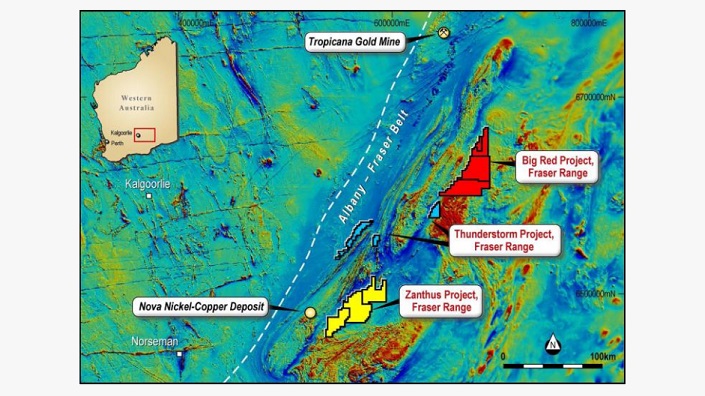

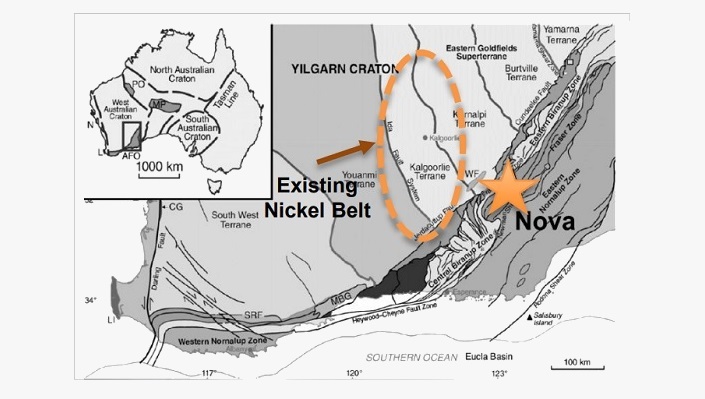

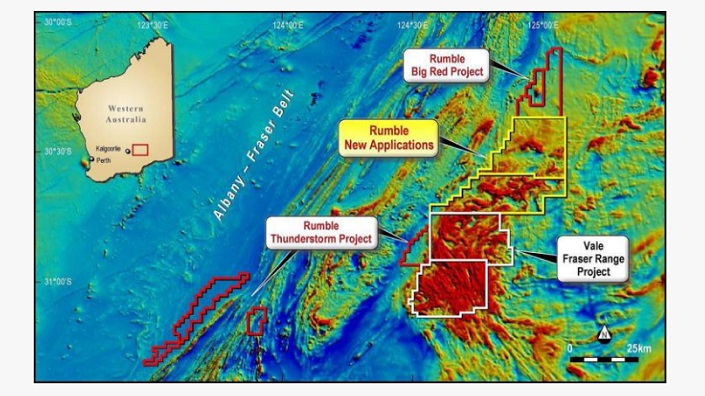

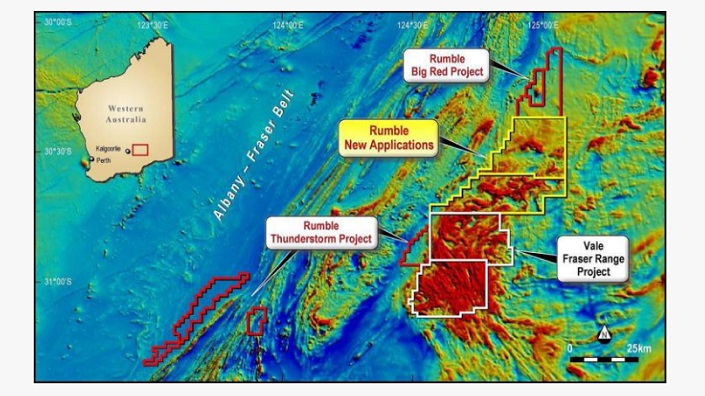

Overview: Rumble Resources Ltd (“Rumble Resources, “the Company”) is an Australian minerals exploration company focused on Western Australia. Its primary asset is a portfolio of exploration licenses located in the Fraser Range, approximately 150km northeast of Norseman. The Fraser Range represents a potentially new nickel district focused around Sirius Resources’ Nova deposit, which is the largest nickel sulphide discovery Australia has seen in at least twenty years. Rumble Resources’ license holdings in the Fraser Range stand at 3,260km2. Certified mineral resources have yet to be defined within the portfolio.

Catalysts: Following a $1.6million placement at $0.045/share, Rumble Resources is scheduled to commence a maiden drilling program at its Zanthus licenses, 18km East of Nova. Zanthus is adjacent to Windward Resources (WIN.ASX) Fraser Range North license which is currently the subject of drilling. The value of Rumble Resources two year tenement accumulation period has been signalled by the recent emergence of Vale SA as an adjacent license holder to its Big Red tenements, and subsequent engagements with Nathan Tinkler & EAS Advisors LLC. In our opinion, these appointments enhance Rumble Resources’ access to capital markets, elevating focus on its exploration activities.

Hurdles: Rumble Resources is reliant on external capital and ongoing availability of finance beyond near-term programs is not assured. Whilst initial drilling of its Big Red licenses confirmed the presence of a mineralized conductor, economic intercepts were not encountered and there is no guarantee subsequent exploration can delineate a commercially recoverable base metal deposit.

Investment View: Rumble Resources provides speculative exposure to the potential for Western Australia’s Fraser Range to emerge as a new nickel mining district. We are attracted to the magnitude of its land package, recent corporate activity, and near-term value drivers. Maiden drilling of multiple EM conductors at Zanthus followed by a second round at Big Red has the potential to yield a major re-rating in the event of a ‘Nova like’ discovery. Whilst exploration risks are elevated, given the potential value impact of these activities, we are initiating coverage on Rumble Resources.

Rumble Resources Ltd (“Rumble Resources, “the Company”) is an Australian minerals exploration company focused on Western Australia. Its primary asset is a portfolio of exploration licenses located in the Fraser Range, approximately 150km northeast of Norseman. Rumble Resources’ license holdings in the Fraser Range stand at 3,260km2. Certified mineral resources have yet to be defined within the portfolio.

Fraser Range land holding 3,260km2

Rumble Resources listed on the Australian Securities Exchange in July 2011 after raising $2.5million at $0.20/share. Issued capital currently stands at $11.9million, or $0.063/share.

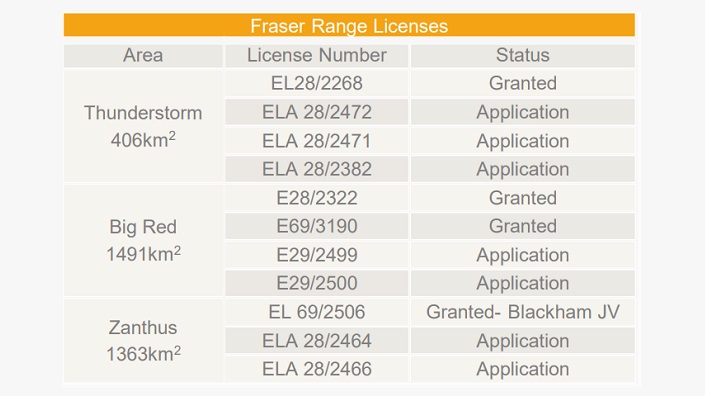

The Fraser Range Projects consist of six exploration licenses and five exploration license applications in the Fraser Range region of Western Australia. Spanning 3,260km2, the licenses were acquired between 2013 and 2014, and represent a grassroots exploration asset currently absent of certified mineral resources.

Rumble Resources holds a 100 percent equity interest in ten of the licenses, and is earning a 75 percent interest in the basement mineral rights of E69/2506 via a Joint Venture with Blackham Resources Ltd (“Blackham JV”).

The Blackham JV required issuance of 2million shares for an initial 20 percent interest, which rises to 75 percent following cumulative project expenditures of $2.5million over four years and vendor payments of $0.75million.

Blackham will be free carried to completion of a bankable feasibility study in relation to the Project, at which point if Blackham decides not to contribute in proportion to its interest in the Project, its interest will dilute by an industry-standard formula, to a minimum 10% before reverting to a 2% net smelter royalty.

Australia hosts around one-third of the world’s economic nickel resources and 90 percent of the nation’s nickel endowment are contained in Western Australia.

To date, the state’s nickel mining industry has focused on a 500km belt stretching from Wiluna to Kambalda known as the Kalgoorlie Terrane. The region has hosted a nickel-metal endowment exceeding 10million tonnes spread amongst more than 100 individual deposits.

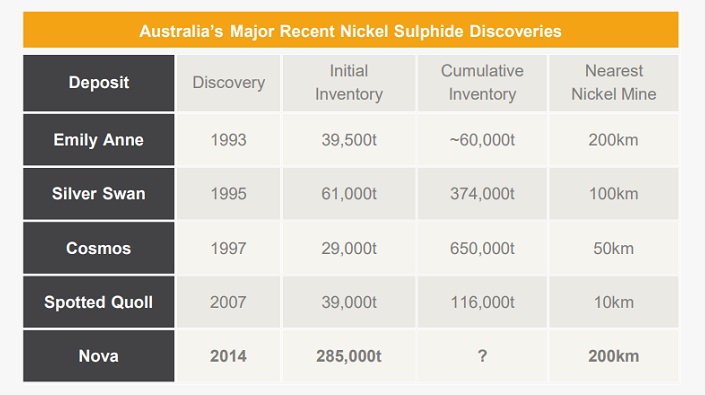

Nova is the most prolific nickel discovery Australia has witnessed in decades

Most of these mines were discovered more than four decades ago amidst the nickel boom of the late 1960’s – early 1970’s. The most substantial discovery since this time is the Nova Bollinger deposit currently being developed by Sirius Resources Ltd (“Sirius”).

Hosting a minable nickel inventory of 285,000tonnes, Nova stands as Australia’s largest greenfield nickel discovery in at least twenty years, and its geographical position relative to existing mines and deposits elevates its status to the most significant of our generation.

Nova’s positioning within a geological setting known as the Albany- Fraser Orogen is unique to any other nickel deposit in Australia and could potentially herald the beginning of a new nickel district for the surrounding area which is known as the Fraser Range.

Recognising the significance which Nova could spell for the surrounding Fraser Range, Rumble Resources has spent the past two years accumulating exploration assets in the district. Spanning 3,260km2, its tenement position now represents one of the largest and most proximal to the Nova deposit amongst exploration companies focused on the area.

As the Fraser Range Projects are presently absent of certified resources, Rumble Resources is currently focused on exploration aimed at the identification of commercially extractable nickel resources.

The Company’s exploration program is being led by Terry Topping, who is credited with delineation of the original orebody supporting the Paulsen’s Gold Mine currently operated by Northern Star Resources Ltd (NST.ASX).

Rumble Resources’ exploration strategy utilises intelligence gained from Nova and work conducted by previous license holder Teck Australia Pty Ltd on its ‘Big Red’ licenses.

Whilst Nova represents a ‘blind’ deposit with little to no surface expression, two previous drill holes conducted by Teck Australia Pty Ltd in 2010 indicated bedrock underlying the Big Red licenses to be of similar age and characteristics to that hosting the Nova deposit.

Strategy is to identify and drill EM targets

Nova’s discovery followed a shallow and broad-spaced, 120 hole air core drilling program that identified weathered, sub-economic nickel and copper mineralization within 50 metres of surface. Subsequent ground-based electromagnetic (“EM”) surveys provided an impetus for deeper drilling, identifying three conductive targets representing possible sources of near-surface mineralization.

Sirius targeted the largest EM conductor (1000 metres by 220 metres) for its deep drilling program, in which the third hole marked the Nova discovery, confirming the EM target to host massive magmatic nickel and copper sulfide mineralization.

Rumble Resources’ exploration strategy is therefore focused on the identification and drill testing of EM targets that could represent mineralised sulphide deposits.

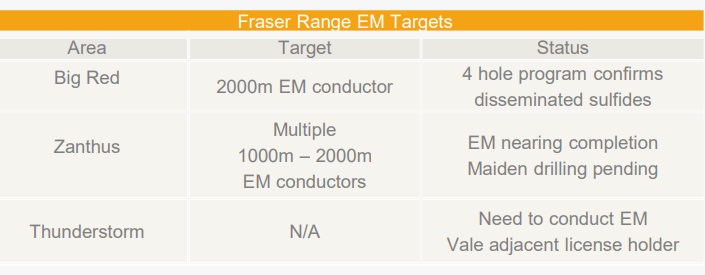

To date, ground EM surveys have identified multiple targets across its Zanthus and Big Red licenses. Whilst the targets are of a similar scale to that which represented the Nova deposit, the primary risk factor and goal of drilling is to appraise whether they are mineralised.

To date, further investigation of the EM targets has been limited to the Big Red conductor. Big Red is adjacent to tenements recently acquired by Vale SA and represents the most distant of Rumble’s licenses from Nova – located between 250-300km to the northeast.

Vale is Rumbles new neighbour at Big Red

With a strike length of 2km, Rumble Resources regards it as the largest conductor identified in the Fraser Ranges thus far. A four-hole Mud Rotary/Diamond drill program designed to test the Big Red conductor was completed in late 2014 to depths of up to 400metres below surface.

Whilst economic mineralization was not encountered, the presence of broad disseminated sulphide zones containing anomalous copper and nickel indicates the Big Red conductor to represent the significant mineralized system.

A downhole EM survey has been completed to determine the strike, dip, and depth of the conductive bodies. Results to date indicate the conductive zone to be present at depths of 300-420 metres below surface. Further drilling of the Big Red conductor is scheduled to follow an imminent maiden drilling program at Zanthus.

Zanthus is the most proximal of Rumble Resources licenses, located 18km east of Nova, adjacent to licenses held by Windward Resources Ltd (WIN.ASX). The Zanthus program is scheduled to consist of five Reverse Circulation drill holes for 1200 metres to appraise five EM targets identified within the licenses.

ECONOMICS

As certified resources have yet to be defined at Rumble Resources Fraser Range Projects, direct appraisal of their economic potential is limited.

At a district level, the circa 50-120 metre layer of sediment covering host rocks containing the Nova deposit indicates that future mining developments in the Fraser Range are likely to also be underground operations. The elevated grade is, therefore, an important economic driver for future discoveries, although the development of the Nova mine significantly reduces barriers to entry.

Nova reduces barriers for other deposits

Nova is currently under construction after procuring development capital totaling $473million. The deposit’s ore reserve stands at 13.1Million tones (Mt) grading 2.1% Ni, 0.9% Cu, and 0.07% Co. A 1.5Mt pa concentrator and 16-megawatt diesel power plant are being constructed to support an initial ten-year mine life.

We estimate the operation could generate a Net Present Value (5%, pre-tax) in the order of $1billion at current metal prices, rising to $2billion utilizing three-year average metal prices.

Project economics at Nova are greatly assisted by the presence of significant payable by-products and the deposit’s commencement within 40metres of the surface. However, fixed investments associated with its development mean that future discoveries in the district needn’t possess equivalent characteristics.

As Rumble Resources mineral assets are of exploration status, the Company does not presently generate revenue and is reliant on external capital to advance its development. To date, Rumble Resources has financed operations primarily through equity issuances, complimented by Government drilling grants.

Its latest equity issuance was completed this month, raising $1.68million via a private placement of 37.5million shares at $0.045/share. Participants in the offer were granted listed options on a one for two basis, exercisable at $0.08/share prior to 30 June 2016.

The raising of expanded shares on the issue by 25 percent and also coincided with several significant advisory appointments. Nathan Tinkler has been engaged as Strategic Corporate Advisor, whilst EAS Advisors LLC has been engaged as North American Corporate Advisor.

Mr. Tinkler has a record of identifying underdeveloped mineral resource assets in Australia, playing important roles in the acquisition, financing, and development of the Middlemount Coal Mine in Queensland and the Maules Creek Coal Mine in New South Wales.

EAS Advisors LLC has a record of capital procurement for natural resource ventures involving ASX listed entities. The engagement with Rumble Resources enhances our confidence in the Company’s capacity to attract ongoing funding.

April placement provides exploration funds

Following the April private placement, we estimate issued capital to be $11.9million, or $0.063/share. Exercise of the Company’s $0.08/share option tranches would provide additional funding of ~ $6million.

Rumble Resources provides speculative exposure to the potential for the Fraser Ranges in Western Australia to emerge as a new nickel mining district. We are attracted to the magnitude of the land package which Rumble Resources has assembled during the past two years, recent corporate activity, and the presence of near-term catalysts with the potential to drive value growth.

DRILLING RESULTS ARE THE MAJOR CATALYST

Rumble Resources tenement portfolio represents one of the largest dedicated exploration packages in the Fraser Range. Whilst at an early stage of development, the strategic value of these assets is highlighted by the emergence of Vale SA as an adjacent license holder at Big Red, and recent advisory engagements. In our opinion, the support of Nathan Tinkler and EAS Advisors enhances Rumble Resources capacity to access capital markets, elevating the focus of its exploration activities.

On that front, maiden drilling of multiple EM conductors at the Zanthus licenses 18km east of Nova, followed by a second round of drill testing at the Big Red conductor has the potential to yield a major re-rating in the event of a ‘Nova like’ discovery. Whilst risks associated with the exploration of this nature are high, recognising their potential value impact, we are initiating coverage on Rumble Resources.

Rumble Resources Fraser Range Projects largely represent greenfield exploration assets requiring significant further technical appraisal and capital investment. There is no guarantee Rumble Resources planned exploration activities will successfully delineate commercially recoverable mineral resources, nor that they exist within its licenses.

Changes in the price of metals targeted by Rumble Resources at the Fraser Range can have a major bearing on the market value of its exploration assets, any future discoveries, and the Company’s ability to attract financing. The London Metals Exchange Nickel and Copper prices are presently trading near six-year lows and there is no guarantee against further declines.

Rumble Resources is reliant on external capital to advance its Fraser Range assets. Whilst its April equity issue provides sufficient funding to facilitate near-term exploration programs, there is no guarantee subsequent funding will be available to the Company nor on favourable terms for existing shareholders.

The more exploration and time required to determine whether commercially recoverable minerals exist at its Fraser Range assets may have a negative effect on shareholder value due to the associated influence on funding requirements and dilution.

THE BULLS SAY

THE BEARS SAY

Mr. Sikora is a founding member of Rumble, having been General Manager from 2011 to mid-2013. During that time Mr. Sikora has been instrumental in project acquisitions, operations management, and securing financial partners.

Previous to Rumble Mr. Sikora acquired over 10 years of corporate experience in business development, strategic planning, and project management. Mr. Sikora has been involved across many aspects of the exploration industry including capital raisings, IPO’s, project acquisitions, joint ventures, tenement management, and corporate governance.

Mr. Topping has over 18 years of experience in the management of listed public companies on ASX and TSE. Mr. Topping has experience in corporate finance, mergers, and acquisitions and also as an exploration geologist in Australia and overseas.

Mr. Topping was a founder of Taipan Resources NL, which listed as a gold exploration company in 1993 and which Mr. Topping remained a director until 2002. During this time he was integral in the discovery of the high-grade Paulsens gold deposit now mined by Northern Star Resources Ltd. Since 1985, Mr. Topping has gathered experience as an exploration geologist searching for gold, diamonds, base metals and recently in the uranium sector as the founder of Scimitar Resources Ltd now Cauldron Energy Ltd.

Mr. McBain has significant corporate and business management experience having successfully developed a number of start-up businesses over the past 10 years. Mr. McBain successfully founded and developed the largest grain production business in Australia, AACL Holdings Ltd (ASX code: AAY), in addition to founding and being a key developer of the most successful carbon sequestration business in Australia, Carbon Conscious Ltd (ASX code: CCF). The capital raised for these ventures has been in excess of $250 million since 2005.

Previously Mr. McBain was a director and founding shareholder of Scimitar Resources Ltd (now Cauldron Energy Ltd – ASX code: CXU) and is currently a director of ASX listed Carbon Conscious Ltd. Mr. McBain has experience in capital raising, business management, and business development.

Mr. Banks has over 10 years experience specialising in marketing and public relations and more recently in finance. During that time Mr. Banks has developed strong relationships with a number of leading public and private companies as well as with high net worth individuals from across a number of industries. Since 2005 Mr. Banks has been involved in raising capital for a number of listed exploration companies and is currently working with a leading finance business based in Melbourne.

Mr. Smith is a director of Smith Feutrill and is a Chartered Accountant with over 25 years of experience in the accounting, business, and taxation advice sectors. He is a Fellow of the Taxation Institute of Australia, a member of the ICAA’s Forensic Accounting Special Interest Group, and was Chief Executive of a division of a publicly listed national financial services consolidator for five years overseeing significant growth in that time.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.