Can IRD be the next to join the big league?

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 1,402,907 IRD shares at the time of publication. S3 Consortium Pty Ltd has been engaged by IRD to share our commentary and opinion on the progress of our investment in IRD over time.

It was a topsy-turvy year for iron ore in 2021.

Aggressive stimulus programs led by China in response to the pandemic saw steel demand balloon, and combined with disrupted supply, iron ore hit record high prices mid-year, breaching the US$230/t mark.

But prices quickly reversed course, plummeting later in the year by more than half to under US$100/t as China abruptly curbed its demand.

Now we are well into 2022 and iron ore optimism has returned, prices have resumed their longer-term uptrend and analysts are raising targets.

With that in mind, today we launch our 2022 Investment Memo for Iron Road Ltd (ASX: IRD), our iron ore investment in our long term Wise-Owl portfolio.

Our IRD Investment Memo provides a short, high-level summary that outlines our reasons for investing in and continuing to hold a position in IRD.

It also covers the risks involved with the investment and our own investment plan.

It details the objectives that we want to see IRD achieve in the year ahead, specifically, attracting a strategic partner to help fund and derisk its main project, plus the greenlighting of the Cape Hardy Port development – more on these later.

We will use the memo to track IRD’s progress over time and how it compares to our expectations.

Capped at under $150M, IRD remains one of the few companies with its hands on a significant, development ready, high product grade iron ore project, anywhere in the world.

“Development ready” is the key term here.

Projects not yet at this stage are unlikely to capitalise on the latest growing demand nor the historically high prices for high-grade iron ore.

Whilst there are plenty of iron ore projects, only a handful are ready for commercialisation now AND are of substantial size and quality.

That’s because big iron ore projects routinely take decades to progress from inception to production.

Consider Australia’s next iron ore producer, the Iron Bridge Project, which Fortescue acquired back in 2003. Almost two decades later and is only now nearing the starting blocks to first production — expected around Christmas time.

Companies can’t simply respond to recent positive iron ore tailwinds by flicking a switch to bring on new production.

It takes a very long time, with permitting hurdles to overcome and significant capital required to reach production. After 14 years of work and investment, IRD is now closing in on production in the coming years.

This is one of the key reasons why we invested in IRD as our long-term pick in the iron ore space — it has already done the hard yards.

The project economics stack up well, especially in today’s low Aussie dollar, high commodity price environment.

Though the cost (CAPEX) is a high hurdle at ~US$1.7BN — pointing to just how big this could be — we think that a project value (NPV) in excess of US$3BN could be justified in today’s environment, based on IRD’s optimised study findings. More on these later.

We have outlined all the reasons why we are invested in IRD and will continue to remain invested this year in our Investment Memo. The memo also lists the key objectives that we will be looking for IRD to achieve this year in order to give us confidence that progress is tracking as expected.

IRD has been progressing its flagship Central Eyre Iron Project (CEIP) in South Australia since it listed on the ASX in 2008.

It has grown the project into Australia’s largest undeveloped magnetite deposit with a whopping 3.7 billion tonne Ore Reserve that is capable of producing 589Mt of high-grade magnetite (66.7% Fe) over the life of the mine, having invested almost $180M in the process.

CEIP sits just ~140km from IRD’s port development, which will facilitate the iron ore reaching the market.

That extensive time and expenditure commitment sees IRD positioned as one of the next cabs off the rank for iron ore commercialisation.

We like that IRD has significantly de-risked its flagship project beyond the definitive feasibility phase and more recent optimisation stages.

Since we invested at a low-point in the investment life cycle of mining companies, we think there is upside to be realised if IRD can successfully navigate the funding risk.

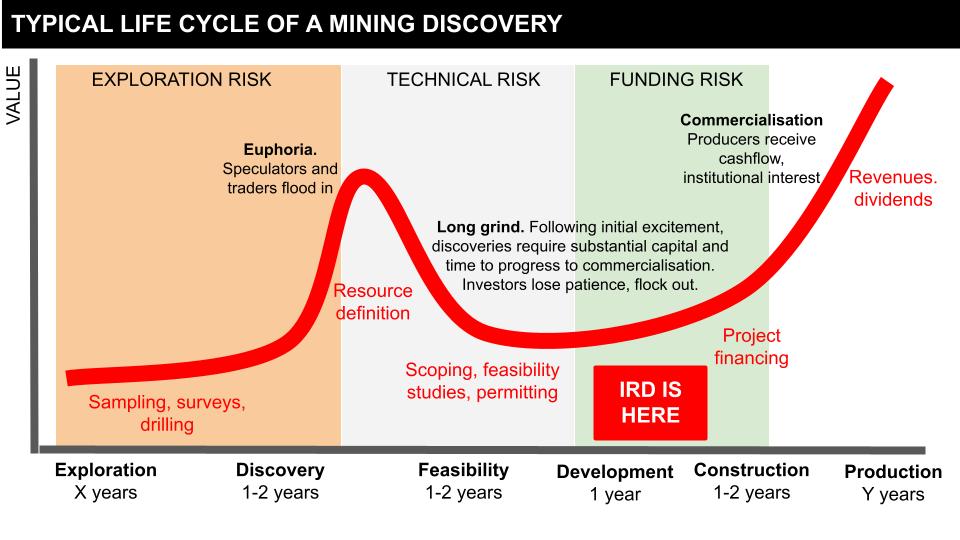

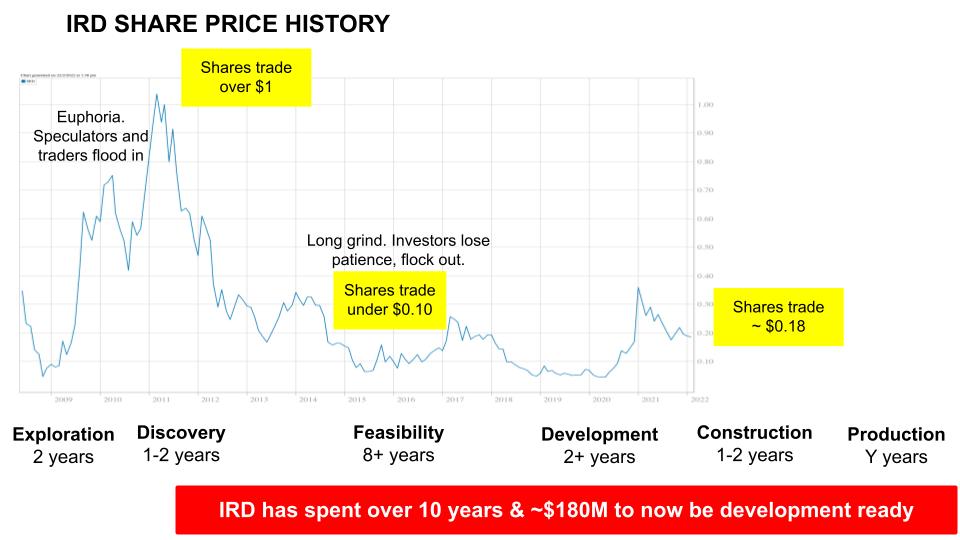

Below is what the typical value returns profile of a mining company over time, starting from early exploration, to making a discovery, through the feasibility (ie permitting, environmental and land studies, scoping and feasibility studies), and then the development (engineering, project financing), construction, and all the way to production.

The “scoping, feasibility studies, permitting” stage typically takes over a decade for big iron ore projects, given the size, infrastructure requirements and impact of operations. This compares to just a few years for other commodities, including many precious and base metals.

We’ve marked where we think IRD is at this stage in the above chart in a red box.

Compare that cycle to the chart below spanning IRD’s share price performance since its 2008 IPO to 2022. Here you can see that IRD continues to work through feasibility and development stages after spiking on an earlier discovery. The stock remains in a lull as it works towards bedding down a project partnership arrangement, construction and eventual production.

As is the case with other big iron ore plays, IRD’s path to commercialisation is taking much longer than other non-bulk commodity juniors.

If we are correct, and provided that IRD can secure project financing through a strategic partner/s, the company appears well placed to deliver to return to investors going forward. Nothing is a guarantee of course – we’ll also cover the risks associated with our investment in IRD.

Sure and steady progress continues

Good things come to those that wait… at least according to the motherhood adage.

At Wise-Owl, we look for long-term investments that have the potential to deliver significant returns over a 4+ year investment horizon. We have the patience to withstand the market ups and downs, allowing sufficient time for management to execute their vision.

Following almost a year of due diligence and research, we added IRD to the portfolio in May 2021, just as iron ore prices were setting new historical highs.

Besides the advanced status of its flagship, we liked IRD’s tight register and board composition (there are very, very, few juniors that have a former BHP chairman sitting on the board).

We think that IRD has a good chance of being in the next generation of iron ore companies to join the big leagues.

We are patient long term holders, and believe that our investment in IRD had already been substantially de-risked over the past 14 years. This bodes well for future returns, especially given the robust commodity demand of late.

We think that IRD remains on track to be one of the very few iron ore developers that is able to transition to significant production – i.e. over 10 million tonnes per annum (Mtpa) – over the next few years.

What do we want to see IRD deliver this year

We continue to follow the IRD story closely in 2022, a year where we expect the company to finally transition from the feasibility to commercialisation phase of its main project…

Which brings us to our 2022 IRD Investment Memo – here we outline our investment thesis and key objectives we expect IRD to deliver by year end.

The purpose of this is to record our current thinking as a benchmark to assess IRD’s performance at year-end against our expectations. We have created this memo based on our own research, opinions and expectations.

As the year progresses, we will cover IRD’s progress on each listed objective as outlined in the Investment Memo. As the objectives are ticked off and the risks to our thesis addressed, we will update readers on how we think the company is progressing.

Here is a breakdown of our 2022 IRD Investment Memo:

- What IRD does

- The macro picture

- Why we like it

- What we want to see IRD achieve in 2022

- What could go wrong

- Our investment plan

Below is a breakdown of our 2022 Investment Memo for IRD:

Who is IRD?

IRD is an iron ore junior with one of the most advanced, high product grade, significant iron ore projects ready for development anywhere in the world today.

IRD’s iron ore prospects are our primary focus and main appeal to our investment decision. We also acknowledge that the company’s multi-commodity port opportunity (backed by Macquarie Capital) could be significant too, leveraging IRD’s iron ore products with an export logistics solution.

What is the Macro Theme behind IRD

Iron ore is the key input of refined iron and steel products – a cornerstone requirement to our modern life, central in construction and infrastructure, vehicles, appliances…etc.

Iron ore is the key input of refined iron and steel products – a cornerstone requirement to our modern life, central in construction and infrastructure, vehicles, appliances…etc.

Stimulus packages introduced by the world’s largest economic powers are pitched at driving investment at a public and private level, particularly in the areas of infrastructure development and large-scale building projects, initiatives that are likely to underpin strong steel demand for years to come.

On the supply side, Australia is the world’s largest exporter of iron ore, comfortably more than double that of what second placed Brazil provides.

On the demand side, China is by far the biggest importer, accounting for around two-thirds of all seaborne iron ore supply (following on, China is by far the biggest steel producer globally). This means that what happens in China has a sizable impact on the wider iron ore market.

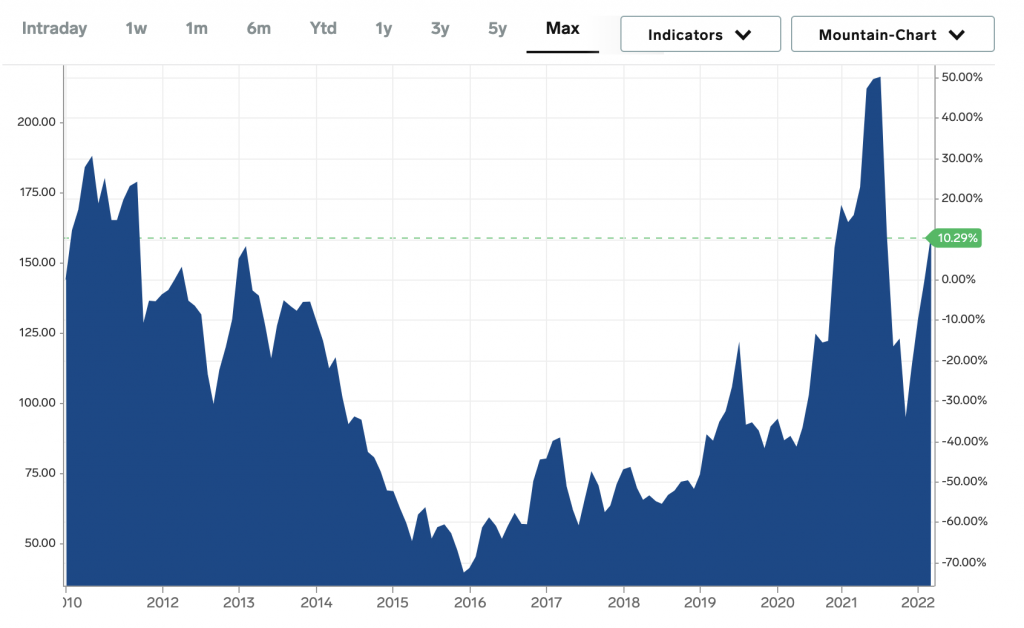

This is reflected in how the iron ore price has travelled over the past decade. Here is the price chart since 2010 (when we refer to iron ore prices, the commonly used benchmark is 62% Fe (iron) grade).

Iron ore Fe 62% spot price – 10 years. Market Index.

You can see the previous boom period was in the 2010-2013 range, with spot prices trading fairly consistently above the US$100/t mark. This helped spur a number of juniors to becoming $1Bn+ capped entities — consider the likes of Atlas Iron, Mt Gibson, and the emergence of Fortescue Metals Group.

Prices subsequently fell to a low, under US$40/t in 2015, as steel demand in China weakened substantially and remained fairly subdued through to late 2019, when the market began to pick up again and prices again breached the US$120/t mark.

Then COVID hit.

Nations shut down and economic activity halted. A pandemic-induced cut in global steel consumption led to a 2020 low price of sub-US$80/t.

But by mid-2021 this quickly rebounded to new dizzy heights, setting record highs above $230/t as nations around the world launched aggressive stimulus spending packages to re-ignite their economies.

Whilst iron ore demand sky-rocketed, before halving to under US$100/t in late 2021, and now returning to levels around US$150/t today, the supply side has remained severely constrained. Indeed, current supply levels from the big five global producers have remained fairly static for the past five years.

The combination of growing demand and constrained supply points to favourable macro-tailwinds for iron ore companies — especially those already in production, or with advanced assets ready for development, like IRD.

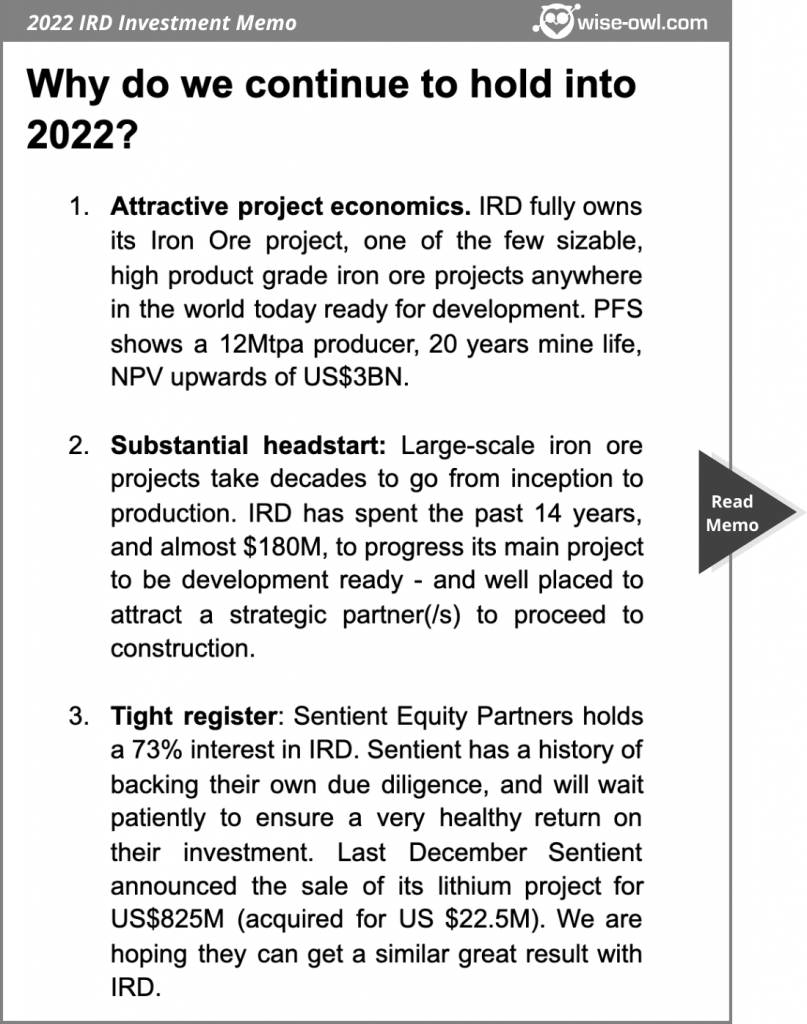

Why we continue to hold IRD

Despite the supportive commodity market sentiment over the past few years, we think that only companies with very advanced projects will be able to meaningfully and sustainably capitalise on the strong iron ore price.

Despite the supportive commodity market sentiment over the past few years, we think that only companies with very advanced projects will be able to meaningfully and sustainably capitalise on the strong iron ore price.

That’s because it takes a very, very, very long time — and substantial capital — for any significant iron ore project to get up and running. And that makes sense given the huge scale, project impact and infrastructure requirements of iron ore projects.

We maintain that IRD owns one of the very few, significant, development ready, high-grade iron ore projects available today that could be up and running within the next few years.

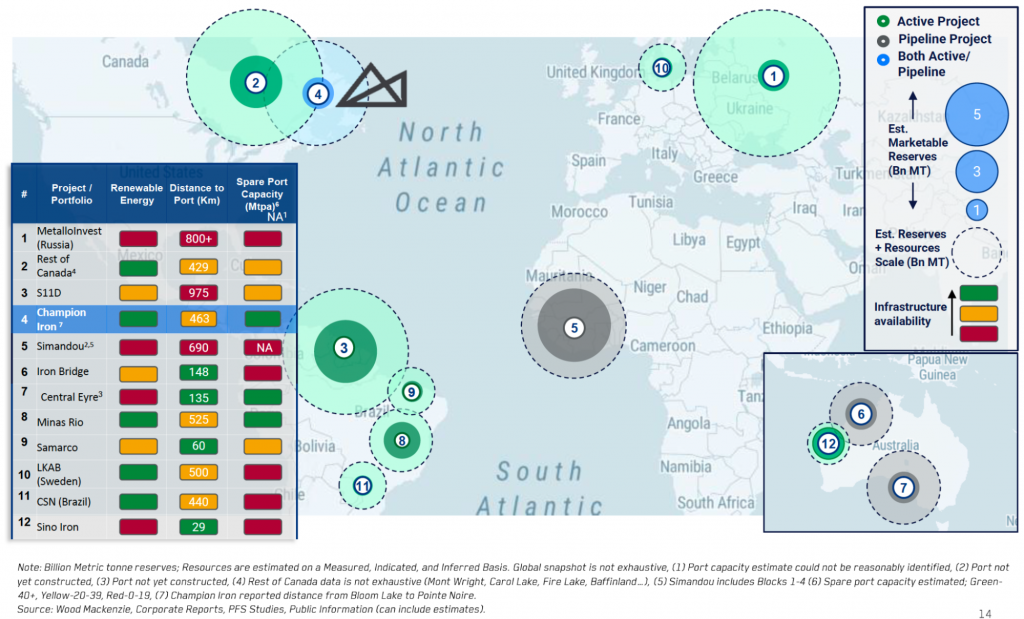

The slide below is from the latest presentation of ~$3.5BN capped producer Champion Iron (ASX:CIA), highlighting 12 high grade, significant iron ore projects that are either already in operation or else credibly in the development phase.

Source: Champion Iron February 2022 investor presentation

The slide shows that there really aren’t that many substantial options available today for new, high-grade supply to enter the market.

We also note that IRD’s main project (#7 in the slide) screens highest in terms of proximity to port, and spare port capacity, complementing its long-life and scale. Whilst it screens lower for access to renewable energy, we think that South Australia’s commitment to a Green Hydrogen hub nearby will change that going forward.

Furthermore, the project economics appear to stack up well.

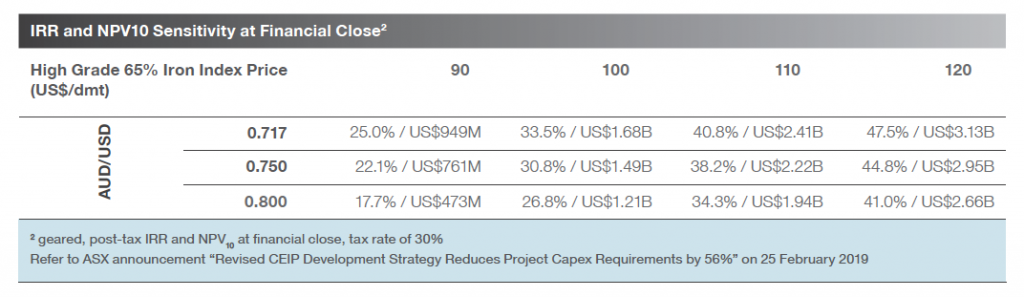

IRD released findings from its optimised feasibility study for a 12Mtpa CEIP operation in early 2019 – this was re-done off its earlier Definitive Feasibility Study (DFS) that had a 21.5Mtpa operation as its basis.

Whilst the study displayed favourable project economics back then, the potential returns and upside are only heightened further under current commodity dynamics (ie much higher pricing today, very few projects ready to add new supply to the market).

Let’s look at the Net Present Value (NPV) of the project across several exchange rate and 65% Fe commodity price scenarios:

Source: 2021 November Annual General Meeting – CEO’s Presentation

The NPV helps investors evaluate the profitability of proposed investments – it does this by translating the amount of future money you’d expect to make from an investment into today’s dollars. The higher the NPV, the more profitable the investment is expected to be.

Even under the most conservative scenario in the above table, the NPV is US$473M – not bad.

That assumes 65% Fe commodity pricing of US$90/t – comparing to ~US170/t recently (ie substantial 85% margin cushion at present). It also assumes a very high AUD/USD exchange rate of 80 cents – comparing to ~73 cents this week (about a 9% cushion).

With the Aussie dollar hovering around 72 cents since 2020 (which is about the 5 year average), we think that the first row is more akin to where the market currently is.

Just crunching those numbers (applying the US$120/t pricing for 65% Fe grade) and applying recent foreign exchange rates of 73, our rough calculations show that the project is valued well north of US$3 billion.

Even allowing for significant retracement in the commodity price (say to ~US$95/t level), an NPV of over US$1 billion would appear justified.

Following on, we think that IRD’s main project remains a rare beast in terms of being development ready and of significant size, and possesses attractive project dynamics, especially at current exchange rate/ commodity pricing levels.

What we want to see IRD deliver in 2022

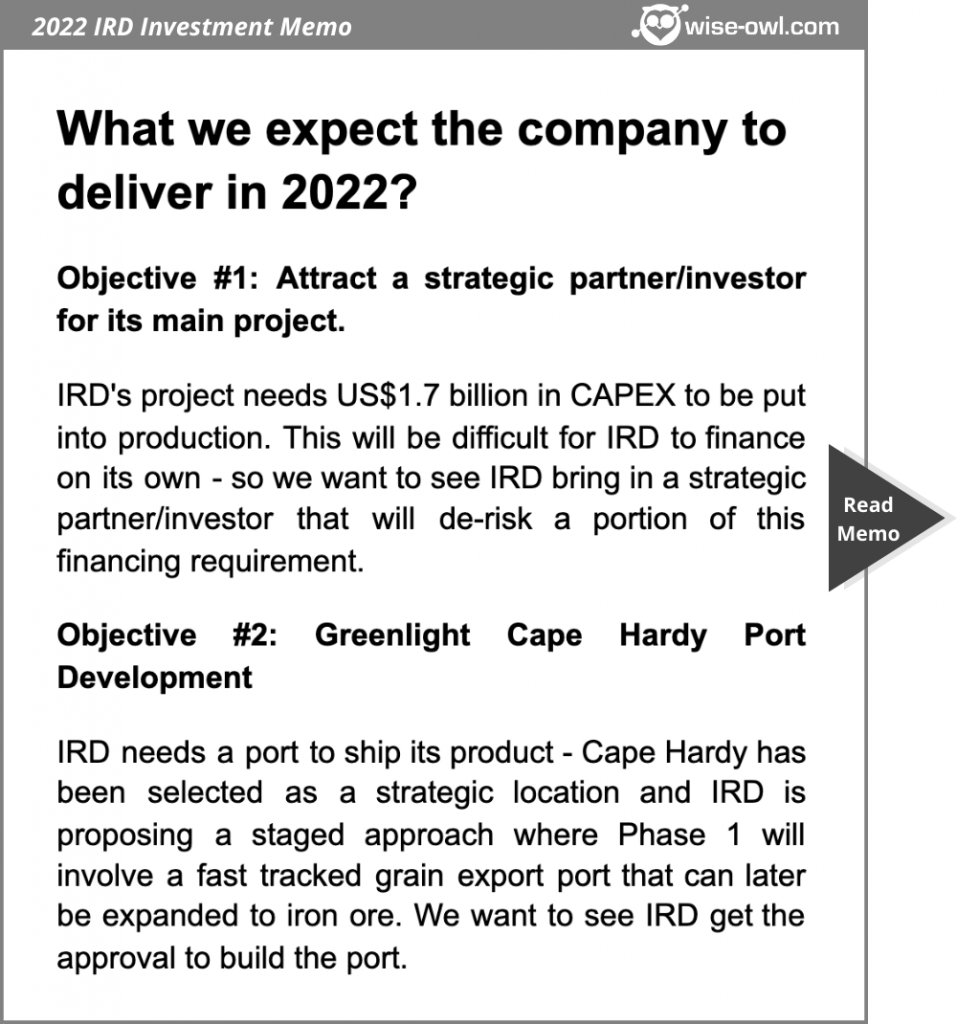

We have two objectives for IRD this year that will be used as benchmarks against which the company’s performance over the coming 12 months will be assessed.

Objective #1: Attract a strategic partner / investor

The primary objective is for IRD to attract a strategic partner/s for its main project. Success here would translate to securing project funding and the project moving into construction and ultimately production.

Failure translates to the project stalling – not much can be advanced until funding is secured.

We suspect interest might come from the likes of a steel producer (looking to secure long-term supply) or else a larger iron ore producer (looking to expand/ grow), or perhaps a consortium including both.

We understand that IRD has had discussions with suitable parties, but suspect that the pandemic and bans on travel to South Australia had slowed progress. With borders open again, we want this to be the year that IRD concludes arrangements for a strategic partner to come aboard.

Objective #2: Greenlight Cape Hardy

Secondly, we would like to see the Cape Hardy port approved for development.

It is more likely for this to be accelerated once Objective #1 is settled, as there would be more certainty with export requirements at that stage (ie IRD could pre-select Cape Hardy as the logistics route for its product).

Prior to this, we would expect to see other groups also commit to using the port facilities.

There is also potential for IRD to skip ahead to Stage II development (before Stage I occurs), and/or develop both stages in parallel. The buoyant iron ore market makes a much stronger economic case to do this.

Any developments on South Australia’s proposed green hydrogen hub could also accelerate development of Cape Hardy, subject to it being selected as the preferred export channel.

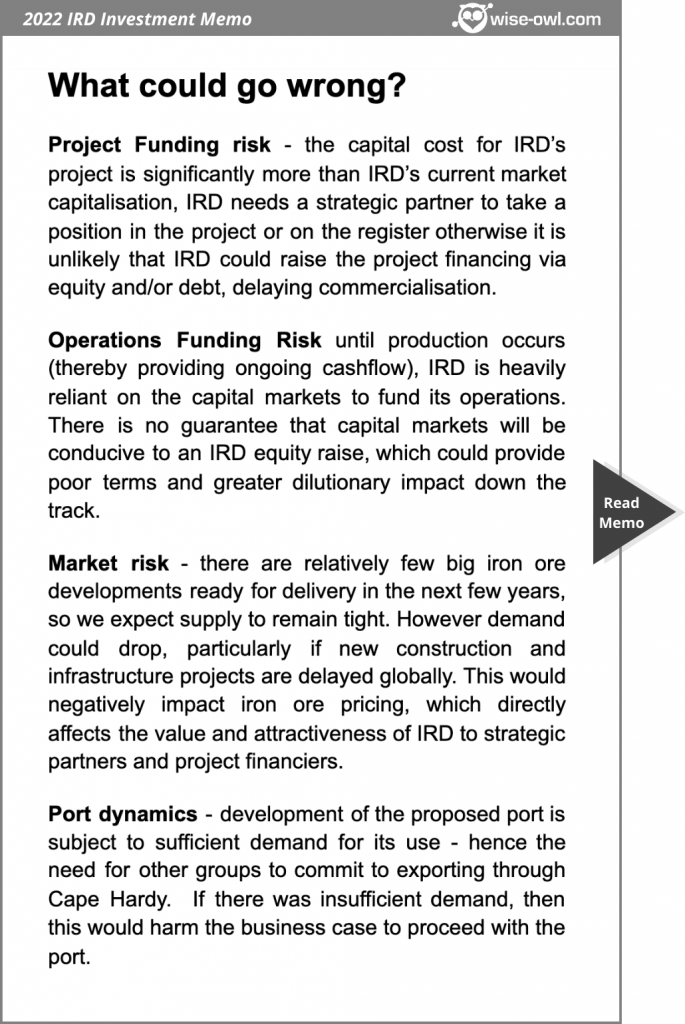

What are the risks

The first major risk to our investment thesis relates to Objective 1 in our Investment Memo.

The first major risk to our investment thesis relates to Objective 1 in our Investment Memo.

IRD has essentially advanced its main project as far as it can go. The company now needs to secure funding, to commercialise the project – without securing this funding, the project cannot advance to construction and ultimately production.

The capital cost for its flagship project is substantial at US$1.7BN, which is well beyond IRD’s capability to raise via equity. Tapping the debt markets can form part of the solution, as too securing offtake agreements that pay up front for guaranteed supply.

However, we think the only realistic route to securing funding will be by attracting a strategic partner(/s) that takes a position in the project or on the register.

Should such a partner not be found, it is highly unlikely that IRD could raise the project financing via equity and/or debt, delaying commercialisation of its flagship This would have the follow on effect of delaying Stage II development of Cape Hardy.

The second major risk is with respect to Objective #1 in our Investment Memo.

On the supply side, there are relatively few big iron ore developments ready for delivery in the next few years, so we expect supply to remain tight.

On the demand side, whilst stimulus spending will likely create growing demand for steel and iron ore, there is no guarantee that these stimulus programs eventuate globally, or to a level that will ripple through the iron ore market. If iron ore demand declines for a significant period of years, particularly if new construction and infrastructure projects are delayed globally, this would negatively impact iron ore pricing, which directly affects the value and attractiveness of IRD’s flagship to strategic partners and project financiers.

The third major risk is with respect to Objective #2 in our Investment Memo.

A port without demand for its use is not going to get built, nor continue to operate.

Development of the proposed Cape Hardy port is subject to sufficient demand for its use – hence the need for other groups to commit to exporting through Cape Hardy. Having the grain growers co-operative should provide some grain exports, but there would likely be need for other groups to choose to use the port as well, to back its development.

If there was insufficient demand from exporters such as the grain growers and the proposed green hydrogen hub, then this would negatively impact the business case to proceed with the port.

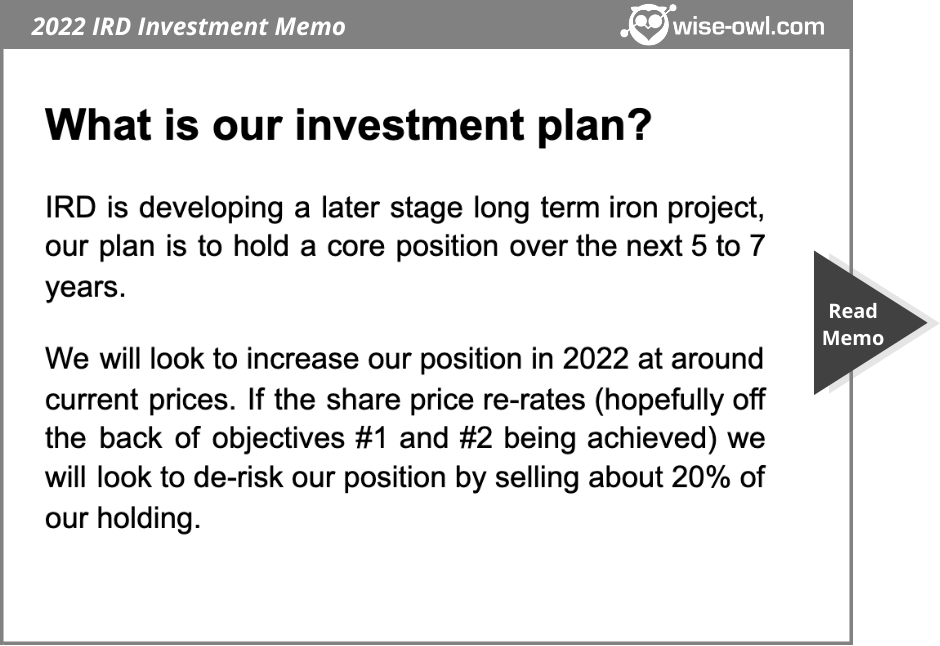

What is our investment plan?

As long term investors, we are looking to see a significant share price re-rate as IRD looks to secure a strategic partner and project financing, especially given the current buoyant commodity market and favourable exchange rate conditions.

Our investment in IRD has ultimately treaded water over the past year, in line with movements in the commodity market.

We will look to increase our position in 2022 at around current prices. If the share price re-rates (hopefully off the back of objectives #1 and #2 being achieved) we will look to de-risk our position by selling about 20% of our holding.

So that wraps up our summary of what we want to see from our investment in IRD during 2022.

Our 2022 IRD Investment Memo:

Below is our 2022 investment memo for IRD including:

- Key objectives for IRD in 2022 (shown above)

- Why we invested in IRD

- What the key risks to our investment thesis are

- Our investment plan