EV1 Commits to serious ESG…

Disclosure: The authors of this article and owners of Wise-owl, S3 Consortium Pty Ltd, and associated entities, own 3,125,000 EV1 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by EV1 to share our commentary on the progress of our investment in EV1 over time.

Nine days ago we announced Evolution Energy Minerals (ASX:EV1) as the Pick of the Year for our Wise-Owl portfolio.

Today, our Wise-Owl Pick of the Year moved to cement its Environmental, Social and Governance (ESG) credentials and ESG commitment roadmap to the market.

ESG is an important aspect of why we chose to invest in EV1 as we see great opportunity in companies that take their responsibilities in this area seriously.

For a full rundown of why we invested in EV1 and our investment plan, read our original note from last week:

We think the benefits of today’s official commitment to ESG by EV1 are three-fold:

- Best in class ESG companies attract more capital, better customers and top talent – this leads to better shareholder returns over time.

- It can reduce the cost of capital because there are large pools of ESG capital seeking verified ESG deals.

- Production from EV1’s graphite project in Tanzania is more de-risked as the company maintains the necessary social licence to operate and the funds to make it happen

Here are the specifics of today’s announcement…

EV1’s Board staking their positions on ESG

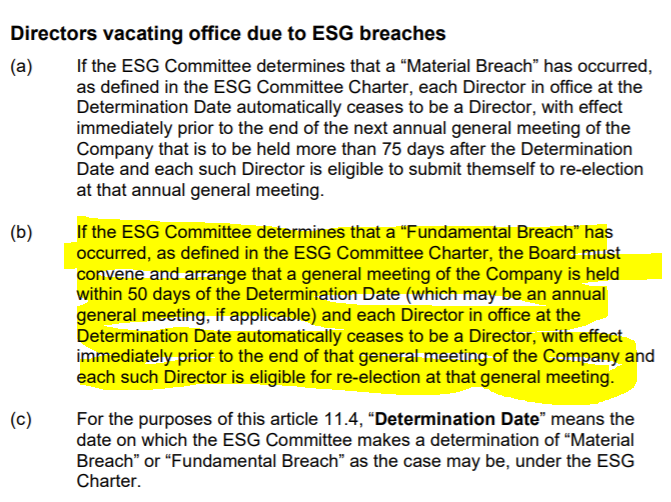

The EV1 board is serious about ESG and if they make what is determined to be a ‘Fundamental Breach’ they can lose their position on the board (via EV1’s constitution):

The announcement today outlines how EV1 intends to implement ESG principles.

The announcement today outlines how EV1 intends to implement ESG principles.

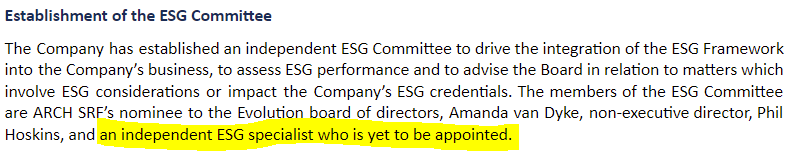

Today’s announcement also details the creation of an independent ESG Committee:

We’re looking forward to the appointment of that independent ESG specialist as it will provide added ESG bona fides to EV1’s Tanzanian graphite project.

EV1’s key goal of being best in class ESG – Reduce funding risk

Having best in class ESG provides access to growing pools of ESG capital, which reduces project financing risk for EV1.

Understanding the importance of ESG to helping secure future capital (and the other benefits), EV1 has secured investment from ESG fund ARCH, who owns 25% of EV1 after investing $8M in the IPO.

London-based ARCH Emerging Markets Partners runs several investment funds, with EV1 set to be the inaugural investment within its ARCH Sustainable Resources Fund.

ARCH brings several key elements to the EV1 story, primarily:

- An initial cornerstone investment of $8M,

- ESG expertise through consulting and board member Amanda van Dyke

- A hands on approach to helping EV1 be top class in ESG, and;

- Future funding opportunities via US$25M set aside for follow-on investment (there are some conditions on this), co-investment from some of its investors (described below) as well as introductions to project financiers.

Project financing is going to be a huge hurdle for many budding graphite companies, but we believe EV1’s relationship with ARCH combined with their commitment to ESG means they already have one foot over that hurdle.

As part of the investment deed with EV1, ARCH secured co-investment rights in EV1 for existing investors in its own fund.

This is important as we expect those investors to primarily be ESG and Green Funds that absolutely trust in ARCH’s due diligence. As a result, when the time comes to seek project financing, we believe EV1 will have greater access to capital from a host of ARCH’s investors seeking more exposure to what could be considered the most sustainable, green and ESG friendly graphite play in existence.

Trading so far and our investment strategy:

It has now been nine days since the IPO was completed and EV1 started trading on the ASX – still very early in EV1’s life as a publicly traded company.

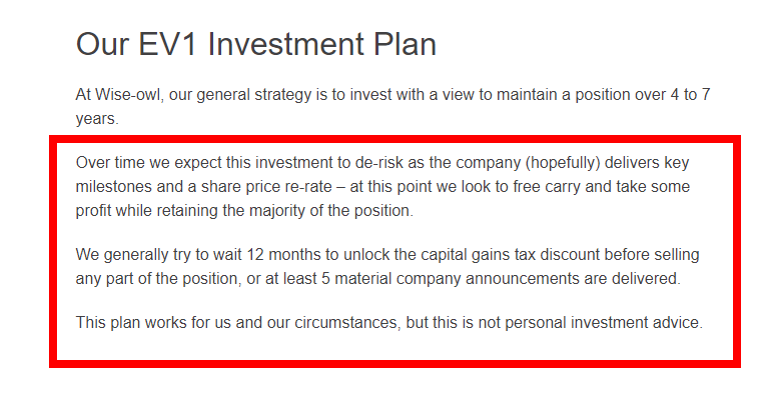

At Wise-Owl we are long-term investors. Our investment strategy is generally to back a company over a longer period of time, often between 4-7 years.

We think that companies need time to execute their proposed business strategies and that the long-term share price performance of a company is dictated by the progress it makes on its projects as-well as its ability to execute.

As a result, we wouldn’t generally comment on share price movements this early on but with the EV1 share price higher than the IPO price of 20¢, we thought it would be good to do a quick recap.

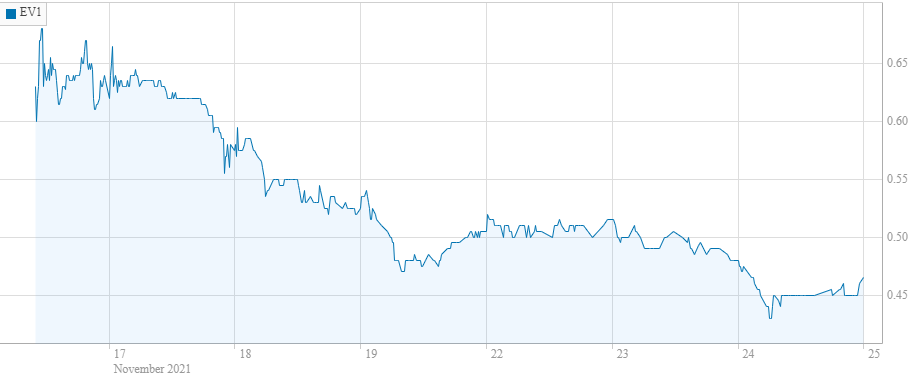

EV1 trading 9 days after IPO:

On the day of listing EV1 shares changed hands as high as 70¢ per share (250% premium to the IPO price).

Naturally, when a share price increases by such a large premium in such a short-space of time, some short term holders decide to cash-in some profits. Trading in EV1 suggests this may be the case, with the share price re-tracing down to today’s price of ~46.5¢.

Our investment model is to see the share price consolidate over a longer period of time and hopefully permanently re-rate as the company releases announcements progressing its projects.

We had touched on this in our initiation note, and think that what we said is even more applicable now.

Reminder: Why we invested in EV1, the top 10 reasons

See our note on why we invested in EV1 for a deeper dive into each reason (and our investment plan, expected milestones and risks)

- Graphite: Right sector, right time – Our best performing investments to date have been sustainable, ESG credentialed battery metals stocks. Graphite is the primary ingredient for just about every electric vehicle (EV) battery, and demand is projected to outstrip supply for the better part of the next decade.

- Aiming to be best in class ESG – Green energy and battery materials buyers are demanding sustainability in their supply chains. EV1 has committed to becoming best in class sustainable, ESG focused graphite producer, which will allow them to attract funding from large pools of ESG capital to build their project.

- Future funding: Major IPO investor is a prominent ESG fund – Cornerstone investor ARCH Sustainable Resource Fund holds 25% of EV1. ARCH has appointed a board member and mandated that EV1 create a top class ESG graphite operation, which should allow EV1 to unlock access to development funding from vast pools of ESG capital. ARCH has already committed to investing a further US$25m in EV1 (subject to conditions being met) and has a network of ESG investors to tap for the rest. ARCH has 20 million 25¢ options which if converted could bring in $5M more in funding.

- EV1 is sitting on premium graphite – All graphite is NOT created equal – Graphite “flake size” is what differentiates mines that are economic and those that are not. 31% of EV1’s defined graphite resource is made up of extra-large or jumbo flake sizes. This gives EV1 optionality in selling it directly at high-margins or using it internally for downstream opportunities. Jumbo flake sizes can sell as high as US$3,000/t whereas smaller mesh sizes fetch prices of US$700/t.

- Project is development ready, low capex, quick to production – We like that EV1 is an advanced stage project, with low capex that can be in production relatively quickly. EV1 has a large graphite resource with upgrade potential, its DFS was completed (in Jan 2020) and a low capex requirement of USD $87M for a NPV of USD $323M with a plan to be in production by 2023, with an 18 year mine life based on reserves only.

- Exploration program to increase resource size – Beyond the existing defined resource, we like that EV1 is investing in a near term exploration program to extend the resource AND try to find more near surface graphite that could bring down the cost to extract and optimise the current DFS.

- Low market cap compared to peers – EV1 listed at a market cap of $32M with $10.5M in the bank, a very low enterprise value relative to its peers. EV1’s resource-to-market cap ratio is among the lowest of ASX peers in the graphite space. The highest market cap peers refine and process their graphite as a “value- add” to the end product. We think EV1 share price will re-rate IF they can deliver capability around “value adding” to their raw graphite.

- Exploring downstream “value add” to graphite products – Digging a material out of the ground and selling it “raw” is the traditional route that most resource companies take. Adding value to the product downstream by refining and processing BEFORE selling it can be highly profitable and is viewed favourably by the market, especially in the graphite space, as we have seen with EV1 peers EcoGraf Limited ($306M capped) and Magnis Energy Technologies ($636M capped). $32M capped EV1 already has DFS-level downstream strategies for expandable and micronised graphite, but we believe the company can re-rate if they introduce downstream battery anode capability as they flagged in the IPO prospectus. In the prospectus $2.5M has been allocated to pursue/study downstream capabilities.

- Best team in the graphite industry – When we invest, backing the best management teams is everything. In our view EV1 has the most experienced management team we have seen on the ASX to bring an advanced stage graphite project to production – we will cover what each key person brings to the table and their experience later in this article, including executive director Michael Bourguignon who was responsible for managing the construction of Syrah Resources’ Balama graphite project in Mozambique.

- Tight capital structure, leveraged for share price growth – The share table and cap structure is one of the most important things we look at prior to investing. EV1 will have ~162M shares on issue when it lists, ~42M options, 25% owned by ARCH and with the Top 20 holding 75% of the shares on issue. The top 2 shareholders own 56% With Marvel Gold escrowed for 2-Years & ARCH for 1-Year, so there is not much free float.

What we want to see next from our investment in EV1

Key Objective 1: Final Construction Decision & progress towards Project Funding

The name of the game for EV1 is to reach a final construction decision and secure the ~US$87M required in capital costs to bring the project into production. DFS upgrades and optimisations will form a part of this process, but more importantly, EV1 needs to deliver all of the ESG requirements set out by ARCH (the cornerstone ESG shareholder), so that ARCH can help EV1 secure funding from other ESG funds in its network that only invest in top class, proven ESG opportunities.

🔲 DFS Optimisation

🔲 Front end engineering design (FEED) – Appointment of Engineer

🔲 Front end engineering design (FEED) – Progress update

🔲 Front end engineering design (FEED) – Final report

🔄 ESG – Initial assessment or report

🔲 ESG – Sustainability report

🔲 ESG – Quarterly progress reporting

🔲 ESG – Life cycle assessment report

🔲 ESG – Progress towards zero carbon operation

🔲 ESG – ESG investment readiness announced

🔲 ESG – Independently assessed ESG score

🔲 ARCH Provides further project funding

🔲 ARCH introduces other ESG funds

🔲 Strategic Board appointment

Key Objective 2: Assess Downstream “Value Add” Opportunities

Assessing further downstream “value add” opportunities and the prospect of commercialisation is important for EV1’s success. Given that each graphite project’s mineralisation has a “unique signature”, it will be important for EV1 to work with potential offtake partners to ensure compatibility with existing technologies as well as the development of new technologies with EV1’s graphite.

🔲 Market update on downstream value add studies

🔲 Market update on downstream value add partnerships

🔲 Market update battery specific value add (studies or partnerships)

🔲 MoU signed with downstream partner 1

🔲 MoU signed with downstream partner 2

🔲 Offtake agreement 1

🔲 Offtake agreement 2

Key Objective 3: Increase Resource Size and find more shallow resource

Whilst an increase in the resource size is not necessary for making a final investment decision, the greatest opportunity to improve project economics identified in the DFS was adding more near-surface graphite deposits to substantially reduce mining costs.

We expect EV1 to undertake an expansionary drill program mid-way through next year, with a geophysics program to identify drill targets to commence imminently. We also want exploration to optimise the economics of the DFS by finding more resources at a shallow depth (cheaper to extract).

🔲 Announce Exploration Program

🔲 Drill Targets Identified/Refined

🔲 Drill Program commenced

🔲 Drill results announced

🔲 Resource Update

What are the key risks?

All mining projects have risks. Here is a short summary of the specific risks we see in an investment in EV1. We will go into them in more detail later in the article.

- Sovereign risk – Tanzania is not Australia. Investing in Africa always poses sovereign risk. While the early signs with regards to the current government’s stance towards mining are in our view encouraging, the situation may change. Economic and social instability are factors we considered before investing in EV1, and indeed in all companies trying to bring a project into production in Africa.

- Market risk – Graphite prices are subject to fluctuations. If the graphite market moves into oversupply territory, this could negatively impact EV1’s DFS and ability to access capital.

- Funding Risk – EV1’s current DFS requires US$87M to develop the project – EV1 may not be able to secure this funding for a variety of reasons that are difficult to predict.

- Construction Risk – Building a mine comes with a set of variables that need to be considered. This includes adverse weather events, safety incidents, environmental factors and stakeholder engagement.

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 3,125,000 EV1 shares.

1,875,000 shares are escrowed for 24 months.

S3 Consortium Pty Ltd company and directors are restricted from selling any holdings in EV1 for 3 months after the announcement of EV1 to our portfolio.

S3 Consortium Pty Ltd has been engaged by EV1 to share our commentary on the progress of our investment in EV1 over time. Please read full disclaimers and disclosures at the end of this communication.