Overview: Rumble Resources Ltd (“Rumble Resources, “the Company”) is an Australian minerals exploration company focused on Western Australia. Its primary asset is a portfolio of exploration licenses located in the Fraser Range, approximately 150km northeast of Norseman. The Fraser Range represents a potentially new nickel district focused around Sirius Resources’ Nova deposit, which is the largest nickel sulphide discovery Australia has seen in at least twenty years. Rumble Resources’ license holdings in the Fraser Range stand at 3,260km2. Certified mineral resources have yet to be defined within the portfolio.

Catalysts: 18km East of Nova at the Zanthus license, results of a gravity survey have added impetus to a maiden drilling program. Drilling is scheduled to commence in the coming weeks following a successful $1.6million placement in April. Subsequent funding requirements have the potential to be met via existing option tranches and recent engagements with Nathan Tinkler & EAS Advisors LLC. In our opinion, these appointments enhance Rumble Resources access to capital markets, elevating focus on its exploration activities.

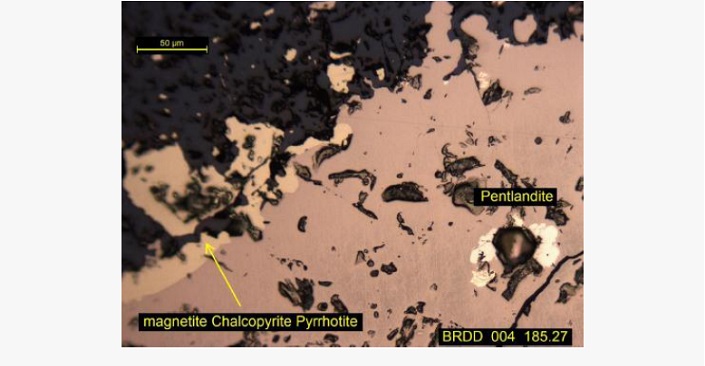

Hurdles: Rumble Resources is reliant on external capital and ongoing availability of finance beyond near-term programs is not assured. Whilst initial drilling of its Big Red licenses confirmed the presence of a mineralized conductor, economic intercepts were not encountered and there is no guarantee subsequent exploration can delineate a commercially recoverable base metal deposit.

Investment View: Rumble Resources provides speculative exposure to the potential for Western Australia’s Fraser Range to emerge as a new nickel mining district. We are attracted to the magnitude of its land package, recent corporate activity, and near-term value drivers. Whilst exploration risks are elevated, we have ascribed a valuation of $0.155/share based on the current market value of its Fraser Range assets. The valuation assumes outstanding 8c option tranches lapse and represents a premium of ~103 percent to a recent trade.

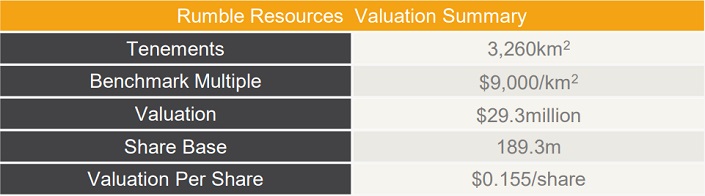

As certified resources have yet to be delineated across Rumble Resources mineral assets, we have utilized a comparables approach for appraising the Company’s potential worth. Our appraisal is focused on Rumble Resources’ Fraser Range portfolio and ascribes no value to its other mineral interests.

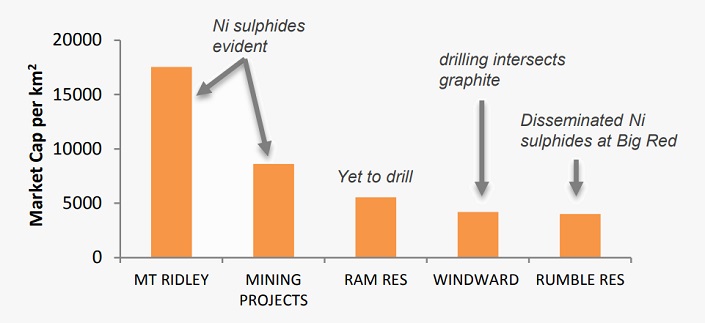

Our comparables approach is based on a universe of more than a dozen listed companies with exploration assets in the Fraser Range district. To date, no company from the universe has delineated certified mineral resources on their assets. Those primarily focused on the Fraser Ranges with little other interests were selected for further appraisal. Within this benchmark group, we appraised each company’s market capitalization relative to the quantity and quality of tenure.

All of the benchmarks held assets within 200km of Nova. Per equity unit of exploration ground, valuations range from $4,000/km2 to over $17,500/km2. Evidence of nickel sulphide mineralisation is associated with valuations higher up the valuation curve. Rumble presently trades at the lower end of this valuation curve despite encounters of nickel sulphide mineralisation at its Big Red license.

Evidence of nickel sulphides driving valuations

To arrive at a valuation for Rumble Resources Fraser Range assets, we have therefore applied a multiple of $9,000/km2 to its current ground position, which equates to a market capitalization of $29million.

To arrive at a per-share figure, we have assumed presently out of the money option tranches lapse, yielding a shared base of 189million and a valuation of $0.155/share. There are 68.5million $0.08/share options on the issue that mature between June 2015 and July 2018. If all are exercised, the valuation adjusts to $0.114/share.

THE BULLS SAY

THE BEARS SAY

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.