Overview: Praemium Ltd (“PPS”, “the Company”) is an Australian software company offering investment administration and financial planning technology platforms for clients in the financial services industry. The company operates in Australia, the UK, Jersey, and Hong Kong. PPS was founded in 2001 and listed on the ASX in 2006. The company currently serves more than 700 clients covering $80bn in assets. The Separately Managed Accounts Technology (SMA) is Australia’s market leader and one of the fastest-growing discretionary platforms in the UK.

![]()

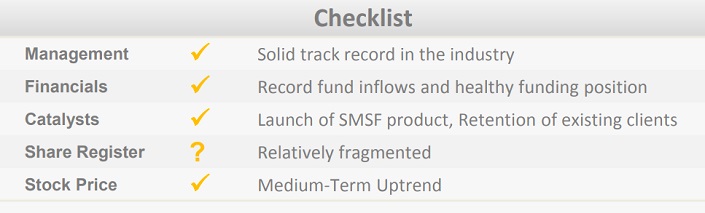

Catalysts: PPS is in the transition to become a self-funding company and is debt-free. The company experienced historic revenue growth of ~12% p.a. over the past three years and operating cash flow has improved 225% y-o-y. One of its long-standing customers extended its contract for a further five years with a minimum contract value of $3m per year (FY14 Revenue ~18m). The company has launched a retail product targeting SMSF which may be a catalyst for long-term growth.

Hurdles: PPS has been historically reliant on external capital to finance operations and there is no guarantee existing income levels will be sufficient to support planned growth initiatives. The cost base expanded by 22% last FY largely driven by an increase in headcount. These large cost investments have absorbed revenue growth and there is no guarantee that these structural changes will result in increased margins. Praemium’s share register is relatively fragmented and could leave the Company open to takeovers below the fair value of its securities

Investment View: PPS offers profitable exposure to the wealth management software industry. We are attracted to its revenue growth trajectory and funding position. Cost investments across the business have been largely completed and PPS can now focus on maximising leverage in future operations. We issue a ‘speculative buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.