Increased Investment: “Value added” Graphite for Electric Vehicles and Nuclear

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 3,578,125 EV1 shares at the time of publishing this article. The Company has been engaged by EV1 to share our commentary on the progress of our Investment in EV1 over time.

Earlier this week we announced a new Investment in lithium, a key ingredient in batteries for electric vehicles and for general energy storage.

Next to lithium, graphite is also a critical and non-substitutable material, making up around half of a battery’s ingredients.

Graphite is increasingly on the offtake menu for electric vehicle makers, and over the last 12 months we’ve seen the big automakers move quickly to secure battery materials supply.

And value-added graphite foil is used in Nuclear Energy – one of the solutions to the current global energy crisis.

Our graphite Investment and 2021 Wise Owl Pick of the Year Evolution Energy Minerals (ASX:EV1) is developing a graphite mine in Tanzania with heavy focus on best in class sustainability and ESG.

Our Big Bet for this Investment:

EV1 will achieve first production of the world’s most sustainably produced graphite by early 2024 (including value adding processing) — coinciding with the onset of a long-term supply shortage in the graphite market.

NOTE: The above is what we think the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done by the company to get to this outcome and obvious risks which need to be considered, some of which we list in our EV1 Investment Memo.

EV1 is quickly coming up on a Final Investment Decision to get its “ESG First” graphite mine built and already has an ESG fund as a cornerstone investor.

On top of that, EV1 has an updated Definitive Feasibility Study due shortly, and it has been steadily chewing through every key milestone we set since its IPO in November of last year when we launched our EV1 Investment Memo.

We Invested in the EV1 IPO at 20c at 16 November 2021, and recently Invested again at 32c in the placement in early August.

EV1 is currently trading at 27.5c after the usual post-placement digestion, which we hope should be just about finished.

Following that placement, EV1 is now capped at about $56M with an estimated ~$18.4M in the bank (June 30 cash plus recent cap raise), with “downstream value add” in progress.

We’ve previously made note of other ASX listed graphite companies that have downstream processing capacity — these are their current market caps:

- Magnis Energy Technologies: ~$485M

- EcoGraf: ~$198M

- Talga Group: ~$427M

- Syrah Resources: ~$1.1BN

That downstream value add work is the topic of today’s note as it is extremely important to EV1’s ability to re-rate.

We have not sold any shares since we first Invested as we believe there is a strong chance that EV1 will deliver first production before 2024 given:

- EV1’s excellent execution of its plan to date.

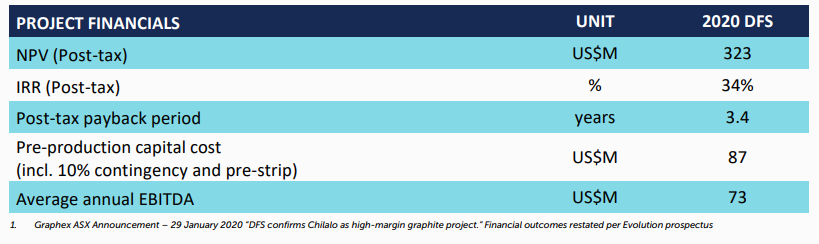

- The low capex to build the project (US$87M to deliver an NPV of US$323M as per current DFS).

- EV1’s “ESG grade” investment status to attract ESG funds to build the mine.

To give an idea of just how well EV1 has executed on its plan since IPO, see our EV1 Progress Tracker below.

It takes about 60 seconds to scroll the EV1 Progress Tracker to get a quick helicopter summary of progress, which we find helpful to do before reading each new EV1 announcement.

A quick scan of the progress tracker helps give context to how the new announcements contribute to our big bet and near term Investment Memo objectives for EV1:

Graphite offtakes and downstream value add

Before we get into more details on what EV1 has been up to, here’s a quick recap of recent events in the graphite offtake space…

In January, Tesla executed a binding offtake with an ASX-listed African graphite producer that has a downstream plant in the US.

In July, Ford signed a non-binding agreement with the very same company to potentially get its hands on future supply.

We’ve seen multiple big battery materials offtakes signed in our Portfolio before – notably Vulcan Energy Resources secured a string of offtakes for its sustainable European lithium.

And EV1 has its own graphite offtake already secured with Chinese graphite giant YXGC as of May of this year.

But as graphite prices continue to move higher, there’s a lot of emphasis in the market on quality.

Quality over quantity is critical to maximising the value of EV1’s graphite resource. This is where EV1 can unlock big value from its Tanzanian project – we’re talking many multiples of the graphite prices that are usually quoted.

Since July, EV1 has been working with an unnamed US-based technology partner to nail down the technical qualities of its graphite to set its battery material apart.

In addition to potential uses in the nuclear industry which we covered in our last note, EV1’s goal is to make graphite that is great for the rapidly growing EV industry — great in terms of sustainability and, as a result, great for ESG funds as an investment.

To do this, EV1 has made a number of clever moves to realise the full potential of its Tanzanian graphite project.

Ever since we initially Invested in EV1, we’ve maintained that this downstream work will be a key plank of the EV1 value proposition to institutional investors, and a big contributing factor in any potential re-rate.

By downstream work, we mean EV1 needs to show that the graphite stacks up to the technical specs of the most demanding customers and end uses.

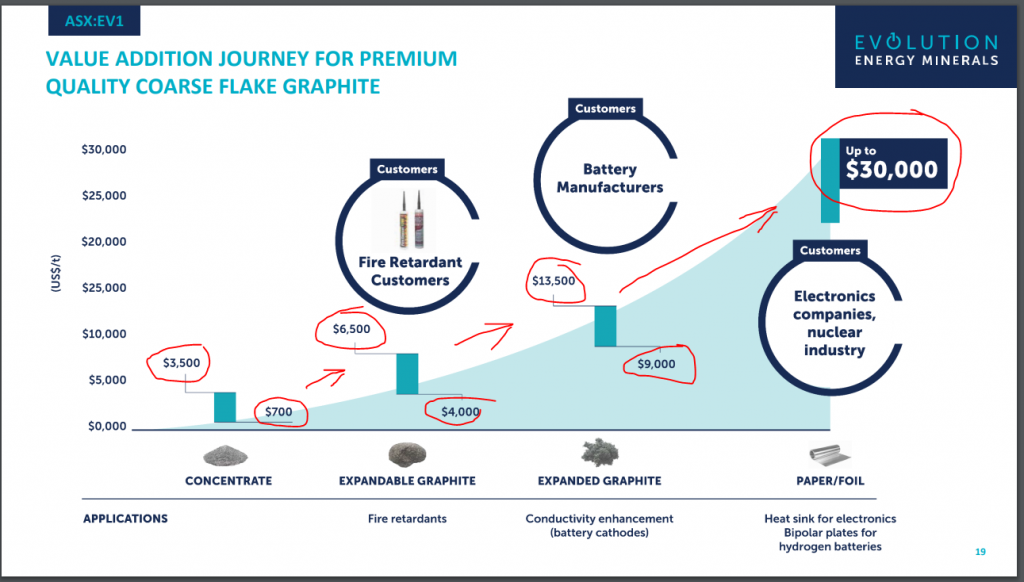

Here is a chart showing how downstream processing (value add work) can increase the sale price of graphite:

Source: EV1 investor presentation

EV1’s downstream value add work is coming to fruition

Since our last note on EV1, the company has delivered the following five bits of good news (in chronological order):

- Achieved thermal purification of its graphite to 99.9995% C – this means that it can be used in high-tech applications like the nuclear industry (12 July).

- 64% yields from testwork for spherical graphite with performance near theoretical levels – this means it should get more money from the graphite, and it performs near the bounds of what graphite is capable of (18 July).

- Shown that the graphite holds up well after multiple charge cycles – which puts its product in the “super-premium” league of anode materials – great for the lithium-ion batteries found in EVs (21 July).

- Completed a $13M capital raise at 32 cents – (ESG fund and major shareholder ARCH will maintain its 24.7% shareholding) which will fund among a range of objectives, feasibility studies on the development of downstream processing facilities. This would be an excellent start on reaching high end EV customers in places like Europe (10 August)

- Bonus: even the performance of its non-spherical by-product is looking good – it could fetch US$12k a tonne based on current market prices, i.e. money could come in from EV1’s relatively low value “offcuts” (22 August)

The quick version of these developments, we think, is as follows…

EV1’s graphite has elite performance metrics, it is suitable for EV batteries, there’s more margin to be found in downstream work, and all of this plays into more attractive long-term project economics.

Some graphite simply doesn’t have these elite performance metrics – which is why downstream processing is so important.

As before, EV1 is currently capped at about $56M with approx ~$18.4M in the bank ($13M just raised plus $5.4M at June 30), with “downstream value add” in progress.

Again, we’ve made note of other ASX listed graphite companies that have downstream processing capacity – these are their current market caps:

- Magnis Energy Technologies: ~$485M

- EcoGraf: ~$198M

- Talga Group: ~$427M

- Syrah Resources: ~$1.1BN

As you can see, EV1 is capped at a fraction of these ‘graphite downstream value adding’ peers.

To catch up to or surpass these companies’ market caps, EV1 needs to show its graphite stacks up and then actually start mining the graphite.

In order to commence mine construction, EV1 needs to reach a successful “Final Investment Decision” – you might see it called a “FID” in places.

Today we’ll share what’s next for EV1, what most caught our eye in the latest EV1 news and why we think this means EV1 is increasingly well positioned to arrive at a successful Final Investment Decision.

This would mean EV1 can then go and secure the capital needed to build the mine — which has a low capex of US$87M and 3.4 year payback period. However, these numbers are likely to change in the updated DFS, where we will get an updated look at the project economics.

Given the multi-decade mine life potential, we think this is shaping up to be an attractive potential investment for big ESG funds.

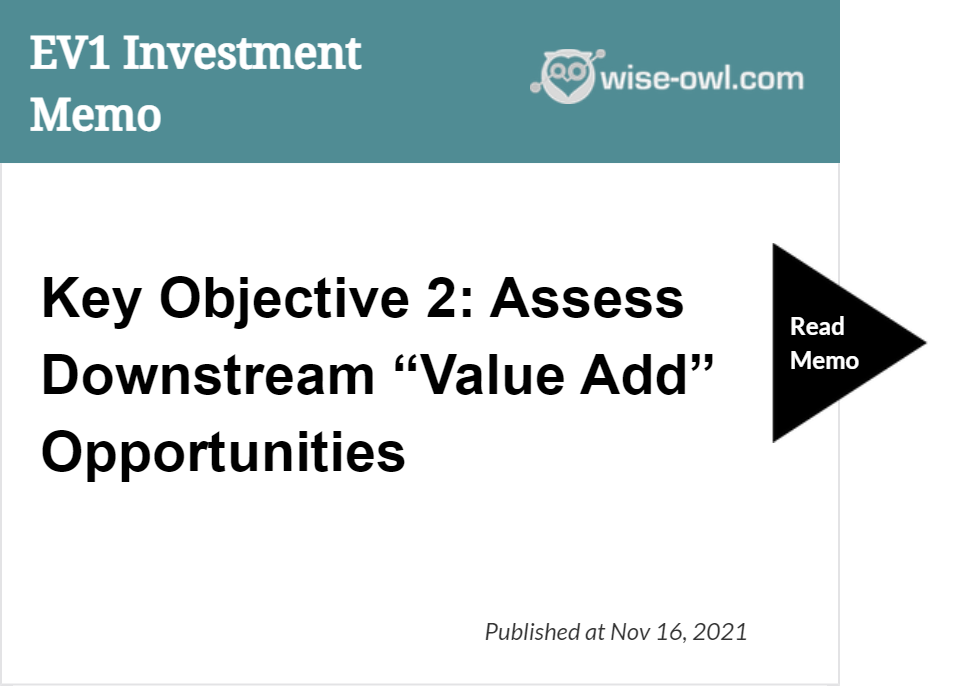

The downstream work is all part of Objective #2 from our EV1 Investment Memo:

Before we take a deeper dive into the five recent progress points on EV1’s downstream value adding work (this can get a bit technical so we have left it till the end), let’s see what’s next for EV1.

What’s next for EV1?

EV1 has a good summary of progress towards milestones across its dual mine + downstream strategy:

Source: EV1 investor presentation

And here’s what we’re looking for from EV1 after this round of very promising downstream news:

Framework Agreement with the Tanzanian government 🔄

This is pending and should be a big moment for EV1 as it would secure EV1’s place in Tanzania’s emerging mining industry.

Other ASX listed companies like Strandline Resources, OreCorp, and Black Rock Mining have already signed these agreements and we have seen BHP and Barrick spend $50M and $60M respectively on projects in Tanzania.

These events point to the fact that Tanzania is not only seeing more investment in its mining industry, but also enshrining its place in the regulatory environment.

As these agreements provide regulatory certainty around projects, the market reacts positively to this type of news.

For example, Strandline, which signed the agreement on 14 December 2021, saw its share price go from ~25c before the agreement to briefly touch all time highs at 51.5c, after which it completed a $50M capital raise.

We suspect the reaction is in response to the certainty around tenure a framework agreement gives companies in Tanzania.

This is likely to be a key catalyst that larger institutional investors look for as a trigger to start investing inside Tanzania.

We think this could also play out for EV1 once it has the framework agreement signed.

EV1 has also been busy building stakeholder support for the project in the local community.

Notably, EV1 has initiated a Resettlement Action Plan after engaging with the Ambye, Lukowe and Nangurugai communities which are close to the Chilalo mine.

This plan is a key pillar of the ESG principles embedded in the company’s constitution and performance incentives.

It also shows the Tanzanian government that they are serious about building good relationships in-country.

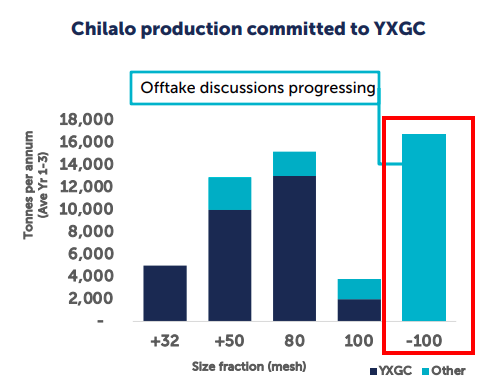

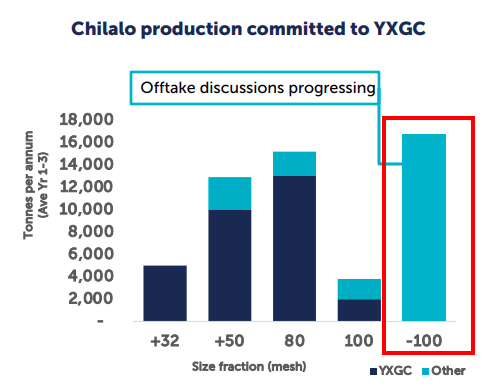

Offtake agreement for its fines product 🔄

For the remaining portion of EV1’s graphite supply, an offtake agreement would be a big coup heading towards a Final Investment Decision.

Knowing that there’s a buyer for your product firms up how the mine makes money.

Source: EV1 investor presentation

Updated Definitive Feasibility Study (DFS) + Final Investment Decision (FID) 🔄

EV1’s 2020 DFS shows an NPV of US$323M with a 3.4 year post tax payback period based on total capital expenditures of ~US$87M to get the mine into development.

EV1 is currently updating its DFS as it moves closer towards making a FID to develop its project.

Source: EV1 investor presentation

With inflation currently rising globally, capital costs of building the mine are likely to be higher now than when the DFS was completed two years ago, so we expect costs (the CAPEX figure) to be higher in the updated DFS.

Countering the increasing capital cost will be the much higher graphite prices EV1 can run through its economic models.

We think this should improve the overall NPV figure, or at the very least, help counter the higher CAPEX.

The importance of completing this work is more about being able to secure financing partners who will want to see updated estimates for capital costs and future profits, and would be less likely to finance a project based on 2020 estimates.

We also note that EV1 had planned a drilling program in which it will target near surface graphite mineralisation which it could feed into an updated DFS. This is also something the company may look to complete before putting out its updated DFS.

We covered that drilling program in a previous note which can be read here: Never miss a chance to improve DFS economics with near surface exploration.

Bonus: Feasibility studies on a downstream processing plant in an EV friendly jurisdiction. We think rapidly growing EV markets would be very amenable to any domestically located processing capacity that EV1 could set up.

EV1 Managing Director Phil Hoskins speaks on graphite market

Source: Stockhead

Key takeaways:

- Downstream value add is crucial – Phil thinks the value added graphite is about more than just lithium-ion batteries: +50 mesh and +80 mesh lend themselves to value added products like expandable graphite, graphite foil, drilling fluids are all important (min 1:00 – min 2:30).

- China supply impacted, demand up – environmental concerns are delivering supply side shocks in China which is interacting with demand from batteries — a significant number of mines need to be built as a result (min 7:00 – min 9:00).

- Inflation increases CAPEX, prices are strong – Phil said on the DFS (due in September) while capital cost estimates rise due to inflation, the graphite pricing environment has changed. The US$1500/tonne price assumed in the 2020 DFS will be higher and likely result in a similar economic case for development.

Deep Dive: 5 key progress announcements on EV1 downstream value add

Earlier we summarised EV1 following five bits of good news in progressing downstream value add processing to improve the sale price of its graphite:

- Achieved thermal purification of its graphite to 99.9995% C

- 64% yields from testwork for spherical graphite with performance near theoretical levels

- Shown that the graphite holds up well after multiple charge cycles

- Completed a $13M capital raise at 32 cents – help fund feasibility studies on the development of downstream processing facilities.

- Bonus: even the performance of their non-spherical by-product is looking good

Below is a deeper dive on each one (warning – this gets quite technical):

Downstream Progress #1: Super pure, super green graphite

As part of its commercial verification program to evaluate the suitability of its graphite fines product for battery anode materials, EV1 confirmed that thermal purification achieved an industry-leading purity level of 99.9995% carbon (C).

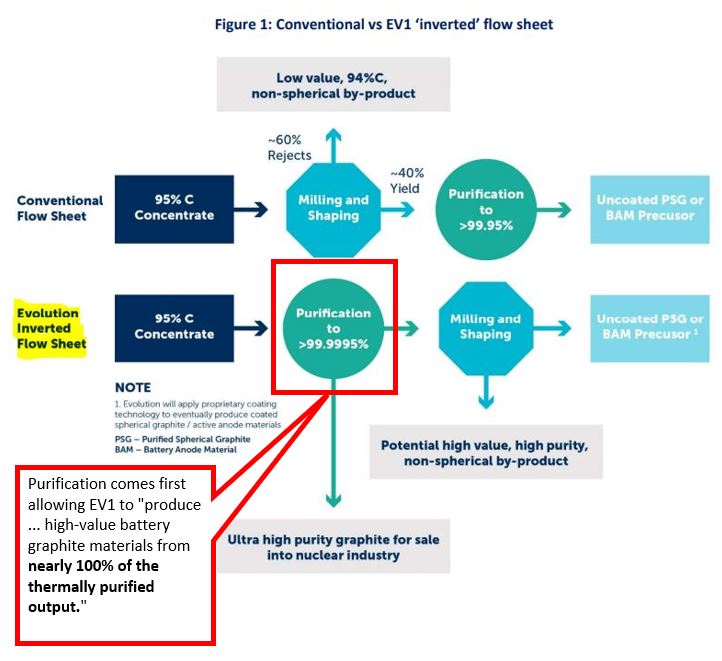

What we’re really interested in from this positive announcement is the “inversion” of the traditional battery anode process flow sheet:

Source: ASX announcement

Importantly, this flow sheet results in a product that exceeds the required purity level for battery grade spherical graphite, while also using an environmentally friendly thermal purification processing methodology.

EV1 is committed to ESG principles and this thermal purification process is in keeping with that.

The conventional approach is currently responsible for producing 100% of the world’s battery grade graphite.

The key difference between the two is that the conventional process uses highly toxic chemicals such as hydrofluoric acid — existing anode manufacturers use between 400-600kg of hydrofluoric acid for every tonne of graphite feedstock.

EV1’s thermal purification is, however, completely sustainable. The required heat is created using renewable energy as opposed to toxic chemicals.

This fits in with EV1’s strategy of producing sustainable and best in class ESG graphite.

We think this is a step in the right direction towards positioning EV1 as the world’s leading producer of the most green and sustainable battery anode materials.

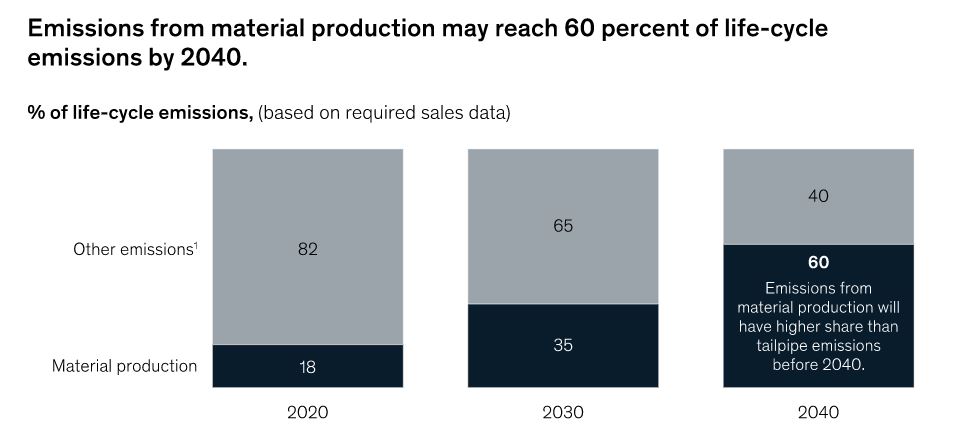

McKinsey estimates that by 2040, 60% of a car’s emissions profile will come from materials production:

Source: McKinsey Research

The shift to batteries brings with it a new set of concerns and we think consumer preferences and a growing realisation that batteries have their own emissions will drive interest in a clean battery supply chain – something which we think EV1’s approach fits well with.

We also note EV1’s proposed thermal purification process could have cost advantages, depending on the power source.

With a large chunk of its Chilalo coarse flake graphite production, which will go to Chinese graphite giant YXGC, EV1’s test work at this stage was starting to demonstrate the characteristics needed for both battery and nuclear uses.

We covered this initial test work in our last EV1 note: EV1’s Graphite Meets Purity Standards – Good for Batteries and Nuclear Energy.

However, we quickly discovered that the 99.9995% carbon (C) purity level obtained with an inverted flow sheet was just the start of a string of positive downstream updates from EV1…

Downstream Progress #2: +24% more yield compared to industry standard

Our second additional big bit of positive news was that EV1 had achieved a 64% yield on its spherical graphite product.

That’s a full 24% more than the industry standard yield, meaning more margin for EV1 if/when the company gets into production.

EV1 would get 640kg of battery anode material using 1 tonne of graphite materials, whereas competitors may only be achieve ~400kg of battery anode material.

In a nutshell, increased yield means less graphite is needed to produce more battery anode material.

At the time of this announcement, EV1 outlined its progress with electrochemical performance tests. Effectively, EV1 was seeing how the chemistry of the graphite holds up with a charge running through it.

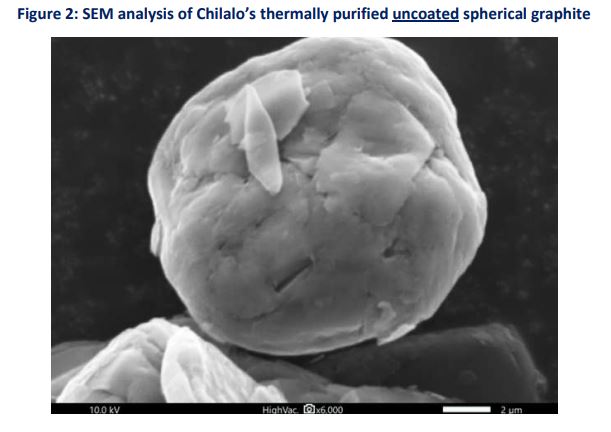

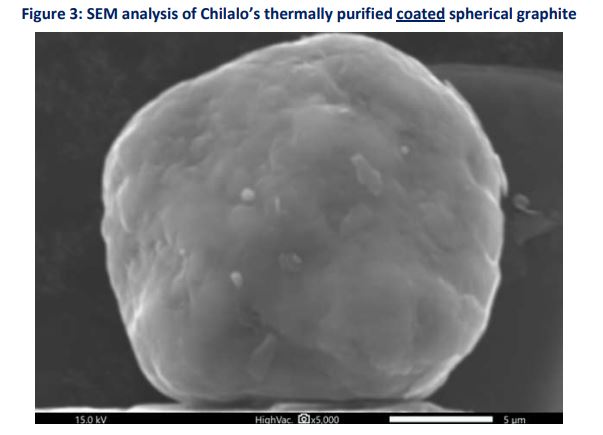

The uncoated graphite (which is not a finished product) looks like this:

Source: ASX announcement

To our untrained eyes that already looks pretty round to us.

“Spheroidisation” of the graphite is important because it decreases the surface area and, as a result, increases its performance.

But in order for EV1’s graphite to be used in lithium-ion batteries, it needs to be coated with what’s known as “soft carbon”, which can be made from things like PVC or petroleum coke.

The reversible capacity of EV1’s coated spherical graphite (the measure of specific capacity rating tied to longer battery life) of 368 mAh/g1 is near the theoretical capacity of 372 mAh/g.

The coated spherical graphite looks even rounder —like this:

Source: ASX announcement

In layman’s terms, EV1’s spherical graphite product is getting pretty darn close to the upper limits of what graphite can achieve from a theoretical perspective, i.e the electrochemical properties of the graphite is almost perfect.

EV1 said the performance at this early stage already met the specifications required by “some of the leading EV battery producers in the world”.

The upshot of this announcement?

It all comes down to the remaining portion of EV1’s Tanzanian graphite products (fines) — EV1 is yet to seal an offtake for this portion of its proposed production:

Source: EV1 investor presentation

Key takeaway: we think the downstream testwork and inverted processing flow sheet the company is working with should help secure a better offtake agreement for the fines product down the track.

That would be an ideal outcome for us as EV1 Investors.

Downstream Progress #3: Durable material – suitable for the best batteries

Following up on the test work, EV1 showed that the surface coated graphite from Chilalo achieved an irreversible capacity loss of 6.95% (below the 7% threshold required for “super-premium” battery applications which fetch between U$18,000 to $22,000/t).

Irreversible capacity loss is a measure of how many times a graphite battery material can be used and reused — basically a measure of its longevity/durability.

This is essential in EVs as consumer preferences favour batteries with a long life.

EV1 Managing Director Phil Hoskins said that the coated spherical graphite in this test work:

“meets the specifications of at least one leading electric vehicle manufacturer and at least one world-class battery technology provider for lithium-ion cells used in utility-scale energy storage. We will work with these companies as intended offtake partners in the future”.

EV1, at this stage, looks to be getting a very good grip on what requirements it needs to satisfy with test work for the targeted end users.

Downstream Progress #4: Balance sheet strengthened – clear plan for using fresh capital

To strengthen the balance sheet, EV1 raised a total of $13M at 32c per share via a placement to private investors in mid-August. We participated in this capital raise.

Importantly, ARCH (an ESG fund and major EV1 shareholder) committed to maintaining its 24.7% shareholding in the company by participating in the placement.

The first tranche of 24,281,250 EV1 shares were issued on 18 August 2022 and the remaining 16,343,750 will be issued after shareholder approvals in early October. Most of the Tranche 2 shares will be going to ARCH.

By doing this capital raise, EV1 added to its ~$5.4M cash balance (at 30 June 2022) which should mean it has ~$18.4M in cash post placement. EV1 plans to use its balance sheet strength to complete the following:

- Front-end engineering design work and delivery of an updated definitive feasibility study (DFS) for its graphite project.

- Progress the company’s downstream strategy.

- Product qualification and marketing (by extraction of 500 tonnes of Chilalo ore).

- Drilling for near surface high grade material to improve project economics.

We see this capital raising as an important part of EV1’s bid to secure a final investment decision and we particularly like how the funds will be used on its downstream strategy.

Interestingly, EV1 is currently trading below the placement price. This means on-market buyers have been investing in EV1 at a lower level than ARCH and other sophisticated investors who participated in the placement.

Downstream Progress #5: Bonus – graphite “offcuts” can fetch high price

As an added bonus, the inverted flowsheet, which makes up approximately 36% of the

feedstock generates a non-spherical by-product which can improve the performance of batteries.

These are generally considered to be largely worthless or low value. If EV1 can prove they are useful and perform, it can get added margin from its fines product.

EV1 did testwork to see how this by-product performs in conductive coatings and conductivity enhancement materials.

This effectively means that EV1 can generate value-added revenue from up to 100% of the fines product.

The conductivity enhancement material fetches US$12,000 per tonne according to EV1, and is used in the cathodes of traditional alkaline batteries. It is sprayed onto the interior of the can casings that are the shell part of a normal battery you find, say, in your TV remote control.

EV1 notes that the graphite pigment used here amounts to approximately 20% of the overall formulation, while the rest is low-cost commodity chemicals and water. Because only one fifth is actually graphite, mixing it with cheap chemicals and water leads to a US$60K price per dry graphite tonne.

While the company is extrapolating here, we think it makes sense and could add some valuable punch to its downstream efforts in the future.

EV1 outlined how it has ambitions to become a vertically integrated producer, which means it makes the graphite AND processes it.

Our 2022 EV1 Investment Memo

Below is our 2022 Investment Memo for EV1 where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our EV1 Investment Memo you’ll find:

- Key objectives for EV1 in 2022

- Why do we continue to hold EV1

- What the key risks to our investment thesis are

- Our investment plan