Overview: Regis Resources Limited (“Regis”, “the Company”) is an Australian resource company focused on gold mining. The Company’s primary asset is the Duketon Project, located near Laverton in WA, which is projected to produce 335-365k ounces of gold in FY18. The Company has a JORC compliant Ore Reserve estimate of 59.3mt at 1.14g/t for 2.18m ounces of gold and Mineral Resources totalling 8.05m ounces. The Company also owns the McPhillamy Project in NSW and exploration licenses in WA and NSW.

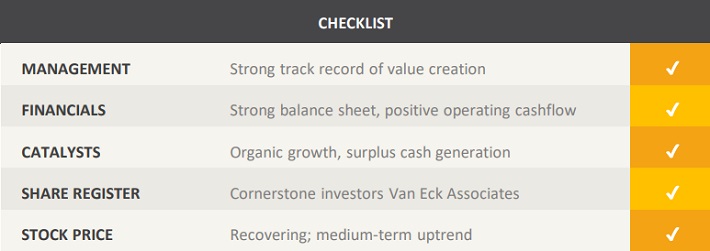

Catalysts: Regis’ Duketon Project has compelling economics in the current price environment and the Company is well-positioned to generate positive operating cash flow. Management targets a 2.5-12.5% increase in gold production with cash costs at the lower end of the industry average. Regis is well funded with over $150 million in cash and gold on hand allowing the company to weather short-term price volatility.

Hurdles: While Regis has a track record of meeting or exceeding its guidance, there is no guarantee that the projected production target can be achieved at a reasonable cost. Gold prices have fluctuated significantly in the past five years and ongoing price volatility could impair the company’s financial performance.

Investment View: Regis offers profitable exposure to gold industry trends. We are attracted to the Company’s current production profile, track record, magnitude of assets, and balance sheet. Risks include mining execution and the volatile gold price. The Company has organically grown its Duketon project through the strategic exploration of adjacent mining tenements, which has improved the project economics while a strong balance sheet allows for ongoing improvement works. Despite a two-year price recovery, gold prices remain ~30% below the cyclical peak and we believe Regis is well-positioned to create shareholder value and benefit from any further price recovery. We initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.