Overview: Deutsche Bank AG (ETR:DBK) is a German global banking and financial services company, headquartered in Frankfurt, Germany. Deutsche Bank is listed in Germany and the U.S. It is publicly traded on XETRA, the electronic trading system for securities-based in Frankfurt, Germany, under the ticker code DBK. The ticker code for the NYSE is NYSE:DB.

![]()

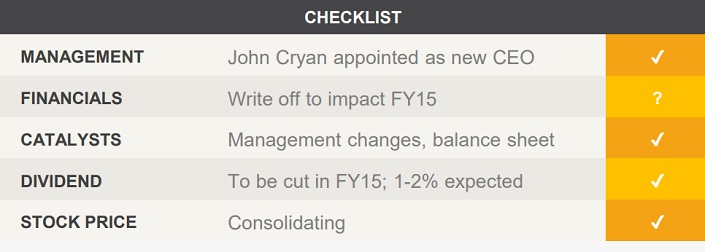

Catalysts: Recent management changes, as well as an improved corporate activity during the first half of 2015, have brightened the outlook. Deutsche Bank recently announced a write-off of €5.8 billion of goodwill, which will result in a loss of more than €6bn for Q3. The impairment charges along with job cuts are part of management’s strategy to lower capital expenditure and boost earnings. Historically when balance sheets are cleared up, return on equity tends to improve. A falling EUR currency should benefit its international operations.

Hurdles: Deutsche Bank has underperformed its peer’s post GFC due to poor balance sheet management, high spending, and lower profit margins. The company has failed to establish a common identity and needs to control capital expenditure, but there is no guarantee that Deutsche Bank’s strategic review will yield economic benefits. Dividend payments are expected to be cut for FY15.

Investment View: Deutsche Bank AG is trading at a historically low valuation and offers speculative exposure to a turnaround in one of the world’s leading investment banks. Whilst impairment charges will weigh on FY15 results, lower spending and a simpler balance sheet are expected to boost its return on equity. With a new management team in place, we initiate coverage with a ‘speculative buy’ recommendation. Our 12-month price target is € 31.50.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.