Overview: Base Resources Limited (“BSE”, the Company”) is a mining Company focused on mineral sands in Kenya. Its primary asset is the Kwale Project, located 50km SW of Mombasa, Kenya’s principal port facility. Following its acquisition by BSE in August 2010, Proved and Probable reserves totalling 140.6million tonnes (mt) have been delineated for an 18-year mine life, and the Company has invested US$292m developing mine and processing infrastructure.

![]()

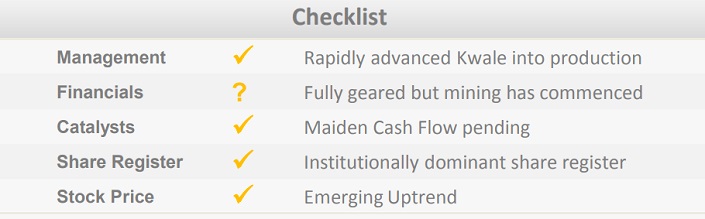

Catalysts: After mining and processing commenced in late 2013, maiden cash flow looms pending first bulk shipments. A $25million extension of BSE’s existing debt facilities has reduced working capital risks as production scales up. Leading market participants are suggesting a demand recovery in 2014.

Hurdles: Whilst mining has commenced, BSE still needs to overcome commissioning risks. The Company is fully geared and yet to demonstrate a cash flow profile. Income is subject to titanium feedstock and zircon prices which have contracted ~ 50 percent yoy. Whilst Kwale is presently exempt from Local Equity Participation Regulations introduced in 2012, BSE remains subject to sovereign risks as the Kenyan Government seeks to increase its mining industry interests.

Investment View: We are attracted to Kwale’s imminent cash flow profile, long reserve life, and BSE’s institutionally dominated share register. With recent falls in mineral sand prices offering a countercyclical entry point, the commissioning process and regulatory regime are primary risks. We expect elections completed during 2013 to offer a platform for BSE to strategically address its sovereign risk profile. Whilst rapidly advancing Kwale, the Company has demonstrated strong local foundations to date, With pending shipments to illustrate its operating credentials, we initiate coverage with a ‘speculative buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.