Overview: Myer Holdings Limited (“Myer”, “the Company”) is an Australian department store company focused on retail products. Myer’s stores offer a diverse range of consumer products including fashion and apparel, homeware, electrical goods, and general merchandise. The Company owns and operates 67 stores across Australia as well as its online digital and mobile platforms.

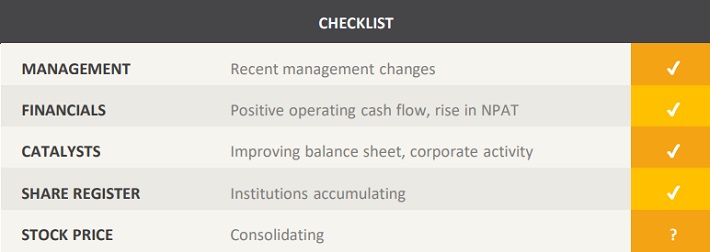

Catalysts: Steady sales and a reduction in capital expenditure are expected to have a positive impact on earnings margins. Recent management changes and a strategic shift geared towards operational improvements provide a platform to turn around one of Australia’s most iconic companies. Myer has made good progress in significantly reducing its debt and a return to sustainable EBITDA growth is a major value driver and could reinvigorate market confidence. We note an increase in corporate activity.

Hurdles: Earnings per share (‘EPS’) have declined over the past six consecutive years and there is no guarantee that the trend won’t continue. Myer’s operations are capital intensive and the Company competes against online stores with significantly lower fixed costs and higher operational leverage. Myer has failed to respond to industry trends over the past few years, which has impacted financial performance and sentiment towards the brand.

Investment View: Myer offers profitable exposure to Australian consumer trends. We are attracted to the Company’s improving balance sheet, a renewed focus on cost control, and recent management changes. However, Myer operates in a mature market characterised by high competition and capital-intensive operations, which has impacted margins. While sales have been steady, a return to sustainable EBITDA growth is the primary driver for the stock and as the balance sheet improves, Myer may witness an increase in corporate activity. MYR is trading near an all-time low and with over 15% of its stock subject to short-selling, we favour the balance of risk and initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.