Challenger Limited (CGF) is an investment management firm focusing on providing Australians with financial security in retirement. Challenger operates two core investment businesses, Life division, and Funds Management division. As of 31 December 2014 Total Assets Under Management were $57.2bn an increase of 12.7% compared to pcp.

![]()

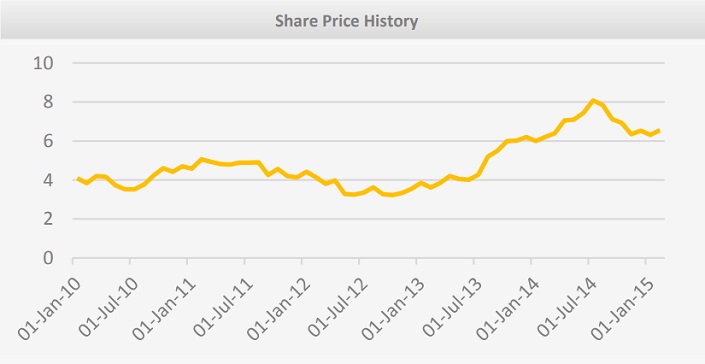

Strong retail sales in its annuities and growing funds under management (FUM) reflect CGF’s strong development in building a leading retirement income platform. CGF’s 52 week high is at $8.20 and its 52 week low is $5.80. The stock has retreated nearly 30% between July and December 2014 during volatile market conditions and as statutory net profit decreased 21.8% compared to pcp mainly due to tax expenses. However, the company has increased its revenue flow by 9.6% and experienced modest growth across most divisions. The board announced an interim dividend of 14.5 which is an increase of 16%. The shares will trade ex-dividend on 2nd March 2015 payable on 31st March 2015. The dividend is 70% franked (2013: unfranked) and Challenger expects its final dividend to be 100% franked and in the range of 45% to 50% of normalised net profit.

We are attracted to CGF’s income profile, healthy funding position, and good dividend yield. We believe the company is well-positioned to deliver long-term shareholder value and we initiate coverage with a ‘buy’ recommendation.

Please note: The recommendations of the ‘Dividend Portfolio’ have a medium to long-term outlook.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.