changed in the country with the appointment as President of Her Excellency Samia Suluhu Hassan in March 2021.

In a speech on 5 April 2021 — only a month after coming into office — Hassan made a point of encouraging foreign investment into Tanzania with the following comments: Since then other ASX listed companies like Strandline Resources, OreCorp, and Black Rock Mining have each signed these agreements. We have also seen BHP invest over $50M in its Kabanga nickel project and Barrick spend $60M on various acquisitions in Tanzania.

Since then other ASX listed companies like Strandline Resources, OreCorp, and Black Rock Mining have each signed these agreements. We have also seen BHP invest over $50M in its Kabanga nickel project and Barrick spend $60M on various acquisitions in Tanzania.

Understandably, the market also seems to like a signed framework agreement — this would significantly de-risk EV1’s project from a regulatory risk point of view.

For example, Strandline, which signed the agreement on 14 December 2021, has seen its share price go from ~25c before the agreement to briefly touch all time highs at 51.5c, after which Strandline completed a $50M capital raise.

Project finance advisor appointment 🔄

EV1 has also flagged the potential appointment of a debt advisor to help with the debt portion of the project funding that EV1 will want to lock in ahead of a final investment decision.

We don’t expect any update with respect to debt funding until at least the optimised DFS is completed. So even if an advisor is appointed, the financing deals are unlikely to come until EV1 is closer to a final investment decision towards the end of the year.

Updated Definitive Feasibility Study (DFS) + final investment decision (FID) 🔄

EV1’s project 2020 DFS shows an NPV of US$323M with a 3.4 year post tax payback period based on total capital expenditures of ~US$87M to get the mine into development.

EV1 are currently working on updating this DFS and the upcoming exploration program which was scheduled for later this year.

We especially like that with EV1’s upcoming drilling program, it can look to try to extend its resource AND try to find more near surface graphite that could bring down the cost to extract the resource and optimise the current DFS.

We covered the geophysical anomalies that EV1 picked up and is targeting in its upcoming drilling program in a previous note: Never miss a chance to improve DFS economics with near surface exploration

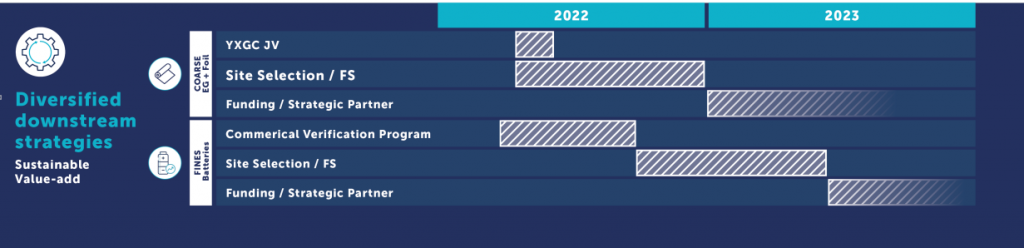

Update on its downstream strategy 🔄 As part of the MOU signed with YXGC, EV1 are looking at building out a downstream strategy via a joint venture, which would see EV1 and YXGC base its manufacturing plant in the EU.

As part of the MOU signed with YXGC, EV1 are looking at building out a downstream strategy via a joint venture, which would see EV1 and YXGC base its manufacturing plant in the EU.

The JV would be for a downstream manufacturing facility in Europe with both parties involved in the feasibility, construction and operation of the facility.

EV1 plans to provide its graphite, and YXGC its downstream manufacturing technologies.

It is yet to be determined what type of downstream products the joint venture will target, but EV1 anticipates the following:

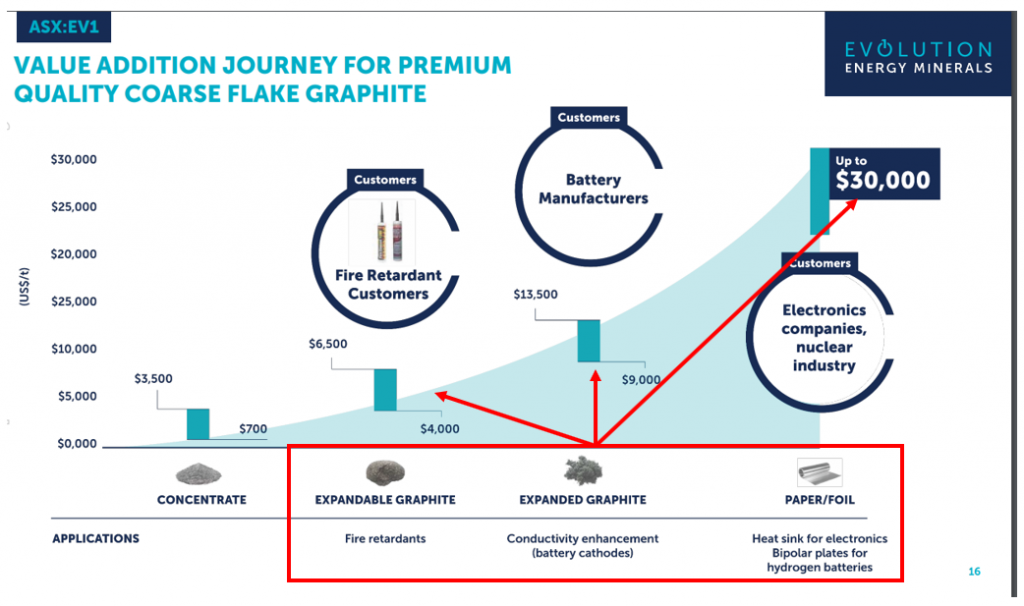

- Expandable graphite: Typically sold directly to Western fire retardant customers (up to US$6,500/t)

- Expanded graphite: Typically sold to battery manufacturers as a conductivity enhancement on the cathode side of the battery (up to US$13,000/t)

- Graphite foil:

- Typically sold to electronic device producers for use as a heat sink (up to US$30,000/t)

- Typically sold to hydrogen battery manufacturers for use in the bipolar plates housing the cathode and anode in hydrogen batteries.

These products, with prices as high as US$30,000/tonne, all command proves well in excess of the raw graphite that EV1 would otherwise be selling.  All of these pending bits of newsflow will significantly contribute to all three of the key objectives we set for EV1 in our 2022 Investment Memo.

All of these pending bits of newsflow will significantly contribute to all three of the key objectives we set for EV1 in our 2022 Investment Memo.

What could go wrong for EV1?

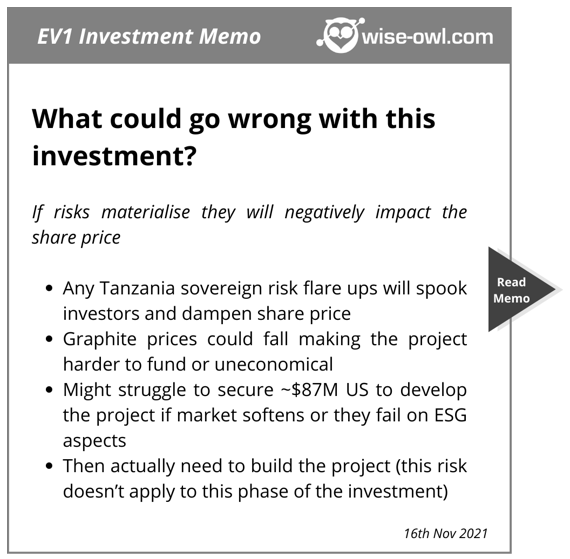

When material announcements like yesterday’s offtake agreement are announced we generally like to go back and check to see if any of the key risks to our investment thesis have been addressed.

One of the key risks we highlighted in our 2022 EV1 Investment Memo was the fact that EV1 may struggle to secure the US$87M in financing required to put its project into production.

The binding offtake agreement has de-risked this to an extent, but it still goes without saying that the money hasn’t been raised so there are still financing risks associated with EV1.

Below is a screenshot of all of the key risks we listed in our 2022 EV1 Investment Memo.

Our 2022 EV1 Investment Memo

Below is our 2022 Investment Memo for EV1 where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our EV1 Investment Memo you’ll find:

- Key objectives for EV1 in 2022

- Why we continue to hold EV1

- What the key risks to our investment thesis are

- Our investment plan

To access the EV1 Investment Memo simply click here.