Overview: Deutsche Bank AG (“Deutsche Bank”, “the Bank”) is a multinational banking and financial services company with a geographical presence in over 70 countries. Deutsche Bank’s four core businesses are corporate banking & securities, private & business clients, asset & wealth management, and global transaction banking. The bank is headquartered in Frankfurt, Germany, and is dual-listed on the German and U.S. stock exchanges. The stock is trading on the Xetra platform (Frankfurt) with the ticker code DBK.

![]()

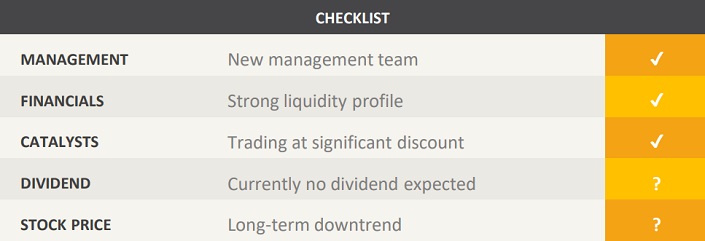

Catalysts: Deutsche Bank is trading at a 60% discount to its tangible book value. The Bank is currently in a transition process with management divesting non-core assets, reducing exposure to risk-weighted assets, and lowering capital expenditure. Following the recognition of substantial impairment charges over the past 12 months, the company is now well-positioned to improve capital ratios and increase its return on equity. Deutsche Bank has a well-diversified funding profile with ~€ 200bn of liquidity reserves.

Hurdles: Deutsche Bank’s share price has declined substantially and there is no guarantee that the trend won’t continue. While the company has set aside € 5.4bn, numerous legal charges are yet to be settled which may exceed the bank’s provisions. The Bank’s reputation has suffered significantly which may challenge Deutsche Bank’s capacity to attract fair value of its stock.

Investment View: Deutsche Bank offers transitional exposure to a turnaround in one of the world’s largest investment banks. We are attracted to its funding position and the progress made on restructuring the bank. As Deutsche Bank continues to divest non-core assets and reduce its exposure to risk-weighted assets, we believe that return on investment may improve over the next 12 months. Hurdles include trends, reputation risks, and legal charges. Deutsche Bank is exposed to significant risks and faces numerous challenges, however trading at a 60% discount to its book value and with new management aiming to restructure the bank, we believe that the balance of risk is attractive. We resume coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.