Overview: iCollege Limited (“iCollege”, “the Company”) is an Australian consumer services company focused on Vocational Education and Training (“VET”). iCollege is assembling a portfolio of Registered Training Organisations (“RTO”) via acquisitions. The Company also operates a cloud-based learning management platform that offers a range of accredited and non-accredited courses. iCollege listed on the Australian Securities Exchange in May 2014 via a reverse takeover of DGI Holdings Limited.

![]()

Catalysts: Closure and integration of recent acquisitions have the potential to upgrade the Company’s historically speculative risk profile. Synergies associated with the acquisitions and targeted partnerships with industry bodies are projected to sustain double-digit earnings growth. With its portfolio achieving student completion rates exceeding 90 percent, iCollege is positioned to capitalise on regulatory uncertainties in the VET industry by accelerating its acquisition strategy on favourable terms.

Hurdles: iCollege’s operations have historically generated 80 percent of income from Government sources. A task force is currently reviewing Federal Government funding of the VET system, and reforms could have a significant bearing on iCollege’s capacity to generate revenue and its cost of doing business. The Company’s RTO portfolio remains subject to integration risks. There is no guaranteed income provided by recent acquisitions that will eliminate iCollege’s reliance on external capital.

Investment View: iCollege offers speculative exposure to domestic demand for VET services. The existing income profile of its RTO portfolio, consolidation strategy and completion rates are attractive qualities. Successful portfolio integration alongside partnerships with major industry bodies present the major near-term catalysts. Principal risks are regulatory. Our valuation of $0.22/share represents a premium exceeding 100 percent to recent trade and does not incorporate potential upside from further acquisitions. Seeking to monitor synergy realisation within the enlarged group, we are initiating coverage.

iCollege Limited (“iCollege”, “the Company”) is an Australian consumer services company focused on vocational education. iCollege is assembling a portfolio of Registered Training Organisations (“RTO’s”) via acquisitions. The Company also operates a cloud-based learning management platform that offers a range of accredited and non-accredited courses.

Reverse listing in May 2014

The registered head office is in Perth, Western Australia. iCollege listed on the Australian Securities Exchange in May 2014 via a reverse takeover of DGI Holdings Limited. Following the completion of a rights issue currently underway and the conclusion of the Company’s upcoming AGM, the issued capital is projected to be $6million, or

$0.07/share.

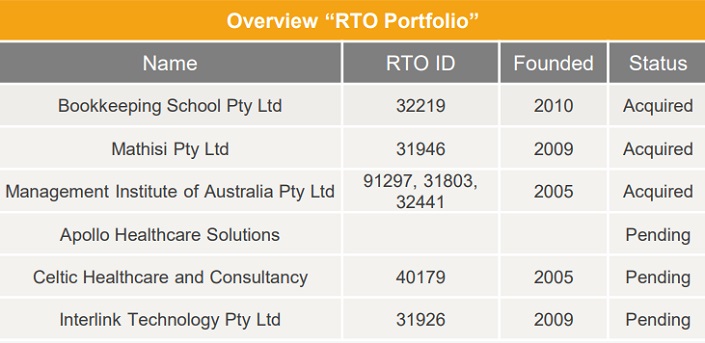

iCollege’s primary asset is a portfolio of Registered Training Organisations (“RTO’s”) as well as software associated with its online learning platform.

The Company currently owns three RTO’s and is in the process to acquire a further three. The RTO’s combined offer more than 70 accredited and non-accredited courses across 22 industries. The principal location of operation in Australia.

iCollege fully owns and operates Bookkeeping School Pty Ltd, Mathisi Pty Ltd, and Management Institute of Australia Pty Ltd.

The company has developed the iCollege platform, a cloud-based learning management platform that allows Australian students to complete accredited courses in their field of study. The e-learning platform is set to be integrated into each acquisition.

iCollege is currently in the process of acquiring a further three RTO’s which are Apollo Healthcare Solutions, Celtic Healthcare and Consultancy and Interlink Technology Pty Ltd.

Vocational Education and Training (“VET”) refers to applied learning programs such as apprenticeships, traineeships, and work skills. These programs can range from entry-level qualifications, advanced vocational diploma courses, and pathways into higher level tertiary education.

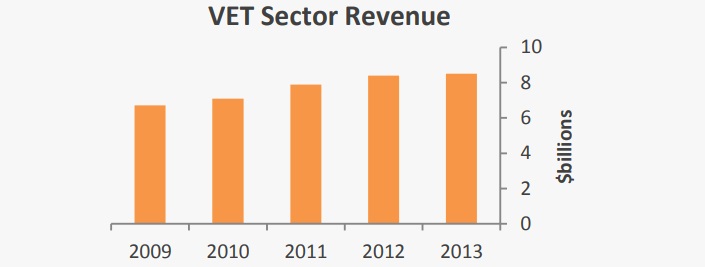

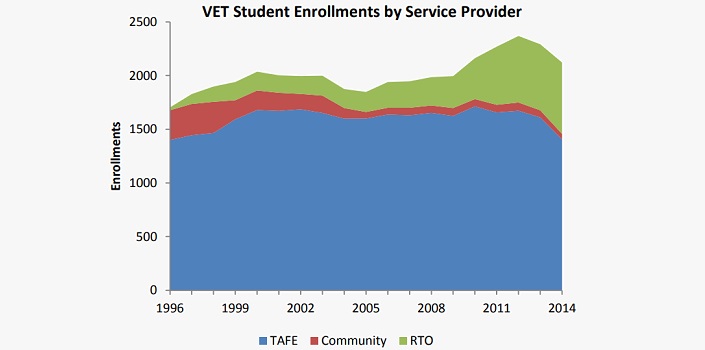

The domestic market for vocational education and training services is an $8billion industry, of which, around 80 percent of revenue is supplied via State and Federal Government funding programs.

From 2009-13, industry revenues expanded at a compound average rate of 6 percent pa as Government funding mechanisms shifted toward a ‘demand driven’ model.

VET sector revenue exceeds $8billion, of which 80 per cent is supplied through Government funding mechanisms

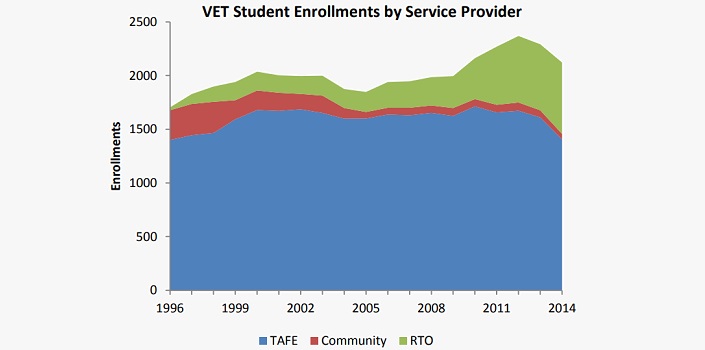

The 2009 restructure extended a two-decade trend that has seen private-based VET services providers attract an increasing market share. Due to their licensing requirements, private providers are known as Registered Training Organisations (“RTO”).

After expanding at a compound rate of 19 percent pa over the past two decades, the number of RTO’s in Australia now exceeds 5,000, accounting for over 30 percent of enrollments and completions.

Private sector VET market share exceeds 30 per cent

A task force, established by the Federal Government in November 2013, is currently investigating the impacts of recent reforms to the VET industry and opportunities for further reform.

iCollege is principally focused on building a portfolio of VET services that achieve better than average completion rates and employment for students.

The Company is positioned to capitalise on initiatives likely to emerge from the Federal Government taskforce and the current fragmented status of RTO’s within the VET industry. No single RTO has a dominant market share, providing iCollege the opportunity to become a consolidating force.

RTO landscape is highly fragmented

With uncertainties created by the Federal Government taskforce suppressing corporate activity in the industry, iCollege has the opportunity to enter mergers and acquisitions with other providers on favourable terms.

Thus far, the Company has secured acquisition agreements with six institutions forming its foundation RTO portfolio. Consolidation of overlapping cost centres, and cross-promotion of courses within the portfolio is the Company’s current priority.

iCollege aims to utilise current regulatory uncertainty to make further acquisitions on favourable terms

Subsequently, new partnerships with accredited industry trade bodies, and reducing its reliance on Government funding are expected to become a focus.

Whilst Government sources have historically generated 80 percent of pro forma income within its RTO portfolio, initiatives are in place to reduce Government contributions to circa 50 percent in 2016, with fee-paying students forming the balance.

Aim to increase contributions from fee paying students to 50%

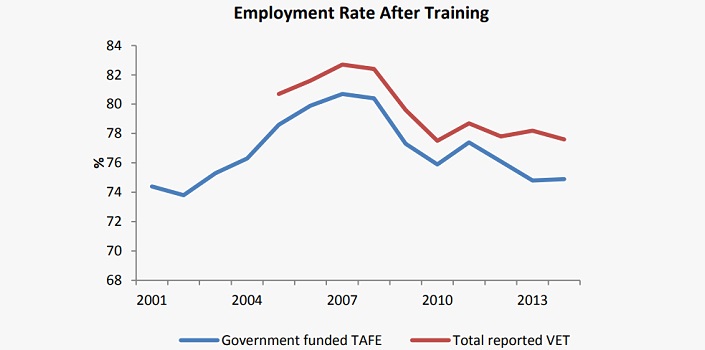

The principal economic drivers for iCollege are student enrollments, completion rates, occupancy, and teaching-related personnel costs. In order to drive growth, completion rates and subsequent employment outcomes are a priority for management.

Completion rates exceed 90 per cent

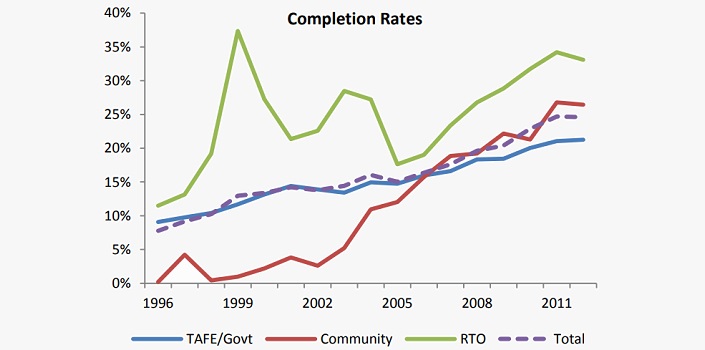

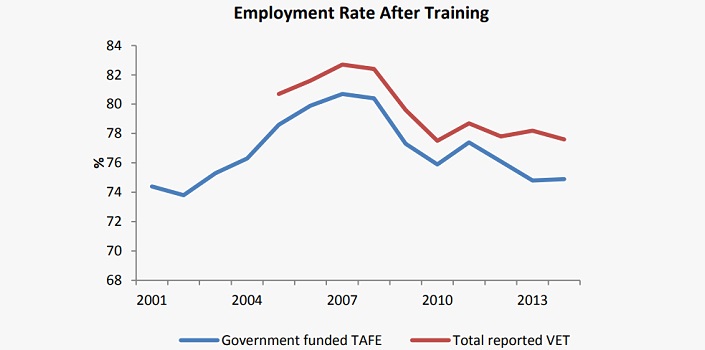

Enrolments that fail to complete impair an RTO’s ability to collect revenue. Although student completion rates have been rising across the VET industry for the past two decades, non-completion remains a major issue.

Industry average completion rates for both public and private providers stand at ~25 percent. We understand completion rates within iCollege’s portfolio are markedly superior, in the order of 90-

95 percent. By comparison, the average RTO completion rate

stands at ~33 percent.

iCollege is addressing low completion and declining employment rates plaguing the VET industry

In order to sustain superior completion rates, a principal focus for management is procuring partnerships with industry bodies and stakeholders to maximise employment outcomes.

Whilst completion rates have been rising across the VET industry, we understand recent declines in employment rates post-completion are a major driver of the Federal Government’s current task force.

iCollege generates income from Government and privately funded course fees. However, as its operating history as a VET service provider is limited the Company has not yet eliminated its reliance on external capital.

During FY15, the Company recorded revenue of $0.6million and a loss after tax of $2.3million.

To date, iCollege has financed operations via equity and hybrid security issuances. Its most recently completed fundraising exercise was a 12-month convertible loan facility, successfully raising $1.3m. The loan may be converted to shares at an exercise price of $0.15 per share.

The Company is currently in the process of conducting a rights issue. Existing shareholders have the opportunity to acquire additional shares on a one for four basis at a price of $0.10. Subscribers to the offer are entitled to a free option on a one for two basis, exercisable at $0.20 and expiring July 2017. The rights issue has the potential to raise $1.6million before costs.

Following the entitlement offer and iCollege’s upcoming AGM, the issued capital is scheduled to stand at $6million, or $0.07/share.

iCollege’s investment appeal rests in the current and future revenue streams generated by its RTO portfolio, as well as the Company’s capacity to make further acquisitions.

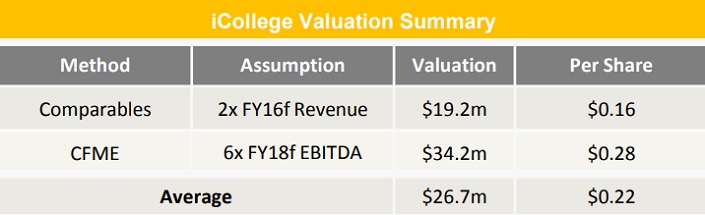

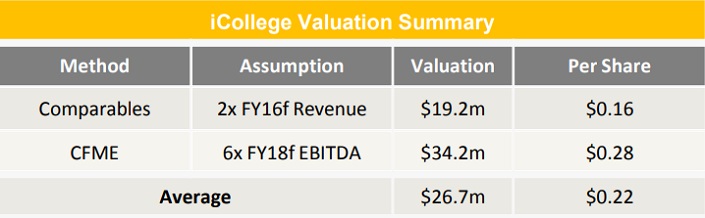

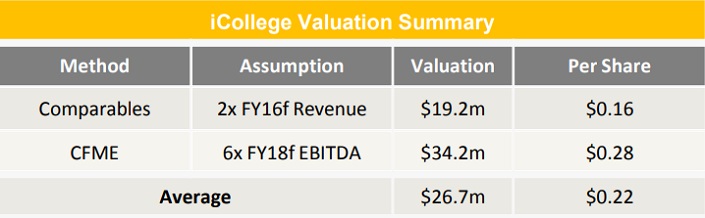

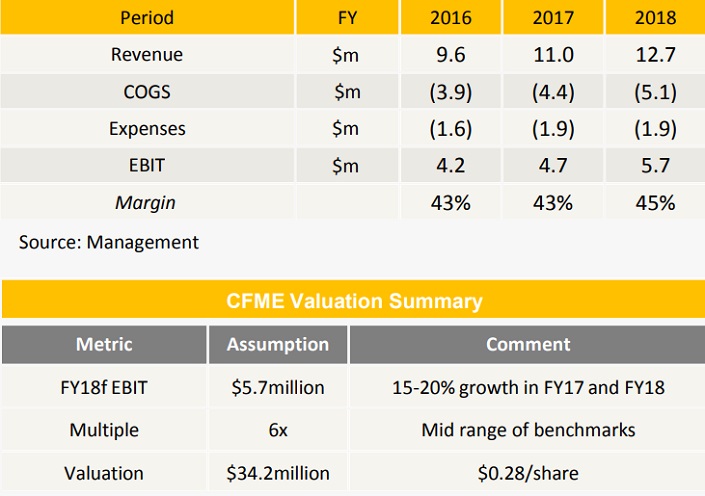

To appraise its potential worth, we have considered the Company’s valuation utilising a Comparables approach and Capitalisation of Future Maintainable Earnings (“CFME”) methodology.

Our appraisal is based on an expanded share count of 121.2million, assuming the current rights issue is concluded successfully and long dated $0.20/share options are exercised. In aggregate, the expanded share base represents additional funding of ~$6.4million.

Valuation $0.22/share

Our Comparables method arrives at a valuation of $19.2million, or $0.16/share. Our CFME method arrives at a valuation of $34.2million, or $0.28/share. Applying equal weightings to both methods delivers an aggregate valuation of $26.7milion, or $0.22/share.

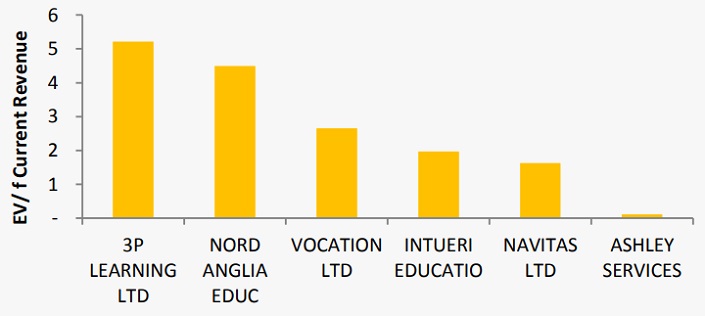

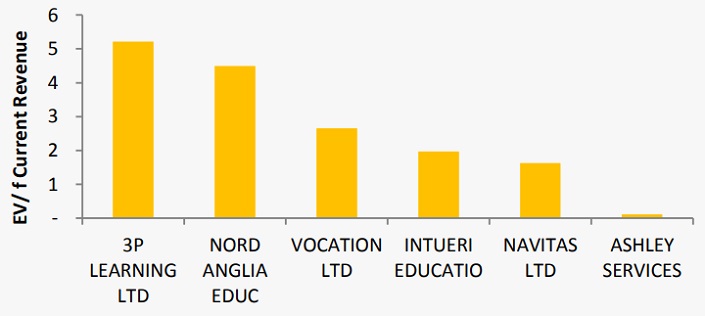

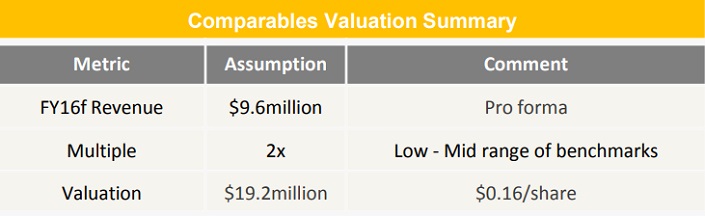

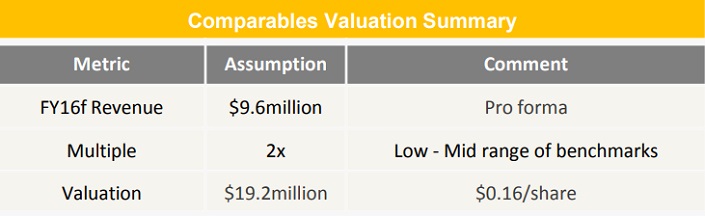

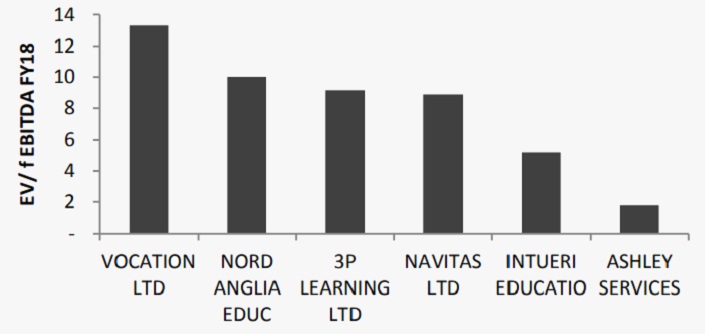

A universe of comparable companies has been assembled which are principally engaged in the provision of educational services and software.

Utilisng current year revenue projections, valuation multiples range from 1x to 5x. The company’s offering recurrent or multi-year services trade at the upper end of the valuation curve. For iCollege, we have adopted a low to mid-range multiple of 2x to our FY16 revenue projection of $9.6million to arrive at a comparables valuation of $19.2million or $0.16/share.

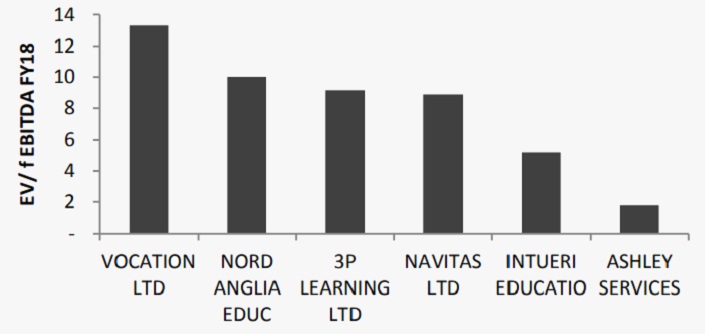

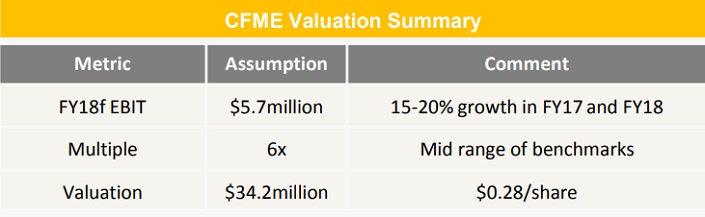

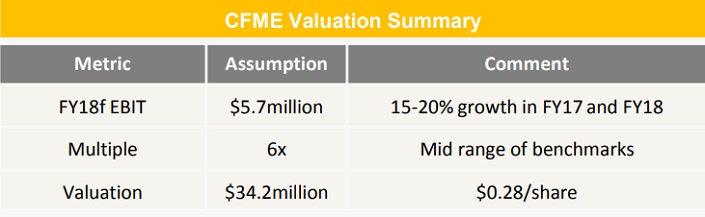

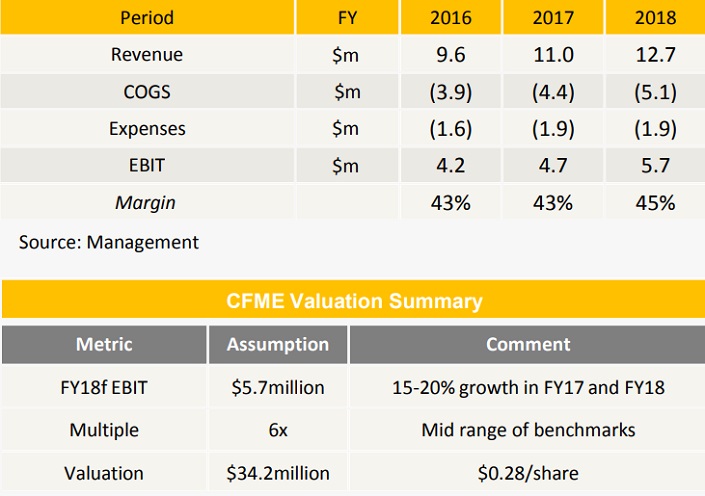

In conjunction with management, we have projected the Company’s financial performance for the next three financial years to a level that represents a sustainable earnings capacity. To our estimation of future maintainable earnings, an industry-based multiple has been applied to arrive at a valuation of the Company.

Projections are only based on existing portfolio

Our financial projections assume iCollege successfully completes the pending acquisitions of Apollo Healthcare Solutions, Celtic Healthcare and Consultancy, and Interlink Technology Pty Ltd during FY16. Subsequently, we project the enlarged group to generate revenue growth of 15 percent for the next two financial years.

Our projections assume the enlarged group achieves a moderate degree of cost efficiencies and revenue synergies through cross-promotion. No further acquisitions have been incorporated.

By FY18, we project iCollege to generate operating earnings of ~$5.7million, to which we have applied a low to mid-range industry multiple of 6x. The CFME method arrives at a valuation of $34.2million, or $0.28/share.

iCollege offers speculative exposure to domestic demand for vocational education and training services. The existing income profile of its RTO portfolio, consolidation strategy, exceptional completion rates, and customer-centric focus are attractive qualities.

Successful integration of its recently completed and pending acquisitions, alongside partnerships with major industry bodies present the major near-term catalysts. Delivery of these milestones is incorporated into our financial projections, although the potential for further acquisitions remains an unaccounted source of upside.

Industry partnerships are a major driver

Principal risks surround the Company’s substantial reliance on Government funding, the potential for regulatory change to impact its cost of doing business, competition within the industry, and the need to integrate its RTO portfolio.

Our valuation of $0.22/share represents a premium exceeding 100 percent to recent trade and does not incorporate potential upside from further acquisitions. Seeking to monitor synergy realisation within the enlarged group, we are initiating coverage.

Mr. Ross Cotton was previously Executive Director of iCollege and has recently been appointed Executive Chairman, effective 6 October 2015. Ross Cotton is also the corporate advisor for Regency Corporate. As a corporate advisor, he has been advising both public and private companies on strategy, financing, acquisitions, and corporate restructuring. Prior to iCollege Ross Cotton has worked in the stockbroking industry and raised capital for small and mid-cap companies.

Mr. Stuart Manifold has been appointed Chief Executive Officer on 6 October 2015 following the role of Chief Operating Officer. Stuart was previously CEO of Risktec Australasia which focused on Crisis Management and Emergency Response Training and Consulting. Risktec was sold in 2008. Stuart Manifold has served on the board of the Entrepreneurs Organisation in WA.

Philip is Non-Executive Director for iCollege and Managing director of Regency Corporate Pty Ltd. Regency Corporate is an advisory business based in Western Australia. Philip Re has experience in raising capital, restructuring businesses, and undertaking initial public offerings. Board positions held include South American Ferro Metals Limited, Promesa Limited, Transit Holdings Limited, Belleview Resources Limited, and Meridian Minerals Limited.

Andrew Clevald has been appointed Non-Executive Director on 6 October 2015 following iCollect’s management and board restructure. Andrew Clevald is Director and Principal at Navitas- owned Curtin College based at Curtin University. As director Andrew oversees principal operations of the College but also strategic and financial aspects.

Whilst the Company aims to increase its proportion of user-pay revenue, approximately 80 percent of iCollege’s pro forma revenue is presently derived from Government funding. With the Government presently conducting a review of its vocational education funding program any adverse changes could have a material impact on iCollege’s financial performance.

The market for vocational education services is highly competitive. There are over 5,000 RTO’s in Australia which could have a significant impact on iCollege’s capacity to attract students and teaching personnel.

iCollege’s RTO portfolio is still in the process of being acquired. The enlarged business, therefore, remains subject to significant integration risks which could adversely influence the financial performance of the enlarged group.

Whilst iCollege is projected to generate positive earnings and cash flow on a pro forma basis, there is no guarantee its reliance on external capital has been eliminated. There is no guarantee current funding initiatives can be successfully concluded or that additional capital will be available to the Company to make further acquisitions.

The valuation is contingent on iCollege successfully integrating its RTO portfolio and achieving double-digit organic growth rates through to 2018. Failure to achieve these milestones would substantially impair the valuation.

THE BULLS SAY

THE BEARS SAY

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.