Overview: Southern Cross Electrical Engineering (“Southern Cross Electrical”, “the Company”) is an Australian company focused on construction and engineering services. Southern Cross Electrical provides electrical, communication, and maintenance services to a variety of sectors including resources, defence, transport, renewable energy and utilities. The Company was founded in 1978 and is based in Naval Base, Australia.

![]()

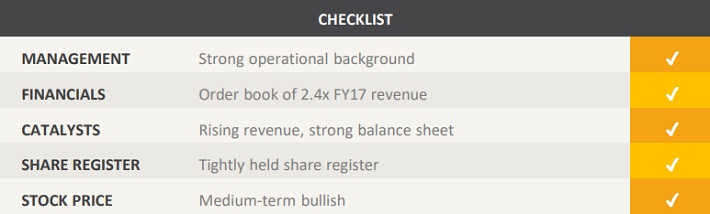

Catalysts: Southern Cross Electrical has a strongly growing order book of over $480m – ~2.4x FY17 revenue – as a result of organic growth initiatives and the acquisition of Heyday. As business activity picks up, the Company is on track to increase revenues in FY18. Over the past year, Southern Cross Electrical has successfully expanded its geographic footprint and diversified its revenue mix by entering into new sectors. The Company has a strong balance sheet and is fully funded after the completion of a $33m placement.

Hurdles: Southern Cross Electrical has a history of earnings volatility and there is no guarantee that this trend won’t continue. Cost control of large-scale projects is an ongoing risk and while the Company has heavily invested in future growth initiatives, there is no guarantee that it will generate a return on shareholder funds. Operating in the engineering and services sector, the Company is subject to the availability of skilled labour.

Investment View: Southern Cross Electrical offers profitable exposure to demand for construction and engineering services. We are attracted to the Company’s growing order book, sector diversification, and balance sheet. History of earnings volatility cost control, and industry specific risks are primary hurdles. Southern Cross Electrical is fully funded and in a strong position to take advantage of a large opportunity pipeline. The Company’s order book has reached record levels as a result of the transition from a resource focused company towards a diversified national electrical contractor and the acquisition of Heyday. We recognise the Company’s growth potential and initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.