Overview: Harvey Norman Holdings Limited (HVN) is the franchisor and operator for Harvey Norman, Domayne, and Joyce Mayne retail stores in Australia, New Zealand, Slovenia, Ireland, Singapore, and Malaysia. The company has 194 franchised stores in Australia and 86 company-operated stores internationally. The stores offer a diverse range of home, electronic or outdoor appliances. The company also has investments in property, media placements activities and is a provider of consumer finance.

![]()

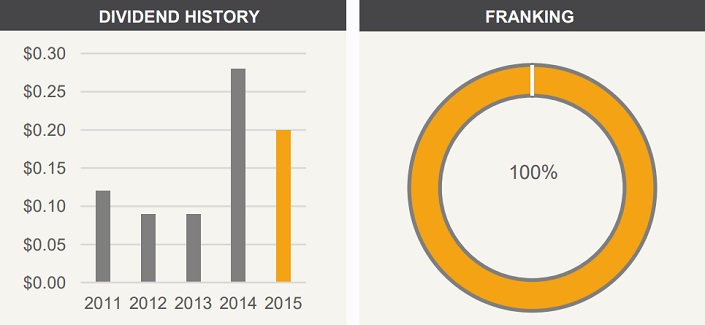

Catalysts: Harvey Norman has recorded average profit growth of 20% over the last four years. While its domestic operations remain robust, overseas revenue experiences strong growth. The annual dividend is forecasted to yield ~5% with 100% franking. The company recently purchased a 40% interest in dairy farm operator Coomboona Holdings Limited which further diversifies Harvey Norman’s investment portfolio.

Hurdles: Harvey Norman’s sales revenue is exposed to retail conditions both domestically and overseas and may be subject to falling consumer confidence. The company’s commercial property portfolio is exposed to the non-residential property market and any downturn in the sector may adversely impact valuations.

Investment View: Harvey Norman provides profitable exposure to the retail sector. We are attracted to the company’s growth trajectory, diversified industry exposure, and attractive dividend yield. The commercial property portfolio is strategically positioned to provide steady income, albeit subject to property prices. Improving consumer sentiment and steady household spending are potential near-term drivers. Offering an attractive mix of capital growth and income we initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.