Overview: Platinum Asset Management Ltd (“Platinum Asset”, “PTM”, “the Company”) is an Australian financial services firm focused on funds management. Platinum Asset is the holding company of Platinum Investment Management Ltd, which manages 14 funds and two listed investment companies (“LICs”). As of June 2017, Platinum had funds under management (“FUM”) totalling $22.7 billion.

Catalysts: Platinum Asset has gone through a period of underperformance due to fund outflows and being the underweight U.S., but management has taken actions to respond to structural industry changes. Historically Platinum Asset has outperformed in challenging conditions and bear markets, providing investors the opportunity to hedge against the market whilst maintaining long exposure to equities. PTM is on track to distribute a fully franked dividend-yielding approximately 6% p.a.

Hurdles: The funds management industry experiences structural changes as investors shift towards Exchange Traded Funds (“ETFs”) and indices and ongoing indexation could further erode funds under management, which have declined over the past two years. There is no guarantee that new pricing structures will retain clients and attract fund inflows. The performance of the Company’s funds is subject to general market volatility.

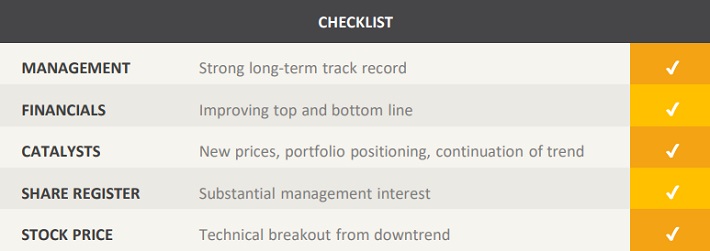

Investment View: Platinum Asset offers profitable exposure to asset management trends and global equity markets. We are attracted to management’s track record, recent product changes, and Platinum’s hedge fund nature. Ongoing fund outflows and market volatility are principal risks. Following two years of stock price depreciation and fund outflows, Platinum Asset may be at an inflection point following recent management actions. The Company has a strong long-term track record of value creation and we are attracted to the fully franked 6% dividend. We initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.