Overview: Spring FG Ltd (“Spring FG”, “the Company”) is an Australian financial services company focused on retail markets. It provides financial planning, investment, asset protection, and tax advisory services, primarily to Self Managed Super Funds (SMSF). Founded in 2010, the Company has operations in Sydney, Brisbane, Canberra, and Melbourne. In FY 2014, Spring FG acquired Moneytree Partners and Pink Diamond.

Catalysts: Profitable since its first full year of operation, Spring FG is on course to generate its third consecutive year of increased revenue and earnings. The Company is now seeking to complement organic expansion with acquisitions. Inaugural deals with Moneytree Partners and Pink Diamond are currently being integrated and the extension of its profit growth trend is the major value driver. The Company is scheduled to pay a $0.026/share dividend in October, representing a yield of 8.8 percent at the listing price.

Hurdles: Financial performance is sensitive to dynamics within the domestic property market, with over half of earnings generated by the provision of real estate investment advice. The shift towards an acquisition-based growth strategy may introduce new operational challenges for management. Regulation and competition within the financial services industry are high.

Investment View: Spring FG offers profitable exposure to Australia’s growing superannuation industry. We are attracted to the Company’s organic growth record and cost-effective procurement strategy. Supported by high dividend payouts and an undemanding valuation, the outlook appears positive. With our valuation of $0.50/share representing a 67 percent premium to its listing price, we initiate coverage with a ‘buy’ recommendation.

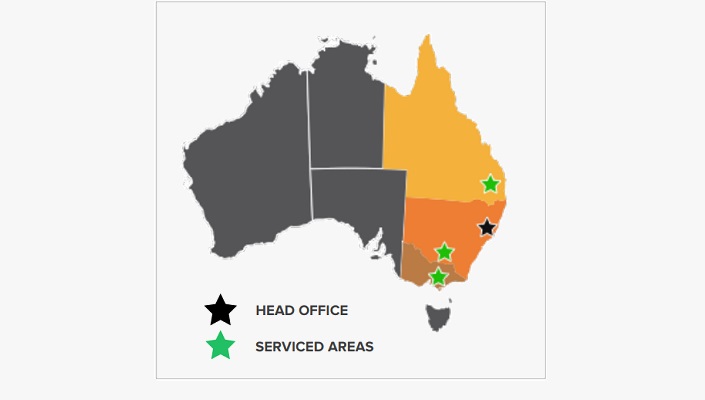

Spring FG Limited (“Spring FG” or “the Company”) is an Australian financial services company with operations in Sydney, Brisbane, Canberra, and Melbourne. The Company offers products and services encompassing financial planning and investment advice; insurance and superannuation; finance; and tax & accounting services.

Spring FG was founded in 2010, with a mission to deliver financial services utilising a ‘holistic’ client philosophy. Spring FG acquired Moneytree Partners in May 2014 and Pink Diamond Financial Group in August 2014.

Spring FG listed on the Australian Securities Exchange in March 2015, raising $4.45million at $0.30/share. Following its Initial Public Offer, issued capital stands at $13.4 million, or $0.11/share.

Spring FG’s primary assets are Intellectual Property and client relationships associated with its existing cash-generating financial services operation.

The Company has a portfolio of approximately 1,000 clients, primarily operating self-managed super funds. Spring FG is remunerated for delivering detailed Statements of Advice (SoA’s) for clients, and the subsequent execution and support of resulting investment strategies.

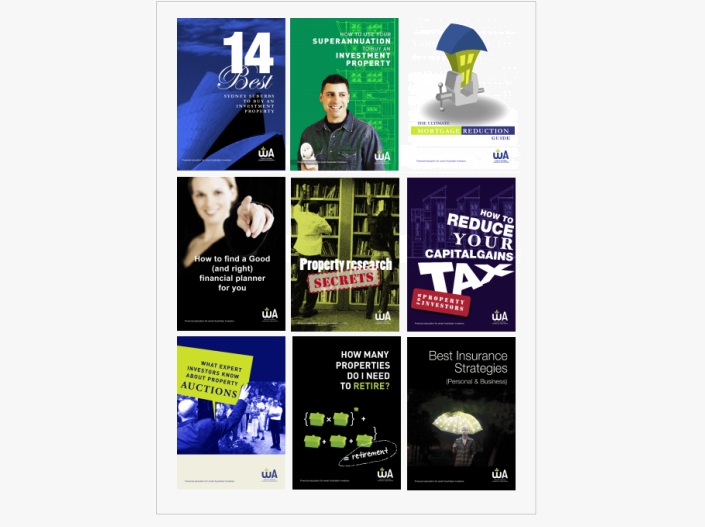

Intellectual Property associated with the operation centers around its ebook portfolio. Published under the Wealthadviser Financial Education brand, the portfolio comprises 50 titles focused on financial education, and is a major driver of client procurement. To date, the Wealthadviser publications have registered more than 60,000 downloads, the most popular of which are focused on self-managed superannuation and investment property-related topics.

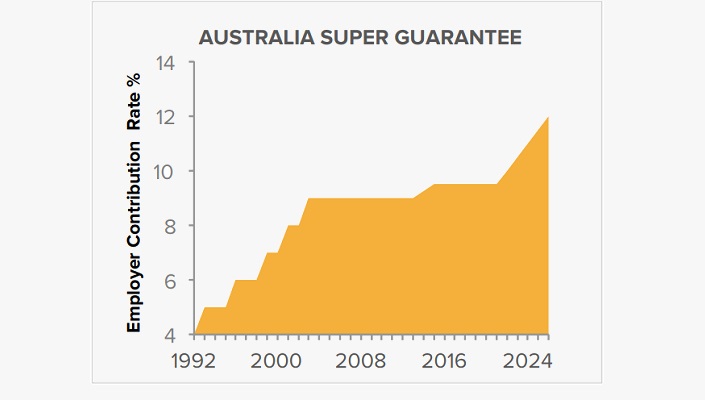

Australia’s financial planning and advice industry is driven by the nation’s mandated superannuation requirements, a large proportion of which is ‘self-managed’. Compulsory employer superannuation contributions rose from 9.25 percent of an employee’s salary in FY14 to current levels of 9.5 percent. From 2021 to 2025, the superannuation contribution rate is scheduled to rise progressively to 12 percent.

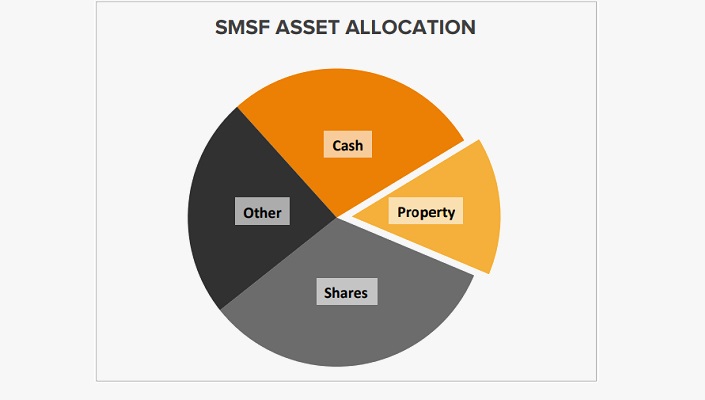

One-third of Australia’s superannuation assets are held in ‘Self Managed Super Funds’ (SMSF’s). Within this segment, 99 percent of assets are held domestically, and over 80 percent of investments are made directly. Approximately one-third of SMSF assets are invested in listed shares and other equity securities, 28 percent is held as cash, and 15 percent invested into the property.

Of the 18,300 registered financial planners in Australia, Spring FG estimates less than ten percent provide advice on or deal in residential real estate as an asset class. In contrast, Spring FG estimates the value of these underserviced investments to exceed one trillion dollars.

1/3rd OF AUSTRALIA’S GROWING SUPER ASSETS HELD BY SMSF

Spring FG’s capability to service the real estate investment market, alongside its client procurement strategy and independent status, are its major competitive advantages.

Client procurement is driven by the company’s ebook collection, which provides a low-cost tool for the company to expand organically. Utilised initially under license, the ebook portfolio was formally acquired via the 2014 takeover of Moneytree Partners.

Prospective clients which engage further subsequently benefit from Spring FG’s uniquely independent positioning. The Company is not aligned with any particular financial services platform, hence the execution of SoA’s can be achieved impartially.

ONLY 10% OF FINANCIAL PLANNERS OFFER REAL ESTATE ADVICE

Spring FG is uniquely able to service SoA’s requiring action regarding real estate investments. The Company has multiple relationships with major developers which provide a reliable supply of investible inventory and access to finance for clients. A critical feature of Spring FG’s real estate unit is its exclusive focus on east-coast capital city markets, mitigating investment risks for clients.

Spring FG has attained strong profitability and is self-funding. The Company’s commercial strategy is therefore focused on growing existing income streams.

The recently acquired ebook collection provides a strong foundation to support further organic client procurement. The library of freely available titles provides prospective clients impetus to engage the Company further, which can include an SoA or educational seminars offered at the Company’s offices in Sydney, Melbourne, Brisbane, and Canberra.

Amongst engaged clients, Spring FG aims to expand the degree of income generated by the provision of trail-based services such as mortgage brokerage. The strategy aims to elevate the Company’s amount of ‘recurring’ income.

SPRING FG OFFERS STRONG PROFITABILITY & IS SELF-FUNDED

Spring FG earns revenue through Financial Advice Fees, Product Rebates and Commissions, as well as Tax and Accounting Fees.

Financial advice fees include SoA preparation fees, implementation fees, ongoing adviser service fees, and transactional-based brokerage fees associated with underlying asset movements. Plan implementation fees range from $1,000 to $6,000 or more, depending on the nature, scale, and complexity of the plan.

Ongoing adviser service fees have also influenced the nature and scale of investments and advice provided. Brokerage fees generally range from 0.5% to 0.85% of the value of the assets being exchanged. Product rebates and commissions are earned via the origination of insurance contracts, real estate transactions, and finance packages. Income generated by these activities is split into upfront and trailing categories.

MORE THAN HALF OF THE INCOME IS FROM REAL ESTATE ADVICE

Tax and accounting fees are charged when clients engage Spring FG Accounting to provide ongoing accounting services or to provide tax returns. For annual SMSF accounting and tax services, clients are charged between $1,800 and $3,500 depending on the complexity of the fund, and the scale and nature of investments and trading activity. Presently, Spring FG derives more than half of income from the provision of advice and support services associated with real estate investments.

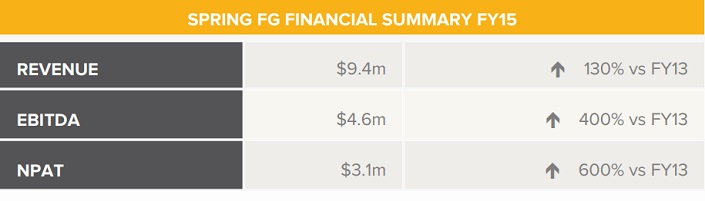

Spring FG generates income via the provision of financial advice. A review of its operating history is limited to the last three financial years, although the company has been profitable since its first full year of operation. FY14 saw the company acquire Moneytree Partners and Pink Diamond Financial Group.

PRO FORMA EARNINGS +100% FY14

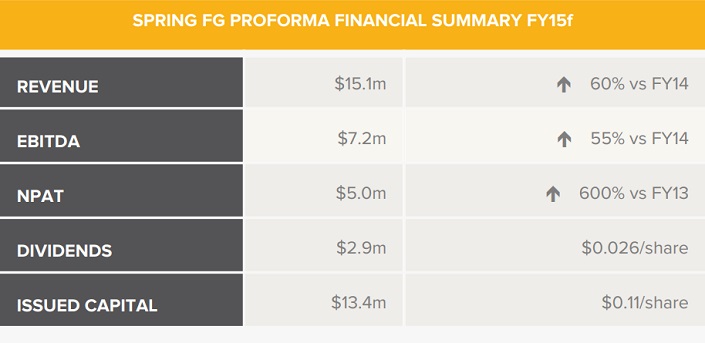

On a pro forma basis, FY14 saw Spring FG generate revenue of $9.4million, normalised EBITDA of $4.6million, and net profit of $3.1million. Against the previous corresponding period (pcp), revenues doubled, and earnings grew by over 400 percent, due to operating expenses staying relatively flat versus pcp.

Apart from major acquisitions, Spring FG is in a largely self-funding position. Its March Initial Public Offer represented the Company’s most recent financing exercise. 13.3million shares were issued at an

offer price of $0.30. Proceeds were used to pay deferred consideration associated with the acquisition of Pink Diamond Financial Group, expand sales and marketing, and support future acquisitions.

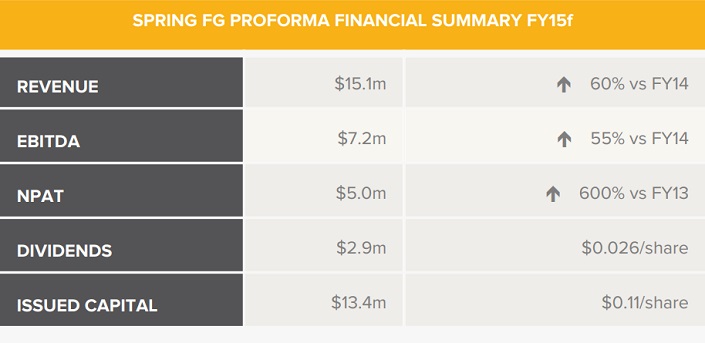

FY15 GROWTH FORECAST +50%

The IPO was supported by forecasts for further growth during FY15. Revenue was projected to rise 64 percent to $15.1million, and net profit after tax 61 percent to $5.0million. Management expects to pay a dividend of $0.026/share in October 2015.

DIVIDEND $0.026/SHARE OCT 15

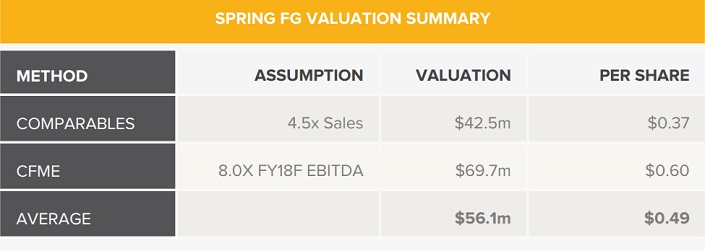

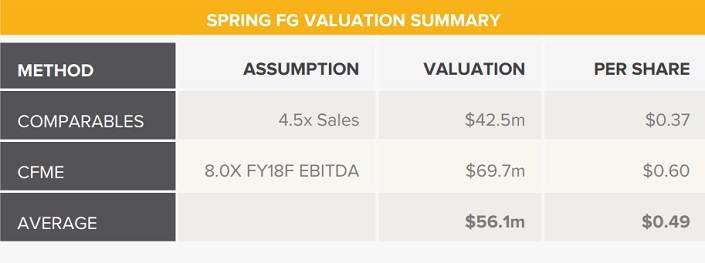

Spring FG’s investment appeal rests in its current income streams and capacity to grow them through further client acquisitions. We have considered the company’s potential worth using Comparables and Capitalisation of Future Maintainable Earnings (CFME) methodologies.

Both methodologies are based on Spring FG’s current capital structure, implicitly assuming subsequent growth accrues organically without the need for further share issuances. In reality, we recognize, the Company may use scrip to fund value accretive acquisitions.

VALUATION $0.50c/SHARE

Our Comparables approach arrives at a valuation of $42.5million, or $0.38/share. Our Capitalisation of Future Maintainable Earnings method arrives at a valuation of $70.2million, or $0.62/share. Applying equal weightings both methods deliver an aggregate valuation of $56.3million or $0.50/share.

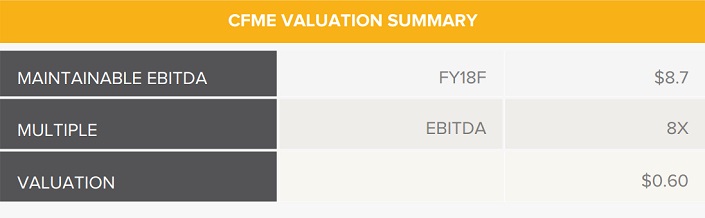

CFME VALUATION $0.62/SHARE

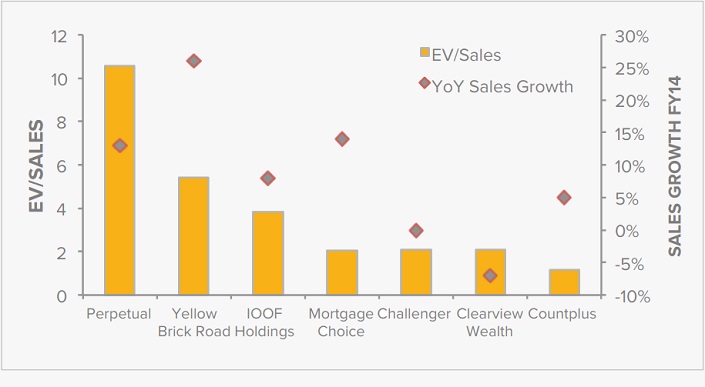

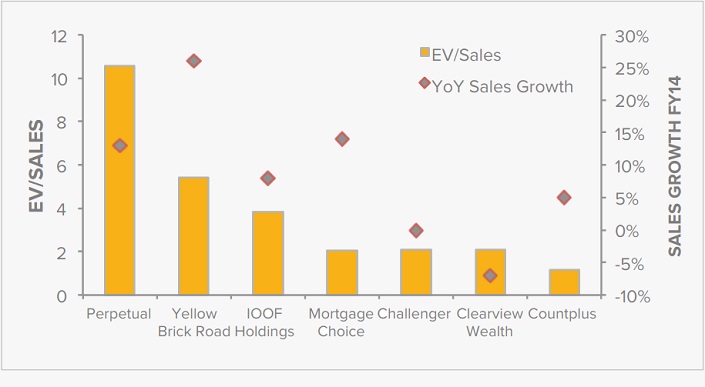

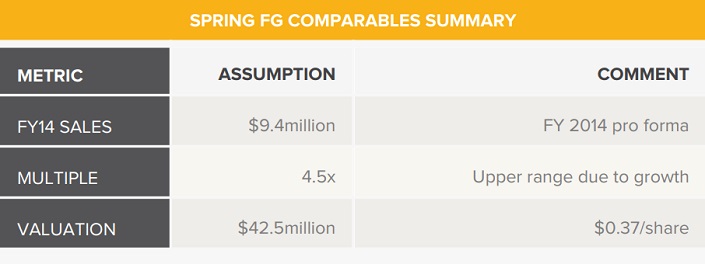

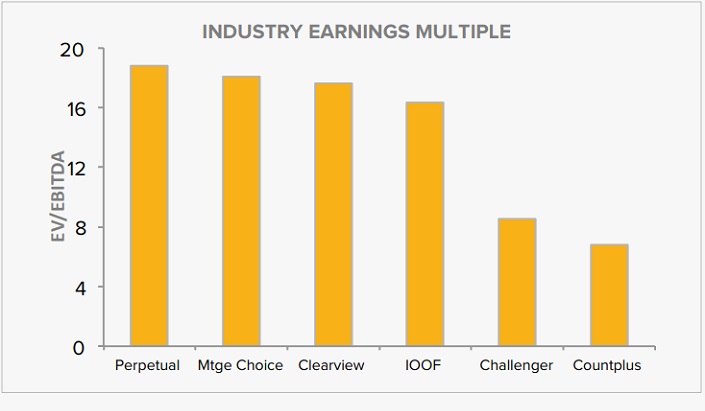

A universe of comparable companies has been assembled which operate in the Australian financial services industry with an SMSF client focus. Price to sales multiples range from one to ten times FY14 revenue, and there appears to be a positive relationship between the multiple and rate of growth in sales.

With Spring FG benefiting from growth rates superior to the benchmark group, we have applied an upper range enterprise value to sales multiple of 4.5x. This multiple implies a valuation of $42.5million or $0.37/share

COMPARABLES VALUATION $0.38/SHARE

Post FY15, we have projected the Company’s financial performance

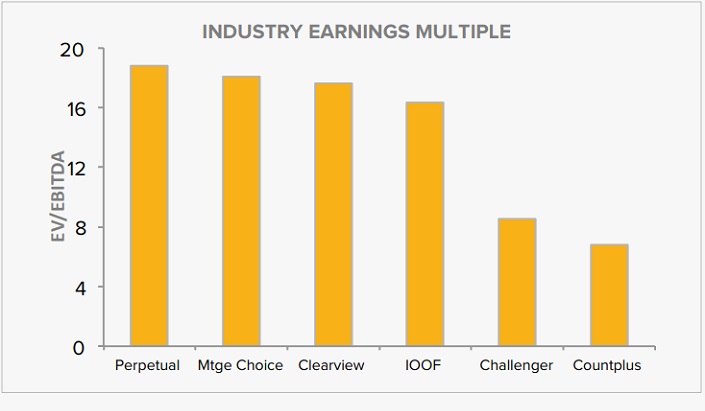

for the next three financial years to a level that represents a sustainable earnings capacity. To our estimation of future maintainable earnings, an industry-based multiple has been applied to arrive at a valuation of the Company.

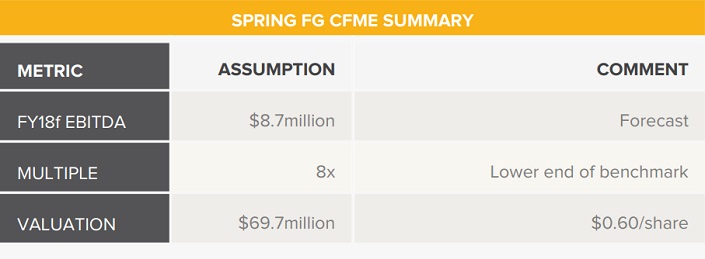

Our financial projections assume Spring FG’s earnings growth moderates from prospectus forecasts exceeding 50 percent in FY15, to between 5 – 10 percent for subsequent periods. By FY18 we project the Company to generate an EBITDA of $8.7million.

Current industry EBITDA trading multiples range from 8x – 19x. We have adopted a lower range multiple of 8x to arrive at a CFME valuation of $69.7million, or $0.60/share.

Spring FG offers profitable exposure to Australia’s growing superannuation industry. We are attracted to the Company’s financial performance, organic growth record, and cost-effective procurement strategy.

Dividend payments, acquisitions, and extension of recent earnings expansion are the primary growth catalysts for new investors. In October, the Company is scheduled to pay a $0.026/share dividend

representing a payout ratio of 60 percent, and a yield of 8.6 per

cent at the listing price.

$0.026/SHARE DIVIDEND IN OCTOBER

The Company’s capacity to sustain recent financial performances appears contingent on dynamics within east coast real estate investment markets, and competition amongst real estate advisory

service providers.

INITIATE COVERAGE WITH A ‘BUY’

However, with the support of relatively high dividend payouts and an undemanding valuation, the outlook appears positive. Our valuation represents a premium of 63 percent to a recent trade. Therefore, we initiate coverage with a ‘buy’ recommendation.

Spring FG relies on its employees to ensure risk and return exposures are optimised to each client’s financial situation. There is no guarantee that the investment strategies recommended by employees will produce acceptable financial outcomes, which can impact client procurement and retention.

Australia’s financial services industry in which Spring FG operates is highly regulated and subject to change. Compliance with applicable codes and requirements has a large impact on the costs of doing business and the company’s ability to generate income. Changes to existing regulations can therefore have a significant impact on Spring FG’s financial performance.

Intellectual Property protections surrounding Spring FG’s assets are presently limited to the Company’s eBook portfolio and the Company’s trademarked brand names. There is no guarantee these protections will be sufficient to mitigate against the competition.

Spring FG is subject to high competition within the financial services industry. Demand for services is heavily driven by investment performances and Spring FG’s historic emphasis on real estate links its financial performance to changes in property prices. Increased competition from other financial services firms within the real estate investment market could also impact demand for Spring FG’s services.

Whilst Spring FG is self-funded and generated positive cash flow during FY14, its earnings history is limited. There is no guarantee the Company will be able to execute its growth and acquisition strategy without seeking external capital.

THE BULLS SAY

THE BEARS SAY

Guy was the founder and (for more than 10 years) head of Macquarie Private Bank in Australia and Asia and an executive director at Macquarie Group from 2002 to 2012. Under Guy’s management, Macquarie Private Bank established itself as the leading private bank in the country. Guy is now the executive chairman of Atlas Advisors Australia as well as being an Advisory Board Member at China House and on the board of the Sydney Writers Festival and chairman of its Finance Committee. He holds an MBA (Exec.) from the Australian Graduate School of Management and is a Master Stockbroker (SAA).

Keith is the founder of Spring FG and has extensive corporate and financial services experience. From 1994 – 2006 he was a founding director and shareholder of eBet Limited (Managing Director, 1994-2004), an ASX-listed technology and gaming company with operations and offices in Australia, New Zealand, USA, Canada, the Philippines, Singapore, Malaysia, Vietnam and Cambodia. From 2004 – 2006 Keith was Group CEO of WPS Financial Group (now Anne Street Partners), a diversified financial services group offering financial planning and investment services across Australia.

Chris Kelesis is a foundation shareholder and Director of Spring FG Limited and its subsidiary companies and licensee-in-charge of Spring FG Realty Pty Ltd. As licensee of Spring FG Realty Pty Ltd, Chris heads the investment property analyst team, and holds primary responsibility for managing the Company’s relationships with major developers and property asset managers.

Jeff has extensive experience at operational and board level with both private and public companies in financial services and technology. Jeff is currently an executive director of Sydney-based corporate advisory firm, Coyne Holdings and is the founder and managing director of Book Buyers Brokerage Services Australia (BBBSA), a specialist mortgage and finance brokerage advisory business. He is also a councillor with Woollahra Municipal Council in Sydney’s eastern suburbs. Previously Jeff held roles as CEO of mortgage aggregator Vow Financial and as the CEO of Beacon IT Group. He was also a non-executive director of ASX-listed eBet Limited for eight years to 2007. He holds a BA Law (Witwatersrand) and Dip. Jurisprudence (Oxford).

Notes

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.