Overview: BC Iron Limited (“BC Iron, the Company”) is an iron ore mining company with assets in the Pilbara region of Western Australia. The Company’s core focus is a 75 percent interest in the Nullagine Iron Joint Venture with Fortescue Metals Group Limited (ASX: FMG). We’ve maintained coverage for its profitability and financial strength. Following a stop level breach, our last advice was to ‘sell’ at $3.25 in March. However, with the stock holding firm amid challenging market conditions, we reconsider its outlook?

![]()

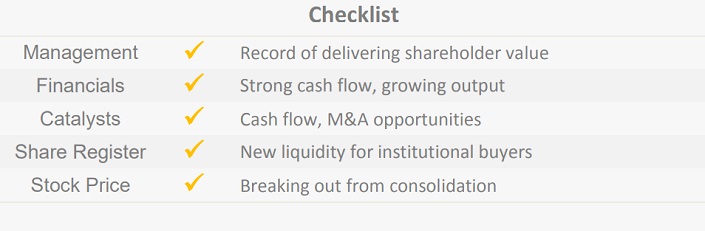

Catalysts: Whilst iron ore prices contracted 10 percent during the June qtr, BC Iron continues to generate strong cash flow. It is rapidly extinguishing borrowings used to opportunistically increase its stake in the Nullagine JV. Operational performance at Nullagine is impressive, achieving nameplate production of 6mtpa and asserting cash costs below $50/t. We expect mine life extensions, ongoing cash flow strength, and recent liquidity initiatives for the share register to drive value growth.

Hurdles: Current mine life of the Nullagine JV is limited to 2020, and increased waste stripping could elevate costs in coming years. Enhanced shareholder liquidity has coincided with the exit of Regent Pacific, which used an existing cornerstone stake as a platform for a takeover bid that failed during 2011.

Investment View: With reserve replacement during 2012 exceeding production to date, we are optimistic for possible mine life extensions. Recent margin resilience has also been impressive amid weakening spot markets. The Company is ideally positioned to consolidate under-funded juniors in the region, and its valuation appears undemanding relative to cash flow. We are upgrading our view to ‘buy’.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.