Overview: TechnologyOne Ltd (“TNE”, “the Company”) is an integrated developer and distributor of enterprise software for the Government, financial services, education, health, and the utilities sectors. It was established in 1987 and has been continually profitable since 1992. We have maintained coverage for its strong balance sheet and history of profit growth. Our last advice was a ‘hold’ recommendation at $1.40/sh in January. With the share price rising in subsequent trade, we consider whether the outlook has improved?

![]()

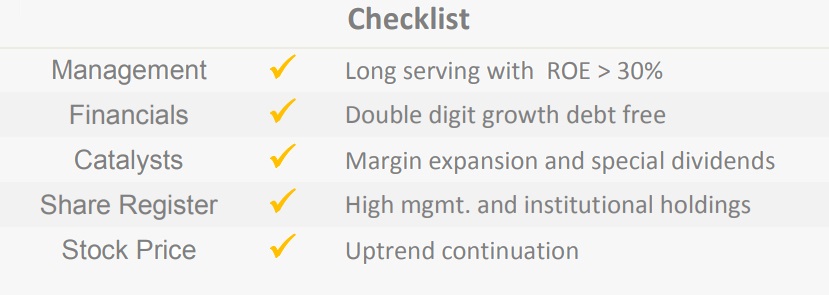

Catalysts: Since its 1999 listing, revenue and earnings have increased every year bar two at double-digit rates. Management has forecast another strong result for FY13 and we expect a reversal of a decade-long trend of margin contraction to fuel further growth. Its strong cash flow, balance sheet, and expanding cash reserves create scope for special dividends.

Hurdles: Recent profit growth has coincided with a contraction in pre-tax margins from 25% to 18%. To reverse the trend management is targeting lower growth in R&D spend, which could impact innovation. As a degree of growth is reflected in the Company’s present valuation, a modest deterioration in its financial performance could adversely impact the stock price. Major shareholdings of founding Director impact trading liquidity in the stock.

Investment View: Whilst TNE’s present valuation incorporates a degree of further growth, the Company commands a strong financial position, and management has a track record of delivering value. Recent capital spending on new local and offshore R&D facilities should facilitate cost control and ongoing innovation. As benefits of the margin focus become salient, we are upgrading our view to ‘buy’.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.