BOD’s big bet – will it pay off?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 500,000 BOD shares at the time of publishing this article. The Company has been engaged by BOD to share our commentary on the progress of our Investment in BOD over time.

| It’s been a rough ride so far with our BOD Investment.

But we think this could be the bottom – and we are participating in the current rights issue at 8c. This offer is open to all existing BOD holders – the full details of the offer are here. Today we will explain why we are Investing in BOD again. We first Invested in cannabis stock BOD Australia (ASX: BOD) back in February 2021 at 50c per share. We originally Invested because cannabis stocks were booming, and we were impressed with BOD founder, CEO and major shareholder Jo Patterson. Despite solid revenues and a fairly modest cash burn since our original investment, it’s only been downhill for the company’s share price, with today BOD hovering around 8c. With the cannabis market broadly out of favour over the last 18 months, many investors lost interest in the BOD business model. This might start to change now – and it’s all due to a new technology BOD is set to acquire – hopefully perfectly timed with a resurgence in the sentiment of cannabis stocks we predict in 2023. BOD is acquiring a cannabis product and process technology that allows more rapid onset, better efficacy and lower dosage rates of cannabidiol (CBD) products – resulting in raw material cost savings and fewer patient side effects. Basically this means the technology lets the human body absorb CBD more effectively, leading to less product being needed to achieve the desired effect. Following the acquisition and capital raise (that we are participating in), BOD will be capped at $12M and should have over $5M in the bank. At this level we think there’s room to grow. We are hoping that BOD’s new acquisition will deliver a few goals for the company and give it some new momentum – which as we noted above, will ideally coincide with what we predict to be a return in favour to cannabis stocks. The current problem with many CBD formulations is that the body struggles to absorb the CBD because it doesn’t get broken down properly in the stomach. CBD users and patients need to take large amounts to get the desired therapeutic impact – and even then, results can be dubious depending on the quality of the product. BOD’s new acquisition promises to dramatically increase the bioavailability of CBD in the human body – so it’s more potent, and more effective. There are a number of value adding things BOD could do with this new technology: |

| 1. Improve BOD’s current product suite – BOD can gain a competitive advantage by applying its new tech to make existing products deliver the same or better therapeutic impact with less raw material.

2. New technology unlocks child epilepsy moonshot – BOD’s new tech presents an opportunity for fast-tracked FDA approval to sell its CBD under a new drug application. The only FDA approved cannabis product is Epidiolex which is a CBD oil used for treating child epilepsy. This product recorded US$500M in sales in 2020, with US$1.4BN in sales forecast in 2025. BOD’s epilepsy “moonshot” is to quickly launch a similar or better product and tap into these big sales figures by early 2024. 3. BOD could enter the giant cannabis drinks market – because BOD’s technology could deliver odourless, flavourless and water soluble CBD, it could be ideal for use in the rapidly growing cannabis drinks market currently valued at ~US$1BN. 4. Other – this is a bit of a wild card and we won’t speculate too much on this one. We note that BOD has 11 clinical trials in its pipeline (either completed or in progress) so the new tech could work across any of these products. Based on these potential applications of BOD’s newly acquired tech, our Big Bet for why we have participated in the current 8c rights issue is: Our Big Bet$8M capped BOD will deliver a minimum 10x return on successfully commercialising at least one application of their new technology that optimises the human body’s absorption of cannabinoids. NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Before we dig deeper into BOD, a quick science lesson is required. As we flagged above, the problem with current CBD oral treatments is that it is inefficiently absorbed in the human body, meaning larger dosages are required to get the desired remedial effect. BOD thinks it can substantially improve this via a new delivery format. The technology that BOD is acquiring provides a superior way of delivering CBD compounds to our bodies, which could revolutionise how we receive their health and medical benefits. The technology is called Aqua Phase, and provides significant improvement on the bioavailability of cannabis compounds. Bioavailability refers to the extent a substance or drug becomes completely available to its intended biological destination. Simply put, it is the ability of a substance to be absorbed and used by the body, which is key to the effectiveness of such substances. A substance will only take effect if it can be absorbed by the body, so low bioavailability means the substance is less efficiently absorbed into the body. Bioavailability is a key measure to define how we use, regulate or dose drugs. Now that the science lesson is over, let’s unpack the key opportunities BOD has with its new technology to hopefully one day hit our Big Bet. Improving BOD’s current product suiteWe first Invested in BOD for its existing suite of cannabis products and partnership with H&H Group, whose major brand is the well known “Swisse”. This was generating all important revenues for the company, and this revenue generation is still a key element to the BOD story. Currently BOD primarily sells cannabis and cannabidiol (CBD) drugs with two key divisions:

We think that with the new acquisition, BOD could gain a competitive advantage and increase market share by applying the new tech to make existing products deliver the same or better therapeutic impact with less raw material. The technology could be fairly quickly applied to BOD’s current and upcoming suite of products, including its existing medical cannabis and over-the-counter insomnia treatment that’s currently in development. From its own work, BOD expects its new technology to improve the bioavailability of its products by some 30% — a significant rise if this can be replicated within their current and upcoming product suite. CBD tends to have very poor biological absorption. Typical bioavailability for oral CBD compounds in oil are estimated to range within 6-8%. By improving the bioavailability BOD can improve its products through:

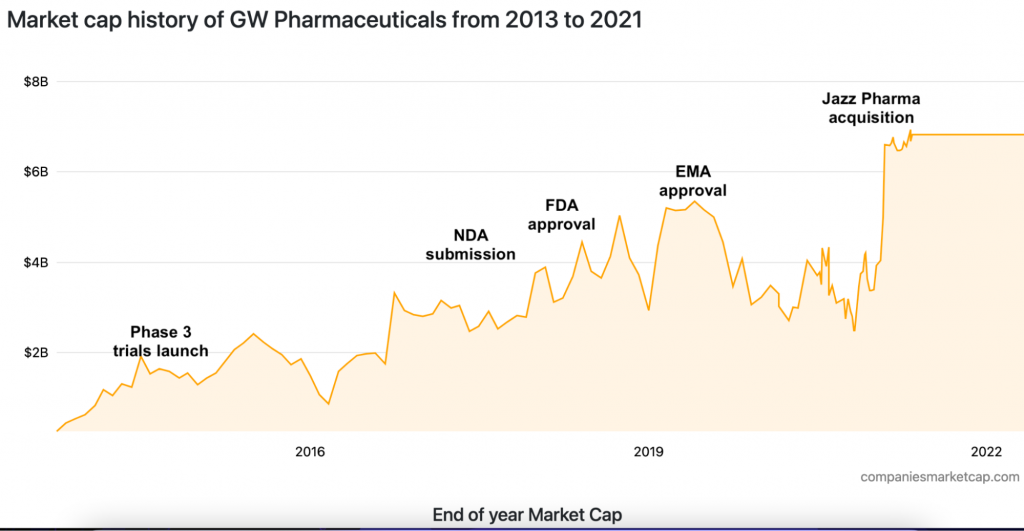

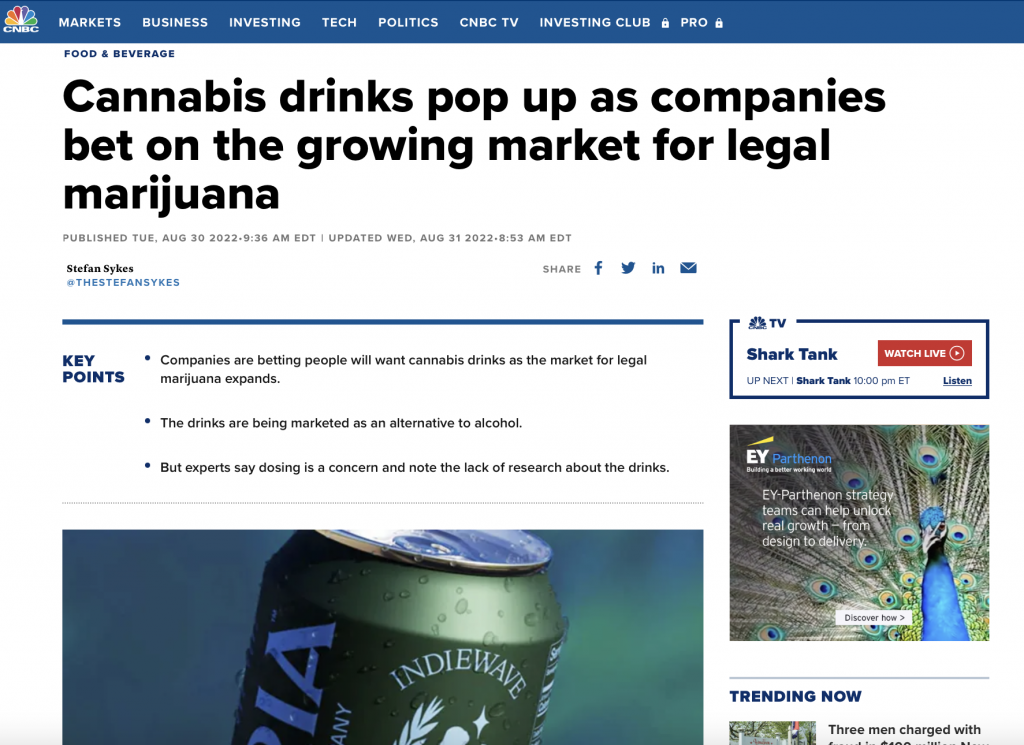

These are all positive attributes for both consumer and medicinal cannabis products. New technology unlocks child epilepsy moonshotIn its acquisition presentation, BOD announced that it would undertake a study to evaluate whether it could fast track a new cannabis product to treat child epilepsy. This is what’s termed a pharmacokinetic study – basically how a substance moves around in the human body. BOD has flagged that it will be having pre-IND meetings with the FDA following this study (roughly 12 months). IND stands for Investigational New Drug and allows for new drugs to enter the market in a much shorter timeframe than traditional trial processes. The FDA has previously indicated a willingness to accept certain cannabis treatments for IND status due to pressing unmet needs of certain conditions – such as child epilepsy syndromes like Lennox-Gastaut syndrome or Dravet syndrome in patients 2 years of age and older. BOD will aim for “fast track” status and will do this via a new drug application with the FDA. BOD’s goal is to launch this new product by Q1 2024. There is currently only one FDA approved cannabis product in the US market that treats child epilepsy called Epidiolex – and BOD is looking to create a competitor. Jazz Pharmaceuticals acquired Epidiolex via its acquisition of UK-based healthcare company GW Pharmaceuticals for US$7BN in 2021. GW was known as being at the forefront of medical treatments utilising plant derived cannabis substances. It was perhaps best known for its multiple sclerosis treatment drug, Nabiximols, the first natural cannabis plant derivative to gain market approval globally. This was followed by Epidiolex. Here’s a timeline of how Jazz got a hold of Epidiolex:

Note that it still took over three years from Phase 3 trials in 2015 before Epidiolex received FDA approval – in that time, GW’s market valuation grew from ~US$1.3BN to US$2.9BN, before Jazz Pharmaceuticals acquired the company for US$7B in 2021. BOD are looking to emulate this product success with a new market entrant, but at a far quicker pace… essentially within 24 months. So what is the roadmap ahead for this? Well, BOD has identified a quick route to commercialisation. Typically, new drugs take upwards of 10 years to come to market, especially in the lucrative US market where the FDA oversees the pharmaceutical industry. But BOD thinks it can fast-track its rival product to Epidiolex, given that it has essentially the same active ingredient as the incumbent ie CBD. It’s just the delivery process that differs. Here are the milestones that BOD will need to achieve in order to get approval: 🔲 Commence epilepsy moonshot study [H2 2022] 🔲 Launch Investigational New Drug (IND) application [2023] 🔲 FDA meetings [2023] 🔲 Complete epilepsy moonshot study 🔲 Submission for FDA approval via new drug application pathway [H2 2023] 🔲 Potential FDA approval [H1 2024] 🔲 Launch competitor product and sell in the US market BOD could enter new cannabis drinks marketAnother desirable effect of BOD’s acquired technology is that it has the potential to deliver a cannabis complex that is soluble, tasteless, colourless and odourless. One clear target market to consider will be the beverages market where several countries, including Canada, are open to cannabis-infused beverages businesses. One estimate of the US cannabis drinks market places it at ~US$1BN and growing at a staggering 54% year on year through to 2028. Several big brewing companies that have already entered the space include Anheuser-Busch (the maker of Budweiser); Constellation Brands (Modelo Especial and Corona); and The Boston Brewing Company (Samuel Adams).

Other companies in the space are pushing hard at drinks and BOD’s tech offers licensing opportunities or the option to develop their own brand. Imagine a cannabis/CBD drink formulated on BOD’s Aqua Phase products… This is a big blue sky opportunity for BOD that could be unlocked with the Aqua Phase acquisition. What’s next for BOD?We have added two new objectives for the BOD investment memo, in particular incorporating the Acqua Phase technology into existing products and to develop its epilepsy moonshot product. To see the milestones for each of these objectives click through to the BOD Investment Memo.

BOD’s Investment MemoBelow is our 2022 Investment Memo for BOD, where you can find a short, high level summary of our reasons for Investing. The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company’s performance against our expectations for the following 12 months. In our BOD Investment Memo, you’ll find:

|