FOD delivers another strong quarter, now primed for growth

Disclosure: The authors of this article and owners of Wise Owl, S3 Consortium Pty Ltd, and associated entities, own 7,857,143 FOD shares and the Company’s staff own 306,722 FOD shares at the time of publication. S3 Consortium Pty Ltd has been engaged by FOD to share our commentary and opinion on the progress of our investment in FOD over time.

Once is a chance, twice could be the start of a trend…

After delivering its first cash flow positive quarter since we Invested 18-months ago, The Food Revolution Group (ASX: FOD) has followed up with another operating cash flow positive quarter – consolidating its financial position and priming the company for growth in FY23.

FOD is a beverage manufacturing company, selling its well known juice products in major supermarkets like Coles and Woolworths.

Yesterday, FOD announced $11M in gross revenue, a 22.7% increase compared to the previous corresponding period last year.

This is second quarter in a row of operating cash flow positive for the $23M capped FOD.

When CEO Steven Cail was first installed in the top seat he said that FOD was on a Fix → Reset → Grow trajectory.

Now, with a second successive cash flow positive quarter behind it, we believe the ‘Reset’ stage has been accomplished and we look forward to FOD executing on the ‘Growth’ phase in FY23.

FOD’s financial performance this quarter is even more impressive when overlayed with the escalating inflationary environment that is affecting manufacturing businesses.

FOD appears to be navigating this inflationary squeeze rather well, given a macro backdrop of labour shortages pushing staffing costs higher, supply chain disruptions, and escalating freight and materials cost.

Kicking off its “Growth” phase, last month FOD announced that it had launched two new products:

- Vegetable-based juices to target health conscious Australians

- An extension to the Juice Labs Wellness Shots range with “Calm”

This continues FOD’s momentum of new product releases over the last 12-18 months, with Plant Based Smoothies, Carbonated Wellness Cans and Juice Shots all released within that time frame.

We think that new product development is driving FOD’s 22.7% revenue growth, validating the company’s strategy of expanding its range.

FOD says that the Juice Labs range is tracking to become a $7M brand in the next financial year – a strong performance considering that the first products were launched only 18-months ago.

Product extensions, like the new “Calm” shots, exemplifies this growth, and FOD’s 53% market share in this segment indicates that the products are resonating with consumers.

Major supermarkets are starting to take notice too.

Earlier this month FOD announced that Costco Australia has agreed to stock FOD’s flagship Original Juice Label products in 4×1 litre packs.

In addition to the Costco deal, Woolworths has agreed to increase its distribution of the Juice Shots.

We think that FOD’s domestic distribution and new product development strategy will position the company well for FY23 with the ‘blue sky’ potential for export into ‘targeted international markets’ being the key catalyst for business expansion and growth.

Newsflow out of FOD is largely limited to the quarterly 4C, so we thought we’d take a look at how some of the financial metrics out of yesterday’s release stack up with FOD’s financial performance over the last 12 months.

Metrics: FOD’s share price in ratios

FOD is in the process of optimising its business for growth – just like squeezing every last drop of juice from an orange.

This was the number 1 objective that we wanted to see FOD achieve in 2022.

We look at four key financial indicators when analysing our FOD Investment (quarterly figures):

- Cash on hand (steady at $900K from Q1 2022 to Q2 2022)

- Debt (being paid down at $320K per quarter for the last 3 quarters, $6.5M facility now paid down to $5.2M)

- Gross revenues (up 22.7% on same period last year, at $11.1M) and cash receipts (steady at $9.2M vs last quarter)

- Operating costs (steady at $8.8M vs last quarter $8.7M)

Overall, we think this was a very strong quarter from FOD and is indicative of the job that CEO Steven Cail has done to ‘Reset’ the company.

This quarter FOD brought in $11.1M in gross revenue, growing 22.7% on the same period last year.

FOD also brought in $9.2M in receipts, steady from the same periods last year.

The difference between gross revenues and cash receipts is one of the finer points of accounting, but it boils down to timing of when revenue is earned vs cash received (more details here).

We suspect a large recent order or number of orders are in the pipeline (the $1.9M difference between gross revenues and cash receipts) for which invoices have been issued but the cash is yet to be received.

This revenue will likely show up as cash receipts for next quarter.

We think FOD’s overall trajectory is positive: cash is on par with last quarter, debt is being paid down, and sales appear to be improving in a difficult inflationary environment while operating costs remain steady as well.

Price to Sales Ratio

One common metric used to assess growth companies is the price-to-sales ratio.

This is essentially a measure of how much an investor pays for a share in a company for every dollar of sales that company makes.

Being below 1.0 is usually a good sign, assuming there are blue skies ahead and the company is growing.

As we mentioned above, we think that FOD is on a Fix → Reset → Grow trajectory.

So if we view FOD as in the ‘Growth’ stage of its lifecycle, we can use this metric to assess FOD’s potential to re-rate its share price as sales grow.

Using FOD’s current market cap, the company has a price to sales ratio of ~0.68, which means that investors are essentially paying 68c for every $1 that FOD makes in cash receipts from customers.

Using FOD’s current market cap, the company has a price to sales ratio of ~0.68, which means that investors are essentially paying 68c for every $1 that FOD makes in cash receipts from customers.

Enterprise Value (EV), as compared to market cap, is potentially a more accurate way to evaluate FOD as it includes the company’s cash balance and outstanding debt.

FOD has an EV of ~$28M (market cap $24M – $0.9M in cash + $5.2M in debt).

Back of the envelope calculations show FOD’s EV / Sales ratio is ~0.8 — still lower than our benchmark of ‘1.0’ for growth companies.

Both “Price to Sales” and “EV to Sales” ratios indicate that FOD could be primed for a steady share price re-rate IF they can continue executing on its growth initiatives.

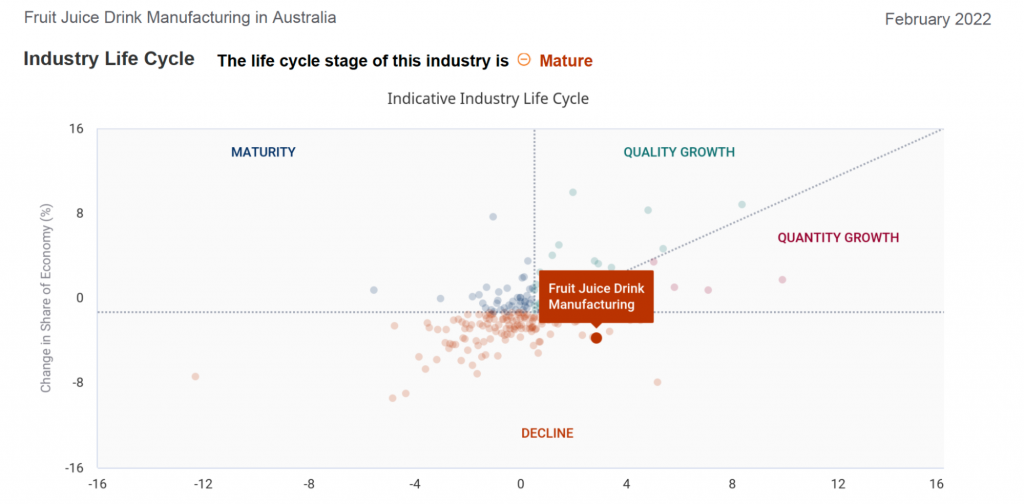

Growth in a mature market

The orange juice market is mature, which means that revenues are reliable, however the potential for growth is limited.

FOD’s flagship Original Black Label brand is growing ahead of the market at 8.7%.

This is a good sign, but as investors in small cap stocks we are always looking for where the growth MULTIPLIERS are going to come from – and it’s no different for FOD.

The reliability of FOD’s juice sales, and brand strength in the market underpins the company’s value – however there are still growth opportunities for the company in this next stage of development.

Remember, FOD is on a Fix → Reset → Grow trajectory, and these are the things that we are looking for as key indicators of ‘Growth’:

- New product development

- Increase domestic distribution

- Export to international market

New product development

A key driver for FOD’s sales growth over the last 18 months has been new product development.

FOD has launched four new innovative products, while extending lines for two existing brands.

New products released:

- Juice Wellness Shots

- Carbonated Wellness Cans

- Plant-Based Smoothies

- Chilled Veggie-Based Juices

Product line extensions:

- Apple Juice added to ‘Original Black Label’

- Calm shot added to the ‘Juice Shots’

With these new products, FOD expects the Juice Labs brand (under which many of these products were launched) to be worth $7M in the next year.

We think that is pretty impressive given the brand had no products in the market 18-months ago.

We think this new product development strategy (NPD) is a key driver for FOD’s revenue growth.

NPD can only take FOD so far, we think that to drastically expand its revenue footprint FOD’s needs to put its products infront of the most customers, more often.

We think the opportunities lie in improving distribution both domestically and abroad.

Increase domestic distribution

FOD has well established relationships within the major Australian supermarkets Woolworths, Metcash and Coles – with Costco added this last month.

However, with FOD’s range of products, we think that there is a big opportunity to distribute through a greater number of partners.

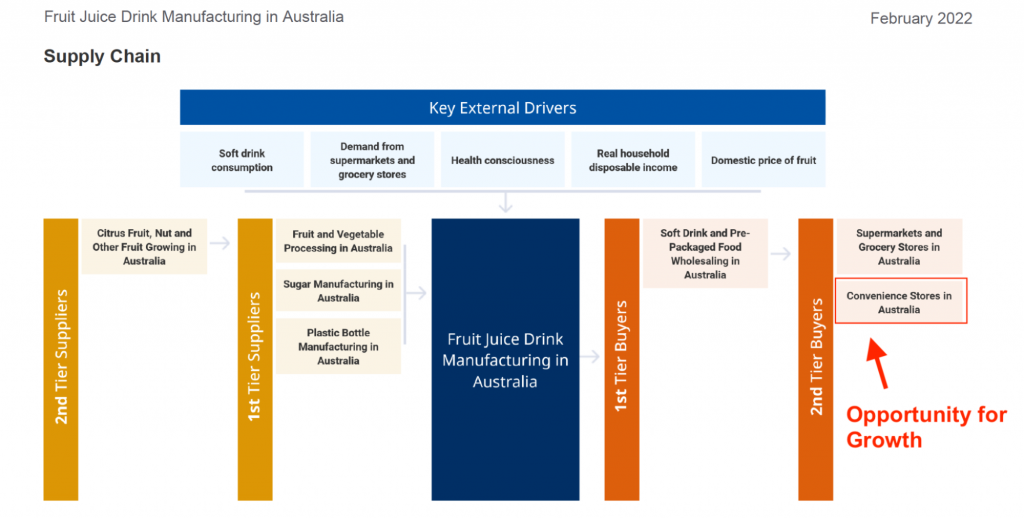

Here is a IBIS world’s breakdown of the fruit drink supply chain in Australia:

FOD only sells to supermarkets and grocery stores, not quick service stores.

Anywhere with a customer facing point of sale that sells convenience goods is an opportunity for FOD to sell its products. Think service stations, coffee shops, convenience stores etc…

This is an untapped market for FOD, and we think that any foothold into the quick service market could quickly improve FOD’s sales revenue.

Export to international markets

Long time FOD investors may be sceptical when hearing about the international export opportunity – FOD has been beating this drum for a number of years now.

However, with CEO Steven Cail’s ‘deliver first, celebrate second’ attitude, we think that any movements are legitimately promising.

Last month FOD announced that the Juice Labs Wellness Shots were being exported to Asian markets through key distribution partner Easychef.

And in the 4C released yesterday, FOD remarked that its attention for FY23 turns towards “further distribution… into targeted international markets”.

We think that IF FOD can secure one or two key export deals, then the company’s revenue could grow quickly – and based on our factory tour from a few months back, they have plenty of capacity to meet this additional demand.

For a company like FOD with a large portion of its costs as fixed (juicing equipment), any increase in sales distribution will lead to better margins through economies of scale.

We will be watching this space closely for any updates with regards to distribution increases and NPD.

Our 2022 FOD Investment Memo:

Below is our 2022 Investment Memo for FOD, where you can find a short, high level summary of our reasons for investing.

The memo’s ultimate purpose is to track our portfolio companies’ progress using our Investment Memo as a benchmark throughout 2022.

In our FOD Investment Memo, you’ll find:

- Key objectives for FOD in 2022

- Why we continue to hold FOD

- What the key risks to our investment thesis are

- Our investment plan