Doubling down on the dip in our favourite long term High Purity Alumina play

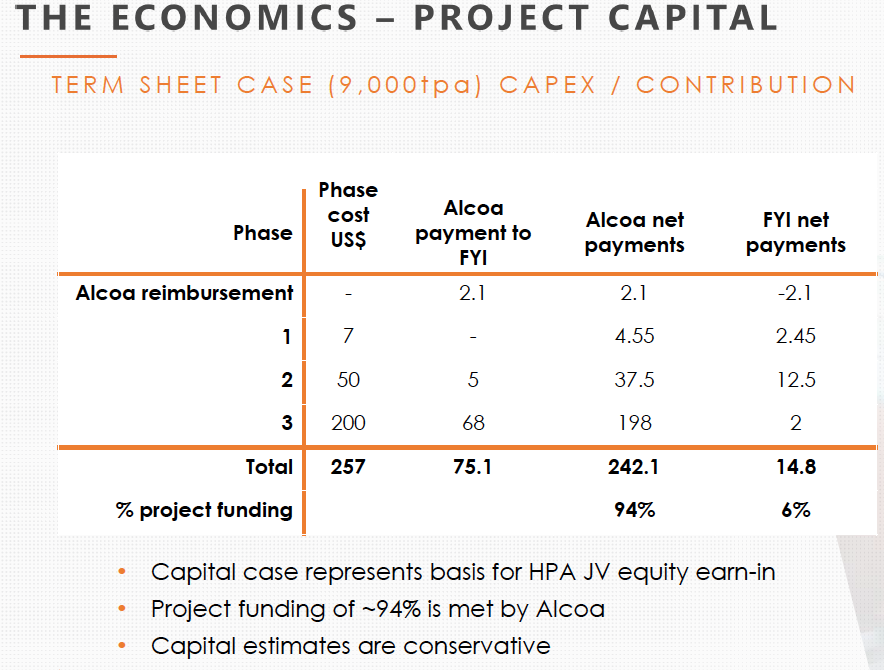

It’s been quite a hectic start to October for our battery metals investment, FYI Resources (ASX:FYI) after they signed a long anticipated deal with global alumina giant Alcoa to fund up to USD $242M (94% of project cost) to develop FYI’s project in return for 65% project ownership.

…and the share price went down from ~82c to settle around ~ 44c.

We are long term investors in FYI and added to our position at around 44c.

FYI is aiming to be the first to market to deliver High Purity Alumina utilising a new kaolin clay-based process that is cleaner, purer, and much less expensive than traditional methods of alumina production – and now backed by the deep pockets and expertise of Alcoa.

Why did FYI’s share price go down so much?

We think because the Alcoa deal was anticipated in the market (though not the details), and the time frame for it to get signed was also well known – many short term investors entered the stock expecting the price to rocket after a deal was announced, which effectively priced the deal into the share price prior to the announcement.

When FYI announced the signed deal terms many short term investors were expecting a share price pop for a quick profit – when it didn’t pop (we think because the deal was priced in already) many ran for the exit putting more pressure on the share price.

This was combined with an announcement that in our opinion wasn’t well worded and was hard to understand… our initial read was that Alcoa was funding USD $194M… turns out it’s actually more like $USD $242M.

The usual “short term investor fear spiral” ensued and it’s our opinion that the FYI share price has been unfairly beaten up, but we think it should be able to work through the current malaise and continue on an orderly uptrend over the next 12 months as Alcoa and FYI roll out the first 1000 tpa of production (which Alcoa will be fully paying for).

FYI has $13M in the bank so we can’t see the need for a cap raise any time soon – hence why we added to our position at ~44c.

Again we are long term patient holders and our strategy may not work for everyone, but we are looking forward to watching the FYI story unfold over the next 3 to 5 years.

So, why are we holding a long term position in FYI and why did we increase our holdings?

Alcoa agreeing to primarily fund the project has significantly de-risked the investment.

From a macro theme perspective, HPA is a key component within lithium-ion batteries, and we expect the HPA demand to grow as automakers secure minerals for electric vehicles (EVs) production.

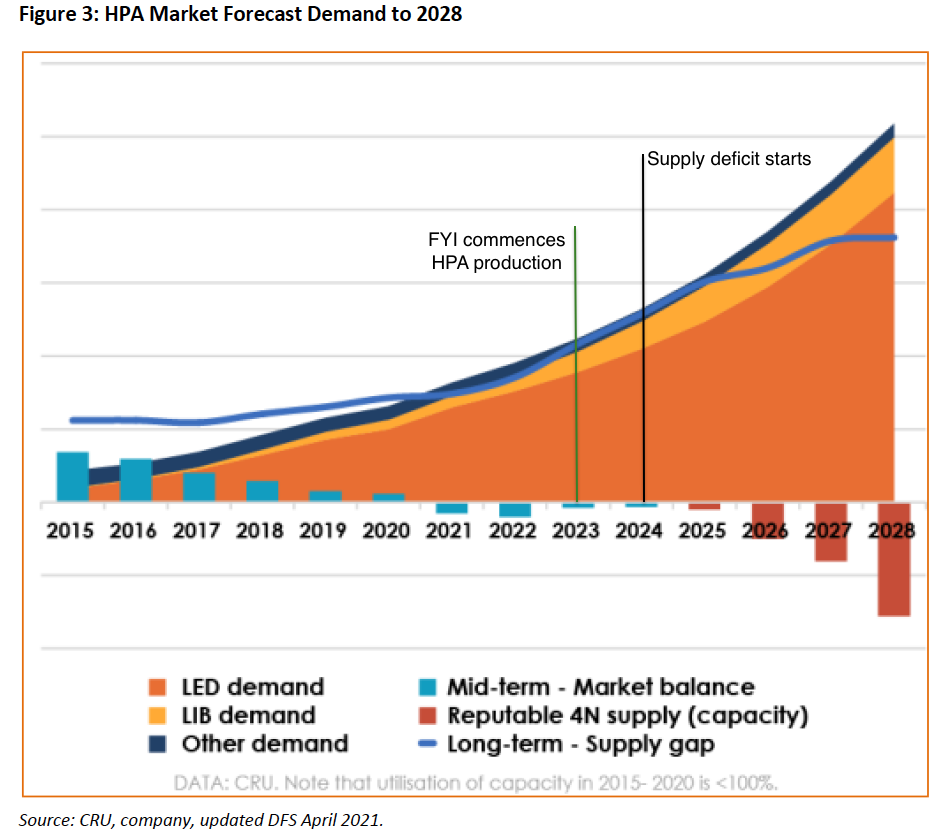

Market intelligence and analysis firm CRU predicts a CAGR growth of 18.7% through to 2028 for the HPA market. Of significance, the HPA market is expected to tip into a supply deficit in 2024.

FYI expects to commence HPA production in 2023, ramping up to full-scale production in the following year. This timing aligns perfectly with the HPA supply deficit predicted by CRU, and we think is a key aspect of the FYI story.

We note that FYI should be the first to market utilising its “revolutionary” kaolin-based process to produce HPA, at roughly US$6000/t. This compares with costs of around US$15,000/t from the traditional bauxite-based process that hasn’t changed much in over a century, is dirtier, produces a less pure HPA, and is still the primary method used today.

If successful, we think that FYI would:

- Deliver a superior HPA product;

- Produce HPA at ~40% of the cost that current traditional producers;

- Target a market expected to continue to grow strongly;

- Time their production just as that market crosses into supply deficit

In a nutshell, that is why we increased our holding in FYI.

Not a bad business proposition… provided they can execute.

So can they? We think so but obviously there are some risks along the way.

The world’s leading aluminium producer, NYSE-listed Alcoa Corporation is betting on FYI’s success, with its Australian subsidiary recently entering a binding joint-venture term sheet with FYI. Alcoa is essentially funding development through to commercialisation – more on this later as well.

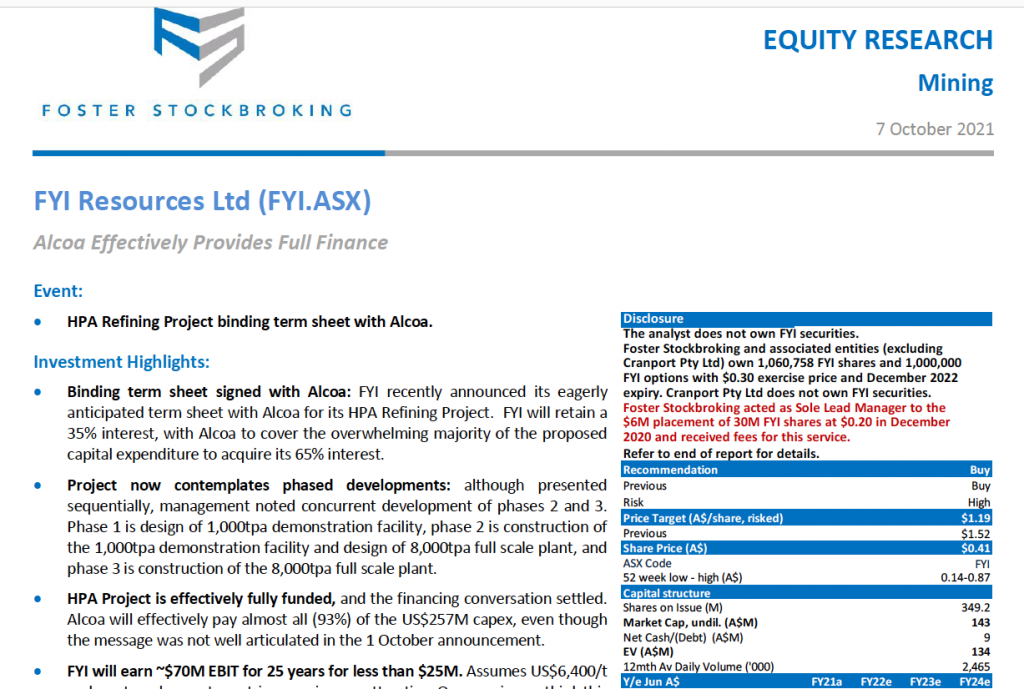

We also note that Foster Stockbroking agrees that there is plenty of upside left with FYI. In a research note titled ‘Alcoa Effectively Provides Full Finance‘ released 7 October, the broker slapped a BUY recommendation with a target price of $1.19 per share for FYI.

In the note, Foster states:

“We continue to recommend FYI as a Buy with a decreased price target of $1.19/share (prior $1.52), due to lower production and minor delay, offset by funding certainty and risk unwind. Cadoux-Kwinana is a long-life, high grade kaolin asset and low-cost refinery aiming to become a single source HPA producer from a tier 1 jurisdiction, now with Alcoa’s validation and balance sheet.”

Broker predictions are a good data point, but obviously they don’t always reach those heights so should only form a part of due diligence on an investment.

Renowned resources analyst Warwick Grigor also commented on the agreement and FYI’s upside within his latest weekly note:

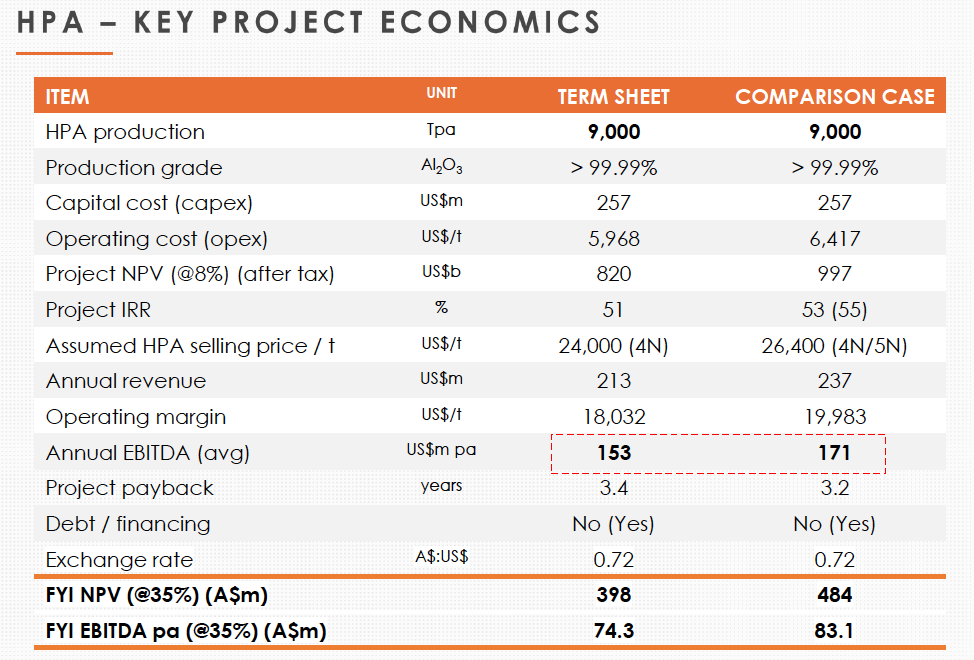

“It would seem that FYI’s 35% interest could generate EBITDA in the order of A$77m p.a. if the modelling assumptions hold. That places the shares on an EBITDA multiple of 2x. There is plenty of room for upside from here, at these artificially depressed prices. The current cash balance of $13m today means that FYI is fully funded. It would be very hard for FYI to have found a better JV partner, so full credit to management for having been able to close this deal.”

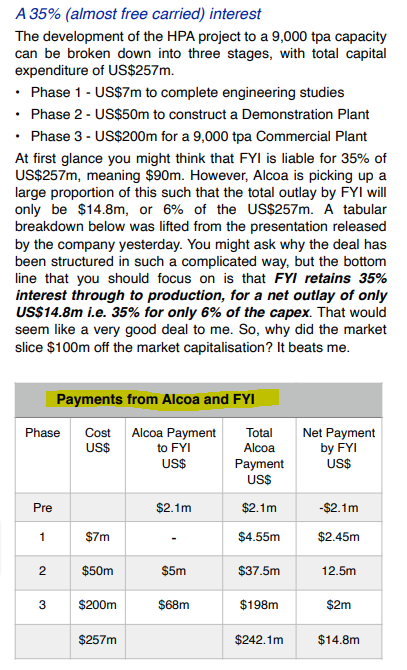

Here is Warwick’s concise interpretation of the deal structure and payment terms:

Our other battery metals investments have done well within our portfolio (VUL, EMN… EMH having ups and downs and still waiting for AOU to have a run on its current Nickel drilling program) and our hope is that FYI can join the list of long-term market winners as it executes its plans.

What happened to FYI on “Black Friday”?

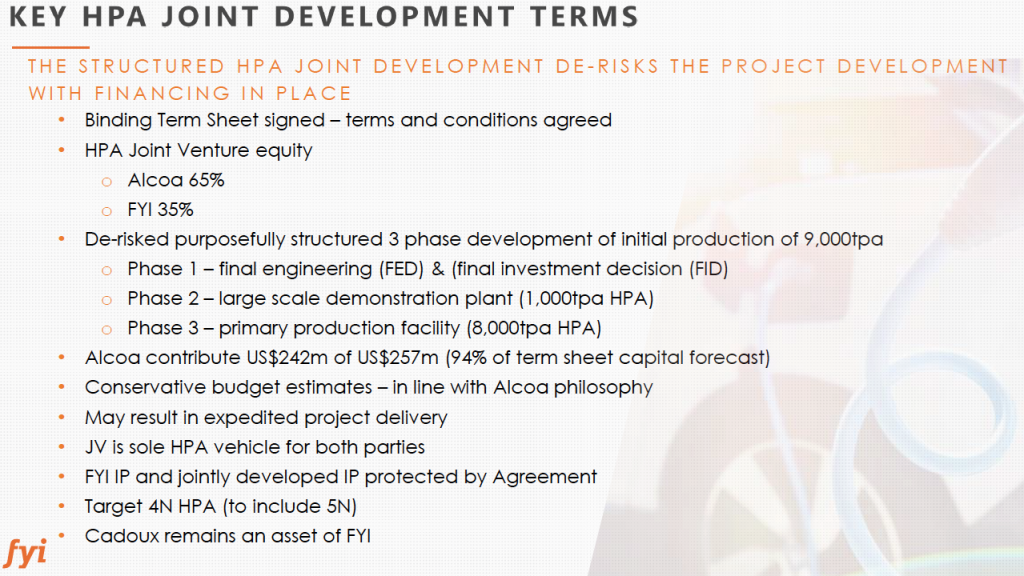

Two weeks ago, FYI announced that it had inked a binding term sheet with the leading aluminium producer Alcoa. Our commentary can be found here – FYI signs JV with Alcoa – now free carried into production, leveraging Alcoa expertise and global networks

The key points are summarised below:

Our key takeaway was that FYI would keep 35% of the project, and that Alcoa would earn in its 65% stake in return for funding up to US$242M (~A$330M) in a three phase plant development AND providing its expertise and global distribution networks to make the project a success

This news was not well received by the market … to put it more bluntly, it was seen as a disaster – judging by how the share price reacted!

Upon announcing the deal, FYI’s shares dropped nearly 40% from 82.5 cents to close at 53 cents.

The following trading day, FYI shares dropped further to under 40 cents… leaving the company with a market capitalisation that has more than halved to be ~ $140M today.

Why such a brutal market response?

We suspect the following mix of elements combined to cause the FYI crash;

- Investors may have thought the market for FYI was already over-heated – shares had already run strongly this year, starting at 25 cents and hitting a historic high of 85 cents in the middle of September.

- Poor communication – we thought that the announcement was not well written containing some confusing sections, and didn’t convey several key elements of the binding term sheet well. Since then, the company has issued a presentation that clarifies the agreement more clearly.

- Spooked market – the entire market was shaky that week, possibly on the back of the Evergrande debt crisis in China, and debt ceiling roulette being played out in the USA

- Equity component of the JV – we suspect that some investors would have preferred for FYI to have maintained control, or at least have a higher equity component to the JV arrangement. We acknowledge that a higher ownership would have been nice, but believe this would have come at the cost of FYI having to fund much more of the development costs. The worse case scenario would have been no binding term sheet agreement, which would certainly have delayed commercialisation, whilst adding financing, marketing and technical expertise challenges to development.

We believe that the market has overreacted, adding to our holdings at 44.4c.

Playing the long game

At Wise-Owl, we are long term investors, taking a 4 – 7 year horizon on the companies within our portfolio. We believe that this provides plenty of runway for their management to execute their growth plans and ultimately become highly profitable enterprises.

We’re looking to invest in companies that will grow into established, real businesses, ultimately generating returns both on the capital and dividend front.

This differs from short term investors, who typically seek capital gains on the back of catalysts, macro trends or market sentiment – and are not really concerned with the longer term prospects of their investments.

So we decided to almost double our holdings earlier this week, at just under 45 cents per share.

Our belief is that the Alcoa JV binding term sheet greatly de-risks the project, removes almost all the project financing required by FYI, and provides credibility to its prospects of transitioning into a real business enterprise that can deliver consistent shareholder returns, for years to come.

What is the prize?

If the project is fully developed to deliver 9,000 tonnes per annum 4N HPA product across 2 plants, then FYI would be looking at receiving an earnings stream (EBITDA) in excess of $70m per annum for the next 25 years.

These figures assume the base-case of just the demonstration and primary production facility contributing.

Further upside resides if production is expanded at either/ both plants, if other projects are green-lighted (which is likely the case if the technology proves itself to be superior) and if 5N production is later implemented as well.

What are the risks?

Key downside risks include technical failure (e.g. pilot plant or demonstration plants fail to replicate the process on a larger scale, project delays…etc) and changes to the HPA market.

We also note that FYI project funding is minimal, being only 6% – ie totaling US $14.8m (compared to Alcoa spending US $242m) – across all 3 development phases.

With minimal financing required by FYI, this means there won’t be the need for a huge capital raise to fund their share, which means minimal dilution going forward – but as we all know in early stage investing anything can happen, and there may be an unexpected, dilutive cap raise at some point in the future.

What lies ahead – where does the FYI re-rate come from?

We are keeping a look out for progress across the following areas:

- Final engineering (FED) & final investment decision (FID) for 1000 tpa demonstration plant;

- Demonstration plant progress;

- FEED and FID decisions and commencement of 8000 tpa primary HPA plant;

- customer offtake MOUs and marketing relationships;

- updates on financing arrangements;

- further updates on the Alcoa JV; and

- updates on LOM extension, capacity upgrade, 5N option, and/or by-products.