Overview: ThinkSmart Limited (“TSM”, the Group”) is an Australian micro-finance Company focused on the UK. It provides a point of sale financing solutions through alliances with major international retailing groups. The Company’s patented ‘QuickSmart’ technology facilitates credit approval in just a few minutes, whether customers are online or in-store. December 2013, TSM announced the sale of its Australian & New Zealand businesses to FlexiGroup (“FXL”) for $43m.

![]()

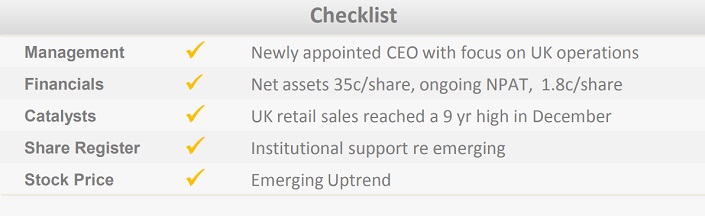

Catalysts: Keith Jones’s appointment as CEO and the disposal of TSM’s marginal ANZ operations provide a platform for growth. Following a three-year rationalisation phase, the Company has resolved to exclusively focus on its profitable UK operations, where Mr. Jones’s alliance partner background is expected to drive opportunity. The remaining business has a CY2014 NPAT profile of $3m, and post special dividend, net assets of ~$57m (35c/share). A 7.4c return of capital is expected in May, and the Company intends to undertake a share buyback for up to 10 percent of the issued capital.

Hurdles: UK segment earnings have been volatile. The Company is reliant on securitisation markets to expand its loan portfolio. A deterioration in borrower quality could adversely impact financial performance.

Investment View: TSM is a turnaround candidate positioned to benefit from improvements in UK consumer spending. We are attracted to recent management changes and view current valuations as undemanding. With pending capital management initiatives expected to drive interest, and UK retail sales growth reaching a nine-year high, we commence coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.