Overview: Pacific Smiles Group Limited (“Pacific Smiles”, “the Company”) is an Australian health care company focused on dental services. Pacific Smiles operates a portfolio of dental centres at which independent dentists practice clinical treatments. Revenue is derived from fees charged to dentists for the provision of fully-serviced facilities. The company’s portfolio comprises 54 dental centres across Eastern Australia.

![]()

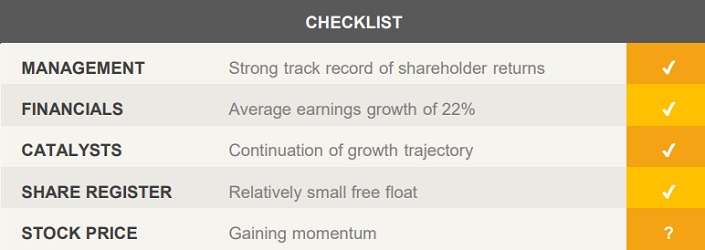

Catalysts: Earnings have consistently increased since 2008 at a compound annual growth rate of 22% per annum. Pacific Smiles is focused on organic growth and in order to maintain momentum, the company targets to open 10 additional centres per year. Management has a strong track record of strategically expanding Pacific Smiles’ portfolio, whilst maintaining a strong balance sheet, a continuation of this trend is the primary catalyst.

Hurdles: The opening of new dental centres is capital intensive and there is no guarantee that new facilities can continue to yield an acceptable return on shareholder funds. 40 percent of centres are less than 3 years old and have yet to demonstrate sustainable earnings potential. With management holding 46 percent of shares outstanding, the potential for minority shareholders to influence corporate governance and strategy is low.

Investment View: Pacific Smiles offers profitable exposure to the domestic healthcare industry. We are attracted to the Company’s growth trajectory, strong balance sheet, and management team. Whilst integration of new practices is a primary risk, the industry’s fragmented nature provides ongoing growth potential. We initiate coverage with a ‘buy’ recommendation for Pacific Smiles’ growth and income potential.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.