EMH Raises $14M and Edges Closer to Lithium Production

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 261,000 EMH shares at the time of publication. S3 Consortium Pty Ltd has been engaged by EMH to share our commentary on the progress of our investment in EMH over time.

Our battery metals investment European Metals Holdings Ltd (ASX: EMH) is developing the largest hard rock lithium resource in the EU.

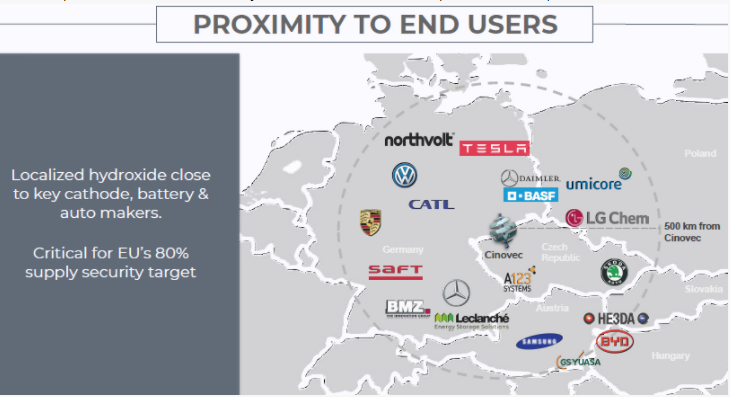

EMH’s advanced stage lithium project is ideally located in the Czech Republic, on the border with battery metal hungry Germany and in close proximity to the continent’s largest automobile manufacturers.

EMH came out with a double salvo of announcements last night, both progressing the company towards its goal of becoming the first local EU battery grade lithium producer.

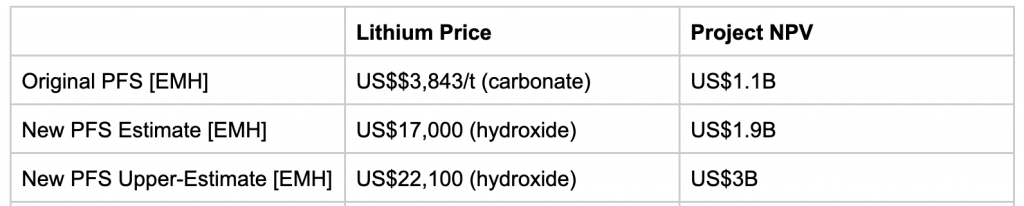

Firstly, EMH announced the results from the updated pre-feasibility study (PFS) – increasing the project’s post-tax NPV by 75% from US$1.1 billion to US$1.94 billion.

AND

EMH raised ~$14.4M in a placement to two big institutional backers, one of which is Ellerston Capital (a Sydney based fund with over $4bn in funds under management).

Institutional investors like Ellerston Capital add important stability to EMH’s share register as institutional investors generally hold for a long period of time, like ourselves. Bringing a fund in also helps put a valuation floor under the company share price and reduces the amount of volatility from short term traders entering and exiting the stock.

Looking at the updated economics of EHM’s project in the PFS…

The increased NPV assumes a long-term price for lithium hydroxide of US$17,000 per tonne. Which is currently long-way below the current market prices of ~US$36,000 per tonne.

For EMH to achieve a 75% mark-up on the previous NPV using a very conservative lithium hydroxide price is an impressive result and the right move.

With the current market price of lithium trading at significant overs to the price estimate used by EMH, we did some back-of-the-napkin calculations on what the NPV could look like if we modelled the project’s lifecycle using today’s lithium hydroxide prices.

The sensitivity analysis is showing us that a ~US$1,000/tonne increase in the price of Lithium Hydroxide translates to a ~US$200M increase in NPV, and the current price of lithium hydroxide trading around US$36,000 the Post-tax NPV could be around ~US$5.8 Billion.

Of course we don’t have a detailed NPV model telling us this and it is all just back of the envelope calculations, we are relying on the figures released in the PFS to justify our investment in EMH.

It is unlikely the lithium price stays at these elevated levels over the project’s entire life-cycle, but these calculations demonstrate the potential upside remaining in the project if the lithium price maintains.

Here is a breakdown of the increase in project NPV as the lithium price increases, noting that the current lithium price is well above the estimate used for the PFS:

With strong project economics and with lithium prices where they are today, we believe that EHM’s lithium project could prove to be critical to Europe’s ambition to secure the domestic battery metals supply chain.

Given the solid results out yesterday from EMH we will cover:

- A review of the specifics of the updated PFS.

- What we think of the $14.4M placement completed @ $1.40 per share.

- Share our 2022 investment memo for EMH

A Closer Look at Yesterday’s Announcement:

Yesterday’s PFS update models out the effects of two key changes to the economics of the project:

- Changes to the mining method and

- An updating of commodity pricing

The impact of those changes together has meant that the project’s post-tax NPV has increased by 75% to US$1.94 billion.

Lithium Price Update

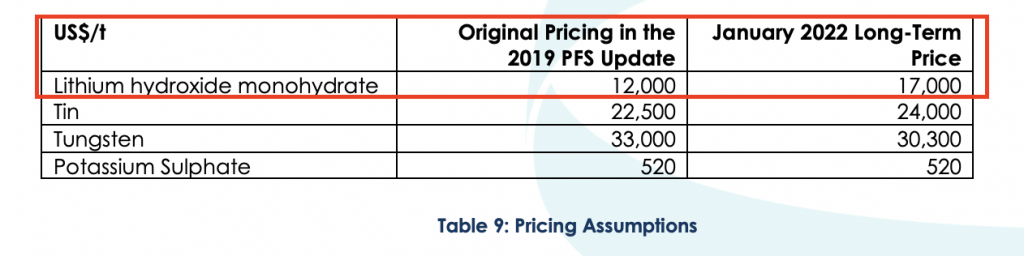

EMH has increased its assumed long-term lithium hydroxide price from US$12,000 per tonne to US$17,000 per tonne – a modest increase – but still significantly below current market prices of US$36,000 per tonne.

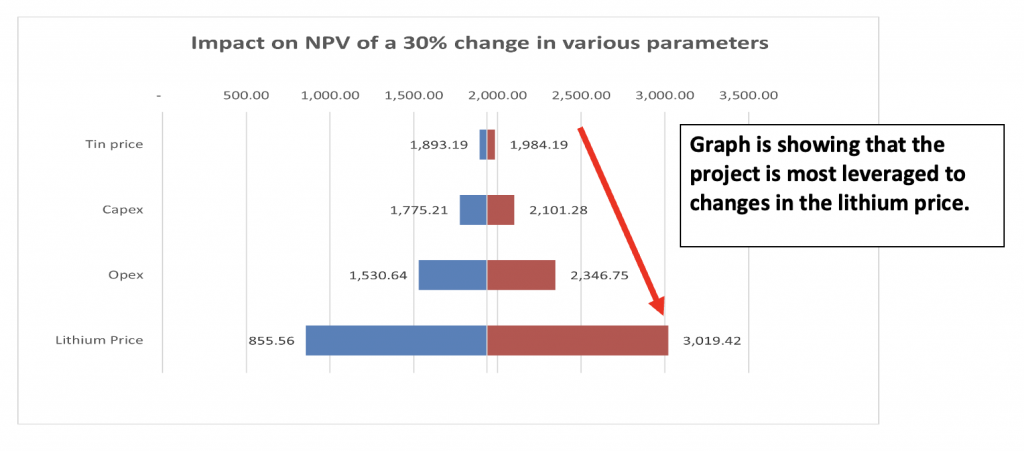

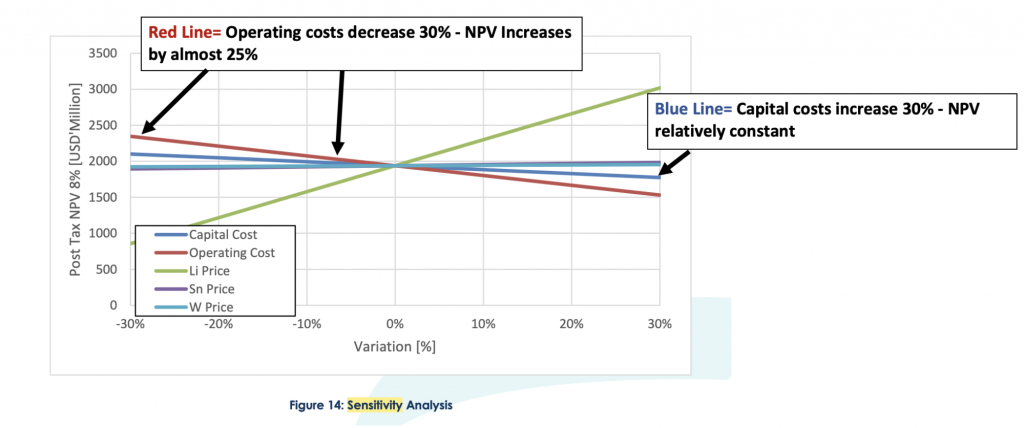

With current market prices of US$36,000 per tonne – over 100% higher versus the assumed PFS long-term price – the section of the PFS that stood-out to us the most was the sensitivity analysis with respect to changes in the lithium prices.

The company showed that a ~30% increase in the lithium hydroxide price to US$22,100 per tonne would see the project’s post-tax NPV increase to ~US$3 billion.

To us this means that for every ~US$1,000 per tonne increase in the lithium hydroxide price the NPV of the project increases by ~US$200m. Extrapolating that out to today’s market prices we get a post-tax NPV of close to US$5.8 billion.

The below chart also shows how the project’s NPV changes based on 30% changes in either direction for 4 different inputs. Clear to us is that the project is highly leveraged to increases in the lithium price.

With the lithium price trading where it is today, EMH’s market cap of $280M at the current share price of $1.60 sits well below the 49% share of the project’s post-tax NPV both at the US$17,000 per tonne used in the PFS and well below what the NPV would be with current market prices.

Changes to the mining method

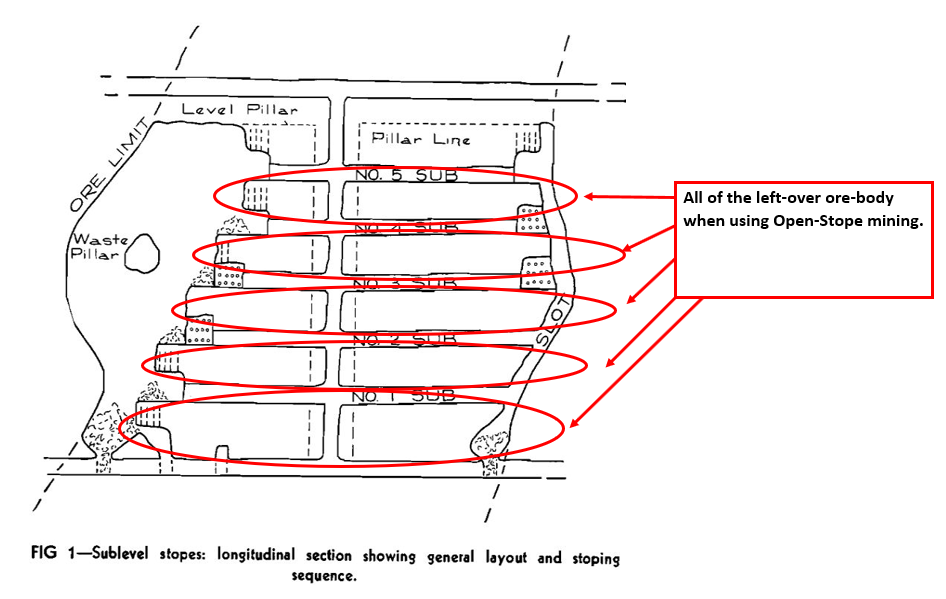

The second change was to update the planned mining method from “open stoping” to “longhole stoping” with backfill using paste backfill.

This is a more expensive mining method, but yields a larger mineral extraction.

EMH’s original PFS which was completed a few years ago, was focussed on lower cost mining methods that were less focussed on scale and more focussed on cost. But, with the increase in the lithium price it now makes sense to spend more to extract more.

The original plan focused on open-stope mining. Essentaily, in order to hold up the mine, the ore body (the bit that has the lithium) is used as a structural pillar so that the mine doesn’t collapse, while the rest of the lithium is extracted around it. Below is an image of what this looks like:

With the updated back-fill mining method however, instead of leaving that ore-body as a pillar, EMH will be able to mine the pillar as well – using a cement casing with backfilled waste-material as a structural replacement.

Not only does this mean more of the lithium is extracted from the rock but it also means the entire operation is more environmentally friendly, using the waste-rock to backfill the “stopes”.

These changes to the mining method, together with changes to the processing infrastructure, has resulted in an increase in ore extraction from 34.5mt up to 54.5mt.

An increase in the annual processing rate by approximately 33% per annum over the previous 21 year life of mine, from 1.69mtpa to 2.25mtpa over a now 25 year life of mine.

All of this translates to Increasing annual production of battery grade lithium hydroxide monohydrate from 25,267 tpa to 29,386 tpa, an increase of 16%.

With the mining method changed, upfront capex has also increased from US$483M to US$643M as a result of the increased processing requirements.

And with projects of this magnitude, we always like to see mine-life extended and increases to annual production rates. Massive mines like this require scale and scale means cost-efficiency.

The graph below demonstrates how a % change in any of the inputs shown translates into an effect on the NPV.

We can see that any changes to the capital cost of the project has a minute impact on the overall NPV of the project whereas any change in operating costs increases the post-tax NPV significantly.

So increasing production at the expense of higher upfront capital costs makes a lot of sense.

It is no surprise to us that scale translates into efficiency and productivity – which naturally results in increased project economics.

Institutional investors now have EMH in their line of sight

Yesterday, EMH completed a $14.4M placement that has been done to two institutional investors at $1.40 per share, a premium to where the stock was trading the day before.

In a note we released late last year we mentioned that EMH in November 2021 still had EUR€26.7M in cash at the subsidiary level. We believed that this would mean EMH wouldn’t need to raise any funds all the way through the DFS being completed and a final investment decision being made.

Placements under normal circumstances mean a company raises capital at a steep discount to its market price to fund operations, which is generally seen as the cost to entice investors and get the cash in the door.

This placement is a little bit different. Institutions like Ellerston Capital who have over $4 billion in funds under management don’t make investments this large for short-term profits. We think they must be investing here to see EMH’s project go all the way through to a final development.

We think that the move to secure the funds from Ellerston Capital is a good one, and when the time comes to make a final investment decision (we hope later this year) EMH will have a juggernaut like Ellerston in its corner to hopefully help with the equity portion of the financing.

In a weekend note we released this past Saturday, we talked about how certain funds would only invest micro cap stocks when the companies reached a certain size and a certain level of project risk.

In that note we had mentioned Ellerston as one of these particular funds. Their participation in the EMH placement indicates that the project has reached a size and risk profile where institutions are prepared to invest.

Why domestic lithium supply is so important for the EU:

EMH’s project is located in the Czech Republic, and is well placed to take advantage of the growing need for a domestic supply of lithium in the EU.

In our eyes, there are two primary motivations for the EU pursuing domestic lithium supply:

- To stimulate the local economy during the pandemic slowdown with green jobs

- Geopolitical concerns

In December 2020, the EU went hard at green stimulus during the pandemic, launching the largest stimulus package in its history called NextGenerationEU (NGEU).

NGEU comprised a total of €800B in funding, to go with a further €1.21B from the previous budget under the Multiannual Financial Framework 2021-2027.

A bit over a year later, the EU battery metals rush is in full swing.

One report that supported this initiative noted that ‘for electric vehicle batteries and energy storage, the EU would need up to 18 times more lithium and… 60 times more lithium … in 2050.’

The same report advocated for the continued work of the European Battery Metals Alliance to ensure that 80% of Europe’s lithium demand is supplied from European sources by 2025.

At the time the report was published, some 78% of the EU’s lithium came from Chile, 8% from the US and 4% from Russia – with 100% of it imported.

Which brings us to the geopolitical features of lithium supply and EHM’s role in the domestic supply chain as it aligns with the bloc’s stated goals.

For one, Chile is a long way away from the EU and there are persistent environmental concerns about its lithium production.

By bringing production under the EU wing, the bloc can get its lithium from sources that are less ethically fraught.

We note EMH is specifically targeting low carbon lithium production – there’s no point going electric if the production of lithium is itself a high carbon intensity activity.

And lithium end users or big automakers are particularly interested in low carbon lithium as well – not only because their consumers will demand it, but because they need it in order to attract ESG capital.

Again, we note EMH’s ideal location close to a range of major players in the EV market in Europe (from our portfolio initiation):

Additionally, following recent events in Serbia regarding Rio Tinto’s proposed Jadar lithium mine, this means that EMH’s massive hard rock lithium deposit may garner fresh attention:

Throw in a very solid partner that EMH has in the form of CEZ (a Czech government backed energy giant), and we believe that the pieces are starting to fall into place for the project.

Ideally, an offtake agreement comes through following this strong positive updated PFS announcement. We view the lithium market as very strong at the moment, and there is a lot of demand for EU lithium, so we expect 2022 to be the year that EMH secures some form of an offtake.

We think that’s an important catalyst in EMH’s future, and one we’ll be sticking around for.

Be sure to check out our Investment Memo on EMH for a high-level summary of what we want to see EMH achieve in 2022, why we continue to hold it and key risks.

Retrospective and what we want to see next:

As long term holders of EMH, we’ve seen some ups and downs since our initial portfolio initiation in March of last year.

So we’ve decided to give you a bit of a hand understanding what’s played out in that period with the following chart:

The key takeaway from the chart is we think that a lack of an offtake agreement has been holding back the EMH share price – we think the market might be waiting for this.

The market can be impatient, so we understand the selldowns from that perspective.

That being said, yesterday’s announcements set the stage for the market getting what it wants.

What we really think is happening below the surface at EMH though, is a slow and steady alignment of activities with long-term value.

An offtake agreement would be nice, but we don’t think it’s the be all and end all. We want to see EMH get the project economics right, get the DFS in and get a Final Investment Decision going with the backing of major institutional investors and European government support.

Given the project’s progress to date, we are increasingly confident that an offtake will come – but it would be more of a ‘cherry on-top’ in the coming months than something that dominates how we look at EMH.

Which is why we want to re-emphasise what we expect to see from EMH going forward.

Our approach to investing in companies is that of a long-term investor. We try to make investments in companies early in their company life-cycle and try to see them go onto achieve all of the objectives they set for themselves.

We believe that in the short term, predicting share price movements is near impossible, and that the share price of a company in the long run correlates more with how a company is performing relative to its objectives and whether or not it is executing on its business plan.

As a result we put together these memos to set objectives for our portfolio companies and then track their performance relative to those objectives. If our strategy is correct then the more of these objectives our investments meet then the more likely the share price will do well.

Read the full ASX:EMH investment memo

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 261,000 EMH shares at the time of publication. S3 Consortium Pty Ltd has been engaged by EMH to share our commentary on the progress of our investment in EMH over time.