Overview: InvoCare Limited (“InvoCare”, “the Company”) owns and operates funeral homes, cemeteries, and crematoria across Australia, New Zealand, Singapore, and the U.S. InvoCare owns key national brands Simplicity Funerals, White Lady Funerals, and Singapore Casket, as well as leading brands in each Australian state in which it operates. The Company’s operations stretch across 270 funeral locations and 16 cemeteries and crematoria.

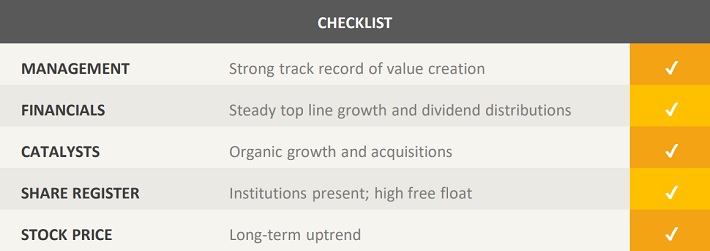

Catalysts: InvoCare continues to be well managed and earnings sound, experiencing steady top-line growth. Over the past five financial years, the company has achieved a compound annual growth rate (‘CAGR’) of 10% per annum. Tight management of costs and an increasing percentage of pre-paid funerals provide increased certainty on price and future market share. The industry is relatively fragmented and consolidation via acquisitions provides additional upside. InvoCare has a strong track record of distributing income to shareholders.

Hurdles: Over the past few years, operating margins have been volatile and expenses have increased during H1FY16. The Company’s market share has recently declined and there is no guarantee that this trend won’t continue. Borrowings of 2.5x EBITDA and prepaid contract liabilities may impact InvoCare’s ability to expand in a relatively stagnant sector.

Investment View: InvoCare offers profitable exposure to demand for funeral services. We are attracted to its revenue growth trajectory, income profile, and resilient business model. Principal risks include lumpy earnings, cost control, and the potential to improve margins. InvoCare has a strong record of distributing steady dividends to its shareholders and as the company operates in a fragmented industry dominated by private operators, consolidation is a major value driver. We initiate coverage for its track record of revenue growth and defensive income profile and issue a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.