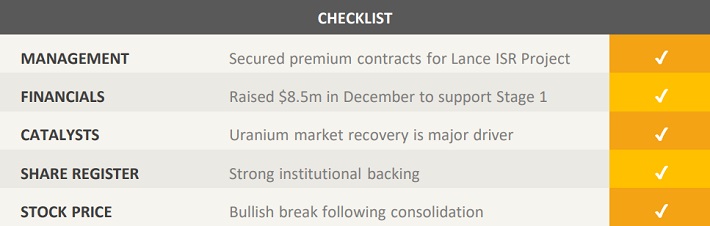

Overview: Peninsular Energy Ltd (“PEN”, “the Company”) is an Australian minerals company focused on uranium with operations in the USA and Sth Africa. Its most advanced asset is the Lance ISR Project in Wyoming, USA. Resources of 51 Million tonnes (Mt) grading 476ppm U3O8, classified as Measured, Indicated, and Inferred, have been delineated at the Lance ISR Project. After completing a Feasibility Study in 2012, and subsequent Optimisation Studies in 2013-14, the Lance ISR Project commenced uranium production in late 2015.

![]()

Catalysts: PEN is positioned to benefit from a structural recovery in uranium markets. The Company has demonstrated its ability to deliver the premium-priced products in a suppressed market and has the financial support of existing institutional shareholders whilst operating conditions remain challenging. Planned Stage 2 and 3 expansions of the Lance ISR Project can increase production over 4x from current levels and over 80% of its resource base remains uncontracted.

Hurdles: There is no guarantee existing resources at the Lance ISR Project can be converted into reserves or economically extracted. Current operations have yet to reach cash flow positive territory, leaving PEN reliant on external capital. There is no guarantee further funding will be available to sustain operations or deliver planned production expansions. Uranium spot and term contract prices are presently significantly below PEN’s sales contracts and further market weakness may impair the Company’s ability to sustain these premiums.

Investment View: PEN offers speculative exposure to the uranium mining industry. We are attracted to the Company’s established, expandable production profile and the strength of its share register. PEN is well-positioned to benefit from potential structural changes in global uranium markets as the world’s largest producer flags a strategic shift away from spot market sales. Amid a limited universe of investible producer stage securities, we initiate coverage with a ‘speculative buy‘.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.