EV1 Begins Drilling – Targeting More Shallow High Grade Graphite

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 3,578,125 EV1 shares at the time of publishing this article. The Company has been engaged by EV1 to share our commentary on the progress of our Investment in EV1 over time.

Everyone loves an exploration drilling event.

Exploration drilling can deliver material re-rates to small cap stocks when new discoveries are made.

Today our graphite development stock Evolution Energy Minerals (ASX: EV1) kicked off 7,500m of exploration drilling.

EV1 already has an advanced, development ready project approaching production, with a well established 18 year mine life.

However, big high grade shallow discoveries near its existing JORC resource would improve the already strong project economics considerably.

EV1 is going to try and do that by drilling into its strongest electromagnetic conductors.

In recent months our 2021 Pick Of The Year EV1 has struck the following binding deals:

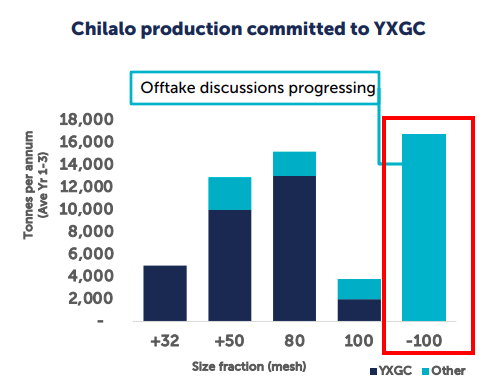

- Offtake agreement for its coarse flake graphite: Covers over 50% of the Chilalo project’s production for the first 3 years. It represents over 70% of forecast revenue over the same period.

- Term sheet for a 60% ownership of a downstream processing joint venture (JV) – This is with EV1’s existing offtake partner. The goal is to deliver a downstream graphite processing facility. The facility could be in Europe or the Middle East and would be capable of producing high value graphite products that sell for up to US$30,000/t.

All of this has been completed whilst EV1 has been busy putting the finishing touches on an updated Definitive Feasibility Study (DFS) in preparation for a Final Investment Decision (FID) on its graphite project in Tanzania.

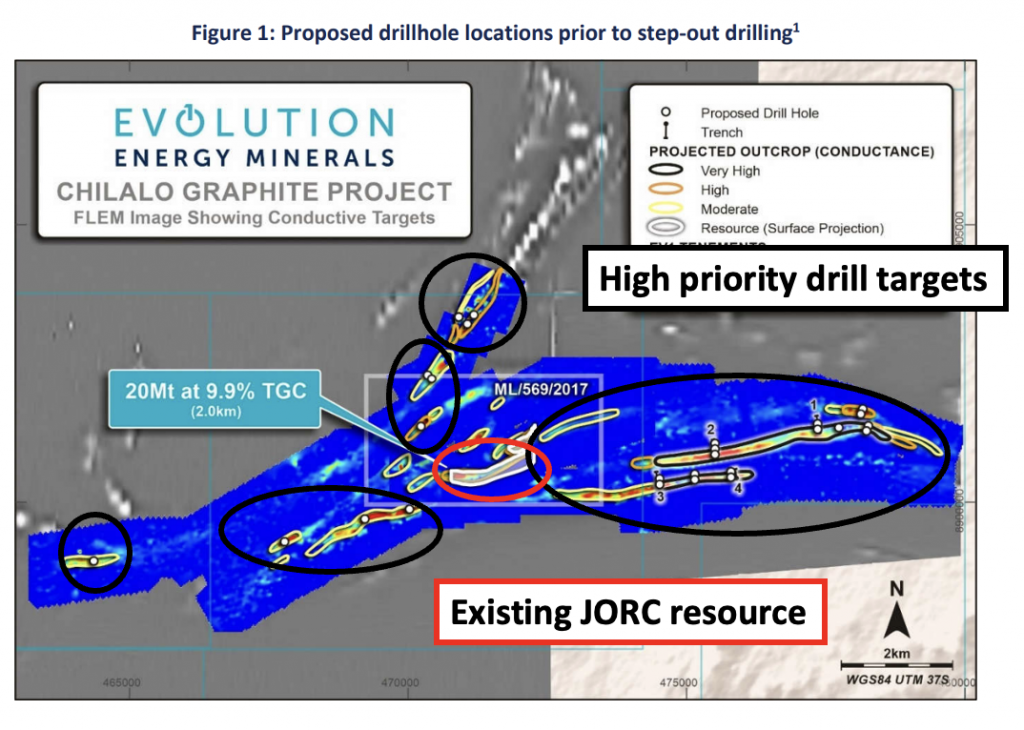

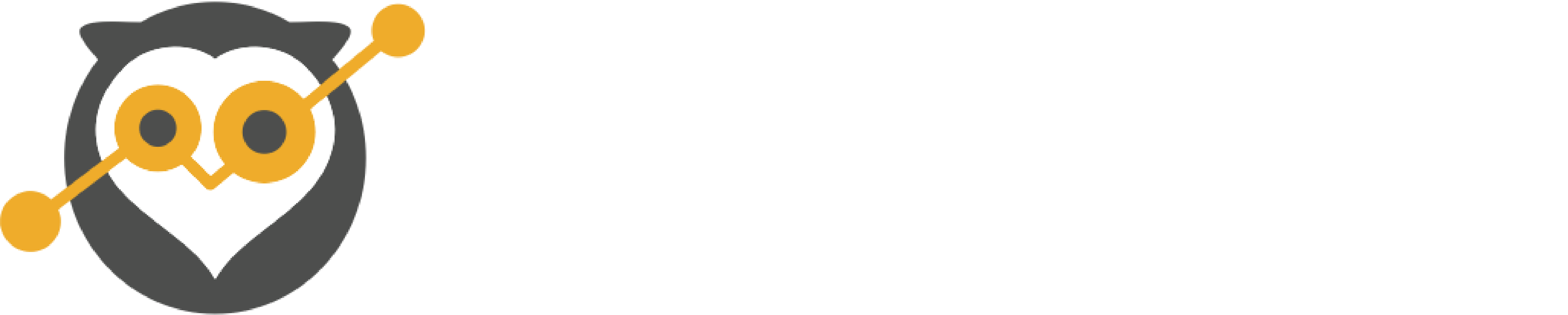

EV1’s drilling program is for a total of 7,500m targeting its highest priority drilling targets – the strongest EM conductors found during previous EM surveying programs.

Importantly, these EM targets represent an area that is ~15x the size of the single EM conductor that houses EV1’s 20Mt JORC resource @ 9.9% Total Graphitic Carbon (TGC).

EV1’s existing JORC resource sits on an EM conductor ~2km long, whereas ~8km of the exploration targets are displaying higher conductivity than where the JORC resource sits.

So while EV1 doesn’t need to do further drilling or make any new discoveries before it can move into production, some additional high grade near surface graphite discoveries would be welcome.

New discoveries could lead to improved project economics by giving EV1 the option to add new resources to the back end of its project (increasing the mine life) or to the front end (highest grade most profitable to mine).

Or both.

With the world desperate to secure critical battery minerals like graphite, we think projects with strong project economics and nearest to production will be the ones that get the most attention.

Given the potential upside from exploration drilling, we think its worth EV1 deploying the capital on this, especially given the scale of the undrilled EM targets.

After all, projects with the best economics will be the ones that make it into production.

This brings us to our “Big Bet” for EV1:

Our ‘Big Bet’

“EV1 achieves first production of the world’s most sustainably produced graphite by early 2024 (including value adding processing), coinciding with the onset of a long-term supply shortage in the graphite market.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved – just some of which we list in our EV1 Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress EV1 has made since we first Invested and how the company is doing relative to our “Big Bet”, we maintain the following EV1 “Progress Tracker”:

See our EV1 progress tracker here:![]()

EV1 now finds itself in a position where it is drilling to add value to its project whilst also pushing forward with all of the pre-development work, looking to bring its project online as soon as possible.

Despite being so close to development, and with progress being made on downstream processing, EV1 is capped at $50M.

We also note that the September quarterly should be out any day now (before 31 October) which will allow for an accurate calculation of the company’s enterprise value (EV).

We will update this as soon as that announcement is made in our capital structure excel doc which you can view here.

EV1’s valuation in comparison to other ASX peers with market caps as follows:

- Magnis Energy Technologies: ~$369M

- EcoGraf: ~$162M

- Talga Group: ~$398M

- Syrah Resources: ~$1.58BN

We are looking forward to seeing EV1 deliver on its strategy and hopefully start catching up to its higher valued peers…

More on today’s news

Below is a high level summary of EV1’s drilling program:

- Initial 3,000m of RC drilling, with step-out drilling to follow the highest grade, shallowest graphite intercepts for a total of ~7,500m of drilling.

The first phase of EV1’s drilling program will be for a total of 3,000m of shallow RC drillholes.

The focus of these is to test high priority EM targets that sit over EV1’s project, with the aim of finding the best structures to punch more holes into.

EV1 will be drilling the targets where it thinks it can find shallow high grade graphite.

Here EV1 will be chasing graphite that is either on par with its current JORC resource or easier to mine and therefore lower cost.

EV1 will follow up with step-out drilling to prove out a resource that can increase EV1’s existing JORC resource of 20mt @ 9.9% Total Graphitic Carbon (TGC).

EV1 will follow up with step-out drilling to prove out a resource that can increase EV1’s existing JORC resource of 20mt @ 9.9% Total Graphitic Carbon (TGC).

So why do we care about exploration when EV1 already has a JORC resource?

There are two key reasons: the potential to improve project economics, and the optionality to extend the project’s mine life.

2. Potential to improve project economics.

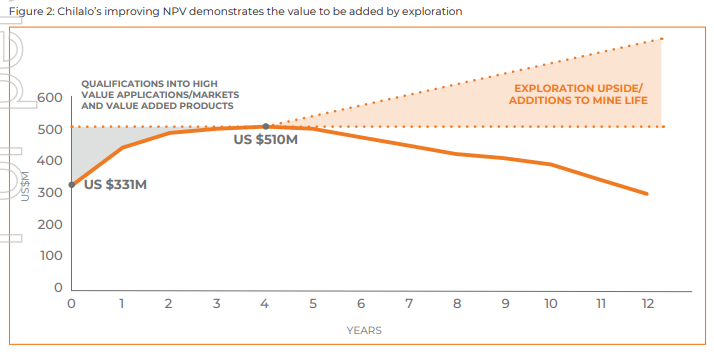

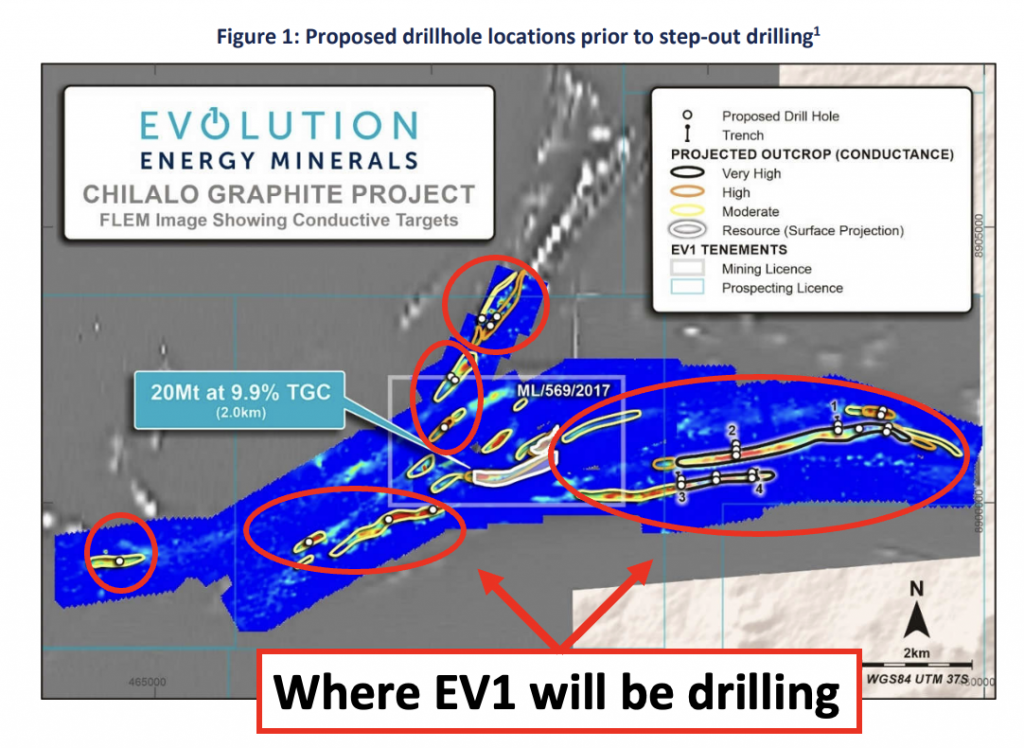

In its 2020 Definitive Feasibility Study (DFS), EV1 confirmed that exploration upside was a key opportunity for EV1 to improve the overall project economics.

Below is the statement from the DFS.

“High conviction opportunities” – we like the sound of that.

“High conviction opportunities” – we like the sound of that.

Most important is the focus on discovering and proving up shallow, high grade graphite – the easiest most low cost graphite to mine.

The obvious advantages of a shallow, high grade resource is that it is much easier to strip away all of the waste rock to get to the high value metals underground.

The industry term for this is a “strip ratio”.

If EV1 can add graphite from shallow depths with higher grades, the cost to mine its project becomes lower and improves project economics.

This is the key reason why we think this round of drilling could be important for EV1.

3. Optionality to increase the project’s mine life.

EV1’s current proven mine life is ~18 years.

This on its own is enough for EV1 to build and operate a profitable mine, however it does act as a sort of cap on the visibility of EV1’s ability to supply graphite products to market for an extended period of time.

The supply side for battery materials is lagging demand, and graphite is one of those critical minerals that is showing signs of a serious supply crunch in the short-medium term.

Recent analysis from battery materials consultancy Benchmark Minerals Intelligence says over 97 new graphite mines are needed to catch up with the demand for anode materials.

The only way this happens is if projects like EV1’s, which was initially planned to produce 50,000tpa, either increase in size or new projects are discovered and quickly brought up to a stage where they are development ready.

The only way this happens is if projects like EV1’s, which was initially planned to produce 50,000tpa, either increase in size or new projects are discovered and quickly brought up to a stage where they are development ready.

We think that growing the resources of already established discoveries is the more feasible way of adding supply and EV1’s drilling program will be aiming to do just this.

Below is a chart from EV1 which shows how the NPV of the project could change if it finds new shallow, high grade graphite that increases EV1’s JORC resource and, in turn, its mine life – the orange triangle on the right of the chart indicates the possibilities:

What’s next for EV1?

Drilling results 🔄

EV1 has started drilling an ~3,000m to work out where it should focus the rest of its drilling 7,5000m program.

This drilling program is a little bit different to that of other explorers in our Portfolio given that EV1 is trying to improve what is already a fundamentally strong project.

EV1 isn’t chasing an entirely new greenfields discovery, instead it is looking to see if the highest priority drill targets produce anything that is material enough to favourably change its project economics.

This being considered, we haven’t set any expectations going into this drilling program.

Any results that EV1 delivers at or above the 9.9% TGC grade of its existing JORC resource will be positive news for us.

If drilling doesn’t find anything material, nothing will change with respect to why we continue to hold EV1 in our Portfolio.

Also of note is how this drilling program could tie into EV1’s updated Definitive Feasibility Study (DFS).

If EV1 unlocks new higher grade, shallower graphite resources this could be included into the mine plan used in the DFS to improve the overall net present value (NPV) of EV1’s project.

Framework Agreement with the Tanzanian government 🔄

We think a Framework Agreement with the government would be a big catalyst for EV1 as it would provide a clear regulatory pathway to production – the ultimate near term goal for EV1.

We have seen other ASX listed companies like Strandline Resources, OreCorp, and Black Rock Mining sign these agreements.

These agreements provide regulatory certainty, making these projects more investable for institutional capital who want to see the project de-risked before investing.

For example, Strandline, which signed an agreement on 14 December 2021, saw its share price go from ~25c before the agreement to briefly touch all time highs at 51.5c. After which it completed a $50M capital raise.

We think similar market attention could come EV1’s way once it has the Framework Agreement signed.

We think similar market attention could come EV1’s way once it has the Framework Agreement signed.

Offtake agreement for its fines product 🔄

EV1 is also chasing an offtake agreement for the remainder of its graphite supply.

Updated Definitive Feasibility Study (DFS) + Final Investment Decision (FID) 🔄

Updated Definitive Feasibility Study (DFS) + Final Investment Decision (FID) 🔄

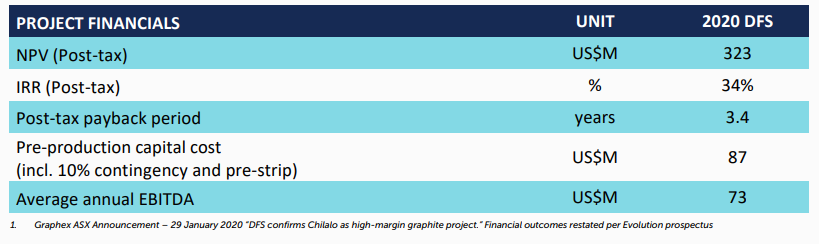

EV1’s 2020 DFS shows an NPV of US$323M with a 3.4 year post-tax payback period, based on total capital expenditures of ~US$87M to get the mine into development.

EV1 is currently updating its DFS as it moves closer towards making a Final Investment Decision to develop its project.

With inflation rising globally, capital costs of building the mine are likely to be higher now than when the DFS was completed two years ago, so we expect costs (the CAPEX figure) to be higher in the updated DFS.

With inflation rising globally, capital costs of building the mine are likely to be higher now than when the DFS was completed two years ago, so we expect costs (the CAPEX figure) to be higher in the updated DFS.

Countering the increasing capital cost will be the much higher graphite prices EV1 can run through its economic models.

We think this should improve the overall NPV figure, or at the very least, help counter the higher expenses.

The importance of completing this work is more about being able to secure financing partners who will want to see updated estimates for capital costs and future profits, and would be less likely to finance a project based on 2020 estimates.

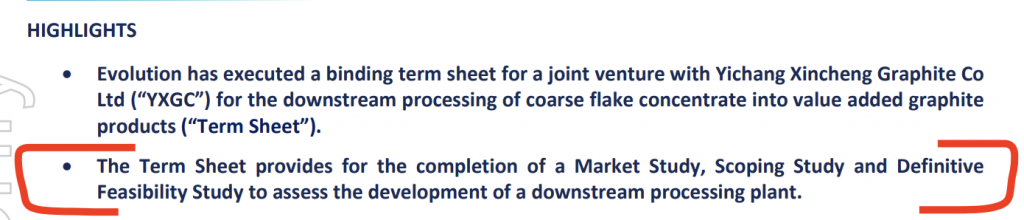

Bonus – Feasibility studies on a downstream processing plant in an EV friendly jurisdiction.

In recent announcements, EV1 has specifically mentioned that it would look to commence a Scoping Study followed by a DFS on a downstream graphite processing plant.

While this may be a bit further down the track, it’s good EV1 is taking concrete steps to advance a processing plant, part of what will ultimately be a vertically integrated graphite production project.

Our 2022 EV1 Investment Memo

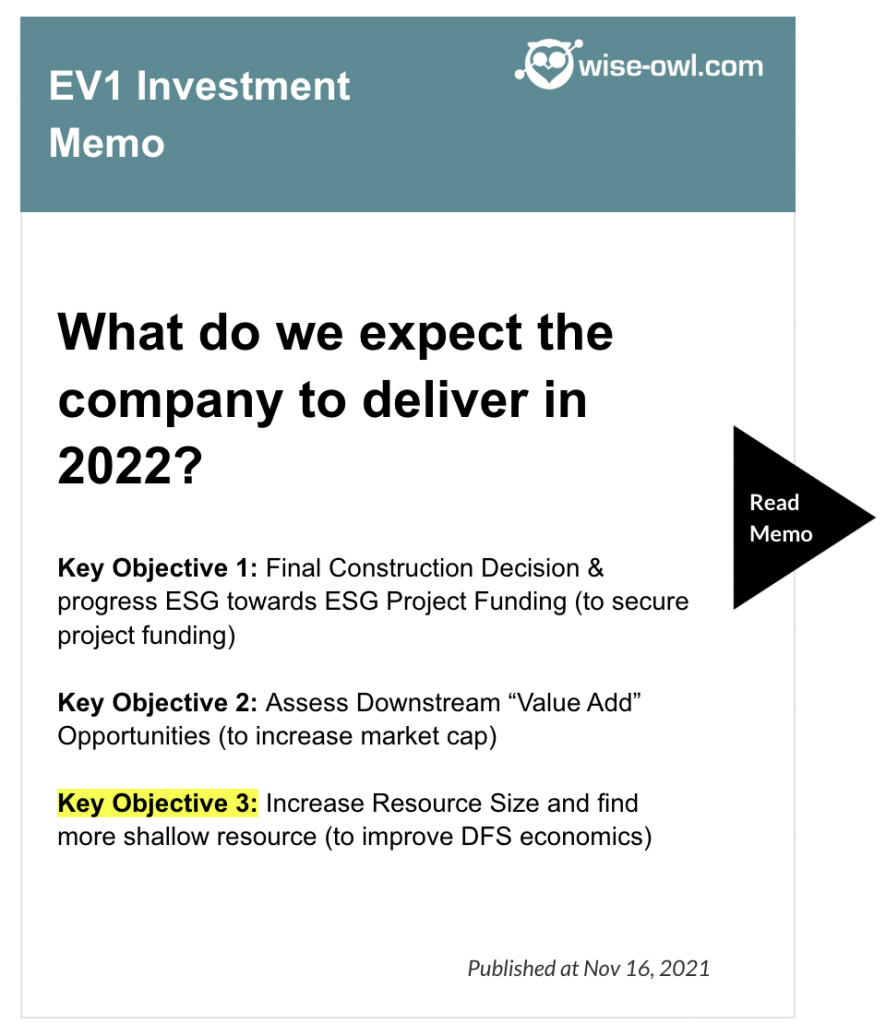

Today’s news contributes to Objective #3 of our EV1 Investment Memo.