FYI to be first to market with a superior battery metals product?

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and Associated Entities, own 1,097,000 FYI shares at the time of publication. S3 Consortium Pty Ltd has been engaged by FYI to share our commentary and opinion on the progress of our Investment in FYI over time.

The prospect of a new, innovative, cleaner, purer, cheaper process to produce high purity alumina (HPA) has boosted the long-term outlook of our specialist batteries metal tech investment, FYI Resources (ASX:FYI).

Backed by the $10BN capped Aloca, FYI could be in a prime position to become a go to supplier for High Purity Alumina globally.

FYI is moving toward the construction phase of its demonstration plant prior to its main WA plant.

The project NPV is forecast to be over US$1BN and in exchange for funding US$243M, Alcoa can become majority owners with a 65% stake, while FYI retains a 35% stake.

HPA is drawing heightened attention as a key component for separators in electric vehicle batteries (amongst other uses such as LED screens…etc) — and as consumers switch from gas guzzlers to electric vehicles, demand for HPA is soaring.

The market for HPA is expected to tip into a supply deficit from around 2024 that is expected to last for the foreseeable future.

Having been labelled a critical mineral by the Australian Government earlier this year, we can expect the HPA sector to draw upon added support at the Federal level.

FYI is our long-term Investment within the HPA sector — we will go into the reasons why shortly.

It’s worth noting that our best returns have come from our green and battery metals Investments to date, consider:

- VUL – lithium, up over 3,500%

- EXR – green hydrogen, coal seam gas, up over 250%

- EMN – manganese, up over 350%

- PRL – green hydrogen, up over 450%

- EV1 – graphite, up over 100%

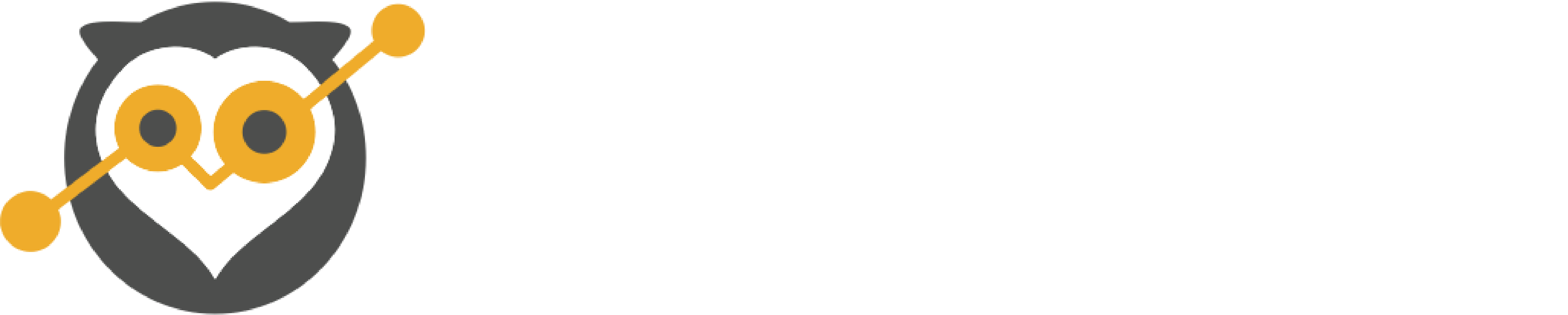

Alas, the past 12 months has been a topsy turvy period for FYI, at least from a markets perspective. The company started 2021 trading at around 25 cents per share, rose to over 80 cents per share by September 2021 just prior to a major deal with Alcoa, before falling to earth again – trading around 20 cents per share now.

Back to where it started…

FYI is currently trading at a substantial discount to our most recent Subsequent Investment (of ~45 cents per share). Whilst we’d obviously prefer our Investments to be in the black, at Wise-Owl we are long-term holders, and are content to provide the companies that we back with 4 to 7 years to execute their vision.

On this front, we believe that FYI has continued to steadily progress its technology with commercialisation within reach in the next few years, and it remains well funded to succeed.

In short, with the funding decision coming before year-end, it may not be long before FYI earns a re-rate and joins the successes of our other battery metals Investments.

Today we launch our Investment Memorandum in our Investment in FYI Resources.

In this note you’ll find:

- What FYI does

- The macro picture

- Why we like it

- What we want to see FYI deliver in the next 12 months

- What could go wrong

- Our Investment plan

FYI Resources – back to the future

Our specialist battery metals Investment FYI Resources Ltd (ASX:FYI) is on the path to commercialising its innovative HPA technology, a new process that is cleaner, purer, and much less expensive than conventional methods.

FYI is backed by leading global alumina company Alcoa, with a binding agreement through to production with its Australian subsidiary. Alcoa Corporation (NYSE: AA) is a US$10+Bn-capped, Fortune 500 company, and one of the world’s largest alumina producers.

Our belief is that the Alcoa JV binding term sheet greatly de-risks the project (essentially a 65:35 split with Alcoa the major owner), removes almost all the project financing required by FYI, and provides credibility to its prospects of transitioning into a real business enterprise that can deliver consistent shareholder returns for years to come.

If Alcoa and FYI can commercialise the technology, the reward is substantial. FYI’s HPA project has already progressed through the definitive feasibility study (DFS) stage, with the project having a net present value (NPV) in excess of US$1B.

This comes at a time where there is increasing focus on critical materials such as HPA.

As we pointed out above, in March this year, the government added HPA to its list of critical materials, alongside 24 others including lithium, rare earths, cobalt and platinum.

This is important as the government is supporting these sectors, having pledged some $2.5 billion in debt and equity towards these sectors over the past 12 months.

Aside from the special status of HPA in Australia and abroad, its usage in a high-growth market segment of electric batteries is fueling demand at present.

Batteries consist of three parts:

- Anode (this is where the lithium goes)

- Cathode (primarily graphite)

- Separator

The separator has been a major growth sector for HPA, as HPA is increasingly the material of choice. Among the reasons for its greater utilisation, one is that HPA is fire resistant – you might recall an issue Samsung Galaxy phones had several years ago with batteries catching fire on flights (these previously used plastic polymer separators).

In addition to the safety benefits, HPA improves the ability of separators to withstand high rates of discharge and enhance battery performance durability.

In our view, FYI is one of the most advanced HPA companies on the ASX today – it is shunning the centuries’ old bauxite-based process of producing HPA and promoting a cleaner, cheaper, kaolin-clay based technology.

The company has already progressed beyond Definitive Feasibility Study and has secured funding through to commercialisation – a huge hurdle for other peer companies.

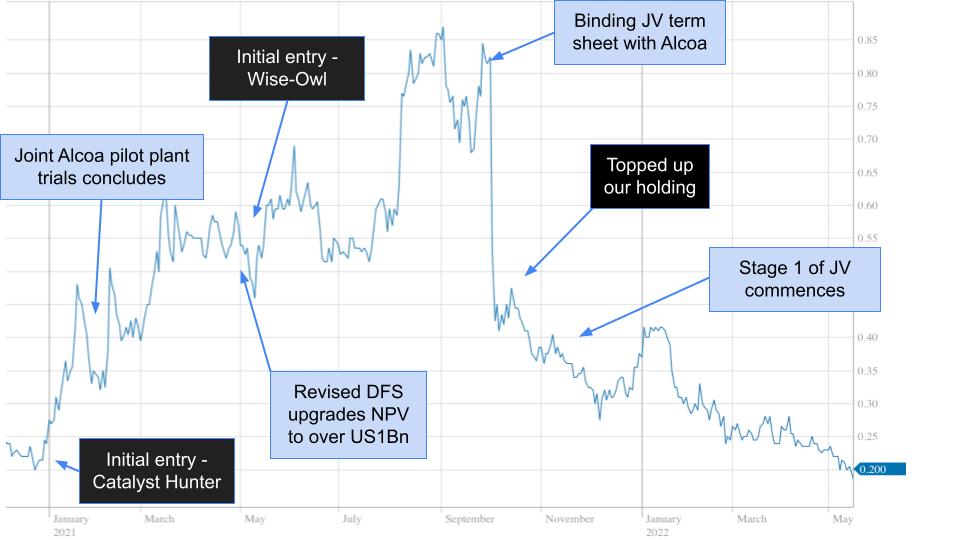

A useful summation of where we see FYI is at present is provided below, mixing the positive tailwinds of the HPA market and timing with project specifics of validation and funding, and corporate side of quality partners:

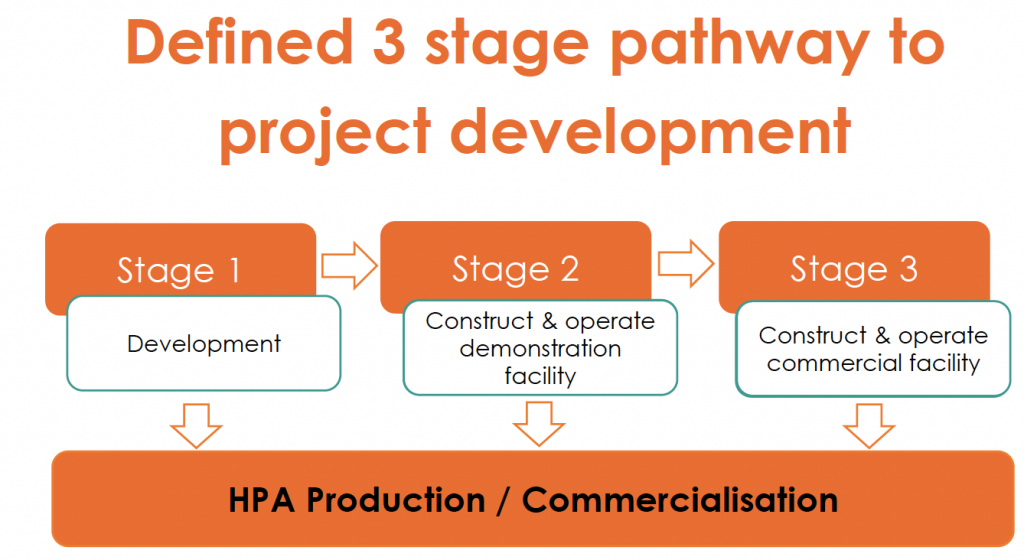

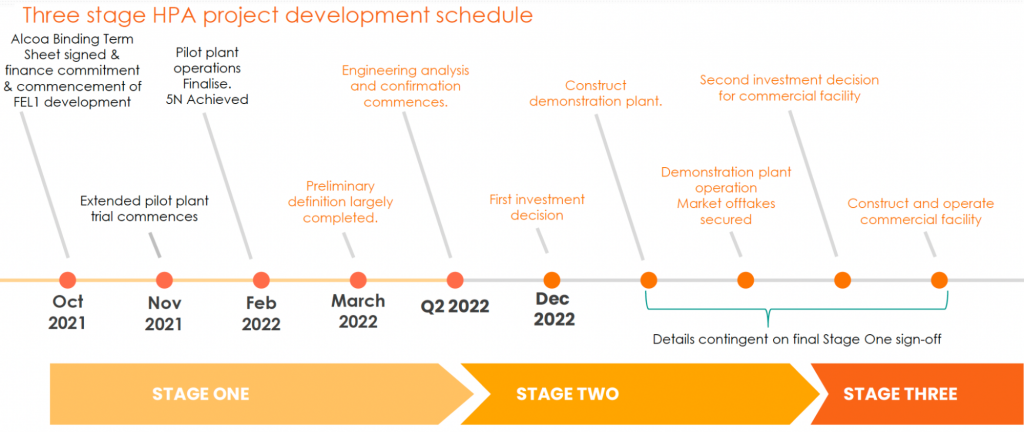

We also like that it is a simple three step process towards commercialisation of FYI’s technology, as illustrated below:

As for timing, FYI expects to commence HPA production in 2024 (about 6 months delayed from our initial projections), ramping up to full-scale production in the following year.

This timeline aligns well with the looming HPA supply deficit, which we will go into detail later.

Our belief is that FYI should be the first to market utilising its “revolutionary” kaolin-based process to produce HPA at roughly US$6,000/t.

This production cost compares very favourably with current costs of the traditional bauxite-based process of around US$15,000/t. That process hasn’t changed much since the late 1800’s — it is dirtier, produces a less pure HPA, yet remains the primary method used today.

If successful, we think that FYI would:

- Deliver a superior HPA product

- Produce HPA at ~40% of the cost that current traditional producers

- Target a market expected to continue to grow strongly

- Time their production just as that market crosses into supply deficit

- Be first to market with ground-breaking new production process

We believe this to be a compelling business proposition… provided the team can execute.

So can they? We think so, but obviously there are some risks along the way – we will get to these in our Investment Memo later.

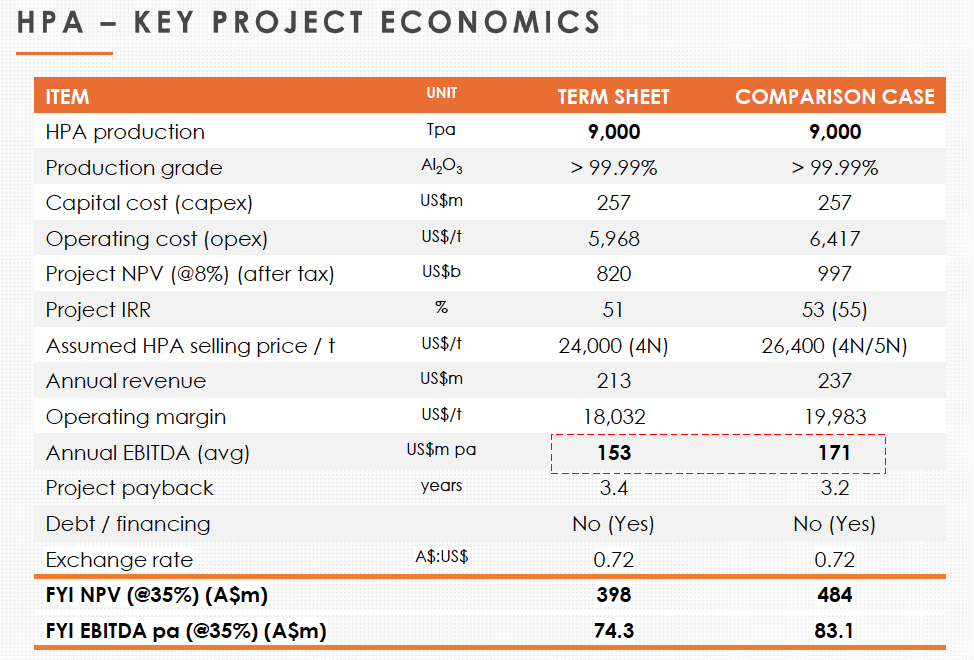

On the financial side, if the project is fully developed to deliver 9,000 tonnes per annum 4N HPA product across two plants (a smaller demonstration plant, followed by the main facility), then FYI would be looking at receiving an earnings stream (EBITDA) in excess of $70M per annum for the next 25 years.

These numbers assume the base-case scenario – that is, just the demonstration and primary production facility contributing, and just 4N purity product (4N refers to 4 nines for purity, i.e. 99.99% HPA the higher the number of N’s, the greater the premium pricing received).

Upside still remains for any other new facility that is built utilising the same technology, or if production is expanded, or if 5N production is later implemented into the production mix.

As aforementioned, the world’s leading aluminium producer Alcoa is betting on FYI’s success, with its Australian subsidiary entering a binding joint-venture term sheet with FYI in September 2021. This matters, as under the terms of the joint venture, Alcoa is essentially funding development through to commercialisation – provided the technology shapes up.

If all objectives are achieved, risks are mitigated and the macro tailwinds continue, we expect the share price to re-rate by the end of the year following Alcoa’s first significant funding decision in December, ahead of commencing construction of the demonstration plant.

With that, let’s take a look at our FYI Investment Memo outlining our thesis for investing in FYI for the year ahead.

Below is a breakdown of our 2022 Investment Memo for FYI

What does FYI do?

FYI is essentially a technology company specialising in producing high purity alumina (HPA).

In essence, under its binding term sheet with Alcoa, FYI receives 35% of the revenue generated from projects that utilise its technology.

What is the Macro Theme behind FYI

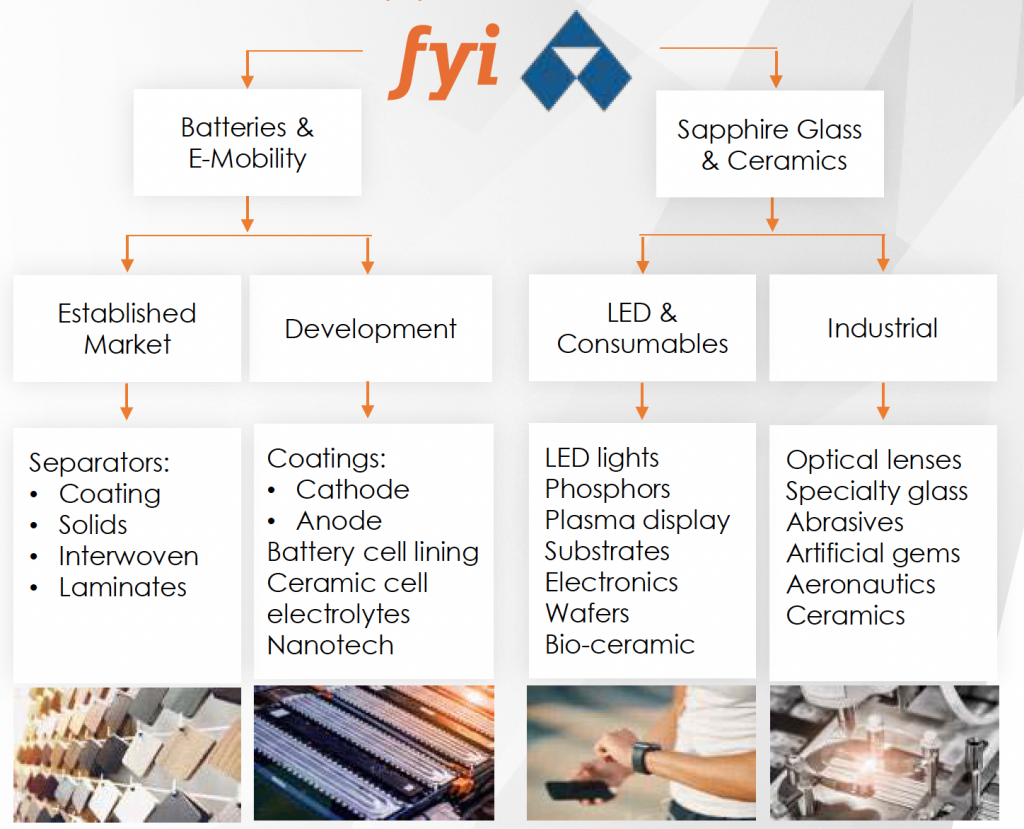

As we mentioned previously, our best returns have derived from investments within either the battery metals or green space – which is front and centre of where FYI is focused. Below is a graphic illustrating the key uses for HPA. We have focused on its use as a separator within lithium batteries (which is a significant growth sector for HPA). But there are several other key uses for HPA, many of which FYI’s product is suitable for.

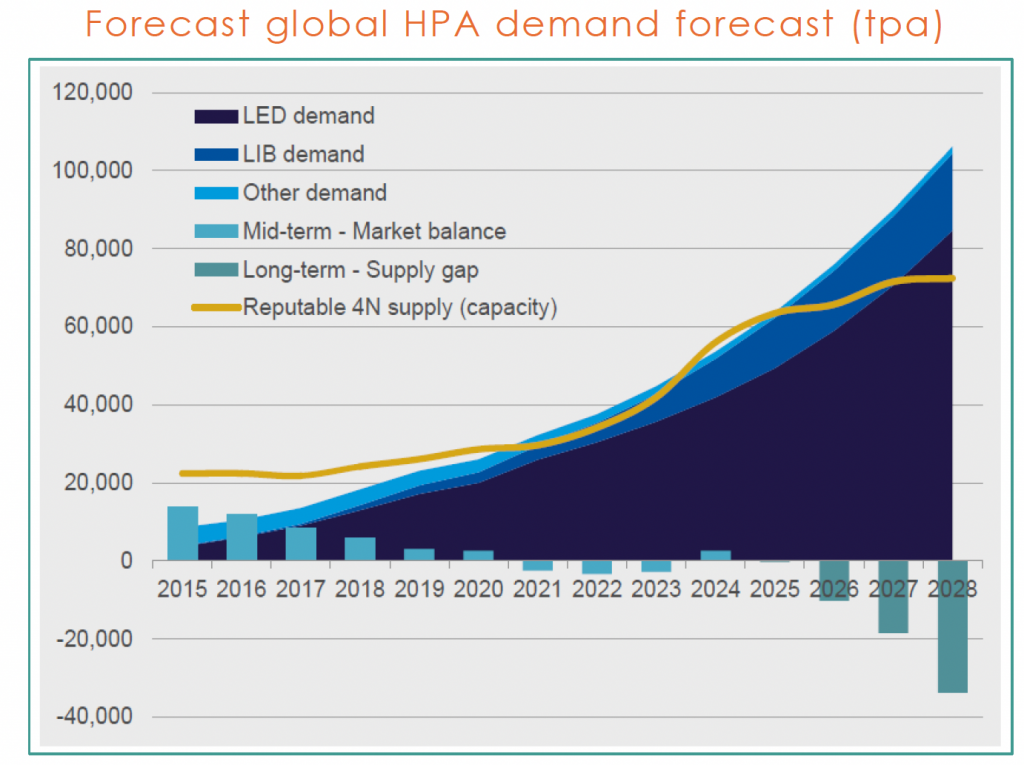

Below is a graphic illustrating the key uses for HPA. We have focused on its use as a separator within lithium batteries (which is a significant growth sector for HPA). But there are several other key uses for HPA, many of which FYI’s product is suitable for. The other key macroeconomic tailwind in FYI’s favour is that the HPA market is edging towards deficit. Below is a chart outlining the market for HPA and forecasts for the decade ahead.

The other key macroeconomic tailwind in FYI’s favour is that the HPA market is edging towards deficit. Below is a chart outlining the market for HPA and forecasts for the decade ahead.

You can see from this chart that come 2025, demand is tipped to exceed supply for HPA and the supply deficit is expected to be heightened as the decade progresses.

This matches well with the timeframe to full capacity production for FYI/ Alcoa.

New technology could move old process towards extinction

Another key macroeconomic tailwind benefitting FYI is the process by which most HPA is currently produced.

HPA is traditionally derived from aluminium via bauxite, producing an end product of variable end product quality and high levels of impurities. It is a carbon intensive process that has seen little evolution since the 1880s.

FYI intends to initially use its own kaolin clay as a feedstock for its HPA production – FYI owns the Cadoux aluminous clay (kaolin) deposit in WA which has a resource that supports over 100 years of production. The process is simple, resulting in cheaper capital and operating costs, and substantially lowers the environmental footprint of HPA production.

FYI’s process reduces raw material waste and generates low toxic waste, with extensive recycling at the inputs and outputs.

FYI has calculated approximately 50% reduction in greenhouse gas emissions and 40% reduction in processing energy consumption per ton of HPA.

This matters as customers are putting increasingly more onus on ESG factors – pollution, emissions, etc., when making business decisions. FYI’s process rates well on several key ESG metrics that the market is now considering for its suppliers.

Why we continue to hold FYI

We have three key reasons we continue to hold FYI (indeed, we increased our Investment late last year based on these factors).

Of these, we suspect that funding is going to be a key hurdle that many alternative HPA players will find difficult to overcome.

Project financing will typically require several hundreds of millions of dollars, yet the market capitalisation of many HPA players is significantly under $100 million – meaning that drawing project financing from equity markets will likely be vastly insufficient.

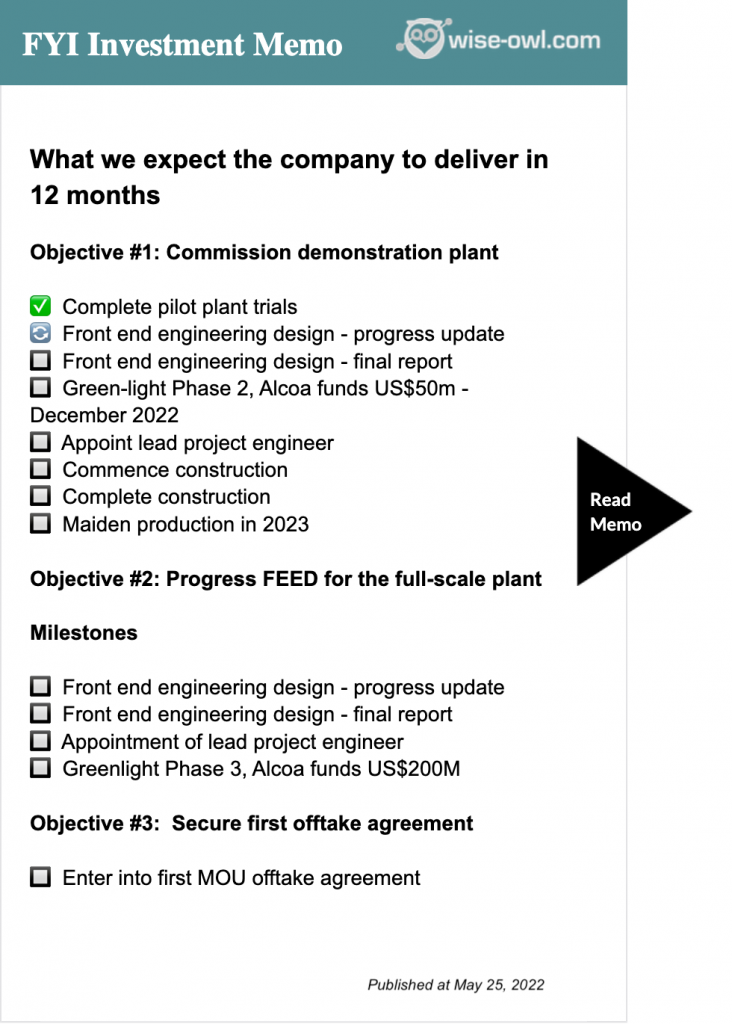

What we want to see FYI deliver in 2022

We view 2022 as a significant year for FYI’s development.

Primarily, Alcoa’s first significant cash injection decision comes in December 2021 – we see this as the next real test of its commitment to commercialisation.

Subject to the technology continuing to prove itself through pilot plant trials, and following front end engineering design progress, Alcoa can greenlight construction of the demonstration plant through funding US$50m at this time.

So, we boil down a successful year as the following:

Success – Alcoa funds US$50M to progress the JV through construction of the demo plant.

Failure – Alcoa declines funding. Unless the JV is restructured at this point, this terminates the Alcoa-FYI arrangement that secures funding to commercialisation. In this scenario, FYI would re-take 100% ownership of the HPA project and technology, but would need to raise US$200M+ to fund commercialisation – a tall order. The development schedule and timeline is below, with FYI currently transitioning to Stage 2 development (ie greenlighting the demonstration plant).

The development schedule and timeline is below, with FYI currently transitioning to Stage 2 development (ie greenlighting the demonstration plant).

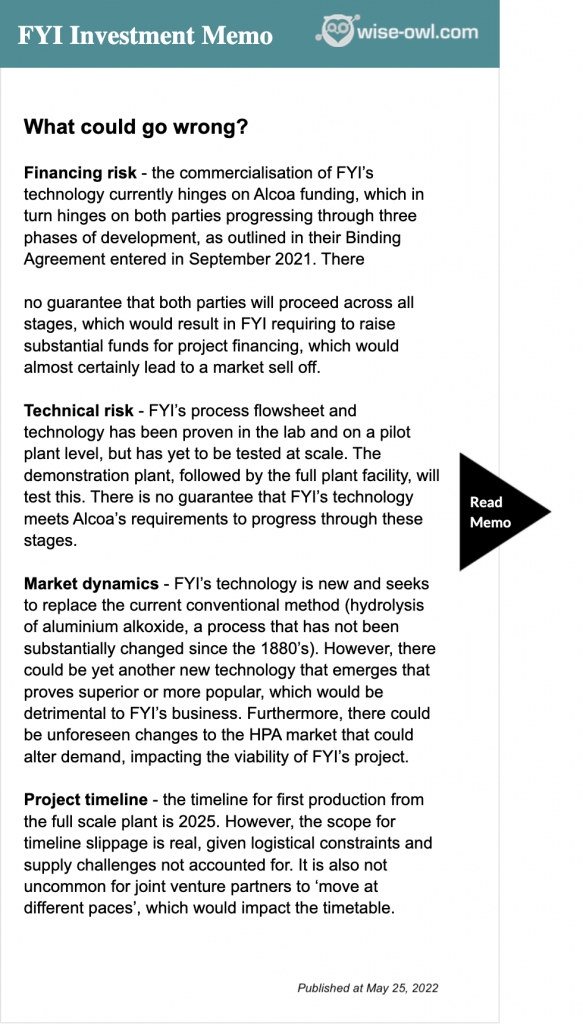

What are the risks

We have identified four key risks for FYI.

What is our investment plan

Conclusion

We’ll be following FYI’s progress over the next 12 months, and will provide updates as important milestones are delivered. We are excited to see the technology and joint venture with Alcoa progress, and look forward to seeing a new, cleaner and greener, less expensive source of HPA becoming available in the near future.