Overview: Nemex Resources Ltd (“Nemex”, “the Company”) is an Australian company focused on biometric security through a strategic investment in Wavefront Biometrics Technologies Pty Ltd (“WBT”). WBT has developed a single sensor multi-biometric system built around a patented cornea-based technology and incorporating other unique aspects of the eye (“the technology”). Patents have been granted in the US, Japan, and Australia. The market for biometric recognition technologies is estimated to be worth US$7billion. Nemex has secured earn in rights for up to 51 percent of WBT.

![]()

Catalysts: Internal validation of the biometric technology within a mobile setting has concluded on schedule, illustrating comparable performance to industry-leading iris technologies and advantages including universal application and proof of liveness. Results have prompted Nemex to increase its WBT interest to 40 percent, proceeds from which are expected to fund independent testing and initial marketing to licensing candidates during H2 2015.

Hurdles: WBT’s technology has yet to be independently appraised and there is no guarantee lab performance can be replicated in a commercial setting. Further development and commercialisation of the technology require additional capital. The partial nature of Nemex’s equity in the technology may impede its capacity to attract fair value in its share price.

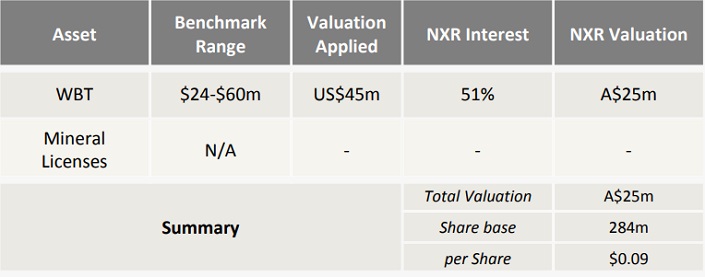

Investment View: Nemex offers speculative exposure to global biometric security markets. Independent appraisal of the technology over the coming months is a major value determinant, providing an impetus for subsequent industry engagement. We retain our valuation of $0.09/share.

THE BULLS SAY

THE BEARS SAY

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.