Overview: carsales.com Limited (“Carsales”, the Company”), is an Australian software company focused on online advertising services, data research, and vehicle finance services. The Company’s primary business segment is online classified advertising for cars, boats, and motorbikes across the Carsales network. Carsales has operations in Australia, New Zealand, China, Malaysia, Thailand, Indonesia, South Korea, and Brazil.

![]()

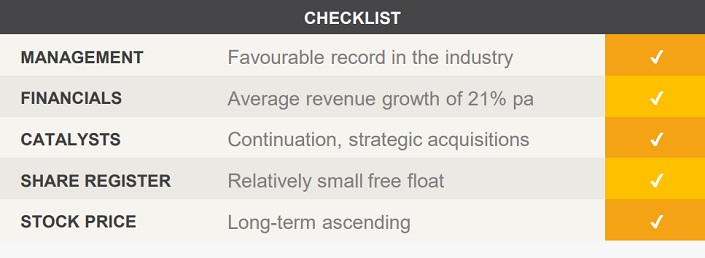

Catalysts: Carsales is the market leader in the Australian online advertising sector for cars and has achieved average top-line growth of 21% per annum over the past five years. Continuation of the trend is the major near-term driver. In order to sustain the trend, Carsales focuses on both overseas and domestic expansion, which is starting to materialise. The Company generates free cashflow which allows for strategic acquisitions, investments, or higher dividend payments in 2016.

Hurdles: Despite double-digit revenue growth, earnings have risen at a slower pace due to an increase in capital spending. Acquisitions remain subject to integration risks and there is no guarantee that these investments will yield economic benefits. The industry has low entry barriers, hence Carsales could face increasing competition.

Investment View: Carsales offers profitable exposure to the online classified advertising market. We are attracted to its dominant market position, historic growth trajectory, and free cash flow. Integration of its acquisitions and rising competition are principal risks. Continuation of the trend remains the primary driver, however, there is scope for additional growth through strategic acquisitions financed via surplus cash flow. Recognising its growth potential, we initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.