Overview: Woolworths Limited (“Woolworths, the Company”) is an Australian diversified retail company that owns the Woolworths supermarket chain and other franchises with exposure to Food & Liquor, Petrol, Hotels, Merchandise, and Home Improvement. Woolworths operates in Australia and New Zealand and owns major brands such as BigW, Beer Wine Spirits (BWS), or Dan Murphy’s. The Company was founded in 1924 and listed on the ASX in 1993.

![]()

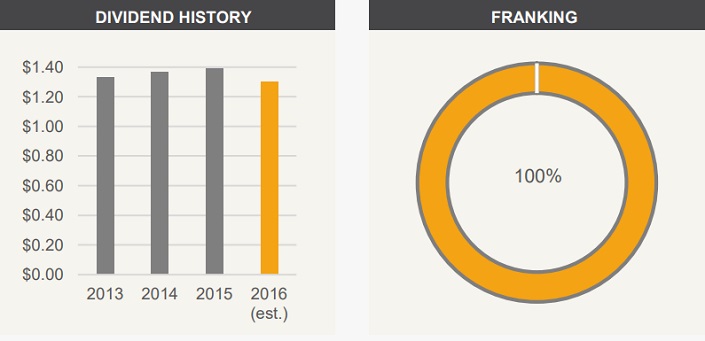

Catalysts: Woolworths has a long-lasting history of delivering shareholder value and sustainable growth. Whilst 2016 earnings are expected to be ~25-30% below the previous corresponding period, increased investment initiatives have the potential to yield long-term economic benefits. Upside stems from the planned exit of the loss-making Masters business. The projected FY16 dividend yields 5-6% at current prices and is expected to be 100% franked. Recent management changes complement the favourable track record of existing board members in capital markets.

Hurdles: Woolworths has recently posted declining earnings and there is no guarantee that increased investments as part of the ‘change program’ will attract new customers. The retail sector is highly competitive which may put downwards pressure on profit margins as competitors offer low prices in order to gain market share.

Investment View: Woolworths offers profitable exposure to a medium-term turnaround of one of Australia’s largest diversified retailers. We are attracted to its long-term growth trajectory, market share, and dividend yield. The competitive environment and recent loss of growth momentum are principal risks. The stock is trading at an undemanding valuation relative to its long-term average due to bearish sentiment and a chain of negative announcements. We favour the balance of risk and upgrade our view from ‘hold’ to ‘buy’.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.