Overview: Monadelphous Group Limited (“Monadelphous”, “the Company”) is an Australian engineering services company. It is engaged in providing construction, maintenance, and industrial services to the mining, energy, and infrastructure sectors throughout Australia. MND has two divisions: Engineering Construction and Maintenance and Industrial Services. Our last advice was a ‘buy’ recommendation on 13 July 2016 at $8.47.

Catalysts: Monadelphous Group has a strong order book and has been awarded an additional $700 million of new contracts during the first half of FY17. The Company has a strong footprint in its core markets and management seeks to expand its services into new and existing markets, which could drive growth if successfully executed. The company has a strong balance sheet with net cash of $226.2 million and debt of less than 1x EBITDA.

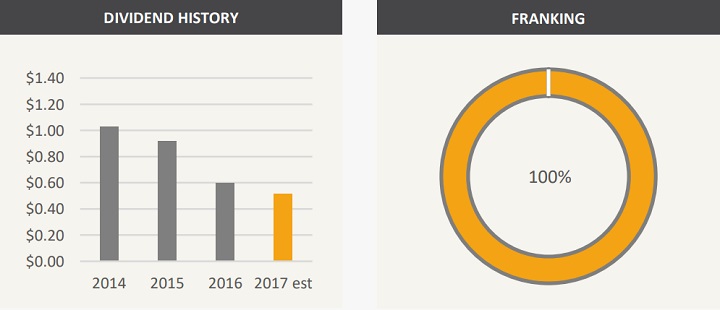

Hurdles: During the past three years, challenging conditions have resulted in declining revenue and earnings and Monadelphous was forced to reduce dividend distributions. There is no guarantee that this trend won’t continue despite the improved order book. The company is subject to economic activity in the mining and construction sector and adverse conditions may aggravate risks of fewer new order flows or deferral of existing contracts.

Investment View: Monadelphous Group offers profitable exposure to demanding engineering services in the resources, energy, and infrastructure sectors. We are attracted to the company’s order book, balance sheet, and diversified income profile. The primary risks are associated with general economic conditions in the construction and resources sector, which may adversely impact Monadelphous operations. With many of its contracts spanning over several years and interest building up, Monadelphous may be at an inflection point to return to dividend growth following several years of contraction. The Company is forecasted to pay a full-year distribution yielding ~4.5%. We reiterate our ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.