Overview: ClearView Wealth Ltd (“ClearView Wealth”, “the Company”) is an Australian financial services company focused on life insurance and wealth management. The Life Insurance division accounts for approximately 85 percent of earnings, while Wealth Management makes up less than 10 percent. In addition, ClearView has built an aligned financial adviser network primarily comprised of self-employed advisers covering ~$8.2bn of FUMA.

![]()

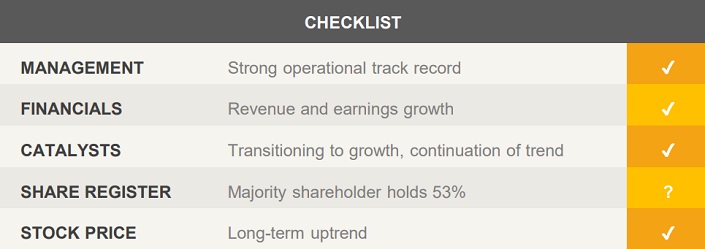

Catalysts: ClearView Wealth has increased operating revenue for the past five financial years at an average annual growth rate of 16 percent. The company has established a sales and distribution pipeline and is now transitioning to the ‘growth’ phase. Continuation of this trend whilst scaling up the business is the major value driver. A recent capital raising was used to repay the Debt Funding facility, whilst a further $50m facility remains in place for future funding. With the majority shareholder looking to divest their holding, there is potential for a takeover.

Hurdles: Maintaining sufficient capital adequacy whilst executing management’s growth strategy is the primary hurdle. While its majority shareholder controls over 50 percent of the company’s stock, the ability for minority shareholders to influence direction is impaired. There is also the risk of stock overhang in case of a sell-down which is currently being discussed. Regulatory hurdles may impact ClearView’s business.

Investment View: ClearView Wealth offers profitable exposure to the domestic insurance market. We are attracted to the company’s revenue growth trajectory, ability to scale up the business, and balance sheet. Hurdles include maintaining liquidity and the company’s capital structure. ClearView Wealth is experiencing growth across all key metrics, which may enable management to reward shareholders with higher dividend distributions in the future. The dividend has been increased for the past two consecutive years and recognising ClearView’s potential for capital growth and income, we initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.