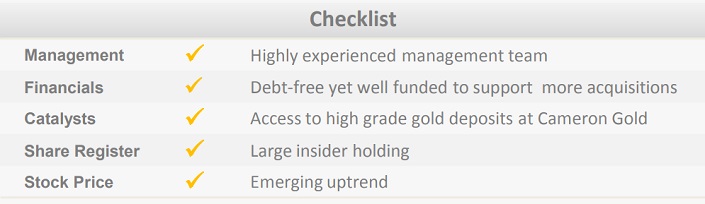

Overview: Chalice Gold Mines Limited (“Chalice” or the “Company”) is an Australian minerals company with gold and base metal interests in Canada, Australia, and Eritrea. Its most advanced asset is the Cameron Gold Project, Ontario, Canada, (“Cameron”) which hosts Measured and Indicated Resources (M&I) of 567,100 oz of gold at 2.45 g/t and Inferred Resources of 830,100 oz of gold at 2.11 g/t (excl. Dogpaw and Dubensk). A Preliminary Economic Assessment (PEA) into a 10-year mining operation was completed in Feb 2013. Cameron was acquired following the takeover of Coventry Resources Inc in Feb 2014 for ~46m shares.

![]()

Catalysts: Chalice aims to reoptimise Cameron by increasing open pit resources and delaying underground development. Two phases of drilling planned for 2014 may validate the strategy and drive interest in its shares which are presently trading below cash reserves. The Company has initiated an on-market buyback for up to 21m shares.

Hurdles: Cameron’s Preliminary Economic Assessment (PEA), conducted in Feb 2013, was based on the expected gold price of US$1,472/oz which implies ~22% premium to the lowest price level of $1,145 touched in 2013 (current spot price: US$1,369/oz). Whilst the Company has a strong cash balance of $55m, it remains reliant on external financing given the Project’s initial capex requirements of US$110m.

Investment View: Chalice offers speculative exposure to gold price trends and potential for enhanced economics at Cameron under new management. We are attracted to the Company’s project development record, funding position, and valuation. Proceeds from exploration, development, and subsequent sale of the Zara Gold Project, Eritrea, underpin its current cash reserves of $55m. With its shares ascribing little value to Cameron, and now supported by a share buyback, we commence coverage with a ‘speculative buy’

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.