Overview: Resolute Mining Ltd (“Resolute”, “the Company”) is an Australian gold mining company with operations in Queensland and Africa. Commissioned in 2009 the Syama mine in Mali produced 225,000oz during FY15. Ravenswood (QLD) was commissioned in 2004 and produced over 100,000oz in FY15. Resolute has operated six other gold mines in Australia and Africa, producing over 7million oz during the past 25 years. Presently, its operating mine and project portfolio hosts Reserves of 5.3million oz and Resources of 9million oz

![]()

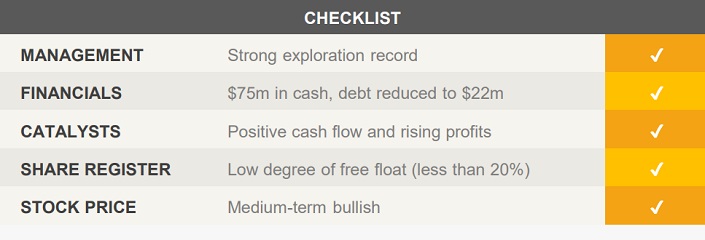

Catalysts: Resolute is on course to produce over 300,000oz in FY16 and post its second consecutive year of higher operating profit. The long-term potential of its Resource inventory is due to be highlighted by the completion of Definitive Feasibility Studies for a mine life extension at Syama and redevelopment of Bibiani, a ~2moz brownfield’s site acquired in 2014. With the Company rapidly extinguishing borrowings, operating cash flow can be increasingly directed to growth projects and capital management.

Hurdles: Whilst Resolute has a track record of successful mine operations, there is no guarantee it can execute the underground mine plan at Syama or operate Bibiani more efficiently than the previous owner, Noble Resources. With 2/3rd of production tied to its Syama Mine in Mali, the geopolitical risk may challenge the Company’s ability to attract fair value in its stock price. Further deterioration in the gold price could impair the Company’s financial performance.

Investment View: Resolute offers profitable exposure to the gold mining industry. We are attracted to the Company’s history of successful mine operations, its current production profile, large resource inventory, and recent balance sheet initiatives. Whilst its African focus carries risk, Resolute’s operating history in the region presents a source of mitigation. With the Company demonstrating increasing operating profit despite weak gold prices, it is well-positioned to benefit from any recovery and we initiate coverage with a ‘buy‘.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.