Overview: Tandou Limited (“Tandou”, “the Company”) is an Australian agribusiness and water investment company. It owns rural property covering ~127,000ha near Menindee, NSW, and 6,000h near Hay. Its farming operations have the capacity to produce ~110K cotton bales pa. It also owns 84.5 Gigalitres of water entitlement in the Southern Murray- Darling Basin.

![]()

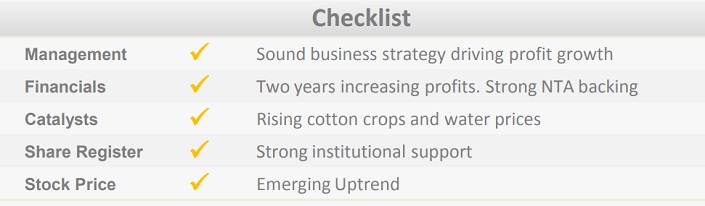

Catalysts: Expansion of farming and water trading operations have driven two years of profit growth and scheduled plantings are expected to support the trend. For FY14 and FY15, the total cotton area has the potential to rise by 20% pa toward 11,000Ha. Forward sale pricing for FY14 is 5 percent stronger yoy. The share price is trading at a discount to its Net Tangible Asset (NTA) backing, which in turn understates the market value of Tandou’s water and land assets by approximately 25%.

Hurdle: Weak cash flow profile and April $25million entitlement offer suggests Tandou’s business model remains reliant on external financings. Forward sale of 87% of FY14 cotton production at an average price of $476/bale may limit earnings upside potential in the short-run. World cotton markets are influenced to a large degree by the Chinese Government, which holds50% of world cotton stocks.

Investment View: Tandou offers profitable exposure to water assets in South Eastern Australia and international cotton markets. We are attracted to its strong asset backing and ability to strategically shift resources between cotton production and water right sales depending on market conditions. Water assets account for approximately half of its NTA. With its recent entitlement offer mitigating funding risks, we initiate coverage with a ‘buy’ for its capital growth potential.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.