Stockland (SGP) is a diversified property group in Australia that owns, develops and manages a large portfolio of shopping centres, residential communities, retirement living villages, office and industrial assets. Stockland continues to grow and develop its Logistics and Business Park Portfolio.

![]()

Stockland has kept its annual dividend distribution steady at $0.24 per share since 2011 which mirrors the stable and predictable performance of the company. The company announced the estimated distribution for the six months 31 December to be 12.0 cents per ordinary stapled security which is line with previous guidance. The shares will trade ex-dividend on Monday 29th December which means investors have to purchase SGP on or before 24th December 2014 due to the Christmas holidays in order to be eligible for the dividend. The payment date is 27 February 2014. Shareholders may participate in the Dividend Reinvestment Plan (DRP) which offers a 1% discount on securities acquired under the DRP.

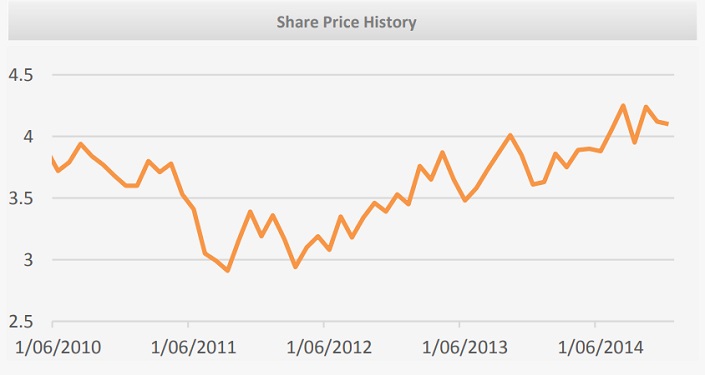

SGP is travelling in a medium to long-term uptrend since Q3 2011. The FY14 financial performance has shown solid growth across most of its divisions. SGP’s diversified portfolio enables the company to increase margins and offset struggles in individual divisions. Wise-owl recommends to add exposure as we are attracted to SGP’s 5.92% annual dividend yield and balanced operational outlook.

Please note: The recommendations of the Dividend Portfolio have a medium to long-term outlook.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.