Lithium Boom: EMH offtake surely coming soon?

Today we take a look at a deep dive video interview with the CEO of lithium development company European Metals Holdings (ASX:EMH), Keith Coughlan.

We invested in EMH at $1.40 back in March as we are big believers in the European battery metals theme and we reckon EMH must surely be pretty close to announcing an offtake agreement…

You might have heard over the last few weeks — it’s boom-time for lithium.

Joe Biden’s push to switch the US to electric vehicles seems to have stoked a global wave of excitement around lithium companies that provide the critical battery metal.

The ASX’s most well-known and established lithium companies including Orocobre, Pilbara Minerals, and Galaxy Lithium are each at all time highs, while Wise-Owl’s OTHER lithium investment, early-stage German Zero Carbon lithium company Vulcan, has increased by more than 3600% in just over a year.

The market doesn’t seem to have caught on to EMH yet.

We believe we are still early in the lithium cycle. Worldwide, we are facing a supply shortfall of the Electric Vehicle battery-making ingredient for at least the coming decade, driven by surging adoption of EVs combined with lithium supply constraints.

EMH is developing the largest hard rock lithium resource in the European Union, and its flagship Cínovec Lithium Project at an advanced stage of development.

While EMH has no doubt performed well over the past year, the stock is yet to attract the levels of market attention of many of its lithium peers. But the $210 million company has all the hallmarks of a major lithium success story…

You’re best hearing it straight from EHM Managing Director Keith Coughlan.

In the following video, he discusses EMH’s partnerships with ČEZ, Germany’s world class EPCM SMS Group, and the company’s planned works over the coming 9-12 months to definitive feasibility study, final investment decision, and financing.

The half hour video is worth a watch for EMH shareholders like OR anyone considering an investment in EMH.

The end to lockdowns (outside of Australia at least) has revealed major pent-up demand for EVs that has taken a hit on surplus supplies of the metal, while governments worldwide — particularly in Europe — are pledging to invest in clean-energy projects.

But the EU has no local supply of lithium, so EMH is racing to become the first local EU battery grade lithium producer to deliver to this emerging local industry.

EMH’s globally significant Cínovec Project is in northern Czech Republic — the epicentre of over a dozen new and planned lithium-ion battery factories and on the doorstep of dozens of potential customers.

EMH shares its Cínovec Project with a majority Czech government owned local partner, the €10BN eastern Europe energy conglomerate ČEZ.

Along with its partner Volkswagen, ČEZ also has plans to invest $2 billion in a new battery Gigafactory that’s just 64km from its Cínovec Project that it shares with EMH.

One of the interesting points made in the video is that a pre-feasibility study (PFS), completed in 2019, valued the project at $1.1 billion (NPV). As EMH owns half the project (CEZ 51%), that’s a ~$550M project valuation to the company. In comparison, EHM is now trading at $1.68 per share for a $218M market cap — that’s just 40% of EHM’s share of the project’s 2019 valuation.

Yet it’s important to note that the project value in the PFS was based on the much lower lithium price at that time, so we can expect a higher project valuation even today.

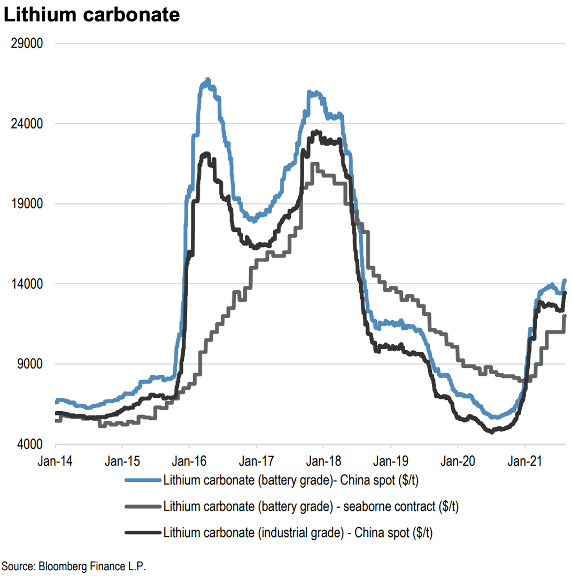

As you can see in the chart below — from a new report from J.P. Morgan on Monday, “Lithium” Raising long-term price forecasts and moving to an Overweight rating on all ASX lithium miners we cover” — lithium carbonate prices are in the early stages of a recovery from the sharp fall of 2018-19.

Over the next few years, J.P. Morgan forecast “prices to equal or surpass the previous cycle highs (reached in 2018) on strong EV sales related demand”.

It raised its long-term lithium spodumene price by 31% to $850/t, long-term carbonate price by 11% at $12,250, and long-term lithium hydroxide price by 12% at $14,000/t.

The report saw the bank upgrade the ASX lithium sector, taking the view that there’s not enough lithium to meet demand for the foreseeable future.

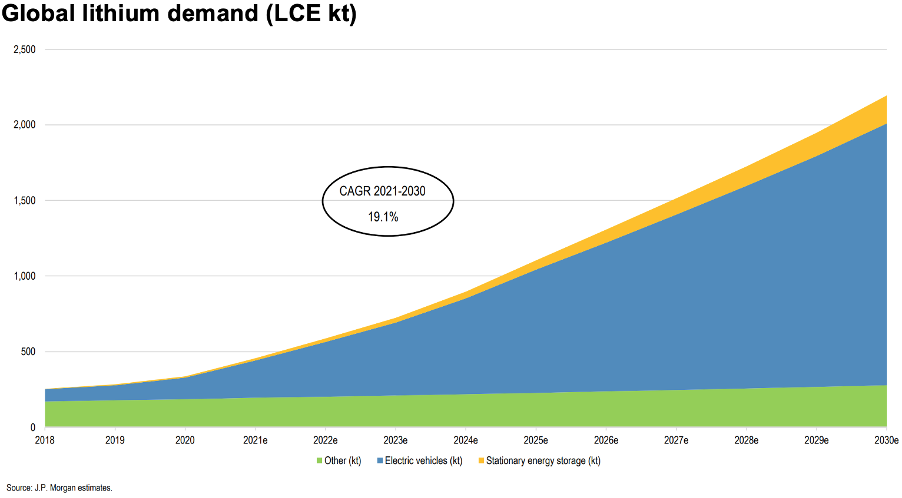

The bank says there will be 19% per year increase (compound annual growth rate) in demand for lithium over the coming 10 years to 2030. This is primarily based on rising demand for electric vehicles and batteries and a lack of supply, and it sees “a perpetual deficit visible beyond 2030 until more projects are defined by the industry”.