Lithium price keeps rising as VUL locks in lithium production plant site

Vulcan Energy Resources (ASX: VUL) has secured a site for its commercial lithium hydroxide plant for its Zero Carbon Lithium™ Project, where it expects to begin commercial production of battery grade lithium hydroxide in 2024.

This was VUL’s second piece of major news this week, coming just two days after VUL announced it has produced its first high-quality, battery-grade lithium hydroxide sample from a pilot plant at its Zero Carbon Lithium™ Project.

Lithium is a key ingredient in electric vehicle batteries and demand for lithium is surging as nearly every country rushes to tackle climate change by switching to electric vehicles.

The lithium price keeps rising every week, and a small increase in the lithium price makes a big difference to the potential revenue for VUL based on current offtake agreements.

VUL is aiming to become the world’s first Zero Carbon Lithium™ and renewable energy development company and has been progressing at a very fast pace. VUL can now move even faster after raising a further $200M a couple of weeks ago.

It has plans to produce battery quality lithium hydroxide and renewable geothermal energy from the same deep brine source in Germany’s Upper Rhine Valley — where it has Europe’s largest lithium JORC resource — at net zero carbon cost.

The lithium produced will help address EU market requirements by reducing the high carbon and water footprint of traditional lithium production. It will also cut the region’s current entire reliance on imports AND help meet Europe’s carbon neutrality policies.

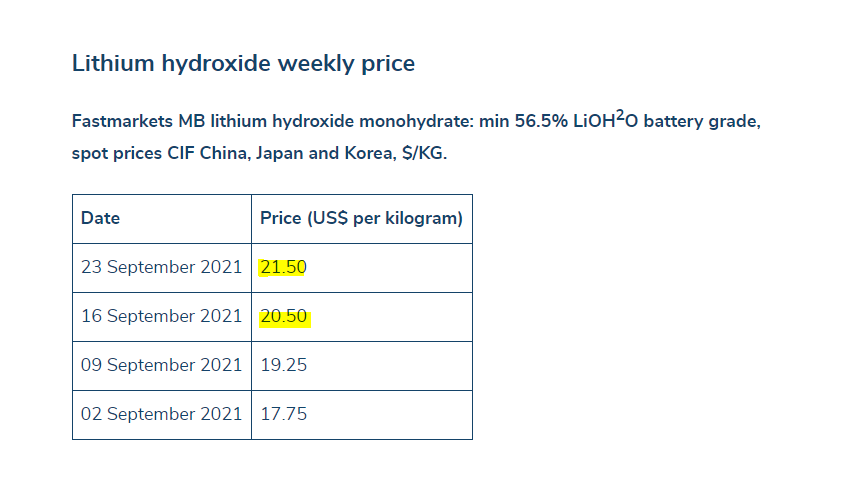

Rising lithium demand, largely from electric vehicle battery makers, continues to push prices for the crucial battery ingredient higher. This week the lithium hydroxide spot price reached more than US$21,500/tonne (compared to US$15,000/tonne a few months ago), and it looks like it wants to continue to rise each week: This is good news for VUL as it already has buyers lined up for its premium priced battery-grade zero carbon lithium hydroxide product.

This is good news for VUL as it already has buyers lined up for its premium priced battery-grade zero carbon lithium hydroxide product.

Over the last few months VUL has signed two offtakes: One with Renault for 6,000-17,000 tonnes per year for 5 years and one with LG Chem for 10,000t per year also for 5 years (with option to extend for another 5 years).

In July we originally calculated LG Chem’s 10,000 tonnes per year at the past (lower) lithium hydroxide price of US$15,000 to assume US$150 million per year of revenue to VUL (our original rough LG Chem offtake calc)

Back in August when Renault signed an offtake for between 6,000 and 17,000 tonnes per year, we assumed the rough mid-point of 10,000 for ease of calculation AND the lithium price was US $15,000/t at the time, that’s another US$150M per year to VUL (our original rough Renault offtake calc).

Combining the two offtakes at the past lithium price gave VUL a (rough) total of US$300M per year.

Now if we recalculate existing offtakes using the CURRENT lithium hydroxide price of US$21,500/t gives us a new rough calc of:

LG Chem 10,000t/y + Renault 10,000 t/y = US$430M per year.

That’s a US $130M PER YEAR difference across the 5 years on both offtakes from 3 months ago.

Our key takeaway from our rough calcs is that the steadily rising lithium price makes a significant difference to the potential yearly revenue of VUL.

Plus, the current US$21,500/t price is well above the US$14,925/t price used in January’s Pre-Feasibility Study (PFS) to arrive at a project valuation of €2.25 billion (A$3.55BN).

We will continue to follow the lithium price with interest as VUL fast tracks the construction of its production facilities and expands its production capacity, helped by its recently raised $200M.

VUL was added to the Wise-Owl portfolio in June 2020 when it was trading at 36¢ per share. Having recently hit a high of $16.65, VUL has been the leading performer in our portfolio.

For existing retail shareholders, VUL has opened a share purchase plan (SPP) to raise a further $20M. The SPP will also be priced at $13.50 per share – the same price as the institutional raise. Each shareholder can subscribe for up to A$30,000 worth of new shares directly with the company (so no brokerage fees). The SPP will close at 5pm AEST on Wednesday, 13 October 2021.

At current prices, VUL certainly stacks up well when compared to the latest analyst report from Germany’s AlsterResearch, which has a price target of $22 on VUL — a significant 71% higher. While it’s always wise to take analys predictions with a grain of salt, VUL has a track record of eventually breaking through Alster’s previous price targets.

We have been following VUL since early 2020 as it passes through Alster’s price targets (although it has pulled back after last $13.50 cap raise):

- March 2020: $2.45 ✅

- January 2021: $12.95 ✅

- February 2021: $13.30 ✅

- May 2021: $16.00 ✅

- June 2021: $16.50 ✅

- August 2021: $19.50

- Current Alster target price: $22.00

Given the pace of VUL’s progress as it works towards its goal of producing commercial quantities of battery quality lithium in 2024, we think there remains plenty of upside potential — something that AlsterResearch also recognises.

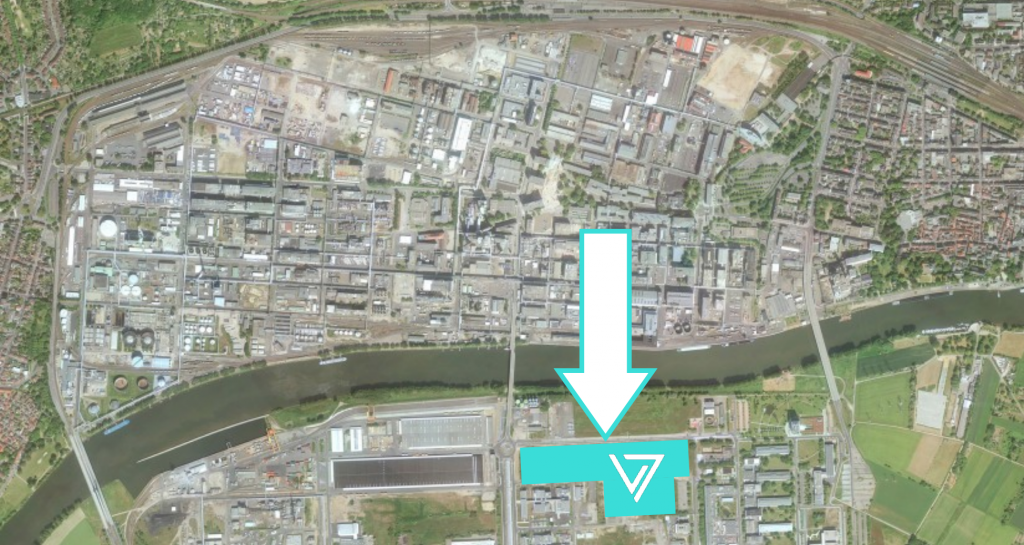

Central Lithium Plant site secured

The site secured for VUL’s planned Central Lithium Plant (CLP) at the Höchst Chemical Park is located just outside of Frankfurt.

This location allows for low carbon transport options from VUL’s nearby project areas, as well as renewable energy to power the proposed plant — underpinning VUL’s commitment to minimising its carbon footprint in each step of its process.

Once commercial production is up and running, the lithium hydroxide monohydrate will be transported from the plant to VUL’s European customers in the battery and electric vehicle industry — dramatically lowering the transport footprint of the current lithium supply chain.

At the plant, lithium chloride from multiple combined geothermal and lithium sorption plants will be processed into lithium hydroxide monohydrate.

Securing this site is an important step toward the execution of the project. It is one of Europe’s largest chemical sites, hosting more than 90 companies and offering a number of key advantages for VUL’s project.

These include its proximity to the Zero Carbon Lithium™ Project areas where the integrated geothermal and sorption operations are to be built, the multiple low carbon transport modes available (barge, train), the availability of renewable power onsite, and enough space and utilities for a future phased expansion of the plant.

Ahead of the plant’s construction and operation, VUL will work to obtain necessary permits to operate in the chemical park.

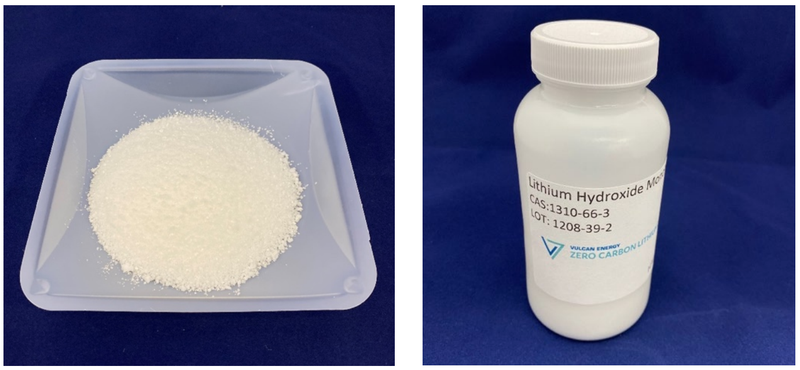

Battery-grade lithium sample produced

Today’s news follows Monday’s announcement that VUL has produced its first battery-grade lithium hydroxide monohydrate (LHM) sample at its pilot plant in the Upper Rhine Valley.

VUL reports that the high grade lithium sample is of better quality than traditional battery grade LHM product, including the current best on the market battery grade specifications required from offtake customers. The product graded greater than 56.5% lithium hydroxide monohydrate and had very low impurities.

With the initial sample a success, VUL will ramp up production of the battery quality material in order to supply samples to its offtake partners, which include LG Chem and Renault (and potentially auto giant Stellantis too).

Lithium hydroxide monohydrate from the Zero Carbon LithiumTM Project

VUL’s chemical engineering team produced this first battery quality lithium hydroxide monohydrate (LHM) from a sorption pilot plant at a geothermal renewable energy plant in the Upper Rhine Valley.

Production of this battery quality lithium sample is a major step on VUL’s path to producing commercial battery-grade lithium, with VUL on track for Phase 1 commercial production of the battery quality material in 2024.

Data generated while producing the sample will also be used in VUL’s Definitive Feasibility Study (DFS) that is now being completed by international lithium plant engineering specialist Hatch Ltd and VUL’s engineering teams.

News on news

This week’s news comes less than two weeks since we last updated you on VUL: Cashed up VUL Expands its Zero Carbon Lithium Ambitions.

It’s worth a read you missed it, as we outlined:

- Details of the recent Placement led by Goldman Sachs and Canaccord Genuity, that brought in new ESG-focused institutional shareholders and additional investment from existing shareholders, including Hancock Prospecting,

- VUL’s addition to the S&P/ASX 300 index,

- The impact that rising lithium prices were having on VUL’s project economics,

- Its intention to list on the main German stock exchange — the first Australian company to do so,

- More on AlsterResearch’s latest report and its history of covering VUL since March 2020, and

- Securing the help of the Eurozone’s largest bank, BNP Paribas, to complete its DFS.

Here are our milestones for VUL

Vulcan Energy ASX Company Milestones

✅ Wise-Owl Portfolio Initiation

✅ $4.8M Capital Raise @40c

✅ EU Backed Investment (EIT InnoEnergy)

✅ Board Appointment (Vincent Ledoux-Pedailles)

✅ Board Appointment (Former Tesla Director Jochen Rudat)

✅ $120M Capital Raise @$6.5

🌎 Volkswagen’s Power Day (1) (2)

✅ Board Appointment (Annie Liu)

✅ Proposed listing on main German Stock Exchange

✅ $220M Capital Raise @ $13.50 ($200M Insto, $20M SPP)

🔲 Commence Trading on Main German Stock Exchange

🔲 More brine/land acquired 1

🔲 More brine/land acquired 2

🔲 More experts hired/acquired

🔲 Acquisition of existing project 1

🔲 Acquisition of existing project 2

Zero Carbon Lithium Project Milestones

✅ Acquisition of disruptive EU focussed Zero Carbon Lithium Project

✅ Commencement of Scoping Study

✅ Reports Lithium Grades above expectatio

✅ Maiden Indicated Resource Reported

✅ Positive Scoping Study

✅ Test Work Shows Excellent Lithium Recoveries

✅ Taro Licence Granted

✅ Positive Pre-Feasibility Study

✅ Collaboration with DuPont

✅ CO2 Traceability Agreement

✅ Bankable feasibility advisor appointed – BNP Paribas

🔲 Ramp up of DLE pilot plant

✅ Offtake Agreement 1: EV battery Maker LG

✅ Offtake Agreement 2: Renault

🔲 Offtake Agreement 3

✅ First Production of Battery Grade Lithium

✅ [NEW] Lithium Production Plant Secured

🔄 Definitive Feasibility Study

🔲 Bankable Feasibility Study Complete

🔲 Project Financing Secured

Investment Milestones for VUL

✅ Initial Investment: @20c

✅ Increase Investment: @40c

✅ Increase Investment: @$6.50

✅ Price increases 500% from initial entry

✅ Price increases 1000% from initial entry

✅ Price increases 2000% from initial entry

✅ 12 Month Capital Gain Discount

✅ Free Carry

✅ Take Profit

🔲 Hold remaining Position for next 2+ years