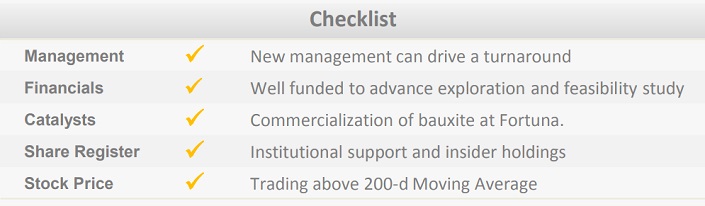

Overview: Bauxite Resources Ltd (“BAU”, the Company”) is an Australian minerals Company engaged in mining, exploration, and development of bauxite properties. It is focused on Western Australia’s Darling Ranges, with direct and Joint Venture interests spanning 17,000 km2, incorporating Measured, Indicated and Inferred bauxite resources totalling 338million tonnes (mt). The Company’s most advanced assets include the Fortuna deposit (39.5mt), and free carried interest (30%) in the Felicitas JV (218.7mt). We initiated coverage in Oct 2012 at $0.11/share with a ‘spec buy’ recommendation for its turnaround potential.

![]()

Catalysts: After expanding its project inventory by 39% during the past six months, BAU is shifting focus to mine planning. Progression of environmental studies at Fortuna and scoping works at the Felicitas JV should highlight the Company’s near-term production potential. In a market facing supply constraints due to Indonesian export bans, we expect BAU’s status to attract greater recognition. The Company is presently valued below its cash reserves.

Hurdles: Whilst BAU has sufficient funding to advance project development, external capital needs may be influenced by a shareholder class action. Litigation funder, IMF, is pursuing a claim relating to disclosures surrounding a $19million share placement completed in Oct 2009 under former management. The Company intends to defend the claim, which we estimate could consume half of its cash reserves.

Investment View: BAU offers speculative exposure to the growing seaborne bauxite trade. We are attracted to the strategic positioning of its assets to key Asian markets and near-term production potential. Whilst strained landholder relations under former management and the IMF claim have challenged sentiment, we see a positive balance of risks. The Company is well funded and valued below its cash reserve, hence we reiterate our ‘speculative buy’ advice.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.