Lithium in the heart of Europe: Counting down to EMH’s feasibility study

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 261,000 EMH shares at the time of publishing this article. The Company has been engaged by EMH to share our commentary on the progress of our Investment in EMH over time.

Aware of the importance of securing critical minerals, European governments are in a race to source and lock in lithium supply from friendly nations.

We believe our development-ready lithium Investment based in the European Union, European Metals Holdings (ASX: EMH), could help meet that demand.

Consider that EMH has:

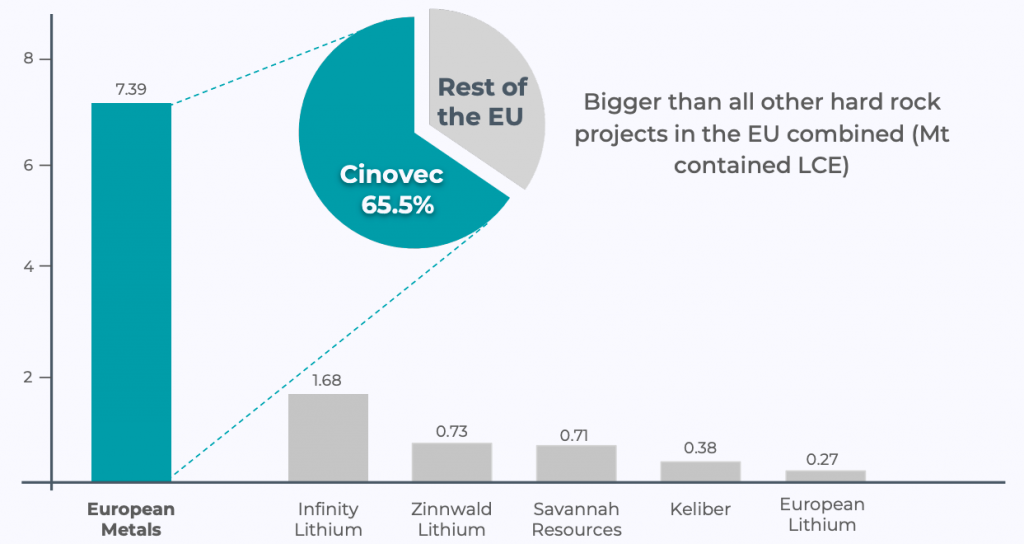

- The biggest hard rock lithium resource in the European Union (in the Czech Republic).

- A completed Pre Feasibility Study indicating an after-tax project value of up to US$1.9BN.

- A joint venture with Czech government backed utility, CEZ Group.

- A Definitive Feasibility Study due in the coming months based on updated higher lithium prices.

With lithium prices soaring and most lithium stocks trading at or close to all-time highs, EMH hasn’t quite taken off – trading mostly sideways and down over the last 12 months.

We think the market is waiting for the key announcement — the Definitive Feasibility Study and updated project economics.

EMH expects the Definitive Feasibility Study to be completed in the next few months, including an updated net present value (NPV) figure based on more recent lithium prices. We think this will help EMH secure project financing in the lead up to a final investment decision.

Here is how EMH’s lithium project (Cinovec) stacks up against other hard rock lithium projects in Europe:

The European Commission recently earmarked the local supply of critical minerals as “strategically important” and we think that EMH’s fortunes may turn as European countries put into action risk mitigation strategies around critical minerals supply.

“Lithium will soon be MORE important than oil and gas…”

This was the statement from the President of the European Commission Ursula von der Leyen while announcing the “Critical Raw Minerals Act” in September.

Spooked from the energy crisis caused by a reliance on Russian gas supply, Europe is looking to avoid a similar geopolitical situation where it relies on China to supply and process critical minerals.

EMH has a development ready lithium project inside of the European Union backed by the Czech government and with a size and scale to support Europe’s growing lithium demand.

Everything the European Commission is looking for.

We hope that the move by the European Union to secure supply chains for critical minerals will increase urgency in the region to develop projects like EMH’s and finally translate into shareholder returns for investors.

This brings us to our “Big Bet” for EMH:

Our Big Bet

“EMH significantly re-rates to $1BN+ market cap on reaching a successful Final Investment Decision for its hard rock lithium project strategically located in the heart of Europe.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our EMH Investment Memo.

To visualise what EMH has done since we Invested, check out our Progress Tracker for the

A quick reminder of EMH’s project feasibility studies

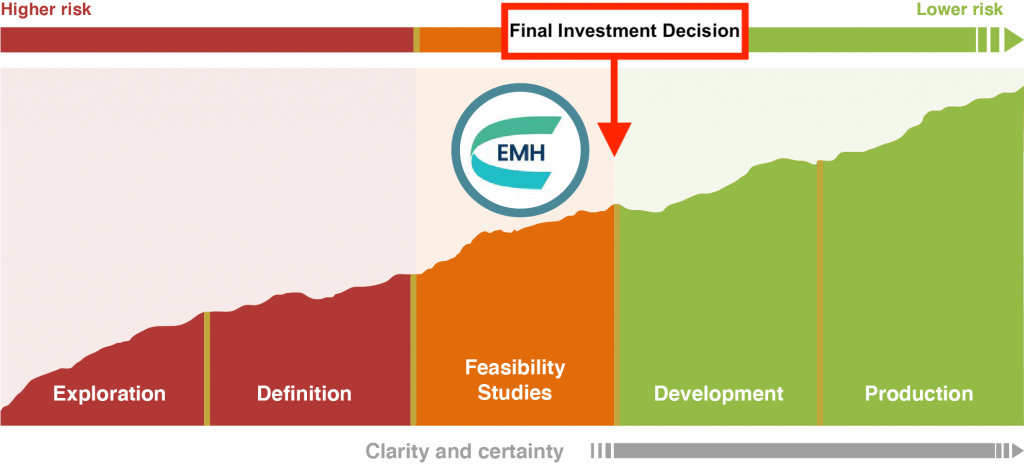

EMH is developing Europe’s largest hard rock lithium project. The company is now in the feasibility studies stage of development, working through various studies, permits and funding options to reach a “final investment decision”.

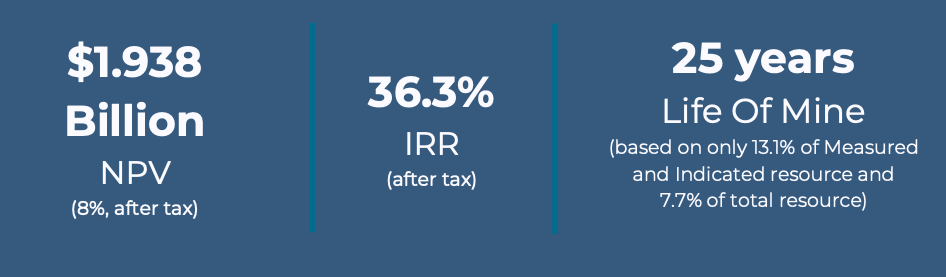

Earlier this year EMH updated its Pre-Feasibility Study (PFS), valuing the project at up to US$1.9BN (post-tax NPV) with an internal rate of return of 36.3% over a 25 year mine life, while costing US$644M to construct (CAPEX).

Almost immediately after updating its PFS, EMH put the wheels into motion on its Definitive Feasibility Study (DFS) — basically a more accurate financial modelling exercise where a company dots the ‘I’s and crosses the ‘T’s on its project economics.

Looking ahead to the DFS, there are some promising developments.

For one, input values will be updated, including the lithium price which has gained some 70% since the PFS was completed back in January.

EMH has also made improvements to its lithium processing flowsheet, and added a lithium expert with extensive DFS experience (both of which we will cover shortly).

A DFS is generally a precursor to securing big project funding, as financiers generally require detailed financial modelling before deciding how much they are willing to lend for a project’s development.

We are still hopeful that the DFS is delivered before the end of this year but EMH has said that it is reviewing this guidance, so for now we will have to wait and see.

EMH recently appointed lithium specialist Marc Rowley, who brings extensive experience in delivering a DFS.

Marc was responsible for:

- Delivering a DFS for Leo Lithium (capped at $647M), after which a final investment decision was made and the project was put into construction.

- Working for Altura Mining, he delivered both the PFS and DFS for what is now the Pilgangoora mine (owned by $13.8BN-capped Pilbara Minerals).

We expect Marc to apply this experience to EMH’s project and help deliver a strong DFS.

What has EMH done since our last note?

Processing flowsheet improvements

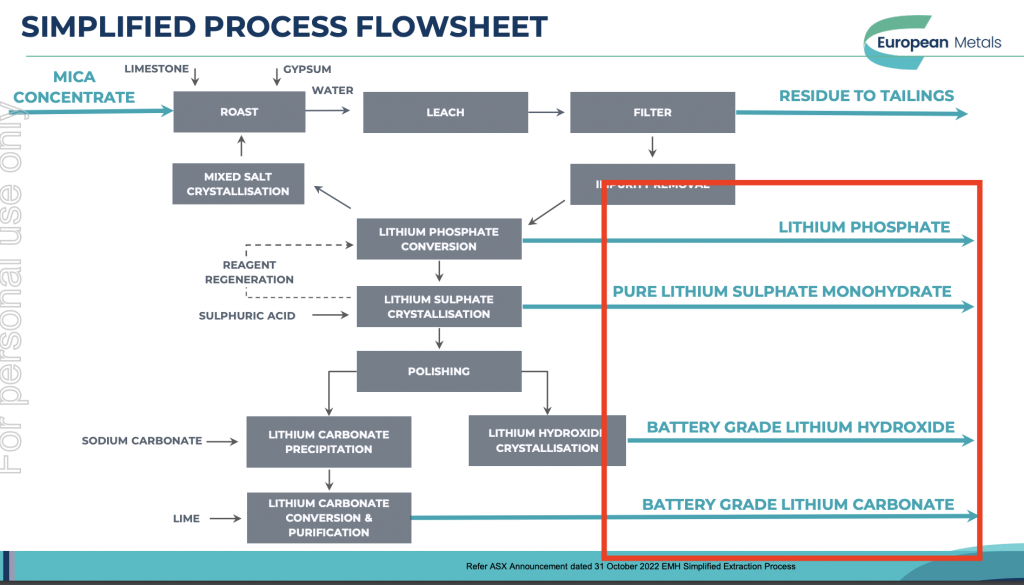

Last month EMH made an improvement to its processing flowsheet that it would look to incorporate into its upcoming DFS.

This is important because while EMH has a large lithium resource, it is not the typical spodumene-hosted lithium. Instead, EMH’s resource is hosted inside micas.

Unlike spodumene-hosted lithium resources, mica lithium deposits require more specialised processing – so the flowsheet used is important to maximise recoveries and keep costs low.

Given the highly specialised nature of processing mica lithium deposits and the potential value in the processing flowsheet, EMH has a patent pending for its new process flowsheet.

Here is a breakdown of how this new process flowsheet will produce an array of lithium products from mica concentrates from EMH’s hard rock lithium deposit:

An important caveat here is that EMH’s processing flowsheet has not yet been tested at a scale of EMH’s giant lithium resource.

There is always a risk that the flowsheet results produced in a lab can’t be scaled and/or the performance of the flowsheet is weaker once scaled up to a level that’s suitable for EMH’s resource.

That said, we took the following key takeaways from the flowsheet improvement:

- Ability to produce different types of lithium – EMH confirmed the flowsheet produced high purity battery grade lithium carbonate and would also be capable of producing high purity lithium hydroxide, lithium sulphate and/or lithium phosphate.

- Reduced costs – the updated flowsheet reduces capital expenditures and operating expenditures for the proposed lithium chemical plant by up to ~20%.

- Improved recoveries – the updated flowsheet references recoveries of up to 93%, ~3-6% improvement on the previous flowsheet.

- Simplification of processes – EMH managed to reduce the steps required in its flowsheet from fifteen down to seven. This should help reduce both construction costs and operating costs.

- Improved ESG credentials – lower reagent use and reduced cooling requirements.

We think that these improvements have the potential to both reduce the capital intensity of EMH’s project while providing optionality so the company can pivot to the varying demands from lithium consumers.

This is important because the demand for different types of lithium can change quickly based on the most efficient battery chemistries at the time.

We expect EMH to utilise this flowsheet process for pilot programme to produce marketing samples which will help with offtake discussions, and we hope that it adds to an overall improvement in project economics in the DFS.

Funding advisor appointed

Two months ago EMH engaged German consultancy group, Luthardt Investments, to kickstart financing discussions for its lithium project.

A key part of our “Big Bet” for EMH is to reach a “Final Investment Decision”, which can’t happen if EMH doesn’t secure funding for its project.

As per its PFS earlier this year, EMH’s project is expected to cost US$644M, which EMH will need to raise through debt funding, equity funding, government grants, or a combination.

Luthardt’s expertise is mostly in the energy sector and government relations with respect to large infrastructure projects both internationally and within the EU.

The appointment comes only a few weeks after the European Commission President Ursula von der Leyen announced a “European Critical Raw Materials Act”, the sole purpose of which is securing Europe’s supply of critical raw materials and decreasing dependency on imports.

We think that the only way the European Commission will be able to secure these supplies is by developing resources inside the EU – like EMH’s project.

This is where we think the appointment last week fits in.

With the European Commission leveraging its muscle to encourage strong investment through either favourable debt financing or government grants, we are hoping that Luthardt Investments can advocate for EMH’s project and help the company secure financing.

EMH is paying the consultancy group two million options that are exercisable at 80c per share and expire on 31 December 2022 and again on 30 June 2023.

Therefore, Luthard is incentivised to get a funding deal done fast.

The options only vest if the advisors deliver on two key milestones:

- Tranche 1 (1M options) vest if EMH receives official German government support for its project and the supply of lithium products into Germany on or before 31 December 2022.

- Tranche 2 (1M options) vest if EMH receives official German government support for an increase in production rates at its project, subject to supply security considerations for European manufacturers of electric vehicles and batteries on or before 30 June 2023.

There is precedent for government funding for lithium-mica plays in Europe.

In October, UK-based Cornish Lithium received funding from the UK government’s £211M “funding for battery research and innovation” program. We note that Cornish Lithium has the same style of deposit as EMH (lithium-mica).

To us, this shows how Western countries are looking to fastrack early stage lithium projects in order to strengthen their critical mineral supply chains outside of China.

Two new substantial shareholders join the register

Institutional investors are a notable addition to EMH’s register as they add stability by adopting longer term investment horizons.

These two new large positions should help put a valuation floor under the company’s share price, where investors are more willing to step in and buy more shares if the price dips too low.

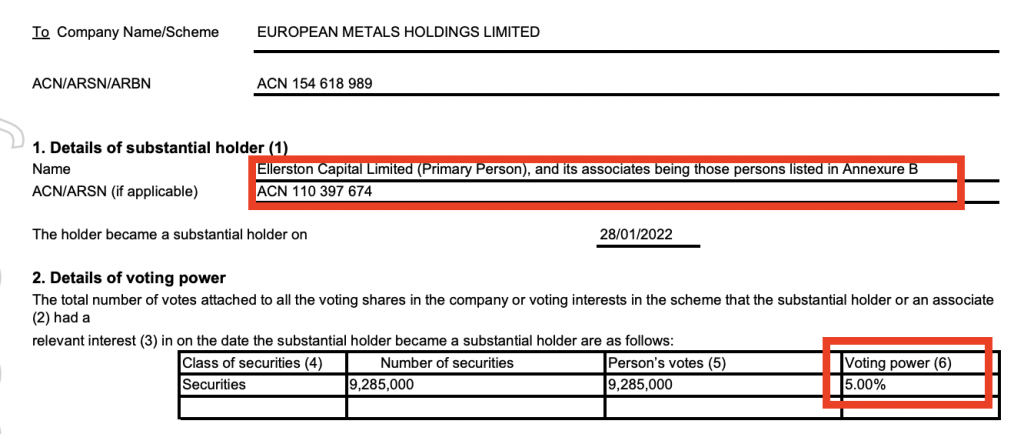

Earlier in the year we saw Ellerston Capital (a Sydney based fund manager with over $4BN in funds under management) become a major EMH shareholder, purchasing $13M worth of shares at $1.40 per share. Ellerston now has a ~5% shareholding in EMH.

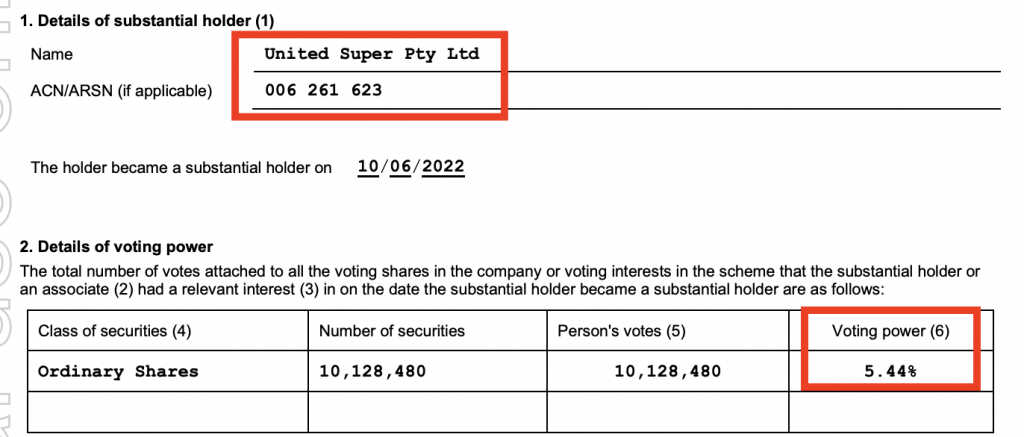

We then saw superannuation fund, United Super, become a major shareholder in EMH when it increased its shareholding to 5.44%.

After looking at its “substantial shareholder notice” we noticed that United Super was buying shares between May and June — when market sentiment was extremely negative and EMH’s share price was trading at its 12-month lows.

United Super purchased ~$7.9M worth of shares at an average price of ~$1.06 per share.

These additions to EMH’s shareholder register come at the perfect time as EMH moves its project towards development, where financing will become a large part of the overall story.

We also note that while listed on the ASX, the company is also accessible to investors in the UK (AIM market), Germany (Frankfurt Börse) and now also in the US (OTCQX Best Market).

We think that during the project financing process, foreign listings should help when trying to secure funding from deep pocketed international investors.

What’s next for EMH?

Definitive Feasibility Study (DFS) 🔄

EMH is currently working on upgrading its project from Pre-Feasibility Study (PFS) to a Definitive Feasibility Study (DFS).

We hope to see the DFS improve on the following financial metrics from the PFS:

- A post-tax NPV of between US$1.1BN to US$1.94BN.

- CAPEX of US$644M.

- Internal rate of return (IRR) of up to 36.3%

- Pay-back period of 2.5 years.

We note that EMH is currently completing Front End Engineering Design (FEED), which is a precursor for the company to estimate its capital costs that will be fed into the DFS.

Offtake agreement 🔄

EMH is set to commence a pilot program in the current quarter with marketing samples available to offtake partners in 1Q CY23. EMH has confirmed that it has a solution containing 48kg of lithium carbonate equivalent ready to be processed.

We expect to see EMH make most of its offtake progress after these samples are handed to potential customers.

Project financing 🔄

EMH’s recent appointment of Berlin based consultancy group Luthardt Investment shows that it is still working to arrange project financing.

Project financing is usually sorted after the feasibility studies are complete, but the situation within the European Union makes the macro outlook stronger for EMH.

With the EU recently announcing a “European Critical Raw Materials Act”, the strategic importance of EMH’s project to the EU will continue to strengthen.

Progress EIAs and permitting for mining and processing 🔄

Another major catalyst for EMH will be the progress made on the permitting side of the project.

EMH is currently working on environmental permitting (EIA) and the permitting for the mining and processing of its lithium resource.

This process is likely to continue in the background as EMH gets closer to making a final investment decision on developing its project.

If we see positive news on the permitting front, we expect the market to react positively, especially considering how difficult and lengthy the permitting process can be in Europe.

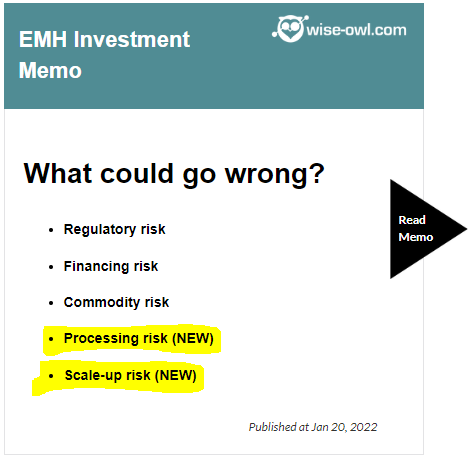

What are the risks?

After reviewing EMH’s updated flowsheet we have added two key risks to our EMH Investment Memo.

To see all of the key risks to our EMH Investment Thesis click on the image below.

Our EMH Investment Memo

Click here to see our 2022 Investment Memo for EMH which covers:

- Key objectives for EMH in 2022

- Why we Invested in EMH

- What the key risks to our Investment thesis are

- Our Investment plan