Overview: Merck & Co., Inc (NYSE:MRK) is a global health care company delivering health solutions through various products such as prescription medicines, vaccines, biologic therapies, and animal health. The three main operating segments of the business are the Pharmaceutical, Animal Health, and Alliances segments. The company serves drug wholesalers and retailers, hospitals, government entities and agencies, and animal producers, as well as managed health care providers. During FY14 the company achieved total sales of US$42.2B

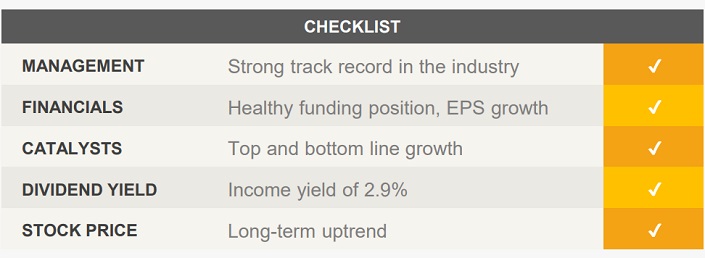

Catalysts: Merck & Co. is experiencing positive sales momentum in a number of key segments. We expect aggregate growth for both the top and bottom line for the group to increase over the next 12 to 24 months. MRK operates in a sector with a moderate growth outlook relative to the broader index. New products offer growth opportunities on top of established income streams, which should positively impact EPS growth. The company pays a stable quarterly dividend with an annual yield of 2.9% at the current price.

Hurdles: A higher USD may negatively impact exports as U.S. products become less competitive on a global scale. Total revenue has declined for the past two consecutive years, putting pressure on management to increase profit margins and reduce capital expenditure.

Investment View: Merck & Co offers profitable exposure to the U.S. pharmaceutical industry. Whilst exchange rates may negatively impact MRK’s earnings in the short-term we believe that top and bottom-line growth should increase. Our valuation incorporates a degree of further growth and our 12-month price target is US$69. We initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.